TIDMSYS1

RNS Number : 7901V

System1 Group PLC

06 December 2023

Press Release

6 December 2023

System1 Group PLC (AIM: SYS1)

("System1" or "the Group" or "the Company")

Unaudited interim results for the six months ended 30 September

2023

System1 Group the marketing decision-making platform

www.system1group.com announces its unaudited interim results for

the six months ended 30 September 2023 ("H1", "H1 FY24").

H1 H1

FY24 FY23 Change**

GBPm GBPm %

------- ------- =========

Management Basis*

Revenue 13.3 10.5 27%

======= ======= =========

Gross Profit 11.7 8.5 37%

Adjusted Operating Costs (9.8) (8.9) 10%

Adjusted Profit/(Loss)before Taxation 1.9 (0.4) NM

======= ======= =========

Statutory Basis

Revenue 13.3 10.5 27%

======= ======= =========

Gross Profit 11.7 8.5 37%

Operating Costs (11.1) (8.6) 27%

Other Operating Income 0.3 0.1 47%

======= ======= =========

Profit before Taxation 0.9 0.0 NM

Income Tax Expense (0.3) (0.2) 46%

Profit/(Loss) for the Period 0.6 (0.2) NM

======= ======= =========

Diluted Earnings per Share 4.9p (1.7p)

* Adjusted Operating Costs exclude impairment, other interest,

share based payments, bonuses and commissions, severance costs, IP

litigation costs, and other staff costs (sabbatical and holiday

provisions). Adjusted Profit/(Loss) Before Taxation is Gross Profit

less Adjusted Operating Costs and excludes Other Operating Income.

Adjusted figures exclude items, positive and negative, that impede

easy understanding of underlying performance. Details can be found

in note 12 of the interim statements.

** Percentages and totals are based on numbers rounded to

GBP'000s

H1 Highlights

-- Platform revenue (Predict Your and Improve Your) grew 44% on

H1 FY23 to GBP10.9m and represented 82% of total revenue (H1 FY23:

73%). Total revenue increased by 27%.

-- Revenue growth in all regions including the Americas.

-- New partnerships launched with Pinterest, Finecast, JC Decaux

and Teads, contributing to strong growth in ad testing revenue.

-- Increased focus on non-TV format ad testing with the launches of TYA Digital, TYA Audio.

-- Innovation product launches during calendar 2024.

-- 136 new platform clients in H1 (H1 FY23: 69) and improved retention of existing customers.

-- Cost of sales down 17% due to platform and supply chain efficiencies.

-- Gross profit margin increased to 87.8% (H1 FY23: 81.5%).

-- Average H1 headcount down 6% to 143 (H1 FY23: 152).

-- Benefits of operational gearing and our scalable business

model showing through: Adjusted profit before taxation increased to

GBP1.9m (H1 FY23: GBP0.4m loss); GBP0.9m statutory profit before

tax (H1 FY23: GBP0.0m).

-- GBP0.6m free cash flow in H1 (H1 FY23: outflow of GBP2.6m).

Cash balance of GBP6.3m as at 30 September 2023 (31 March 2023:

GBP5.7m).

-- Diluted and basic earnings per share 4.9p (H1 FY23 diluted and basic loss per share: 1.7p).

Current Trading & Outlook

-- Second half of the year has started well, and at this stage

we expect H2 revenue to exceed H1.

-- Gross profit margin to date remains close to that achieved in

H1, and well above recent historic levels.

-- Despite a difficult economic environment in some key markets,

and challenging conditions for media owners and advertisers, we

believe System1 can continue to grow profitably by gaining market

share from large incumbents that we believe have less predictive

products.

System1 CEO James Gregory commented:

"One year after our strategic review there are signs that the

Company's fame-building activity and renewed focus on execution are

working. We are helping even more of the world's largest

advertisers make confident creative decisions and won over 100 new

clients in H1, including a global top three advertiser, a leading

global breakfast foods company, a leading European car

manufacturer, a leading budget airline, a 'big four' UK

supermarket, and a multinational consumer goods company. Platform

revenue comprised 82% of total revenue in H1, ahead of our plan and

well above last year's level."

Further information on the Company can be found at

www.system1group.com.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

For further information, please contact:

System1 Group PLC Tel: +44 (0)20 7043 1000

James Gregory, CEO

Chris Willford, Chief Financial Officer

Canaccord Genuity Limited Tel: +44 (0)20 7523 8000

Simon Bridges / Andrew Potts/ Harry Rees

Interim Statement

Financial Performance

KPIs H1 FY24 H1 FY23

Platform Revenue as a % total

Revenue 82 73

Platform Revenue growth % 44 33

Gross Profit % Revenue 87.8 81.5

Adjusted EBITDA GBPm (1) 1.7 0.8

Adjusted EBITDA % Revenue 13 8

"Rule of 40" (2) 57 42

Free cash flow(3) 0.6 (2.7)

Net cash GBPm 6.3 5.7

(1) Statutory profit before taxation + share-based payments +

interest, depreciation and amortisation

(2) Platform Revenue growth % + Adjusted Group EBITDA % Group

Revenue

(3) Cash flow after interest and before debt raising/reduction,

buybacks/dividends.

Total revenue increased by 27% and Platform revenue (Predict

Your and Improve Your) grew 44% on H1 FY23 to GBP10.9m and

represented 82% of total revenue (H1 FY23: 73%). Revenue grew in

all regions including the Americas. In the US platform revenue rose

by 32% and total revenue by 22%.

New "fame" partnerships were launched with Pinterest, Finecast,

JC Decaux and Teads, contributing to strong growth in ad testing

revenue, which was 48% higher than in H1 FY23.

We launched new non-TV ad testing formats in H1 including TYA

Digital and TYA Audio and are planning Innovation product launches

during calendar 2024.

Our fame-building, products and partnerships helped the Company

to win 136 new platform clients in H1 (H1 FY23: 69). Furthermore,

we retained 128 existing H1 platform clients in H1 compared with 99

in H1 FY23.

Gross profit margin increased from 81.5% in H1 FY23 to 87.8% due

to platform and supply chain efficiencies, price increases and

favourable product and geographic mix versus the comparable

period.

Adjusted Operating Costs increased by 10% versus H1 last year

due to increased marketing expenditure, costs relating to enhanced

ongoing sector and geographic coverage of the TYA Premium database,

and lower net capitalisation of IT development costs.

Statutory basis costs increased by GBP2.4m on H1 FY23,

reflecting, in addition to the Adjusted Operating Costs,

performance-related pay compared to a very low H1 FY23 base,

adverse currency effects, and a GBP0.1m provision against rent

deposits made by System1 in respect of WeWork office leases.

Overall average headcount decreased by 6% to 143 FTE with

increases in Sales & Marketing more than offset by reductions

in Operations and IT.

Intellectual Property Litigation

On 30 June 2023 the Company announced that a settlement had been

reached with System1 Inc regarding the use of the "System1"

trademark. The parties have signed a global agreement which governs

the co-existence of their respective use of the "System1" mark in

connection with their operations. As part of this agreement, the

Company is receiving a fixed undisclosed payment payable in

instalments. The first instalment due under this agreement was

received in August 2023 and has been recognised in other operating

income. The parties have agreed to keep further detail of their

agreement confidential.

Tax

The Group has recognised a tax charge of GBP0.3m in the six

months to 30 September 2023 (H1 FY23: tax charge of GBP0.2m). The

H1 FY24 figure includes a receipt of GBP0.2m in respect of R&D

tax credit claims in the UK. The tax charge arises from trading

profits in non-UK jurisdictions which cannot be offset against

trading losses elsewhere.

Earnings Per Share

Diluted and Basic Earnings per Share improved from a loss of

1.7p to an H1 FY24 earnings per share of 4.9p, in line with the

increase in profits for H1 FY24.

Cash

The Group ended the period with cash balances of GBP6.3m, and no

borrowings (FY23: net cash of GBP5.7m). Free cash flow after

property lease costs and interest income amounted to an inflow of

GBP0.6m in the first half (H1: FY23: outflow of GBP2.7m).

Balance Sheet

Total equity increased to GBP9.3m (31 March 2023: GBP8.6m),

arising from the year-to-date post-tax profit of GBP0.6m and a

small GBP0.1m gain on foreign currency reserves. Intangible assets

have increased by GBP0.3m as a result of the capitalisation of

GBP0.5m of certain platform development costs, offset by

amortisation charges on completed projects.

Current Trading & Outlook

The second half of the year has started well, and at this stage

we expect H2 revenue to exceed H1. The gross profit margin in the

third quarter to date remains close to that achieved in H1, and

well above recent historic levels. Despite a difficult economic

environment in some key markets, and challenging conditions for

media owners and advertisers, we believe System1 can continue to

grow profitably by gaining market share from large incumbents that

we believe have less predictive products.

James Gregory Chris Willford

Chief Executive Officer Chief Financial Officer

Condensed Consolidated Income Statement

for the 6 months ended 30 September 2023

Note Sep-23 Sep-22

GBP'000 GBP'000

--------- --------------------

Revenue 3 13,305 10,496

Cost of sales (1,620) (1,946)

--------- --------------------

Gross profit 11,685 8,550

Administrative expenses (11,070) (8,696)

Other operating income 330 224

Operating profit 945 78

Finance expense (20) (84)

Profit/(Loss) before taxation 925 (6)

Income tax expense (298) (204)

Profit/(Loss) for the period 627 (210)

========= ====================

Attributable to the equity holders of the Company 627 (210)

--------- --------------------

Earnings per share attributable to equity holders of the Company

Basic earnings/(loss) per share 4 4.9p (1.7p)

Diluted earnings/(loss) per share 4 4.9p (1.7p)

CONDENSED Consolidated Statement of Comprehensive Income

for the 6 months ended 30 September 2023

Sep-23 Sep-22

GBP'000 GBP'000

======== ===============

Profit/(loss) for the period 627 (210)

======== ===============

Other comprehensive income:

Items that may be subsequently reclassified to profit/(loss)

Currency translation differences on translating foreign operations 57 447

-------- ---------------

Other comprehensive income for the period, net of tax 57 447

Total comprehensive income for the period attributable to equity holders of the Company 684 237

======== ===============

CONDENSED Consolidated Balance Sheet

as at 30 September 2023

Registered no. 05940040

Note Sep-23 Mar-23

GBP'000 GBP'000

-------- ---------------

ASSETS

Non-current assets

Property, plant, and equipment 7 735 1,162

Intangible assets 8 1,650 1,396

Deferred tax asset 132 203

-------- ---------------

2,517 2,761

Current assets

Contract assets 170 102

Trade and other receivables 6,563 6,344

Income taxes receivable 74 55

Cash and cash equivalents 6,281 5,719

-------- ---------------

13,088 12,220

Total assets 15,605 14,981

======== ===============

EQUITY

Attributable to equity holders of the Company

Share capital 10 132 132

Share premium account 1,601 1,601

Merger reserve 477 477

Foreign currency translation reserve 480 423

Retained earnings 6,641 5,974

-------- ---------------

Total equity 9,331 8,607

-------- ---------------

LIABILITIES

Non-current liabilities

Provisions 329 353

Lease liabilities 9 - 362

-------- ---------------

329 715

Current liabilities

Provisions 96 101

Lease liabilities 9 922 1,094

Contract liabilities 796 764

Trade and other payables 4,131 3,700

-------- ---------------

5,945 5,659

Total liabilities 6,274 6,374

Total equity and liabilities 15,605 14,981

======== ===============

CONDENSED Consolidated Statement of Cash Flows

for the 6 months ended 30 September 2023

Note Sep-23 Sep-22

GBP'000 GBP'000

-------------- --------------

Net cash generated from/(used in) operations 11 1,900 (1,297)

Tax paid (252) (187)

-------------- --------------

Net cash generated from/(used in) operating activities 1,648 (1,484)

Cash flows from investing activities

Purchases of property, plant, and equipment 7 (38) (3)

Purchase of intangible assets 8 (500) (654)

-------------- --------------

Net cash used by investing activities (538) (657)

Net cash flow before financing activities 1,110 (2,141)

Cash flows from financing activities

Interest paid (20) (84)

Property lease liability payments (533) (433)

Purchase of own shares - (135)

-------------- --------------

Net cash used by financing activities (553) (652)

Net increase/(decrease) in cash and cash equivalents 557 (2,793)

Cash and cash equivalents at beginning of period 5,719 11,174

Exchange gain on cash and cash equivalents 5 683

Cash and cash equivalents at end of period 6,281 9,064

============== ==============

Sep-23 Sep-22

GBP'000 GBP'000

-------------- --------------

Net cash flow before financing activities 1,110 (2,141)

Net cash flow for property leases (553) (468)

Operating cash flow 557 (2,609)

-------------- --------------

Consolidated Statement of Cash Flows (continued)

for the 6 months ended 30 September 2023

Consolidated Movements in Net Cash/(Debt)

Cash and cash equivalents Borrowings Lease liabilities Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- ------------------ ------------

At 1 April 2022 11,174 (2,500) (2,508) 6,166

Cash flows (2,793) - 478 (2,315)

Non-cash charges

Interest on lease liabilities - - (45) (45)

Exchange and other non-cash

movements 683 - - 683

At 30 September 2022 9,064 (2,500) (2,075) 4,489

========================== ============== ================== ============

Consolidated Movements in Net Cash/(Debt)

Cash and cash equivalents Borrowings Lease liabilities Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- ------------------ ------------

At 1 April 2023 5,719 - (1,456) 4,263

Cash flows 557 - 553 1,110

Non-cash charges

Interest on lease liabilities - - (20) (20)

Exchange and other non-cash

movements 5 - 1 6

At 30 September 2023 6,281 - (922) 5,359

========================== ============== ================== ============

Consolidated Statement of Changes in Equity

for the 6 months ended 30 September 2023

Foreign

currency

Share premium translation Retained

Share capital account Merger reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- --------------- --------------- -------------- --------------- --------------

At 1 April 2022 132 1,601 477 196 5,857 8,263

Loss for the

period - - - - (210) (210)

Other

comprehensive

income:

- currency

translation

differences - - - 447 - 447

Total

comprehensive

income - - - 447 (210) 237

Transactions

with owners:

Employee share

options:

- value of

employee

services - - - - 182 182

Purchase of own

shares (135) (135)

At 30 September

2022 132 1,601 477 643 5,694 8,547

============== =============== =============== ============== =============== ==============

At 1 April 2022 132 1,601 477 196 5,857 8,263

Profit for the

period - - - - 404 404

Other

comprehensive

income:

- currency

translation

differences - - - 227 - 227

Total

comprehensive

income - - - 227 404 631

Transactions

with owners:

Employee share

options:

- value of

employee

services - - - - (153) (153)

Purchase of own

shares (134) (134)

At 31 March 2023 132 1,601 477 423 5,974 8,607

============== =============== =============== ============== =============== ==============

At 1 April 2023 132 1,601 477 423 5,974 8,607

Profit for the

period - - - - 627 627

Other

comprehensive

income:

- currency

translation

differences - - - 57 - 57

Total

comprehensive

income - - - 57 627 684

Transactions

with owners:

Employee share

options:

- value of

employee

services - - - - 40 40

At 30 September

2023 132 1,601 477 480 6,641 9,331

============== =============== =============== ============== =============== ==============

Notes to the Condensed Consolidated Financial Statements

for the 6 months ended 30 September 2023

System1 Group PLC (the "Company") was incorporated on 19

September 2006 in the United Kingdom. The Company's principal

operating subsidiary, System1 Research Limited, was at that time

already established, having been incorporated on 29 December 1999.

The address of the Company's registered office is 4 More London

Riverside, London, UK SE1 2AU. The Company's shares are listed on

the AIM Market of the London Stock Exchange ("AIM").

The Company and its subsidiaries (together the "Group") provide

predictive marketing data and market research consultancy.

The Board of Directors approved these interim financial

statements for the six months ended 30 September 2023 for issuance

on 6 December 2023.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006 and is unaudited. The Group's latest statutory

financial statements were for the year ended 31 March 2023 and

these have been approved by the Board of Directors and filed with

the Registrar of Companies. These accounts, which contained an

unqualified audit report under Section 495, did not include a

reference to any matters to which the auditor drew attention by way

of emphasis of matter and did not contain a statement under Section

498 (2) or (3) of the Companies Act 2006.

1. Basis of Preparation

This condensed consolidated interim financial information has

been prepared in accordance with UK adopted IAS 34 Interim

Financial Reporting and on the going concern basis. The Group is

mindful of the current economic backdrop in Europe, and the Board

continues to review the performance of the Group monthly, and

senior management has a weekly assessment of sales revenue and

gross profit. The Group also prepares and reviews cash flow

forecasts and is confident that the going concern assessment

remains appropriate. The results presented in this report are

unaudited and they have been prepared in accordance with the

recognition and measurement principles of UK-adopted International

Accounting Standards that are expected to be applicable to the

financial statements for the year ending 31 March 2024 and on the

basis of the accounting policies to be used in those financial

statements. The condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual financial statements, being the statutory financial

statements for System1 Group plc, as at 31 March 2023, which have

been prepared in accordance with UK adopted International

Accounting Standards with the requirements of the Companies Act

2006 as applicable to companies reporting under those

standards.

The preparation of financial statements in accordance with

UK-adopted International Accounting Standards ("UK-adopted IFRS")

requires the use of certain critical accounting estimates.

2. Principal accounting policies

The principal accounting policies adopted are consistent with

those of the financial statements for the year ended 31 March

2023.

3. Segment Information

The financial performance of the Group's geographic operating

units ("Reportable Segments") is set out below.

Sep-23 Sep-22

------------ ------------

Revenue Revenue

GBP'000 GBP'000

------------ ------------

By location of customer

Americas 4,748 4,050

United Kingdom 5,610 3,844

Rest of Europe 2,182 1,864

APAC 765 738

------------ ------------

13,305 10,496

*Segmental revenue is revenue generated from external customers

and so excludes intercompany revenue and is attributable to

geographical areas based upon the location in which the service is

delivered.

Consolidated balance sheet information is regularly provided to

the Executive Directors while segment balance sheet information is

not. Accordingly, the Company does not disclose segment balance

sheet information here.

Sep-23 Sep-22

------------ --------------

Revenue

Revenue *As restated

GBP'000 GBP'000

------------ --------------

By product variant

Predict Your (data) 9,036 6,175

Improve Your (data-led consultancy) 1,902 1,447

------------ --------------

Standard (platform revenue) 10,938 7,622

Other consultancy (non-platform) 2,367 2,874

------------ --------------

13,305 10,496

By product group

Communications (Ad Testing) 10,377 7,022

Brand (Brand Tracking) 1,420 1,865

Innovation 1,508 1,609

------------ --------------

13,305 10,496

*Following the expansion of the Group's data and platform-led

offering, revenue segments in respect of "By product variant" were

revised during the second half of the year ended 31 March 2023 to

reflect the new structure of the Group's internal reporting. The

comparatives have been re-stated accordingly.

4. Earnings Per Share

Sep-23 Sep-22

----------- -----------

Profit/(Loss) attributable to equity holders of the Company, in GBP'000 627 (210)

Weighted average number of Ordinary Shares in issue 12,678,929 12,717,762

Basic earnings/(loss) per share 4.9p (1.7p)

Profit/(Loss) attributable to equity holders of the Company, in GBP'000 627 (210)

Weighted average number of Ordinary Shares in issue 12,678,929 12,717,762

Share options* 12,823 13,000

----------- -----------

Weighted average number of Ordinary Shares for diluted earnings per share 12,691,752 12,730,762

Diluted earnings/(loss) per share 4.9p (1.7p)

* The impact of share options is anti-dilutive in the period

ended 30 September 2022 due to the loss.

5. Headcount

The average number of staff employed by the Group during the

period was as follows:

Sep-23 Sep-22

No. No.

------------ ------------

Sales and marketing 50 47

Operations 39 45

IT 32 38

Administration 22 22

------------ ------------

143 152

6. Dividends

The Company did not pay dividends in the six months ended 30

September 2023 and 30 September 2022. The Company does not propose

the payment of an interim dividend.

No dividends were paid to the Company's directors.

7. Property, Plant, and Equipment

Furniture and

Right-of-use assets fixtures Computer hardware Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------------------- ------------------ ----------------

At 1 April 2022

Cost 3,555 33 192 3,780

Accumulated depreciation (1,584) (29) (113) (1,726)

-------------------- -------------------- ------------------ ----------------

Net book value 1,971 4 79 2,054

Net book value, at 1 April 2022 1,971 4 79 2,054

Additions - - - 30 30

Foreign exchange - 49 - 2 51

Depreciation charge for the year (894) (3) (76) (973)

-------------------- -------------------- ------------------ ----------------

Net book value, at 31 March 2023 1,126 1 35 1,162

At 31 March 2023

Cost 2,050 11 206 2,267

Accumulated depreciation (924) (10) (171) (1,105)

-------------------- -------------------- ------------------ ----------------

Net book value 1,126 1 35 1,162

==================== ==================== ================== ================

At 1 April 2023

Cost 2,050 11 206 2,267

Accumulated depreciation (924) (10) (171) (1,105)

-------------------- -------------------- ------------------ ----------------

Net book value 1,126 1 35 1,162

Net book value, at 1 April 2023 1,126 1 35 1,162

Additions - - 38 38

Foreign exchange 1 - - 1

Depreciation charge for the year (440) - (26) (466)

-------------------- -------------------- ------------------ ----------------

Net book value, at 30 September

2023 687 1 47 735

At 30 September

2023

Cost 2,061 11 244 2,316

Accumulated depreciation (1,374) (10) (197) (1,581)

Net book value 687 1 47 735

==================== ==================== ================== ================

No impairment charges or reversals have been recorded in the six

months ended 30 September 2023, and there have been no substantive

changes to leasehold arrangements.

8. Intangible assets

Development costs Software licences Total

GBP'000 GBP'000 GBP'000

------------------ ------------------ ----------------

At 1 April 2022

Cost - 525 525

Accumulated depreciation - (143) (143)

------------------ ------------------ ----------------

Net book value - 382 382

Net book value, at 1 April 2022 - 382 382

Additions 1,225 - 1,225

Depreciation charge for the year (101) (110) (211)

------------------ ------------------ ----------------

Net book value, at 31 March 2023 1,124 272 1,396

At 31 March 2023

Cost 1,225 525 1,750

Accumulated depreciation (101) (253) (354)

------------------ ------------------ ----------------

Net book value 1,124 272 1,396

================== ================== ================

At 1 April 2023

Cost 1,225 525 1,750

Accumulated depreciation (101) (253) (354)

------------------ ------------------ ----------------

Net book value 1,124 272 1,396

Net book value, at 1 April 2023 1,124 272 1,396

Additions 500 - 500

Depreciation charge for the year (194) (52) (246)

------------------ ------------------ ----------------

Net book value, at 30 September 2023 1,430 220 1,650

At 30 September 2023

Cost 1,725 525 2,250

Accumulated depreciation (295) (305) (600)

Net book value 1,430 220 1,650

================== ================== ================

In the 12 months to 31 March 2023, the Company capitalised

GBP1,225k of costs related to the development of the "Test Your"

platform (carrying value GBP865k at 31 March 2023), which completed

during the year ended 31 March 2023, and the Supply Chain

Automation platform (carrying value GBP259k at 31 March 2023),

which is due for completion in the year ended 31 March 2024. A

further GBP500k has been capitalised in respect of the Supply Chain

Automation project in the six months ended 30 September 2023.

Development costs in respect of completed projects are tested

for impairment where impairment indicators exist. Development costs

in respect of ongoing projects are tested for impairment at each

reporting date. The carrying value of the assets in each case are

assigned to their respective cash generating units for the purposes

of assessing future cashflows. The principal assumptions used in

the forecasts were the timing and amount of future revenues and

cost savings, which were derived from the latest forecasts approved

by the Board. Following the assessment, the Board have determined

that no impairment of assets is required at 30 September 2023.

Capitalised platform development costs are being amortised over a

3-year period.

9. Borrowings

The analysis of the maturity of lease liabilities is as

follows:

Sep-23 Mar-23

GBP'000 GBP'000

-------------- -------------

Within one year 934 1,031

Later than 1 but no later than 5 years - 457

More than 5 years - -

-------------- -------------

Minimum lease payments 934 1,488

Future finance charges (12) (32)

-------------- -------------

Recognised as a liability 922 1,456

The present value of finance lease liabilities is as follows:

Sep-23 Mar-23

GBP'000 GBP'000

-------------- -------------

Within one year 922 1,094

Later than 1 but no later than 5 years - 362

More than 5 years - -

-------------- -------------

922 1,456

On 22 February 2023, the Company entered into an Overdraft

Facility with HSBC. The facility of up to a maximum of

GBP1,500,000, is secured over the Company's trade receivables, and

incurs interest at 3% above the Bank of England base rate on drawn

balances. The facility has no fixed end date and can be cancelled

by either party at any time. During the period ended 30 September

2023, the Company has not drawn any amounts under the facility, and

no amounts have been drawn to the date of the signing of these

financial statements.

10. Share Capital

The share capital of System1 Group PLC consists only of fully

paid Ordinary Shares ("Shares") with a par value of one penny each.

All Shares are equally eligible to receive dividends and the

repayment of capital and represent one vote at the Annual General

Meeting.

Sep-23 Mar-23

---------------------------------------------- -----------------------------------------

No. GBP'000 No. GBP'000

--------------------- ----------------------- ---------------- -----------------------

Allotted, called up, and

fully paid ordinary

shares 13,226,773 132 13,226,773 132

At 1 April and at 30

September

Sep-23 Mar-23

---------------------------------------------- -----------------------------------------

Weighted average Weighted average

exercise price per exercise price per

Treasury shares share Treasury shares share

No. Pence No. Pence

--------------------- ----------------------- ---------------- -----------------------

Shares held by Treasury

At 1 April 547,844 487,151

Purchase of treasury

shares - 60,693

Transfer of shares to -

satisfy options exercise - - -

--------------------- ----------------

At 30 September 547,844 547,844

11. Net Cash Generated from Operations

Sep-23 Sep-22

GBP'000 GBP'000

-------------- --------------

Profit/(loss) before taxation 925 (6)

Depreciation of property, plant, and equipment 466 496

Amortisation and impairment of intangible assets 246 58

Interest paid 20 84

Share-based payment expense 40 182

(Increase)/decrease in contract assets (69) 47

Increase in trade and other receivables (219) (1,001)

Increase/(decrease) in trade and other payables 432 (819)

Increase in deferred income 32 51

Decrease in provisions (29) (65)

Exchange differences on operating items 56 (324)

Net cash generated from/(used in) operations 1,900 (1,297)

============== ==============

12. Reconciliation between Operating Costs and Adjusted

Operating Costs:

Sep-23 Sep-22

GBP'000 GBP'000

-------------------- -----------------

Administrative expenses 11,070 8,696

Finance expense 20 84

-------------------- -----------------

Total operating costs 11,090 8,780

==================== =================

Less: Adjusting items

Compensation for loss of

office 35 -

Bonus and commissions expense 1,124 64

Share-based payment expense* 52 189

Other interest expense - 48

Other staff costs (22) 5

Foreign exchange loss/(gain) 74 (490)

Trademark litigation 20 9

-------------------- -----------------

1,283 (175)

Adjusted operating costs 9,807 8,955

==================== =================

*Inclusive of social security accrued in respect of share

options

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKPBBKBDBABK

(END) Dow Jones Newswires

December 06, 2023 02:00 ET (07:00 GMT)

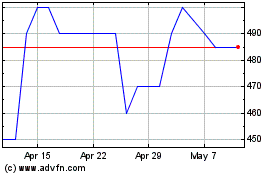

System1 (LSE:SYS1)

Historical Stock Chart

From Jan 2025 to Feb 2025

System1 (LSE:SYS1)

Historical Stock Chart

From Feb 2024 to Feb 2025