RNS Number:1575I

Panafon Hellenic Telecom Co S.A.

7 August 2001

Financial results for quarter ended 30 June 2001 - Greek GAAP

Double digit profitable growth

Revenues +13.1% EBITDA +18.2%

42.2% EBITDA margin

Panafon S.A (Panafon - Vodafone), announces continued profitable growth for the

quarter ended 30 June 2001, according to the Greek Generally Accepted Accounting

Principles.

Revenues for the quarter reached Euro 236.5m (GRD 80.6bn), an increase of 13.1%

compared to the previous period.

EBITDA increased 18.2% compared to the previous period, reaching Euro 99.8m (GRD

34bn), while income before tax reached Euro 65.4m (GRD 22.3bn), an increase of

13.3%.

EBITDA margin reached 42.2%, an improvement of 1.8 percentage points compared to

the previous period.

Gross Profit Margin reached 56.3%, an improvement of half of percentage point

compared to the previous period, reflecting improved profitability and increased

efficiency in company operations.

George Koronias, CEO of Panafon-Vodafone, commented, "The Q1 results reflect

Panafon-Vodafone's leading position in the Greek market. Our latest

achievements, such as the acquisition of a UMTS license and additional 2G

spectrum as well as the official launch of Vodafone branded shops, will

strengthen our position in the market." He continued, "With Vodafone's full

support, we are focused on healthy, profitable growth in line with our strategy

for local and international expansion. Our flexibility and commitment will allow

us to fulfil our strategic plans to the benefit of our customers, employees and

shareholders."

Key Financial Data

1 April - 30 June 2001

Consolidated Financial Results

June 2001 June 2000 June 2001 % change

GRD bn GRD bn Euro m

Revenues 80.6 71.3 236.5 +13.1%

Gross Profit 45.4 39.8 133.2 +14.2%

% of Revenues 56.3% 55.8%

EBITDA 34.0 28.8 99.8 +18.2%

%of Revenues 42.2% 40.4%

Income before tax 22.3 19.7 65.4 +13.3%

% of Revenues 27.6% 27.6%

For Further Information Contact:

Dimitris Tsorbatzoglou Panafon Head of Investor Relations Tel: +301 6160019

ir@panafon.gr, website www.panafon.gr/en/ir

Lulu Bridges or Stuart Carson,

Tavistock Communications, Tel: +(44) 20 7600 2288

Nicolas Bornozis,

Capital Link, Tel: +(212) 661 7566

Notes to Editors

1. Panafon - Vodafone shares are quoted on the Athens Stock Exchange and its

GDSs are quoted on the London Stock Exchange. The shares and GDS's began

trading on Monday 7 December 1998 in ASE and LSE respectively.

2. Panafon - Vodafone had 512,500,000 shares in issue (prior to completion of

the merger) and 534,126,396 (after the completion of the merger with Panafon

Emporiki and Unifon on May 11th 2001).

3. Panafon - Vodafone is a shareholder in:

Panafon Services 100.00 per cent

Panafon Multimedia 100.00 per cent

Next Net 20.10 per cent

Mobitel 25.01 per cent

Ideal Telecom 51.00 per cent

Panafon International Holdings 100.00 per cent

BE- Business Exchanges 30.00 per cent

Vodafone Bulgaria 20.00 per cent

I.N.A 10.555 per cent

CBS 24.00 per cent

E-Motion 100.00 per cent

ACOM 16.00 per cent

Tetoma Com 100.00 per cent

E-Unifon 50.00 per cent

E-Motion Albania 51.00 per cent

E-Motion Cyprus 100.00 per cent

E-Kinitron 2.00 per cent

4. Panafon - Vodafone was awarded a license to operate a GSM network in Greece

for a period of 20 years in August 1992. The network commenced operations on

1 July 1993.

5. Panafon - Vodafone shareholding structure is as follows:

Vodafone Group Plc 52.8 per cent

France Telecom 11.0 per cent

Intracom S.A 8.7 per cent

Free float 27.5 per cent

Panafon - Vodafone listings:

Shares: Athens SE, Reuters PANr.AT. Bloomberg PANF GA. Nominal value GRD 100.

ISIN GRS 307 333 005. SEDOL 556 0349.

GDRs: LSE. Reuters PANq.L. Bloomberg PFH GR, PFHD LI. ISIN US 6981 132 060.

SEDOL 556 0361. Rule 144A: Bloomberg Nasdaq 2250Q US. ISIN US 6981 131 070.

SEDOL 230 2629

Indices: ASE General Index composite (ASE): 4.838%, ASE MAIN GENERAL (ASEAGD):

4.837%, ASE Telecom Index (ASEDTL): 24.156%, DJ EUROPE ST TEL (SXKP): 0.221%,

BE500 TELECOM SE (BETELES): 0.456%, DJ EUROPE STOXX (SXXP): 0.020%, DJ EUROPE ST

TEL (SXKE): 0.511%, FTSE/ASE 20 INDEX (FTASE): 3,77%, DJ EURO STOXX P (SXXE):

0.041%, BBG EUROPE TECHN (BETECH): 0.422%, MSCI 3.52%.

PANAFON HELLENIC TELECOMMUNICATIONS COMPANY S.A. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET AS OF 30th JUNE 2001

These condensed consolidated financial statements have been prepared in

accordance with Greek accounting principles and methods.

ASSETS 30/06/2001 in Grd EURO 30/06/2000 in Grd

B. PRE-ESTABLISHMENT EXPENSES 4,351,346,419 12,769,909 1,736,232,045

Less Acc. Amortization 2,823,009,005 8,264,693 1,197,152,467

1,528,337,414 4,485,216 539,079,578

C. FIXED ASSETS

I. Intangible Assets 61,637,047,305 180,886,419 45,459,217,872

Less Acc. Amortization 22,077,668,610 64,791,397 15,175,275,217

39,559,378,695 116,095,022 30,283,942,655

II. Tangible Assets 308,261,135,652 904,522,775 230,273,521,859

Less Acc. Depreciation 100,602,507,283 295,238,466 68,458,531,480

207,613,628,369 609,284,309 161,814,990,379

III.Investments and other

L.T. receivables 3,967,730,820 11,644,111 8,363,554,425

Total Fixed Assets 251,140,737,884 737,023,442 200,462,487,459

D. CURRENT ASSETS

I. Inventories 5,876,509,933 17,245,811 4,273,063,273

II. Receivables 67,233,867,050 197,311,422 45,762,997,923

III.Securities 2,324,633,876 6,822,110 1,755,000

IV. Cash and cash equivalents 4,981,622,624 14,619,582 1,105,170,788

Total Current Assets 80,416,633,483 235,998,924 51,142,986,984

E. PREPAYMENTS AND ACCRUED

REVENUES 19,941,311,299 58,521,823 22,186,033,016

TOTAL ASSETS 353,027,020,080 1,036,029,406 274,330,587,037

MEMO ACCOUNTS 12,540,418,156 36,802,401 11,310,398,443

LIABILITIES 30/06/2001 in Gr EURO 30/06/2000 in Grd

A. SHAREHOLDERS' EQUITY

I. Share capital 59,020,966,758 173,209,000 51,250,000,000

IV. Legal, other reserves and

retained earnings 97,883,017,951 287,257,573 44,696,323,757

V. Profit for the period

1.4.01-30.6.01

before taxes 22,270,544,455 65,357,431 19,654,309,106

less: Goodwill (9,344,100,190) (27,422,158) (7,404,789,097)

IX. Minority interests 18,774,864 55,099 0

Total shareholders' equity 169,849,203,838 498,456,944 108,195,843,766

B. PROVISIONS FOR RISKS

AND EXPENSES 1,769,660,126 5,193,427 2,111,787,768

C. LIABILITIES

II. Short term liabilities 170,479,950,704 500,307,999 148,621,516,259

D. DEFERRED INCOME AND

ACCRUED EXPENSES 10,928,205,412 32,071,036 15,401,439,243

TOTAL LIABILITIES 353,027,020,080 1,036,029,406 274,330,587,037

MEMO ACCOUNTS 12,540,418,156 36,802,401 11,310,398,443

CONSOLIDATED PROFIT AND LOSS ACCOUNT OF THE PERIOD 1.4.01 - 30.6.01

1.4.01-30.6.01 in Gr EURO 1.4.00-30.6.00

in Grd

Revenues 80,601,198,951 236,540,569 71,277,751,317

Less: Cost of sales 35,376,202,906 103,818,644 31,636,892,804

Gross profit 45,224,996,045 132,721,925 39,640,858,513

Plus: Other operating revenues 175,018,662 513,628 110,547,002

Total 45,400,014,707 133,235,553 39,751,405,515

Less: General & Administrative

expenses 7,499,435,340 22,008,614 5,091,545,937

Selling expenses 14,418,960,943 42,315,366 14,673,552,243

Sub total 23,481,618,423 68,911,573 19,986,307,335

Less: Financial result 1,046,625,882 3,071,536 1,471,758,273

Operating income 22,434,992,541 65,840,037 18,514,549,062

Plus: Non operating revenues 92,002,594 270,000 1,232,367,297

Less: Non operating expenses 189,118,721 555,007 90,969,502

Total 22,337,876,414 65,555,030 19,655,946,857

Less: Depreciation expenses 10,715,670,777 31,447,310 7,659,423,484

Less: Absorbed in operating

expenses 10,648,338,818 31,249,710 7,657,785,733

Income of the period before tax 22,270,544,455 65,357,431 19,654,309,106

Notes:

1. The corporate income tax of the period is estimated at GRD 7.8 bln.

2. At the end of the period, the company employed 2,468 persons.

3. The investment in fixed assets of the period 1.4.01 - 30.6.01 was GRD 16.3

bln.

4. No mortgages exist on the company's fixed assets.

5. The condensed consolidated financial statements include the following

subsidiaries:

PANAFON SERVICES SA, TETOMA SA, IDEAL TELECOM SA, E-MOTION SA, (full

consolidation) and NEXTNET SA, MOBITEL SA, PAPISTAS SA, STELLAKOS SA (equity

method).

6. These condensed consolidated financial statements include Unifon SA (ex-

associate) which merged through absorption by Panafon SA. As a result, the

financial statements of the period April - Jun 01 are not comparable to the

corresponding period of last year.

Marousi, 2 August 2001

MANAGING DIRECTOR CHIEF FINANCIAL OFFICER ACCOUNTING MANAGER

GEORGE KORONIAS CHARALAMBOS MAZARAKIS DIMITRIS TSOPELAS

PANAFON HELLENIC TELECOMMUNICATIONS COMPANY S.A.

CONDENSED BALANCE SHEET AS OF 30th JUNE 2001

The condensed financial statements have been prepared in accordance

with Greek accounting principles and methods.

ASSETS 30/06/2001 in Grd EURO 30/06/2000 in Grd

B. PRE-ESTABLISHMENT EXPENSES 3,966,514,072 11,640,540 1,272,927,245

Less Acc. Amortization 2,565,944,744 7,530,285 890,379,825

1,400,569,328 4,110,255 382,547,420

C. FIXED ASSETS

I. Intangible Assets 55,394,776,421 162,567,209 46,618,830,700

Less Acc. Amortization 20,736,852,377 60,856,500 15,151,428,805

34,657,924,044 101,710,709 27,467,401,895

II. Tangible Assets 300,542,387,333 882,002,604 225,350,559,276

Less Acc. Depreciation 99,032,670,865 290,631,463 67,365,587,351

201,509,716,468 591,371,142 157,984,971,925

Total Fixed Assets 250,508,728,074 735,168,681 201,928,893,133

III.Investments and other

L.T. receivables 14,341,087,562 42,086,831 16,476,519,313

Total Fixed Assets 250,508,728,074 735,168,681 201,928,893,133

D. CURRENT ASSETS

I. Inventories 5,745,909,190 16,862,536 2,934,241,619

II. Receivables 66,931,860,012 196,425,121 53,894,093,901

III.Securities 2,324,633,876 6,822,110 0

IV. Cash and cash equivalents 4,509,393,108 13,233,729 262,660,114

Total Current Assets 79,511,796,186 233,343,496 57,090,995,634

E. PREPAYMENTS AND ACCRUED

REVENUES 19,639,115,123 57,634,967 17,717,746,708

TOTAL ASSETS 351,060,208,711 1,030,257,399 277,120,182,895

MEMO ACCOUNTS 11,685,875,458 34,294,572 10,519,805,095

LIABILITIES 30/06/2001 in Grd EURO 30/06/2000 in Grd

A. SHAREHOLDERS' EQUITY

I. Share capital 59,020,966,758 173,209,000 51,250,000,000

IV. Legal, other reserves and

retained earnings 98,402,162,444 288,781,108 45,058,104,948

V. Profit for the period

1.4.01-30.6.01

before taxes 21,732,548,514 63,778,572 19,898,850,016

less: Goodwill

Total shareholders' equity 179,155,677,716 525,768,680 116,206,954,964

B. PROVISIONS FOR RISKS

AND EXPENSES 1,471,681,652 4,318,948 2,019,828,640

C. LIABILITIES

II. Short term liabilities 157,753,707,227 462,960,256 145,024,281,423

D. DEFERRED INCOME AND

ACCRUED EXPENSES 12,679,142,116 37,209,515 13,869,117,868

TOTAL LIABILITIES 351,060,208,711 1,030,257,399 277,120,182,895

MEMO ACCOUNTS 11,685,875,458 34,294,572 10,519,805,095

PROFIT AND LOSS ACCOUNT OF THE PERIOD 1.4.01 - 30.6.01

1.4.01-30.6.01 EURO 1.4.00-30.6.00

in Grd in Grd

Revenues 79,985,255,530 234,732,958 65,377,443,949

Less: Cost of sales 37,455,855,393 109,921,806 25,965,206,637

Gross profit 42,529,400,137 124,811,152 39,412,237,312

Plus: Other operating revenues 249,921,507 733,445 184,110,716

Total 42,779,321,644 125,544,598 39,596,348,028

Less: Administrative expenses 5,715,908,432 16,774,493 4,017,246,393

Selling expenses 14,224,727,321 41,745,348 15,743,028,743

Sub total 22,838,685,891 67,024,757 19,836,072,892

Less: Financial result 936,064,217 2,747,070 1,287,128,671

Operating income 21,902,621,674 64,277,686 18,548,944,221

Plus: Non operating revenues 48,271,660 141,663 1,424,576,666

Less: Non operating expenses 151,012,861 443,178 74,670,871

Total 21,799,880,473 63,976,172 19,898,850,016

Less: Depreciation expenses 9,770,990,952 28,674,955 7,448,022,522

Less: Absorbed in operating

expenses 9,703,658,993 28,477,356 7,448,022,522

Income of the period before tax 21,732,548,514 63,778,572 19,898,850,016

Notes:

1. The corporate income tax of the period is estimated at GRD 7.5 bln.

2. At the end of the period, the company employed 1,669 persons.

3. The investment in fixed assets of the period 1.4.01 - 30.6.01 was GRD 15,3

bln.

4. No mortgages exist on the company's fixed assets.

5. These condensed financial statements include Panafon Emporiki (ex-subsidiary)

and Unifon (ex-associate) which merged through absorption by Panafon.

As a result, the financial statements of the period Apr-Jun 01 are not

comparable to the corresponding period of last year. The transactions

incurred between Panafon SA and the two merged companies (Unifon SA, Panafon

Emporiki SA) from 1.4.01 and up to the approval date of the merger (11.5.01

for Unifon SA and 18.05.01 for Panafon Emporiki) have been eliminated.

6. Revenues are analyzed to the following categories:

a) 642.0 Telecommunications GRD 72,679,443,972

b) 525.1 PC retail and other equipment GRD 7,287,870,318

c) 526.3 Other retail sales GRD 17,941,240

Marousi, 2 August 2001

MANAGING DIRECTOR CHIEF FINANCIAL OFFICER ACCOUNTING MANAGER

GEORGE KORONIAS CHARALAMBOS MAZARAKIS DIMITRIS TSOPELAS

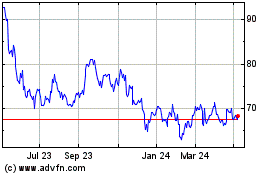

Vodafone (LSE:VOD)

Historical Stock Chart

From Feb 2025 to Mar 2025

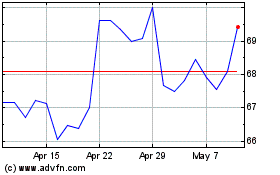

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Mar 2025