AIM Sch 1 - Shearwater Group Plc (4035C)

October 01 2018 - 1:30AM

UK Regulatory

TIDMSWG

RNS Number : 4035C

AIM

01 October 2018

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Shearwater Group plc

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Registered office - 22 Great James Street, London, WC1N 3ES

Trading address - Octagon Point, 5 Cheapside, London EC2V 6AA

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://www.theshearwatergroup.co.uk/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Shearwater is an AIM-quoted company focused on building a UK

based group providing digital resilience solutions.

The Company's aim is to acquire and develop information security

and cyber security companies with a leading product, solution

or service capability whose full potential can be unlocked

through active management and capital investment.

Shearwater Group plc is the holding company for the group's

wholly-owned trading companies, including SecurEnvoy Limited,

Xcina Limited and, following re-admission, Brookcourt Solutions

Limited ("Brookcourt").

Brookcourt is a multi-award winning, UK-based cyber security

company, focusing on the provision of networking and cyber

security solutions to corporate and public sector organisations.

Brookcourt's solutions help its customers by providing all

and any aspect of the full end to end network design, supply,

integration, support and managed services that a customer needs

to assure and secure their network infrastructure in an advanced

threat landscape. Brookcourt is headquartered in Redhill in

Surrey, with a second office located in Bracknell and currently

employs 28 people across both sites.

The Transaction consideration is GBP15.15m cash and GBP15.15m

in Shearwater shares. This consideration structure has been

amended from the earlier announced split of GBP22.95m cash

and GBP7.35m in Shearwater shares. The cash consideration component

of the Transaction will be financed through a fundraising consisting

of a placing and an open offer (the "Fundraising"). The Transaction

and the Fundraising are inter-conditional.

The Transaction constitutes a reverse takeover under AIM Rule

14 and accordingly, the Company will seek readmission ("Admission")

of its shares to trading on AIM of the London Stock Exchange.

The Transaction and associated fundraising will be subject

to the passing of relevant resolutions at the Company's general

meeting to be confirmed.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Up to 1,906,854,786 Ordinary shares of 1 penny each ("Ordinary

Shares") (assuming full take up under the Open Offer).

There will be no Ordinary Shares held in treasury and no restrictions

on the transfer of the securities.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Gross capital raised on admission - Placing of GBP16.7m and

up to additional GBP1m under open offer.

Implied market capitalisation - GBP68.6m

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

Before Admission 45.8 per cent.

Post Admission 40.3 per cent.

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Directors

David Jeffreys Williams (Chairman)

Michael Joseph ("Mo") Stevens (Chief Executive Officer)

Robin Simon Southwell (Non-Executive Director)

Stephen Robert Ball (Non-Executive Director)

Giles Kirkley Willits (Non-Executive Director)

Proposed Directors

Paul John McFadden (Interim Finance Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Significant Shareholder 30 June After Admission(1)

2018

Phil Higgins - 11.03%

-------- -------------------

Dene Stacy - 11.03%

-------- -------------------

David Williams 12.04% 6.72%

-------- -------------------

Schroders 10.91% 8.61%

-------- -------------------

Stephen Watts 8.97% 4.68%

-------- -------------------

Andrew Kemshall 8.77% 4.58%

-------- -------------------

Killik & Co 5.48% 7.21%

-------- -------------------

Columbia Threadneedle 4.43% 3.19%

-------- -------------------

Canaccord Genuity WM 3.77% 3.42%

-------- -------------------

1. Assumes full take up of open offer.

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

N/A

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 March

(ii) Target's information is to 31 December 2017. Shearwater's

information is audited annual financial information to 31 March

2018.

(iii) Half year report for the six months ended 30 September

2018 published by 31 December 2018. Annual report for the year

ended 31 March 2019 published by 30 September 2019. Half year

report for the six months ended 30 September 2019 published

by 31 December 2019.

EXPECTED ADMISSION DATE:

17 October 2018

NAME AND ADDRESS OF NOMINATED ADVISER:

Cenkos Securities

6.7.8 Tokenhouse Yard

London EC2R 7AS

NAME AND ADDRESS OF BROKER:

Cenkos Securities

6.7.8 Tokenhouse Yard

London EC2R 7AS

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

The admission document containing full details about the Group

and the admission of its ordinary shares will be available

from the registered office of the Company, being 22 Great James

Street, London WC1N 3ES, and on the Company's website www.theshearwatergroup.co.uk.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA

DATE OF NOTIFICATION:

1 October 2018

NEW/ UPDATE:

New

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PAAUWAVRWUAKUAR

(END) Dow Jones Newswires

October 01, 2018 02:30 ET (06:30 GMT)

Shearwater (LSE:SWG)

Historical Stock Chart

From Jun 2024 to Jul 2024

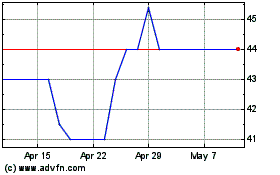

Shearwater (LSE:SWG)

Historical Stock Chart

From Jul 2023 to Jul 2024