Tidelands Oil & Gas Corporation Secures Financing Commitment

May 14 2008 - 4:38PM

PR Newswire (US)

SAN ANTONIO, May 14 /PRNewswire-FirstCall/ -- Tidelands Oil &

Gas Corporation (OTC:TIDE) (BULLETIN BOARD: TIDE) today announced

the closing on May 9, 2008 of a financing transaction in which the

Company entered into a Securities Purchase Agreement ("Purchase

Agreement") with Golden Gate Investors Inc. ("Golden Gate") which

provided for the issuance and sale by the Company of up to $3

million of 6% convertible debentures, with the initial issuance of

a $1 million debenture ("Debenture") and the payment of cash by

Golden Gate of $200,000 and issuance by Golden Gate to the Company

of a $800,000 promissory note ("Note"). The Purchase Agreement

provides Golden Gate with the right to lend, in two separate

transactions, an additional $1 million of funding to the Company,

in its sole discretion, through advancing cash of $200,000 and

issuing a note for the balance, similar to the Note. The Company

has the right until August 8, 2008, to redeem, at a price equal to

the principal and accrued interest, the Debenture provided that no

event of default has occurred. The Debenture is unsecured and bears

interest at the annual rate of 6%, payable monthly, with the

principal amount due on May 9, 2011. The Debenture is convertible

at a per share equal to the lesser of $.50 or 80% of the average of

the three lowest volume weighted average prices during the twenty

trading days prior to Golden Gate's election to convert. The Note

is secured and bears interest at the annual rate of 6.25%, payable

monthly, with the principal amount due on May 31, 2011. Golden Gate

has the option to prepay this note, subject to the satisfaction of

certain conditions. The Company also announced that on May 12,

2008, in exchange for prior advances, the Company issued to James

B. Smith, the Company's President, an unsecured promissory note in

the principal amount of $150,000, bearing interest at the rate of

8% per annum, which amount is due upon demand, and if no demand is

made, on August 31, 2008. The purpose of these financing

transactions is to provide incremental funding and liquidity until

the Company enters into a strategic transaction or consummates an

alternative financing transaction. The Company is exploring

strategic options to enhance stockholder value, including the

acquisition of income generating businesses in the energy sector or

the merger of its operations with other energy enterprises. Any

acquisition is expected to be pursued in partnership with third

parties that are familiar with the current projects and strategic

vision for growth of the Company. There can be no assurance as to

the type of agreement or transaction that may be entered into or

completed, the terms and conditions of any particular agreement or

transaction, the price or other consideration that will be offered

or received by the Company and/or its stockholders in connection

with the completion of a particular agreement or transaction, if

any, or the approximate time it would take for any transaction to

be completed. About Tidelands Oil & Gas Corporation Tidelands

Oil & Gas Corporation, San Antonio, Texas, focuses its business

on natural gas pipeline infrastructure and natural gas receiving

and storage facilities. This press release may be deemed to contain

certain Forward-Looking Statements with respect to the Company that

are subject to risks and uncertainties that include, but are not

limited to, those identified in the Company's press releases or

discussed from time to time in the Company's Securities and

Exchange Commission Filings. Actual results may vary. COMPANY

CONTACT James B. Smith Tidelands Oil & Gas 210-764-8642

DATASOURCE: Tidelands Oil & Gas Corporation CONTACT: James B.

Smith of Tidelands Oil & Gas Corporation, +1-210-764-8642,

Copyright

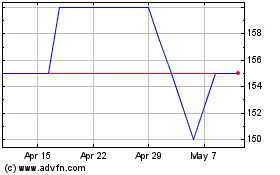

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Crimson Tide Plc (Tidex): 0 recent articles

More News Articles