Change to Reporting

June 18 2010 - 1:00AM

UK Regulatory

TIDMSPT

RNS Number : 8224N

Spirent Communications PLC

18 June 2010

SPIRENT COMMUNICATIONS PLC

CHANGE TO REPORTING CURRENCY

2009 COMPARATIVES RE-PRESENTED IN US DOLLARS

London, UK - 18 June 2010: Spirent Communications plc ("Spirent", the "Company"

or the "Group") (LSE: SPT), a leading communications technology company,

announced in May a change to the Group's reporting currency from sterling to US

dollars in 2010. The key financial information for full year and half-year 2009

is re-presented in US dollars and is set out in this press release for

comparative purposes.

The decision to change the Group's reporting currency was made in order to give

a clearer understanding of Spirent's performance, more closely reflecting the

profile of the Group's revenue and operating profit which are primarily

generated in US dollars or US dollar-linked currencies. The change will be

effective for the results for the six months ended 4 July 2010 which will be

reported on 5 August 2010.

The reporting currency of the parent Company will remain as sterling, as it is

located in the United Kingdom and its functional currency is sterling. It will

retain its share capital denominated in sterling. Dividends will be determined

in US dollars and paid in sterling at the exchange rate prevailing when the

dividend is declared.

Unaudited full year and half-year 2009 income statements, balance sheets and

cash flow statements are presented below restated in US dollars together with

other key financial information. Quarterly unaudited income statements for 2009

and 2008 are available in the investor's section of the Company's website.

The change to the Group's reporting currency has been accounted for in

accordance with IAS 21 "The Effects of Changes in Foreign Exchange Rates".

Income and expenses have been translated at the average exchange rate for each

period and assets, liabilities and equity have been translated at the closing

exchange rate at each balance sheet date.

The US dollar exchange rates against sterling for 2009 were as follows:

+--------------------+--------------------+--------------------+

| | Half-year ended 28 | Year ended 31 |

| | June 2009 | December 2009 |

+--------------------+--------------------+--------------------+

| | | |

+--------------------+--------------------+--------------------+

| Average exchange | 1.50 | 1.57 |

| rate | | |

+--------------------+--------------------+--------------------+

| Closing exchange | 1.65 | 1.61 |

| rate | | |

+--------------------+--------------------+--------------------+

| | | |

+--------------------+--------------------+--------------------+

| | | |

+--------------------+--------------------+--------------------+

- ends -

Enquiries

+----------------------------+-+--------------------+-+---------------+

| Eric Hutchinson, Chief | | Spirent | | +44 (0)1293 |

| Financial Officer | | Communications plc | | 767676 |

+----------------------------+-+--------------------+-+---------------+

| | | | | |

+----------------------------+-+--------------------+-+---------------+

| James Melville-Ross/Juliet | | Financial Dynamics | | +44 (0)20 |

| Clarke | | | | 7831 3113 |

+----------------------------+-+--------------------+-+---------------+

About Spirent Communications plc

Spirent Communications plc is a global leader in test and measurement inspiring

innovation within development labs, communication networks and IT organisations.

We enable today's communication ecosystem as well as tomorrow's emerging

enterprises to deploy life-enriching communications networks, devices, services

and applications. The Systems group develops power control systems for

electrical vehicles in the mobility and industrial markets. Further information

about Spirent Communications plc can be found at www.spirent.com.

Spirent Communications plc Ordinary Shares are traded on the London Stock

Exchange (ticker: SPT). The Company operates a Level 1 American Depositary

Receipt ("ADR") programme with each ADR representing four Spirent Communications

plc Ordinary Shares. The ADRs trade in the US over-the-counter ("OTC") market

under the symbol SPMYY and the CUSIP number is 84856M209. Spirent ADRs are

quoted on the Pink OTC Markets electronic quotation service which can be found

at www.pinksheets.com.

Spirent and the Spirent logo are trademarks or registered trademarks of Spirent

Communications plc. All other trademarks or registered trademarks mentioned

herein are held by their respective companies. All rights reserved.

Consolidated income statement (unaudited)

+---------------------------------+---------------+---------------+

| US$ million | First half | Year ended |

| | 2009 | 31 December |

| | | 2009 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Revenue | 208.7 | 427.2 |

+---------------------------------+---------------+---------------+

| Cost of sales | (72.6) | (143.8) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Gross profit | 136.1 | 283.4 |

+---------------------------------+---------------+---------------+

| Product development | (37.7) | (74.6) |

+---------------------------------+---------------+---------------+

| Selling and distribution | (38.1) | (78.0) |

+---------------------------------+---------------+---------------+

| Administration | (24.2) | (44.0) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Operating profit | 36.1 | 86.8 |

+---------------------------------+---------------+---------------+

| Finance income | 0.3 | 0.6 |

+---------------------------------+---------------+---------------+

| Finance expense | (0.9) | (2.5) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Profit before tax | 35.5 | 84.9 |

+---------------------------------+---------------+---------------+

| Tax | (5.4) | 6.3 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Profit for the period | 30.1 | 91.2 |

| attributable to equity | | |

| shareholders of parent Company | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Earnings per share (cents) | | |

+---------------------------------+---------------+---------------+

| Basic | 4.53 | 13.67 |

+---------------------------------+---------------+---------------+

| Diluted | 4.52 | 13.60 |

+---------------------------------+---------------+---------------+

Consolidated balance sheet (unaudited)

+---------------------------------+---------------+---------------+

| US$ million | | 31 December |

| | 28 June 2009 | 2009 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Assets | | |

+---------------------------------+---------------+---------------+

| Non-current assets | | |

+---------------------------------+---------------+---------------+

| Intangible assets | 111.7 | 112.4 |

+---------------------------------+---------------+---------------+

| Property, plant and equipment | 24.8 | 23.6 |

+---------------------------------+---------------+---------------+

| Trade and other receivables | 2.8 | 3.7 |

+---------------------------------+---------------+---------------+

| Cash on deposit | 3.6 | 1.8 |

+---------------------------------+---------------+---------------+

| Defined benefit pension plan | 0.7 | 1.0 |

| surplus | | |

+---------------------------------+---------------+---------------+

| Deferred tax | 23.9 | 42.5 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | 167.5 | 185.0 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Current assets | | |

+---------------------------------+---------------+---------------+

| Inventories | 30.0 | 28.1 |

+---------------------------------+---------------+---------------+

| Trade and other receivables | 83.0 | 81.3 |

+---------------------------------+---------------+---------------+

| Derivative financial | 1.3 | 1.0 |

| instruments | | |

+---------------------------------+---------------+---------------+

| Cash and cash equivalents | 132.8 | 173.9 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | 247.1 | 284.3 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Total assets | 414.6 | 469.3 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Liabilities | | |

+---------------------------------+---------------+---------------+

| Current liabilities | | |

+---------------------------------+---------------+---------------+

| Trade and other payables | (89.3) | (86.6) |

+---------------------------------+---------------+---------------+

| Current tax | (7.4) | (10.3) |

+---------------------------------+---------------+---------------+

| Derivative financial | (1.3) | (0.2) |

| instruments | | |

+---------------------------------+---------------+---------------+

| Provisions and other | (5.4) | (6.1) |

| liabilities | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | (103.4) | (103.2) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Non-current liabilities | | |

+---------------------------------+---------------+---------------+

| Trade and other payables | (6.4) | (7.9) |

+---------------------------------+---------------+---------------+

| Defined benefit pension plan | (11.9) | (1.1) |

| deficit | | |

+---------------------------------+---------------+---------------+

| Provisions and other | (9.1) | (5.3) |

| liabilities | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | (27.4) | (14.3) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Total liabilities | (130.8) | (117.5) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Net assets | 283.8 | 351.8 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Capital and reserves | | |

+---------------------------------+---------------+---------------+

| Share capital | 37.0 | 36.4 |

+---------------------------------+---------------+---------------+

| Share premium account | 28.5 | 29.5 |

+---------------------------------+---------------+---------------+

| Capital redemption reserve | 17.5 | 17.1 |

+---------------------------------+---------------+---------------+

| Capital reserve | 2.3 | 1.6 |

+---------------------------------+---------------+---------------+

| Other reserves | (2.9) | (0.6) |

+---------------------------------+---------------+---------------+

| Translation reserve | 23.1 | 22.6 |

+---------------------------------+---------------+---------------+

| Cash flow hedges | 0.3 | 0.6 |

+---------------------------------+---------------+---------------+

| Retained earnings | 178.0 | 244.6 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Total equity attributable to | 283.8 | 351.8 |

| equity shareholders of parent | | |

| Company | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

Consolidated cash flow statement (unaudited)

+----------------------------------+---------------+---------------+

| US$ million | | Year ended |

| | First half | 31 December |

| | 2009 | 2009 |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Cash flows from operating | | |

| activities | | |

+----------------------------------+---------------+---------------+

| Cash flows from operations | 50.8 | 106.3 |

+----------------------------------+---------------+---------------+

| Tax paid | (5.8) | (10.2) |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Net cash inflow from operating | 45.0 | 96.1 |

| activities | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Cash flows from investing | | |

| activities | | |

+----------------------------------+---------------+---------------+

| Interest received | 0.3 | 0.6 |

+----------------------------------+---------------+---------------+

| Transfer from long term deposit | 0.5 | 2.2 |

+----------------------------------+---------------+---------------+

| Purchase of intangible assets | - | (0.3) |

+----------------------------------+---------------+---------------+

| Purchase of property, plant and | (4.8) | (10.1) |

| equipment | | |

+----------------------------------+---------------+---------------+

| Proceeds from the sale of | 0.2 | 0.2 |

| property, plant and equipment | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Net cash used in investing | (3.8) | (7.4) |

| activities | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Cash flows from financing | | |

| activities | | |

+----------------------------------+---------------+---------------+

| Dividend paid | (6.2) | (12.1) |

+----------------------------------+---------------+---------------+

| Proceeds from the issue of share | 0.4 | 3.8 |

| capital and employee share | | |

| ownership trust | | |

+----------------------------------+---------------+---------------+

| Share repurchase | (0.1) | (1.1) |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Net cash used in financing | (5.9) | (9.4) |

| activities | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Net increase in cash and cash | 35.3 | 79.3 |

| equivalents | | |

+----------------------------------+---------------+---------------+

| Cash and cash equivalents at the | 86.0 | 86.0 |

| beginning of the year | | |

+----------------------------------+---------------+---------------+

| Effect of foreign exchange rate | 11.5 | 8.6 |

| changes | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

| Cash and cash equivalents at the | 132.8 | 173.9 |

| end of the period | | |

+----------------------------------+---------------+---------------+

| | | |

+----------------------------------+---------------+---------------+

Segmental analysis

+---------------------------------+---------------+---------------+

| US$ million | First half | Year ended |

| | 2009 | 31 December |

| | | 2009 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Revenue | | |

+---------------------------------+---------------+---------------+

| Performance Analysis | 153.8 | 316.8 |

+---------------------------------+---------------+---------------+

| Service Assurance | 27.4 | 52.6 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Communications | 181.2 | 369.4 |

+---------------------------------+---------------+---------------+

| Systems | 27.5 | 57.8 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | 208.7 | 427.2 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Operating profit | | |

+---------------------------------+---------------+---------------+

| Performance Analysis | 32.9 | 78.3 |

+---------------------------------+---------------+---------------+

| Service Assurance | 3.9 | 7.5 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Communications | 36.8 | 85.8 |

+---------------------------------+---------------+---------------+

| Systems | 3.2 | 7.9 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Segment operating profit | 40.0 | 93.7 |

+---------------------------------+---------------+---------------+

| Non-segmental | | |

+---------------------------------+---------------+---------------+

| Corporate | (2.7) | (4.9) |

+---------------------------------+---------------+---------------+

| Acquired intangible | (0.8) | (1.4) |

| amortisation | | |

+---------------------------------+---------------+---------------+

| Share-based payment | (0.4) | (0.6) |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | 36.1 | 86.8 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

Earnings per share

+---------------------------------+---------------+---------------+

| | First half | Year ended |

| | 2009 | 31 December |

| | | 2009 |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| Basic (cents) | 4.53 | 13.67 |

+---------------------------------+---------------+---------------+

| Diluted (cents) | 4.52 | 13.60 |

+---------------------------------+---------------+---------------+

| Weighted average number of | 664.5 | 667.0 |

| shares in issue at period end - | | |

| basic (million) | | |

+---------------------------------+---------------+---------------+

| Weighted average number of | 666.2 | 670.4 |

| shares in issue at period end - | | |

| diluted (million) | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

| | | |

+---------------------------------+---------------+---------------+

The Group discloses adjusted earnings per share attributable to equity

shareholders in order to provide a measure to enable period-on-period

comparisons to be made of its performance:

+----------------------------+---------+---------+---------+-----------+

| | | First | | Year |

| | | half | | ended |

| | | 2009 | | 31 |

| | | | | December |

| | | | | 2009 |

+----------------------------+---------+---------+---------+-----------+

| | US$ | cents | US$ | cents |

| | million | | million | |

+----------------------------+---------+---------+---------+-----------+

| Profit for the period | 30.1 | 4.53 | 91.2 | 13.67 |

| attributable to equity | | | | |

| shareholders of parent | | | | |

| Company | | | | |

+----------------------------+---------+---------+---------+-----------+

| Deferred tax assets - | - | | (21.7) | |

| change in estimate | | | | |

+----------------------------+---------+---------+---------+-----------+

| Prior year tax charge | - | | 2.8 | |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

| Adjusted basic | 30.1 | 4.53 | 72.3 | 10.84 |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

| Adjusted diluted | | 4.52 | | 10.78 |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

| | | | | |

+----------------------------+---------+---------+---------+-----------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEDLFFBQFFBBB

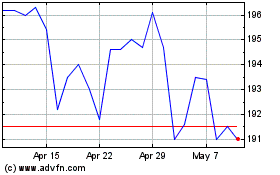

Spirent Communications (LSE:SPT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Spirent Communications (LSE:SPT)

Historical Stock Chart

From Feb 2024 to Feb 2025