TIDMWWH

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH

AFRICA OR ANY JURISDICTION WHICH THE SAME COULD BE UNLAWFUL.

LEI: 5493003YBCY4W1IMJU04

13 July 2021

Worldwide Healthcare Trust PLC

Publication of Prospectus

Worldwide Healthcare Trust PLC (the "Company") has today published a prospectus

(the "Prospectus") relating to a placing programme of up to 20 million new

ordinary shares (the "New Ordinary Shares").

The New Ordinary Shares will be issued pursuant to the authorities granted by

the Company's shareholders at a general meeting of the Company held on 12

February 2021.

The Prospectus will shortly be available on the Company's website

(www.worldwidewh.com) and on the National Storage Mechanism via https://

data.fca.org.uk/#/nsm/nationalstoragemechanism.

Terms not otherwise defined in this announcement have the meanings given to

them in the Prospectus.

Enquiries:

Frostrow Capital LLP 020 3008 4913

Mark Pope

Winterflood Securities 020 3100 0000

Neil Morgan

Hande Derinkok

Winterflood Securities Limited ("Winterflood"), which is authorised and

regulated by the Financial Conduct Authority in the United Kingdom, is acting

only for the Company in connection with the matters described in this

announcement and will not be responsible to anyone other than the Company for

providing the protections afforded to clients of Winterflood or for advising

any such person in relation to the matters contained herein.

Neither Winterflood nor any of its directors, officers, employees, advisers or

agents accepts any responsibility or liability whatsoever for this

announcement, its contents or otherwise in connection with it or any other

information relating to the Company, whether written, oral or in a visual or

electronic format.

Each of the Company, Frostrow Capital LLP ("Frostrow"), ObiMed Capital LLC ("

OrbiMed"), Winterflood and their affiliates and their respective officers,

employees and agents expressly disclaim any and all liability which may be

based on this announcement and any errors therein or omissions therefrom.

This announcement is an advertisement and does not constitute a prospectus

relating to the Company and does not constitute, or form part of, any offer or

invitation to sell or issue, or any solicitation of any offer to subscribe for,

any New Ordinary Shares in any jurisdiction nor shall it, or any part of it, or

the fact of its distribution, form the basis of, or be relied on in connection

with or act as any inducement to enter into, any contract therefor.

This announcement is not an offer to sell or a solicitation of any offer to buy

New Ordinary Shares in the United States (including its territories and

possessions, any state of the United States and the District of Columbia

(collectively the "United States")), Australia, Canada, the Republic of South

Africa, Japan, or any Member State of the European Economic Area, or any of

their respective territories or possessions, or in any other jurisdiction where

such offer or sale would be unlawful. No action has been taken by the Company

or Winterflood that would permit an offering of any shares in the capital of

the Company or possession or distribution of this announcement or any other

offering or publicity material relating to such shares in any jurisdiction

where action for that purpose is required. Persons into whose possession this

announcement comes are required by the Company and Winterflood to inform

themselves about, and to observe, such restrictions.

This communication is not for publication or distribution, directly or

indirectly, in or into the United States of America. This communication is not

an offer of securities for sale into the United States. The securities referred

to herein have not been and will not be registered under the U.S. Securities

Act of 1933, as amended, and may not be offered, sold, resold, transferred or

delivered directly or indirectly in the United States, or to, or for the

account or benefit of, U.S. Persons, except pursuant to an applicable exemption

from registration. No public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the US Investment

Company Act of 1940, as amended (the "Investment Company Act") and, as such,

holders of the New Ordinary Shares will not be entitled to the benefits of the

Investment Company Act. No offer, sale, resale, pledge, delivery, distribution

or transfer of the New Ordinary Shares may be made except under circumstances

that will not result in the Company being required to register as an investment

company under the Investment Company Act.

The merits or suitability of any securities must be independently determined by

the recipient on the basis of its own investigation and evaluation of the

Company. Any such determination should involve, among other things, an

assessment of the legal, tax, accounting, regulatory, financial, credit and

other related aspects of the securities.

This announcement may not be used in making any investment decision in

isolation. This announcement on its own does not contain sufficient information

to support an investment decision and investors should ensure that they obtain

all available relevant information before making any investment. This

announcement does not constitute or form part of and may not be construed as an

offer to sell, or an invitation to purchase or otherwise acquire, investments

of any description, nor as a recommendation regarding the possible offering or

the provision of investment advice by any party. No information in this

announcement should be construed as providing financial, investment or other

professional advice and each prospective investor should consult its own legal,

business, tax and other advisers in evaluating the investment opportunity. No

reliance may be placed for any purposes whatsoever on this announcement or its

completeness.

The information and opinions contained in this announcement are provided as at

the date of the announcement and are subject to change without notice and no

representation or warranty, express or implied, is or will be made in relation

to the accuracy or completeness of the information contained herein and no

responsibility, obligation or liability or duty (whether direct or indirect, in

contract, tort or otherwise) is or will be accepted by the Company, Frostrow,

OrbiMed, Winterflood or any of their affiliates or by any of their respective

officers, employees or agents to update or revise publicly any of the

statements contained herein. No reliance may be placed for any purpose

whatsoever on the information or opinions contained in this announcement or on

its completeness, accuracy or fairness. The document has not been approved by

any competent regulatory or supervisory authority.

The value of the New Ordinary Shares and any income from them is not guaranteed

and can fall as well as rise due to stock market and currency movements. When

you sell your investment you may get back less than you originally invested.

Figures refer to past performance and past performance is not a reliable

indicator of future results. Returns may increase or decrease as a result of

currency fluctuations.

This announcement contains forward looking statements, including, without

limitation, statements including the words "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or, in each

case, their negative or other variations or comparable terminology. Such

forward looking statements involve unknown risks, uncertainties and other

factors which may cause the actual results, financial condition, performance or

achievements of the Company, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements.

Information to Distributors

Solely for the purposes of the product governance requirements contained

within: (a) the UK version of EU Directive 2014/65/EU on markets in financial

instruments, as it forms part of the laws of England and Wales by virtue of the

European Union (Withdrawal) Act 2018, as amended ("EUWA") and as amended by UK

legislation ("MiFID II"); (b) Articles 9 and 10 of the UK version of Commission

Delegated Directive (EU) 2017/593 supplementing MiFID II, as it forms part of

the laws of England and Wales by virtue of the EUWA and as amended by UK

legislation; and (c) local implementing measures (together, the "MiFID II

Product Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any "manufacturer" (for

the purposes of the MiFID II Product Governance Requirements) may otherwise

have with respect thereto, the New Ordinary Shares have been subject to a

product approval process, which has determined that the New Ordinary Shares

are: (i) compatible with an end target market of retail investors and investors

who meet the criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target Market

Assessment"). Notwithstanding the Target Market Assessment, distributors should

note that: the price of the New Ordinary Shares may decline and investors could

lose all or part of their investment; the New Ordinary Shares offer no

guaranteed income and no capital protection; and an investment in the New

Ordinary Shares is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or regulatory

selling restrictions in relation to the Placing Programme.

For the avoidance of doubt, the Target Market Assessment does not constitute:

(a) an assessment of suitability or appropriateness for the purposes of MiFID

II; or (b) a recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to the New

Ordinary Shares.

Each distributor is responsible for undertaking its own Target Market

Assessment in respect of the Ordinary Shares and determining appropriate

distribution channels.

PRIIPS (as defined below)

ln accordance with the UK version of Regulation (EU) No 1286/2014 of the

European Parliament and of the Council of 26 November 2014 on key information

documents for packaged retail and insurance-based investment products as it

forms part of the laws of England and Wales by virtue of the EUWA and as

amended by UK legislation ("PRIIPs") and its implementing and delegated acts

(the "PRIIPs Regulation"), the Company has prepared a key information document

(the "KID") in respect of the New Ordinary Shares. The KID is made available to

"retail investors" prior to them making an investment decision in respect of

the New Ordinary Shares at https://www.worldwidewh.com/corporate-information/

key-information-document

If you are distributing New Ordinary Shares, it is your responsibility to

ensure that the KID is provided to any clients that are "retail clients".

The Company is the only manufacturer of the New Ordinary Shares for the

purposes of the PRIIPs Regulation and none of Winterflood, Frostrow or OrbiMed

are manufacturers for these purposes. None of Winterflood, Frostrow or OrbiMed

make any representations, express or implied, or accepts any responsibility

whatsoever for the contents of the KID prepared by the Company nor accepts any

responsibility to update the contents of the KID in accordance with the PRIIPs

Regulation, to undertake any review processes in relation thereto or to provide

the KID to future distributors of New Ordinary Shares. Each of Winterflood,

Frostrow or OrbiMed and their respective affiliates accordingly disclaim all

and any liability whether arising in tort or contract or otherwise which it or

they might have in respect of the KID prepared by the Company. Investors should

note that the procedure for calculating the risks, costs and potential returns

in the KID are prescribed by laws. The figures in the KID may not reflect

actual returns for the Company and anticipated performance returns cannot be

guaranteed.

END

(END) Dow Jones Newswires

July 13, 2021 10:37 ET (14:37 GMT)

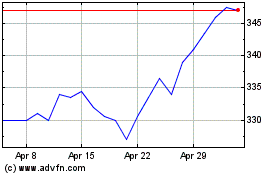

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Jun 2024 to Jul 2024

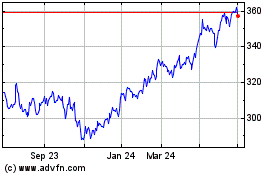

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Jul 2023 to Jul 2024