Time Out Group plc Block Admissions Six Monthly Return

April 24 2024 - 8:58AM

RNS Regulatory News

RNS Number : 9063L

Time Out Group plc

24 April 2024

24 April 2024

Time Out Group

plc

("Time Out", the "Company" or

the "Group")

Block Admissions Six Monthly

Return

Time Out Group plc (AIM: TMO), the

global media and hospitality business, today makes the following

notification pursuant to AIM Rule 29 and Schedule 6 of the AIM

Rules for Companies regarding its block admissions announced on (a)

25 March 2022, effective 31 March 2022 (the "2022 Block Admission"),

(b) announced on 30 June 2023, effective 5 June 2023 (the

"2023 Block Admission"),

and (c) announced on 26 February 2024, effective 1 March 2024 (the

"2024 Block

Admission").

The Company has now allotted all of

the shares under the 2022 Block Admission of 2,000,000 shares. 1,583,364 shares

have now been allotted under the 2023 Block Admission

of 2,500,000 shares. No shares have yet been allotted under the

2024 Block Admission of 2,500,000 shares.

|

Name of Company

|

Time Out Group plc

|

|

Name of Scheme

|

a) 2022 Block

Admission in respect of the Time Out Group plc Long Term Incentive

Plan

b) 2023 Block

Admission in respect of the Time Out Group plc Long Term Incentive

Plan

c) 2024 Block

Admission in respect of the Time Out Group plc Long Term Incentive

Plan

|

|

Period of Return (from /

to)

|

21 November

2023 to 20 April

2024

|

|

Number and class of securities not

issued at the start of the period under the scheme

|

a)

345,135 ordinary shares of 0.1 pence

each

b) 2,500,000 ordinary shares

of 0.1 pence each

c) 2,500,000 ordinary shares

of 0.1 pence each

|

|

Number of securities issued under

the scheme during the period

|

a) 345,135 ordinary shares of

0.1 pence each

b) 1,583,364 ordinary shares

of 0.1 pence each

c) nil

|

|

Balance under the scheme of

securities not yet issued at the end of the period

|

a) nil

b) 916,636 ordinary shares of

0.1 pence each

c) 2,500,000 ordinary shares

of 0.1 pence each

|

|

Number and class of securities

originally admitted and the date of admission

|

a) 2,000,000

ordinary shares of 0.1 pence each admitted on 31 March

2022

b) 2,500,000 ordinary shares

of 0.1 pence each admitted on 5 July 2023

c) 2,500,000 ordinary shares

of 0.1 pence each admitted on 1 March 2024

|

|

Name of contact and telephone

number

|

Emma Humphrey - General Counsel

& Company Secretary

+44 (0)207 813 3000

|

|

For

further information, please contact:

|

|

|

|

|

|

Time Out Group plc

|

Tel: +44 (0)207 813 3000

|

|

Chris Ohlund, CEO

|

|

|

Matt Pritchard, CFO

|

|

|

Steven Tredget, Investor Relations

Director

|

|

|

|

|

|

Liberum (Nominated Adviser and Broker)

|

Tel: +44 (0)203 100 2222

|

|

Andrew Godber / Edward Thomas

/

Joshua Borlant

|

|

|

|

|

|

FTI

Consulting LLP

|

Tel: +44 (0)203 727 1000

|

|

Edward Bridges / Fiona

Walker

|

|

Notes to editors

About Time Out Group plc

Time Out Group is a global media and

hospitality business that inspires and enables people to experience

the best of the city through its two divisions - Time Out Media and

Time Out Market. Time Out launched in London in 1968 to help people

discover the exciting new urban cultures that had started up all

over the city - today it is the only global brand dedicated to city

life. Expert journalists curate and create content about the best

things to Do, See and Eat across 333 cities in 59 countries and

across a unique multi-platform model spanning both digital and

physical channels. Time Out Market is the world's first editorially

curated food and cultural market, bringing a city's best chefs,

restaurateurs and unique cultural experiences together under one

roof. The portfolio includes seven open Markets in cities such as

Lisbon, New York and Dubai, several new locations with expected

opening dates in 2024 and beyond, in addition to a pipeline of

further locations in advanced discussions. Time Out Group PLC,

listed on AIM, is headquartered in the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

BLRSEMFDLELSEIL

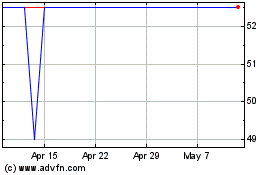

Time Out (LSE:TMO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Time Out (LSE:TMO)

Historical Stock Chart

From Jan 2024 to Jan 2025