TIDMSRT

RNS Number : 3196H

SRT Marine Systems PLC

27 July 2023

SRT MARINE SYSTEMS PLC

(AIM: SRT)

("SRT" or the "Company")

FINAL RESULTS FOR THE YEARED 31 MARCH 2023

SRT Marine Systems PLC, a provider of maritime surveillance,

monitoring and management systems, announces its results for the

financial year ending 31 March 2023.

FINANCIAL SUMMARY

-- Increased revenues to GBP30.5m.

-- Profit after tax GBP0.1m.

-- GBP2.2m gross cash at year end. Post year end GBP5.4m equity

raise and GBP20m loan note programme headroom increase.

-- GBP160m systems forward contract order book and GBP1.4bn new prospects pipeline.

OPERATIONAL HIGHLIGHTS

-- Significant transceiver distributor network expansion.

-- Continued progress with new NEXUS VHF/AIS radio system and

DAS transceiver products, both of which entered testing phases.

-- Expansion of analytics within the SRT-MDA System to improve

dark vessel detection and tracking capabilities.

-- Expansion of SRT delivery team to accommodate multiple simultaneous projects.

NOTICE OF AGM

-- The AGM will be held at the Centurion Hotel, Charlton Lane,

Radstock BA3 4BD at 11.00am on September 19, 2023. Prior to the

commencement of the formal AGM there will be an Open Morning at

SRT's offices, commencing at 9.00am.

Commenting on today's results, Simon Tucker, CEO of SRT

said:

"Our many years of technology, product and market investments

are now starting to show in our financial results. Our transceivers

division grew by 60% and our systems division is back on track

following a pause in government business during Covid. We go into

the new year with an expanded product range and distribution

network, a forward contract order book of GBP160m and a new

prospects pipeline of system contracts worth approximately

GBP1.4bn. This position reflects the early strategic decisions made

to position SRT at the centre of these substantial global

markets."

Contacts:

SRT Marine Systems plc www.srt-marine.com

+ 44 (0) 1761 409500

Simon Tucker (CEO) simon.tucker@srt-marine.com

Louise Coates (Marketing Manager) louise.coates@srt-marine.com

finnCap Ltd

Jonny Franklin-Adams / Teddy Whiley (Corporate

Finance) +44 (0) 20 7220 0500

Tim Redfern / Charlotte Sutcliffe (Corporate

Broking)

About SRT:

SRT Marine Systems PLC is a global company which develops and

provides integrated maritime surveillance, monitoring, management

and safety systems used by coast guards, fishery authorities,

infrastructure and vessel owners for the purposes of managing

and controlling their maritime domain. Applications include security,

safety, search & rescue, law enforcement, fisheries management,

illegal fishing detection and environment monitoring.

The information contained within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is

now considered to be in the public domain.

CHAIRMAN'S STATEMENT

Whilst not as high as we had hoped, I am pleased to report that

we were profitable on a 273% year on year increase in revenues

to GBP30.5m as our target markets recovered and recommenced their

expansion enabling us to benefit from our accumulated investments

in technologies, products and customers over many years and enter

the new financial year with a GBP160m forward order book and substantial

new prospects pipeline.

As reported in our year-end trading update in March 2023, year

on year group revenues grew to GBP30.5m (2022: GBP8.2m) of which

transceivers generated GBP12.1m and systems GBP18.4m. Gross profit

margin increased to 36% (2022: 33%), resulting in a profit after

tax of GBP0.1m (2022: loss GBP5.8m). As at year-end, gross cash

was GBP2.2m (2022: GBP5.9m), and after the year-end we completed

an equity raise of GBP5.4m and increased our loan note programme

capacity by an additional GBP20m.

During the period our systems business executed on three projects,

two with coast guards and one with a national fisheries ministry,

increased our forward contract order book to GBP160m and grew our

new prospects pipeline to be worth an estimated GBP1.4bn. This

growth is driven by the increasing desire of national agencies

to have effective maritime surveillance and intelligence in line

with what has become the norm in air traffic control.

The Philippine BFAR IMEMS system is now fully operational and in

daily use, enabling BFAR to track, monitor and manage all their

fisheries within a single optimised system. This project was originally

scheduled to complete in December 2022, but is now expected to

complete during 2023. This delay is a consequence of COVID where

all installation work was suspended for well over a year due to

mandatory travel and work suspensions. We also won and delivered

a small but strategically important project to a national coast

guard to enable the sharing of maritime information between multiple

government agencies and completed the first phase of a GBP40m SRT-MDA

System Vessel Tracking & Identification systems contract with a

major Middle East Coast Guard, the formal sign-off of which was

concluded shortly after our financial year end, along with preparations

for the next and final two phases which are scheduled to be implemented

by the end of 2024.

The SRT-MDA System is a flexible and scalable integrated surveillance

system solution that can be configured for either coast guard or

fisheries use. After many years of continuous development, it offers

an extensive range of innovative functionalities and capabilities

that deliver enhanced maritime domain awareness. I am pleased to

report that our development and product team have continued to

enhance existing functionalities and introduce new capabilities.

Of particular note is our focus on multi-sensor and multi-platform

network integration, data fusion and management and intelligent

analytics in the area of automated vessel detection and identification,

along with specialist fisheries functionalities such as aquatic

modelling and electronic catch reporting and auditing. This continuous

development of the SRT-MDA System falls to our expanding development

team which we have carefully built over many years and today combines

a rare blend of scale, talent and experience.

The transceivers division grew year on year by 60% to a turnover

of GBP12.1m, generating a blended gross profit of 45%, with some

product and application areas generating margins as high as 80%

and some 20%. We believe that growth has come from the compound

effect of our reputation for having the best products, being a

reliable supplier, expanding our distribution channels and the

slow but steady rolling adoption and proliferation of AIS across

commercial and leisure vessels. We remain in the early stages of

AIS adoption with an estimated 500,000 vessels out of 26 million

now having an AIS device, and most navigation aids at an even earlier

stage. We therefore see very significant opportunity for steady

long-term growth from our transceivers business driven by the same

fundamentals of recent years.

The primary focus of our transceiver development team has been

the development of our NEXUS VHF/AIS product. This product moves

SRT into the voice communications segment of the leisure and commercial

marine electronics market which has much greater volumes than data

only AIS due to its greater maturity. NEXUS is a significant investment

for SRT and the project is now in its third year, with the expectation

that it will start commercial shipments in early 2024. In 2023

we decided to delay the commencement of shipping by approximately

up to 9 months to allow for further testing. This decision was

made in the context of our global reputation for excellence and

wishing to enter this new segment with a truly innovative product

that matches our history of reliable and trustworthy products.

NEXUS will therefore not contribute material revenues during the

coming financial year, but we do expect it to make an impact thereafter.

In the meantime, we have seen a significant growth in our distribution

network and have added additional sales and marketing resource,

particularly with our first in-territory presence in the USA, the

effects of which we expect to see in the coming financial year.

During the year we soft launched our DAS product offer and have

received a good response with visibility of some substantial new

projects. DAS targets the aids to navigation market which is integral

to the digitisation of the marine domain and the realisation of

safer and more efficient navigation. In the coming year we will

invest more in this segment, including the hiring of a dedicated

salesperson.

Shortly after the year end, we signed a new systems contract worth

GBP140m to deliver an integrated maritime surveillance and intelligence

system to a National Coast Guard increasing our forward systems

order book to GBP160m. This opportunity was previously in our new

systems prospects pipeline, which continues to grow and now contains

prospects at various stages of the sales cycle with an aggregate

value of GBP1.4bn, and I expect to see some of these convert into

contracts in the coming months In the first half of the new financial

year, we expect to commence the implementation of the next and

final phases of our Middle East project, whilst the newly signed

GBP140m National Coast Guard contract, with associated revenue

milestone completion will commence first implementation milestones

in the second half of the financial year. As usual, our transceivers

business will be more balanced but with the traditional second

half weighting.

In summary, the year has seen both our businesses grow strongly

as a result of our long-term technology, product and market investments

that have placed SRT at the centre of the global digitisation of

maritime domain awareness and navigation. With over 3,000 transceiver

distribution partners, established products, GBP160m of forward

contracts and a pipeline of new prospects that has grown to GBP1.4bn,

we feel very confident, although not complacent, about the future.

This year really has been operationally tough, with a lot of product

development and sales and contracts work to keep up with market

demands, so I would like to take this opportunity to thank our

staff, partners and shareholders for their hard and diligent work

throughout the year.

Kevin Finn, Chairman

26 July 2023

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME FOR THE YEARED 31 MARCH 2023

Note 2023 2022

GBP GBP

Revenue 30,506,152 8,172,900

Cost of sales (19,467,188) (5,500,942)

Gross profit 11,038,964 2,671,958

Administrative costs (10,723,838) (8,721,560)

Foreign exchange losses (180,102) (147,754)

--------------------------------------------- ------- --------------- ------------------

Total administrative costs and

foreign exchange losses (10,903,940) (8,869,314)

Operating profit / (loss) 135,024 (6,197,356)

Finance expenditure (781,547) (615,648)

Finance income 351 421

Loss before tax (646,172) (6,812,583)

Income tax credit 715,692 974,578

Profit / (loss) for the year after

tax 69,520 (5,838,005)

Total comprehensive income / (expense)

for the year 69,520 (5,838,005)

Earnings / (loss) per share:

Basic 4 0.04p (3.53)p

Diluted 0.04p (3.53)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH

2023

2023 2022

Note GBP GBP

Assets

Non-current assets

Intangible assets 11,756,717 9,368,069

Property, plant and equipment 1,256,223 1,328,842

Total non-current assets 13,012,940 10,696,911

Current assets

Inventories 3,465,626 2,359,922

Trade and other receivables 5,828,652 3,847,735

Current tax recoverable 968,607 978,963

Cash 2,181,548 5,924,601

Restricted cash 949,115 906,245

Total current assets 13,393,548 14,017,466

Liabilities

Current liabilities

Trade and other payables (7,009,926) (6,459,635)

Borrowings 5 (8,002,500) (7,245,000)

Current tax liabilities (199,126) -

Lease liabilities (237,371) (201,402)

Total current liabilities (15,448,923) (13,906,037)

Net current (liabilities)

/ assets (2,055,375) 111,429

Total assets less current

liabilities 10,957,565 10,808,340

Non-current liabilities

Borrowings 5 - (312,500)

Lease liabilities (649,946) (703,317)

------------- --------------

Total non-current liabilities (649,946) (1,015,817)

Net assets 10,307,619 9,792,523

Shareholders' equity

Share capital 181,517 180,677

Share premium account 18,213,072 18,067,612

Retained loss (13,577,566) (13,946,362)

Other reserves 5,490,596 5,490,596

Total shareholders' equity 10,307,619 9,792,523

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 MARCH

2023

2023 2022

GBP GBP

Cash generated from operating

activities 778,840 1,405,136

Corporation tax received 925,174 789,217

-------------- --------------

Net cash generated from operating

activities 1,704,014 2,194,353

-------------- --------------

Investing activities

Expenditure on product development (4,795,292) (3,327,011)

Purchase of property, plant

and equipment (199,061) (183,802)

Interest received 351 421

Net cash used in investing

activities (4,994,002) (3,510,392)

-------------- --------------

Financing activities

Gross proceeds on issue of

shares 146,300 4,919,130

Costs of issue of shares - (266,828)

New loans issued 1,695,000 1,000,000

Loan repayments (1,250,000) (1,957,500)

Lease repayments (258,835) (267,458)

Loan interest paid (742,660) (566,891)

Net cash (used in) / generated (410,195) 2,860,453

from financing activities

Net (decrease) / increase

in cash and cash equivalents (3,700,183) 1,544,414

-------------- --------------

Net cash and cash equivalents

at beginning of year 6,830,846 5,286,432

--------------

Net cash and cash equivalents

at end of year 3,130,663 6,830,846

============== ==============

Notes

1. Status of financial information

SRT is a public limited company incorporated in England and

Wales whose ordinary shares of 0.1p each are traded on the AIM

Market of the London Stock Exchange. The Company's registered

office is Wireless House, Westfield Industrial Estate, Midsomer

Norton, Bath BA3 4BS.

The Board of Directors approved this preliminary announcement on

26 July 2023. This announcement does not itself contain sufficient

information to comply with all the disclosure requirements of IFRS

and does not constitute statutory accounts of the Company for the

years ended 31 March 2023 or 31 March 2022.

The financial information has been extracted from the statutory

accounts of the Company for the years ended 31 March 2023 and 31

March 2022. The report of the auditors on those statutory accounts

was unqualified and did not contain a statement under section

498(2) or (3) of the Companies Act 2006. The audit reports for the

years ended 31 March 2023 and 2022 drew attention by way of

emphasis to a material uncertainty relating to going concern and

recoverability of certain assets.

The statutory accounts for the year ended 31 March 2022 have

been delivered to the Registrar of Companies, whereas those for the

year ended 31 March 2023 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

2. Basis of preparation

The financial statements have been prepared in accordance with

UK-adopted international accounting standards. For the purposes of

the preparation of the consolidated financial information, the

Group has applied all standards and interpretations that are

effective for accounting periods beginning on or after 1 April

2022. The financial information has been prepared under the

historical cost convention unless otherwise stated.

3. Dividends

The Board is not recommending the payment of a final

dividend.

4. Earnings / (loss) per ordinary Share

The basic earnings per share has been calculated on the profit

after taxation of GBP69,520 (2022: loss GBP5,838,005) divided by

the weighted number of ordinary shares in issue of 180,961,021

(2022: 165,167,407).

During the year the calculation of diluted earnings per share

has been calculated on profit on ordinary activities after taxation

of GBP69,520. It assumes conversion of all potentially dilutive

ordinary shares, all of which arise from share options. A

calculation is performed to determine the number of shares that

could have been acquired at fair value, based upon the monetary

value of subscription rights to outstanding share options. The

number of dilutive shares under option was 1,958,724 and the

weighted average number of ordinary shares for the purposes of

dilutive earnings per share was 182,919,745.

During the previous year, the Group incurred a loss on ordinary

activities after taxation and therefore there is no dilution of the

impact of the share options granted.

5. Borrowings

Bank loan

The bank loan (amount owed at 31 March 2023: GBP312,500) was

drawn down in April 2020 as a GBP2,500,000 one year loan provided

under the UK government Coronavirus Business Interruption Loan

Scheme (CBILS) at an interest rate of 0%. During the previous year,

the renewal of this facility has been agreed with quarterly

repayments commencing in July 2021 through to April 2023 at an

interest rate of 2.59% above base rate.

Loan notes

As of 31 March 2023, the outstanding balance of loan notes

amounted to GBP7,690,000. These all relate to drawdowns on a

secured note programme which has been arranged by LGB Capital

Markets and which is secured by a floating charge over the Group's

assets . The loan notes have terms of up to 3 years and an interest

rate of 8%-12%. Subsequent to the year end, the capacity on the

secured note programme has been increased from GBP20 million to

GBP40 million.

During the year ended 31 March 2023 the covenants in relation to

debt service cover and gearing were breached and a waiver from loan

note holders was obtained subsequent to the year end on May 2 2023.

Due to the waiver not being received prior to the year end and the

covenants being re-tested on 30 September 2023, IAS 1 requires that

the loans are all classified as being repayable in less than one

year, despite their maturity dates.

6. Annual Report and AGM

The Annual Report will be available from the Company's website,

www.srt-marine.com once it is published. To locate the report,

click "Investors" and then scroll down the page to "Reports and

Presentations". The Annual Report and Notice of AGM will be posted

to shareholders on 18 August 2023.

The AGM will be held at the Centurion Hotel, Charlton Lane,

Radstock BA3 4BD at 11.00am on September 19, 2023. Prior to the

commencement of the formal AGM there will be an Open Morning at

SRT's offices, commencing at 9.00am.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UNSNROUUBUAR

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

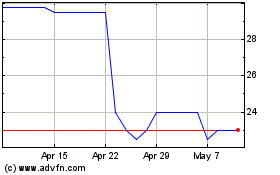

Srt Marine Systems (LSE:SRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Srt Marine Systems (LSE:SRT)

Historical Stock Chart

From Mar 2024 to Mar 2025