Smurfit Kappa GrpPLC Statement re successful completion of EUR1.375 billion Senior Credit Facility Re-financing

July 25 2013 - 1:00AM

UK Regulatory

TIDMSKG

Smurfit Kappa Group announces successful completion ofEUR1.375

billion Senior Credit Facility Re-financing

Re-positions the Group's debt profile from leveraged to

corporate

Reduces interest costs, extends debt maturity and earnings

accretive

SKG:IDSKG:LN

Smurfit Kappa Group plc ('SKG' or the "Group") is pleased to

announce that it has successfully completed the refinancing of its

existing senior secured credit facility with a new 5 year unsecured

relationship bank facility. In connection with the refinancing, the

collateral securing the obligations under the Group's various

outstanding senior notes and debentures has also been released and

the senior notes and debentures are therefore now unsecured. The

transition of the capital structure from secured to unsecured

reflects the re-positioning of SKG's credit profile from leveraged

to corporate.

The new EUR1,375 million 5 year facility comprises a EUR750

million term loan with a margin of 2.25% and a EUR625 million

revolving credit facility with a margin of 2.00%, reduced from

margins of 3.75% and 3.25% respectively. The Group expects cash

interest savings from the refinancing will be approximately EUR13

million per annum and the transaction will be immediately earnings

accretive. There will be a one-off exceptional cost of

approximately EUR16 million arising from the accelerated

amortisation of unamortised deferred debt issue costs related to

the existing facility.

The transaction was initially launched at EUR1,100 million and

was upsized to EUR1,375 million following a substantial

oversubscription. A total of 22 banks, all of whom are SKG

relationship banks, have committed to the new facility. Citi,

Crédit Agricole Corporate & Investment Bank, Danske Bank A/S,

HSBC Bank plc, JPMorgan Chase Bank N.A. and The Royal Bank of

Scotland plc / Ulster Bank Ireland Limited acted as Bookrunners and

Mandated Lead Arrangers. The Royal Bank of Scotland plc was sole

Co-ordinator.

In addition to the new senior facility, SKG has put in place a 5

year trade receivables securitisation programme of up to EUR175

million utilising the Group's receivables in Austria, Belgium,

Italy and the Netherlands. The programme, which has been arranged

by Rabobank and carries a margin of 1.70%, will complement the

Group's existing EUR250 million securitisation programme.

Ian Curley, Smurfit Kappa Group CFO, commented: "These

transactions re-position SKG's debt portfolio from a secured

leveraged structure post take private in 2002 to an unsecured

corporate profile. The new facilities will lower SKG's overall cost

of capital, materially reduce debt servicing costs, enhance

earnings and provide greater financial flexibility, including the

potential to refinance part of its more expensive bond debt at the

appropriate time."

Smurfit Kappa

Smurfit Kappa is one of the leading producers of paper-based

packaging in the world, with around 41,000 employees in

approximately 350 production sites across 32 countries and with a

sales revenue of EUR7.3 bn in 2012.

Innovation, service and pro-activity towards customers, using

sustainable resources, is our primary focus. This focus is enhanced

through us being an integrated producer, with our packaging plants

sourcing the major part of their raw materials from our own paper

mills. We are the European leader in paper-based packaging,

operating in 21 countries selling products including corrugated,

containerboard, bag-in-box, solidboard and solidboard packaging. We

have a growing base in Eastern Europe in many of these product

areas. We also have a key position in other product/market segments

including graphicboard, MG paper and sack paper.

We are the only large scale pan regional player in the Americas,

operating in 11 countries in total in North, Central and South

America.

ENDS

For further information contact:

Seamus Murphy FTI Consulting

Smurfit Kappa Group

Tel: +353 1 202 71 80 Tel: +353 1 663 36 86

E-mail: ir@smurfitkappa.com E-mail: smurfitkappa@fticonsulting.com

This information is provided by Business Wire

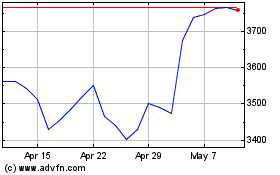

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jun 2024 to Jul 2024

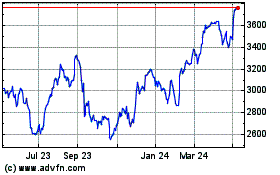

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2023 to Jul 2024