TIDMWWH

17 November 2021

LONDON STOCK EXCHANGE ANNOUNCEMENT

Worldwide Healthcare Trust PLC

Unaudited Half Year Results for the six months ended

30 September 2021

This Announcement is not the Company's Half Year Report & Accounts. It is an

abridged version of the Company's full Half Year Report & Accounts for the six

months ended 30 September 2021. The full Half Year Report & Accounts, together

with a copy of this announcement, will also shortly be available on the

Company's website: www.worldwidewh.com where up to date information on the

Company, including daily NAV, share prices and fact sheets, can also be found.

The Company's Half Year Report & Accounts for the six months ended 30 September

2021 has been submitted to the UK Listing Authority, and will shortly be

available for inspection on the National Storage Mechanism (NSM): https://

data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact: Mark Pope, Frostrow Capital LLP 020

3008 4913.

Company Summary / Performance

Six months to One year to

30 September 31 March

2021 2021

Net asset value per share (total return)* # 0.4% 30.0%

Share price (total return)* # (1.5%) 27.4%

Benchmark (total return)^ # 13.0% 16.0%

30 September 31 March Six months

2021 2021 change

Net asset value per share 3,700.7p 3,703.0p (0.1%)

Share price 3,625.0p 3,695.0p (1.9%)

Discount of share price to the net asset value 2.0% 0.2%

per share*

Leverage* 14.7% 7.6%

Ongoing charges* 0.8% 0.9%

Ongoing charges (including performance fees 1.3% 0.9%

crystallised during the period)*

# Source - Morningstar.

^ Benchmark - MSCI World Health Care Index on a net total return, sterling

adjusted basis (see glossary)

* Alternative Performance Measure. Leverage calculated under the

Commitment Method (see glossary)

Chairman's Statement

Sir Martin Smith

Performance

Following a period of strong relative and absolute performance, the first six

months of the current financial year have proved to be challenging for the

Company. While the Company's net asset value per share total return ended the

period in positive territory (+0.4%), it significantly underperformed the

Company's Benchmark, the MSCI World Healthcare Index, measured on a net total

return, sterling adjusted basis, which rose by 13.0%. Sterling depreciated by

2.3% against the U.S. dollar over the period; the U.S. dollar being the

currency in which the majority of the Company's investments are denominated.

The Company's share price total return of -1.5% fared less well and, as a

result, the discount of the Company's share price to the net asset value per

share widened to 2.0% as at 30 September 2021 from 0.2% at the beginning of the

period.

The principal reasons for this underperformance were the significant overweight

positions in poorly performing Emerging Biotechnology* and China, a strategy

that had previously served the Company well. These sectors were subject to

significant volatility as investors rotated to larger stocks in more developed

markets, which is why they were the largest contributors to the reported

relative underperformance. In addition, absolute performance was affected by

the political uncertainty arising from the incoming new Presidential

administration in the U.S.

Looking at specific names in the portfolio, the largest contributions during

the reporting period came from UK pharmaceutical and biotechnology company

AstraZeneca, Indian multinational hospital chain company Apollo Hospitals

Enterprise and U.S. medical supplies company DexCom. The largest detractors

from performance were Chinese pharmaceutical company Jiangsu Hengrui Medicine

and U.S. biopharmaceutical companies Vor Biopharma and Haemonetics. Further

information regarding the Company's investments and performance can be found in

the Review of Investments.

The Company had, on average, leverage of 10.9% during the period which

contributed 0.04% to performance. As at the half year-end leverage stood at

14.7% compared to 7.6% at the beginning of the period. Our Portfolio Manager

continues to adopt both a pragmatic and a tactical approach to the use of

leverage.

The underperformance of the Benchmark in the period has resulted in a reversal

of the performance fee provision of £18.9m, which now stands at zero. In

accordance with the terms of the performance fee arrangements*, following an

exceptional period of outperformance in the period to 30 June 2020, which was

maintained to June 2021, a performance fee of £12.9m became payable as at 30

June 2021. Further details are provided in note 3.

* See Glossary.

As I have mentioned previously, the Company is able to invest up to 10% of the

portfolio, at the time of acquisition, in unquoted securities. Our Portfolio

Manager, through its extensive private equity research capability, has

continued to identify opportunities which have been added to the portfolio.

Exposure to unquoted equities accounted for 7.5% of the total portfolio at the

half year-end, and these holdings made a positive contribution of 1.9% to the

Company's performance during the period under review.

Capital

The Board continues to monitor closely the relationship between the Company's

share price and the net asset value per share. As a result of continued

investor demand, a total of 1,122,500 new shares were issued at a premium to

the cum income net asset value per share during the half year, raising £41.7

million of new funds. Following the half year end to 16 November 2021, a

further 75,000 new shares were issued at a premium to the cum income net asset

value per share, raising £2.8 million of new funds. No shares were repurchased

by the Company during the period under review and to 16 November 2021.

As mentioned at the Company's year-end, the ongoing share issuance programme

triggered the requirement for the Company to produce a prospectus which was

published on 13 July 2021. The prospectus provides authority for the issuance

of 20 million new shares. A copy of the prospectus can be found on the

Company's website at www.worldwidewh.com

Revenue and Dividends

The revenue return for the period was £9.0 million, compared to £5.6 million in

the same period last year. This increase was due primarily due to a rise in

portfolio income. The Board has declared an increased interim dividend of 7.0p

per share, for the year to 31 March 2022 (2021: 6.5p), which will be payable on

11 January 2022 to shareholders on the register of members on 19 November 2021.

The associated ex-dividend date is 18 November 2021.

I remind shareholders that it remains the Company's policy to pay out dividends

at least to the extent required to maintain investment trust status. These

dividend payments are paid out of the Company's net revenue for the year and,

in accordance with investment trust rules, only a maximum of 15% of income can

be retained by the Company in any financial year.

It is the Board's continuing belief that the Company's capital should be

deployed rather than paid out as dividends to achieve a particular target

yield.

Outlook

Our Portfolio Manager continues to believe that despite this disappointing

half-year, the positive investment themes which underpin the healthcare sector

remain intact and they will continue to focus on the selection of investments

with strong prospects for capital growth. They further believe that innovation

will continue to be the primary value driver for the healthcare sector. In

addition, an expected increase in mergers and acquisitions activity, a

relatively benign political environment in the U.S. and a return to favour of

both emerging markets healthcare stocks and Emerging Biotechnology companies

will lead to an improvement in the Company's performance.

Sir Martin Smith

Chairman

17 November 2021

Review of Investments

Markets

The hallmark of equity markets so far in 2021 has been that share price returns

are being primarily driven by global factors and events. Whether it be the

pandemic "recovery" trade, growth-to-value rotation, large capitalisation

companies over small, inflation concerns, interest rate gyrations, or other

"factor" influences, the effect of these factors often swamped company specific

fundamental factors in moving share prices. As a specialist investor in a

highly complex and idiosyncratic industry like healthcare, it was, at best, a

frustrating six?month period.

Of course, the global pandemic wrought by the SARS-Cov-2 virus has not ended

with the administration of billions of COVID-19 vaccine doses worldwide.

Despite the explosion of the highly contagious Delta-variant in mid-2021 across

continents, global equity markets continued to move higher, with multiple

indices reaching record highs in the period.

At a high level, one critical driver of global equities over the past

six-months has been investor sentiment about the global economic outlook.

Concerns about U.S. tax reform, global inflation, supply chain disruption and

unemployment were ignored as stocks moved higher. Recurring waves of COVID-19

infections across the globe were also ignored by investors as stocks once again

moved higher. Globally, investor sentiment was buoyed by an economy that was

expected to expand at a pace not seen in 80 years.

Overall, we saw an MSCI World Index total return of 10.7% in the half-year

period (sterling adjusted). In the U.S., the S&P 500 finished up 9.2% (dollar)

on a total return basis. In the U.K., the FTSE All Share total return was 7.9%

(sterling). For healthcare, the Benchmark return was 13.0%. Similarly, the S&P

500 Healthcare Sub-Index (sterling adjusted) rose 12.7% on a total return

basis.

Performance

For the six-month period ended 30 September 2021, the Company posted a net

asset value total return of +0.4%. and a share price total return of -1.5%.

This performance lagged the Benchmark return of +13.0%. The Company's

underperformance was due to multiple factors but was focussed on three primary

factors.

* First, two subsectors in which we have long held a strategic overweight

position - Emerging Biotechnology and China - significantly underperformed.

* Second, a backdrop of a rotation by investors from growth-to-value and from

small capitalisation to large capitalisation stocks, hurt the Company's

relative performance.

* Third, the persistent threat of U.S. drug price reform created an overhang

for some parts of healthcare.

Our investment strategy, centred around innovation, resulted in

underperformance during the six-month period. Our preferences for biotechnology

over pharmaceuticals, growth over value, and small capitalisation over large

capitalisation companies all conspired against relative performance. Despite

this recent challenging performance, we plan to maintain this strategy going

forward. Whilst this strategy is susceptible to short-term volatility, it has

proven successful over the longer term.

Since its inception as of 28 April 1995, the Company's NAV has posted a

+4,505.8% total return, or an average of +15.6% per annum through to 30

September 2021. The Company's share price return over the same period has been

+4,282.2%, or +15.4% per annum. This compares to a Benchmark return of

+1,990.8%, or +12.2% per annum over the same investment horizon and is a

testament to the long-term success of our investment approach.

Sector Review

Two sectors that are long term, key strategic overweight positions for the

Company, Emerging Biotechnology and China, were subject to some extreme

volatility in the six-month period and were the largest factors in the reported

underperformance versus the benchmark. Partially offsetting this poor

performance, however, were contributions from other sectors and regions, most

notably Medical Devices Pharmaceuticals, and India, as well as from the

Company's portfolio of "unquoteds" (a mix of private companies and fixed

income).

Biotechnology

Following record performance in 2020, the biotechnology sector, and in

particular small and mid-capitalisation stocks, has dramatically underperformed

the overall market thus far in 2021. With the post-election political overhang,

some negative fundamental news flow, and the abundance of "macro" and sentiment

factors driving investor behaviour, the sector has materially underperformed to

a record extent.

Additionally, investor concerns about news flow from the U.S. Food and Drug

Administration (FDA) increased during the period which applied further pressure

to biotechnology valuation levels. In 2021, there were several unexpected

regulatory trends from the FDA, notably: surprise Complete Response Letters

(effectively "non?approvals" of new drugs), clinical holds (halting a clinical

trial due to safety concerns), and deferrals on target action dates (when more

time is required to review a new drug application). Also, of note, was the

stretched workload of the FDA due to COVID-19 related responsibilities,

delaying a plethora of clinical trials, advisory committees, manufacturing site

visits, new drug reviews, and vaccine reviews.

The controversial approval of Biogen's Aduhelm (aducanumab) by the FDA, despite

mixed clinical trial data and a negative recommendation by an external advisory

committee, also hurt investor confidence in the agency, leading investors to

become increasingly wary of potential regulatory risks and uncertainties in

biotechnology.

Further, the Emerging Biotechnology sector has been plagued by several

high-profile negative news events in 2021, including multiple late-stage

clinical trial failures as well as unexpected safety problems across clinical

trials. This includes some safety concerns among high profile new technologies,

like gene editing.

Other issues also created headwinds for biotechnology stocks, including modest

levels of mergers and acquisitions (M&A) in the period, a paucity of positive

clinical catalysts, and a significant "growth-to-value" rotation that resulted

in dramatic underperformance of biotechnology stocks (as measured by the S&P

Biotech ETF or XBI) when compared to the S&P 500 Index.

Nevertheless, we remain positive on the outlook for the sector, and believe the

broad valuation reset within biotechnology could catalyse strategic action from

acquirors, which could help reignite investor interest. These companies remain

the cradle of innovation within the sector and will remain a strategic

overweight for the Company.

Emerging Markets

Another strategic overweight for the Company that experienced volatility was

Emerging Market stocks, specifically in China, in the latter part of the

reported six-month period. Like biotechnology stocks described above, emerging

market healthcare names experienced robust returns in 2020, in part due to

COVID-19 related tailwinds. Many Chinese healthcare stocks, especially vaccine

players, digital healthcare and hospital operators were favoured by investors

during the pandemic and valuations rose accordingly.

However, with richer valuations, we witnessed some profit taking in 2021. This

selling pressure was exacerbated by investor concerns over potential tightening

of government regulations in the Chinese healthcare sector, which first

occurred in other industries such as the internet and education. Harsher

government intervention in these sectors caused investors to worry about

additional regulations that may come in healthcare, creating a "wait and see"

sentiment which allowed share prices to fall further still.

Despite the recent volatility, we believe the correction in valuations in China

is largely done and investor sentiment may be swinging positive. Further, the

China biopharmaceutical industry remains innovation-driven and there has been

an increasing number of molecules being licensed to overseas players, a

critical point of validation for the burgeoning research and development (R&D)

activity coming out of China.

Of course, macro tailwinds remain strong. With a declining number of new-borns,

an aging population remains one of the largest issues in China. As a result,

government investment in the healthcare system, including private hospitals,

internet/ digital healthcare and medical insurance remains the primary focus of

government in the next five-year plan.

Healthcare

The current calendar year has been challenging for healthcare stocks. The

outcome of the 2020 U.S. Presidential election created a "Blue Wave" with the

Democrats in full control of the White House, the House of Representatives, and

the Senate.

This final election outcome increased the possibility that the incoming

administration would be both motivated and capable of passing industry-changing

legislation - specifically on drug pricing - that would be harmful to

healthcare stocks. Whilst this has yet to happen (and we believe that it will

not), the compression in valuation compared to the broader market became

evident as many generalist investors chose to avoid what is seen as a complex

area of the market.

This is not without precedent. Previously healthcare stocks have traded at a

steep relative discount due to generalist investor fears over federal

legislative changes related to prescription drug pricing, notably the

Democratic controlled Presidencies of Bill Clinton in 1993 ("Hillarycare") and

Barack Obama in 2009 ("Obamacare"). In both cases, the discount eventually

reversed after legislation went nowhere or proved benign or even positive for

the healthcare industry. Ultimately, we expect a similar reversal in valuations

under Joe Biden.

Life Sciences

The Life Science Tools and Services sector is another which benefited

significantly from COVID-19 tailwinds in 2020 and this has continued into 2021.

Whilst the Company did enjoy some modest positive contribution from the sector

in the reporting period, it was below the Benchmark return. The

underperformance was principally due to our positioning in the sector, where we

favour companies we view as long-term secular winners based on novel and

exciting new innovations, as opposed to the more mature large-capitalisation,

diversified companies that make up much of this sector.

This reflects our longer-term thesis around compelling investment opportunities

across key themes such as liquid biopsy and spatial genomics. However, in the

period, there was significant volatility across the stocks tied to these newer

trends, unlike the general strength in the larger, more diversified names who

were able to weather COVID-19 related disruptions to their end markets.

Looking ahead, we continue to see the most attractive opportunity set in our

preferred high growth areas of innovation, where relative valuations have been

recently depressed and which investors may appreciate attractive upside moving

into the end of the calendar year and into 2022.

Major Contributors to Absolute Net Asset Value Performance

As has been an important hallmark of the Company's performance over the years,

major contributors to performance are represented by a very diverse and

distinct set of companies. Key contributors in the six-month period ended

30 September 2021 included a large capitalisation pharmaceutical company from

the UK, a major hospital operator in India, and three U.S. based companies: a

specialty drug developer, the maker of an artificial pancreas, and a

cardiovascular medical device maker.

The COVID-19 pandemic brought industry, governments, and academia together in

unison to attempt to thwart one of the most deadly pandemics in modern history.

But it was not without controversy. One company that attempted to do the right

thing, AstraZeneca, was perhaps the pre-eminent example. Imperfect execution

across trial design, trial logistics, manufacturing, and communication led to

over promising and under delivery of a vaccine and (so far) a therapeutic for

COVID-19.

With it, came share price volatility that obfuscated the company's

best-in-class growth profile generated by some of the best innovation and

business development in the industry across a wide range of therapeutic

categories, including oncology, diabetes, respiratory, and cardiometabolic

medicine.

We invested in the company during the tumult and now that the pandemic related

headlines have subsided, the company has maintained a top tier growth

trajectory despite a difficult operating environment with the share price

responding accordingly.

Apollo Hospitals Enterprise is the largest hospital chain in India with 71

hospitals and over 10,000 beds as of June 2021. Alongside this, Apollo has the

largest retail pharmacy in India with over 4,000 pharmacies. The company has

recently entered digital healthcare in a significant way under the umbrella

brand, "Apollo 24*7". Impressive share price performance, including record

highs, came from several factors. First, occupancy rates have shown a strong

recovery through 2021, to near pre-pandemic highs, though it had COVID-19

related occupancy as well. The company's strong execution in terms of cost

control and managing case-mix led to healthy average revenues per operating

bed. Second, multiple new business initiatives have fuelled investor

enthusiasm; another reason for the share price re-rating. These include "Apollo

Healthco" (a recent carve out from the existing business), "PharmEasy" (a

potential IPO with a prospective U.S.$9 billion valuation), and other new

initiatives showing results and margin accretion such as proton therapy,

clinics, and diagnostics.

Dexcom is a California-based medical device company that is the market leader

in continuous glucose monitoring (CGM). The company is ushering in a new

paradigm in diabetes care - an artificial pancreas. Historically, monitoring

blood glucose was done via needle-based finger pricks and external devices

which gave only individual data points that were of modest value. Today, using

the company's innovative technology, patients can now receive real-time

indications of their blood glucose on their mobile phone, which can detect

whether the user's blood sugar is improving or worsening, and even communicate

with an insulin pump to mimic a pancreas by automatically and algorithmically

administering insulin.

With up to eight million diabetics requiring daily insulin in their core

markets and hundreds of millions of diabetics globally, Dexcom has been working

tirelessly to drive adoption of this innovative technology. The past six months

were strong operationally for the company, in particular it posted a very

strong second quarter result, suggesting the current business is accelerating

at the same time as the company moves closer to the expected launch of its next

generation product; G7. As a result, the share price reached record highs in

the period.

Horizon Pharmaceuticals is a US-based specialty pharmaceutical company that

presided over one of the most successful drug launches ever in 2020, Tepezza

(teprotumumab) which was developed by the company to treat "TED" or thyroid eye

disease, a painful, disfiguring, and debilitating disorder of the musculature

of the eye. Launched in January 2020, the drug was well on its way to

blockbuster status despite the commercial headwinds of the COVID-19 pandemic.

Despite a temporary government-mandated shutdown in the manufacturing of

Tepezza due to the prioritisation of COVID?19 vaccine production, the re-launch

of the product in April 2021 exceeded expectations. Management has continued to

raise near-term estimates for Tepezza sales, pushing the stock to all-time

highs during the reported period.

Another distinct and unique example of innovation is Edwards Lifesciences, a

developer of tissue replacement heart valves, and more specifically

transcatheter heart valves (THV). The company's current valve portfolio is

largely comprised of aortic heart valves, a market which continues to grow

solidly in the double-digit range and has remained relatively well insulated

from COVID-19 disruptions, given the severity of the disease that this

technology is designed to treat: aortic stenosis.

A strong competitive position and growing demand have allowed the company to

continue to outperform its peer group with respect to organic sales and

earnings growth rates, resulting in solid share price performance during the

six-month period. Importantly, there have been several positive updates on the

company's product pipeline, specifically around mitral heart valve

technologies, which has led to increased investor confidence in sustained high

sales growth for the next several years.

Major Detractors from Absolute Net Asset Value Performance

Theravance Biopharma is a biopharmaceutical company specialising in the

discovery and development of organ-selective medicines. The company offers the

marketed drug, Yupelri (revefenacin), a once-daily, nebulised long-acting

muscarinic antagonist for use in the treatment of chronic obstructive pulmonary

disease (COPD). The company's pipeline is also innovative and includes a novel

mechanism - pan-janus kinase (JAK) inhibition - for the treatment of both

ulcerative colitis and asthma.

Unfortunately, the share price dropped in the reported period after two

separate but high-profile pipeline failures: (1) TD?1473 - a gut-selective JAK

inhibitor for the treatment of ulcerative colitis and (2) ampreloxetine - a

norepinephrine reuptake inhibitor in neurogenic orthostatic hypotension. Both

TD-1473 and ampreloxetine were discontinued due to a lack of efficacy shown in

their respective clinical trials. The stock fell as a result, however, the

company immediately implemented a significant cost reduction programme to focus

on reaching profitability, which helped buoy the valuation after these

disappointing catalysts.

Another notable detractor which fell victim to the broader biotechnology

sell-off was Boston-based Ikena Oncology, which develops targeted cancer

therapies and modulators of the tumour microenvironment. The company's lead

programme, IK-930, targets solid tumours with defined genetic mutations. The

company expects this asset to enter clinical development by the end of 2021 and

has a promising pipeline of earlier stage programmes that should also generate

company value. However, in the absence of clinical data, the shares have been

weak following its March 2021 IPO amidst a broader sell off of early-stage

biotechnology companies.

Haemonetics is the largest provider of equipment and consumables used for

plasma collection in the world. The company has worked to provide value for its

customers by pioneering an innovative new machine and collection process that

can significantly enhance collection plasma yields per donor, at a time when

collections have been significantly challenged due to the COVID-19 pandemic.

Notable players, like Takeda, were readily adopting this new technology.

Unfortunately, however, one of the company's largest customers, CSL of

Australia, announced in April 2021 that they would not be renewing their

contract with Haemonetics and would instead be moving to a new entrant into the

market. The share price fell as a result, and on the basis of this new

information we exited the stock.

Vor Biopharma is a Massachusetts-based biotechnology company developing

cellular therapies for the treatment of acute myeloid leukemia. The company's

lead programme utilises CRISPR/Cas9-based gene editing technology to disrupt

the expression of a very specific protein coding gene (called CD33) in stem

cells that produce blood cells in bone marrow. This is in effort to reduce the

toxicity of CD33-targeted agents including Mylotarg, an antibody-drug

conjugate, and of chimeric antigen receptor T cell therapy. The share price for

the company has waned since its February 2021 IPO, again reflecting a lack of

current investor interest in the small cap biotechnology space.

Jiangsu Hengrui Medicine is the largest pharmaceutical company listed in China

and is an example of a "blue-chip" healthcare stock which we target as a

strategic investment in emerging markets. Their innovative oncology franchise

consists of many "hot targets" including novel therapies in immuno-oncology

(PD-1 inhibitors) and targeted therapies (tyrosine kinase inhibitors and PARP

inhibitors). The company's large and robust generic franchise spans many

therapeutic categories including oncology, cardiovascular, pain, and

antibiotics.

Declines in the share price in the reporting period reflected two factors.

First, the company suffered some reimbursement and pricing setbacks in the

Chinese Group Purchasing Organisation (GPO) programme that concluded during the

period, adversely impacting the company's revenue in 2021. Second, changes to

regulatory guidelines in China for new cancer drug approvals (i.e., the

requirement of a comparator arm) was a negative development for the company's

innovative oncology franchise. Intensified debate over pricing for new cancer

drugs in China also hurt the share price after the company's PD-1 inhibitor,

AiRuiKa (camrelizumab), faced a government mandated price revision of over 50%.

Contribution from Unquoted Holdings

During the six months ended 30 September 2021, the Company continued to take

advantage of a favourable market in crossover investments (i.e. investment in

the last financing round before a company goes public) and we continue to

believe they offer an attractive combination of near-term liquidity and

financial return.

As of 30 September 2021, investments in unquoted companies (excluding debt

securities) accounted for 7.5% of the Company's net assets versus 5.3% as of 31

March 2021, and 1.0% as of 31 March 2020. The Company initiated positions in

three China-based unquoted investments during the period; one investment,

Erasca , completed its initial public offering in July 2021 despite a difficult

market environment for biotechnology new issues in the United States. For the

period under review, unquoted equities contributed 1.9% to the Company's

performance.

Leverage Strategy

Historically, the typical leverage level employed by the Company has been in

the mid-to-high teens level. Considering the market volatility during the past

financial year, we have, more recently, used leverage in a more tactical

fashion. For example, after the dramatic "V"-shape market recovery of April

2020, leverage was significantly reduced by over 10% month-over-month, to 3%

and ultimately to 1% in May 2020. This low level of leverage was maintained for

a period of months but was increased ahead of and into the U.S. Presidential

election in November 2020 and decreased in the post-election period heading

into 2021.

However, given the sell-offs in Emerging Biotechnology and China healthcare

stocks during the six-month period under review, leverage was again increased,

effectively increasing month-over-month thereafter in 2021. The significant

potential for a positive resolution to the U.S. drug pricing reforms has also

pushed gearing up as of the end of October 2021. We expect to continue with a

tactical approach to leverage in 2022.

Derivative Strategy

The Company has the ability to use equity swaps and options. During the current

review period the Company employed single stock equity swaps to gain exposure

to emerging market Chinese and Indian stocks. The exposure via swaps averaged

6.7% on a gross basis during the period and detracted 0.6% from the Company's

performance. Analysis of the Company's investments in emerging markets is set

out earlier in this report. Further explanation regarding swaps can be found in

the Glossary.

Looking Ahead

We have long espoused the "Golden Era" of innovation that has been the primary

creator of value for biopharmaceuticals for nearly ten years now. We have no

reason to believe that this is going to change. In fact, the industry's

response to the COVID-19 pandemic is just the latest example of the

unprecedented innovation and societal benefit that the industry can offer.

Despite not attracting as much headline attention as vaccines, the novel

therapeutics developed to treat and potentially prevent the COVID-19 illness

are just as impressive as the vaccine initiatives. The development of multiple

antibodies, antibody cocktails and anti-virals to reduce the severity of

symptoms, prevent hospitalisations, and lower mortality have been critical in

the public fight against COVID-19. The re-purposing of many already approved

medicines to combat the disease burden has been under reported. Also, the

development of oral therapies to reduce illness and prevent death will be

another critical arrow in the quiver against the pandemic.

The FDA has certainly been in the spotlight in 2021. From its efforts to combat

to COVID-19, to much scrutinised delays for some new drug approvals, to the

controversial approval of new Alzheimer's drug, and the on-going lack of an

appointed Commissioner; there has certainly been reason for investor concern.

But what are the facts?

First and foremost, we expect another near record number of new drug approvals

in 2021. With 41 novel approvals in the first three quarters of the calendar

year, the Agency has approved one more drug compared to the same time period a

year ago and has the potential for 58 approvals in 2021 (source: Washington

Analysis). This would be the second highest level of annual approvals of all

time and would represent the most productive five-year period in FDA history.

On 7 June 2021, the FDA approved Aduhelm (aducanumab) for the treatment of

Alzheimer's disease. However, this unexpected approval set off a maelstrom of

controversy given the debatable clinical efficacy of the drug and the fact that

an external advisory committee voted against recommending approval of the drug.

The ultimate approval debunks the myth that the FDA cannot operate properly or

is too conservative in the absence of a full-time commissioner. We believe this

view underappreciates the importance of the permanent staff and career

employees who do almost all of the primary due diligence on behalf of the FDA.

What else can we expect from the Biden Administration in Washington? Both

Medicare expansion and drug pricing reform have featured prominently in debates

regarding the social spending bill. The most realistic Medicare proposals being

discussed are incremental; including the expansion of benefits and lowering the

cost of premiums. In the effort to lower the cost of prescription drugs to

patients, there is a notable lack of consensus regarding the preferred size and

scope of such reforms. We feel that these disagreements may derail drug pricing

legislative efforts completely or produce a significantly watered-down update,

either of which would be welcomed by investors.

M&A has been a common industry staple in healthcare for decades, especially in

the therapeutics space, and a core part of the Company's investment strategy.

The fragmented and heterogeneous nature of the industry, coupled with clinical

and technological complexity, will continue to generate many

business-development deals. That said, there is an ebb and flow to M&A, a

variable cyclicality driven by influences from capital markets, IPOs, and

crossovers, plus considerations like valuation, large capitalisation company

appetites, and of course, the impact of the pandemic.

The summer of 2021 certainly saw an "ebb" in M&A activity with a total

transaction value of only U.S.$6 billion across eight deals. This inflected in

earnest in October when Merck announced its intention to acquire Acceleron

Pharma for U.S.$11.5 billion. We do expect an uptick in M&A given the limited

cash flow disruption for likely acquirors arising from the pandemic, continued

solid balance sheets and the positive tone from large capitalisation companies

about potential M&A.

In our current and fast-changing society, new and novel technologies abound and

have impacted many industries. Healthcare is no exception and technological

advances are the primary pillar for our positive outlook on the industry. We

see an unprecedented level of innovation across the spectrum, from therapeutics

to services, from devices to diagnostics. Moreover, advances in genomics and

biotechnology have pushed the therapeutics space to such frontiers that the

number of known disease states and druggable targets are at an all-time high.

Novel platform technologies have enabled more therapies to target diseases that

were previously thought to be untreatable.

Sven H. Borho and Trevor M. Polischuk

OrbiMed Capital LLC

Portfolio Manager

17 November 2021

Principal Stock Contributors to and Detractors from Absolute Net Asset Value

Performance

For the Six Months Ended 30 September 2021

Top Five Contributors Contribution Contribution

£'000 per share

£

AstraZeneca 25,830 0.4

Apollo Hospitals Enterprise 24,314 0.4

Dexcom 24,034 0.4

Horizon Therapeutics 20,342 0.3

Edwards Lifesciences 18,870 0.3

Top Five Detractors

Jiangsu Hengrui Medicine (15,075) (0.2)

Vor Biopharma (16,320) (0.2)

Haemonetics* (17,511) (0.3)

Ikena Oncology (18,044) (0.3)

Theravance Biopharma (23,738) (0.4)

Based on 65,108,269 shares being the weighted average number in issue during

the period.

* Not held at 30 September 2021

Source: Frostrow Capital LLP

Portfolio

At 30 September 2021

Country/ Market value % of

Investments Region £'000 investments

Merck USA 142,736 5.5

Bristol-Myers Squibb USA 137,650 5.3

AstraZeneca United 130,247 5.1

Kingdom

Boston Scientific USA 116,803 4.5

Horizon Therapeutics USA 107,162 4.1

Mirati Therapeutics USA 97,106 3.8

AbbVie USA 87,273 3.4

SPDR S&P Biotech Fund USA 83,707 3.3

UnitedHealth Group USA 77,142 3.0

Natera USA 73,070 2.8

Top 10 investments 1,052,896 40.8

Vertex Pharmaceuticals USA 70,291 2.7

Edwards Lifesciences USA 67,420 2.6

Intuitive Surgical USA 65,578 2.5

DexCom USA 61,592 2.4

Guardant Health USA 60,004 2.3

Humana USA 56,437 2.2

Stryker USA 55,561 2.2

Zimmer Biomet Holdings USA 48,380 1.9

Novartis Switzerland 46,563 1.8

Caris Science (unquoted) USA 42,556 1.7

Top 20 investments 1,627,278 62.9

Neurocrine Biosciences USA 38,982 1.5

Anthem USA 38,724 1.5

Erasca USA 34,077 1.3

Progyny USA 33,060 1.3

Deciphera Pharmaceuticals USA 32,336 1.2

ImmunoGen USA 28,454 1.1

CRISPR Therapeutics Switzerland 27,417 1.1

Thermo Fisher Scientific USA 25,705 1.0

Oak Street Health USA 25,231 1.0

Biogen USA 23,556 0.9

Top 30 investments 1,934,820 75.0

Alphamab Oncology China 23,475 0.9

HCA Healthcare USA 23,405 0.9

Joinn Laboratories China China 22,332 0.9

Select Medical Holdings USA 22,154 0.8

Arrail (unquoted) USA 19,772 0.8

Turning Point Therapeutics USA 17,859 0.7

Jinxin Fertility Group China 17,721 0.7

Shanghai Bioheart Pharmaceutical (unquoted) China 17,660 0.7

Crossover Health (unquoted) USA 17,358 0.7

Galapagos Belgium 16,759 0.6

Top 40 investments 2,133,315 82.7

Country/ Market value % of

Investments Region £'000 investments

EDDA (unquoted) China 16,759 0.6

Yidu Tech China 16,298 0.6

Iovance Biotherapeutics USA 16,136 0.6

Arcutis Biotherapeutics USA 16,017 0.6

Ikena Oncology USA 15,088 0.6

SI-BONE USA 14,941 0.6

Beijing Yuanxin Technology (unquoted) China 14,870 0.6

Shanghai Kindly Medical Instruments China 14,831 0.6

MeiraGTx USA 14,531 0.6

Theravance Biopharma USA 14,298 0.6

Top 50 investments 2,287,084 88.4

Celldex Therapeutics USA 14,275 0.5

Visen (unquoted) China 14,164 0.5

Ruipeng Pet Group (unquoted) China 13,922 0.5

Tenet Healthcare USA 13,173 0.5

Dingdang Health Technology Group (unquoted) China 13,083 0.5

New Horizon Health China 13,038 0.5

Seagen USA 12,461 0.5

Burning Rock Biotech China 12,385 0.5

Rimag (unquoted) China 11,704 0.5

uniQure Netherlands 11,664 0.5

Top 60 investments 2,416,953 93.3

CSPC Pharmaceutical Group China 11,142 0.4

NanoString Technologies USA 11,106 0.4

Hangzhou Tigermed Consulting China 11,079 0.4

RxSight USA 9,889 0.4

Vor BioPharma USA 9,654 0.4

Danaher USA 9,652 0.4

Daiichi Sankyo Japan 9,564 0.4

Shenzhen Hepalink Pharmaceutical Group China 9,299 0.4

Medlive Technology China 9,278 0.3

Harpoon Therapeutics USA 8,580 0.3

Top 70 investments 2,516,196 97.0

Apollo Hospitals Enterprise India 8,447 0.3

Achilles Therapeutics USA 7,988 0.3

CVRx USA 7,949 0.3

Shandong Weigao Group Medical Polymer China 7,809 0.3

Passage USA 7,502 0.3

United Laboratories International Holdings China (HK) 6,528 0.3

China Medical System China 6,391 0.3

MabPlex International (unquoted) China 5,736 0.2

Abbisko (unquoted) China 5,714 0.2

NanoString Technologies 2.63% 01/03/2025 (unquoted) USA 5,681 0.2

Top 80 investments 2,585,941 99.8

Country/ Market value % of

Investments Region £'000 investments

Shanghai Junshi Biosciences China (HK) 5,623 0.2

Simcere Pharmaceutical Group China 4,778 0.2

Convey Holding Parent USA 4,050 0.2

Hansoh Pharmaceutical China (HK) 1,196 0.0

AiQ Warrant 13/10/2027 (unquoted) USA 1,187 0.0

Peloton (DCC**- unquoted) USA 501 0.0

Total equities and fixed interest investments 2,603,276 100.8

OTC Equity Swaps - Financed

JPMorgan iDex US SMID Biotech Index* United 47,284 1.8

States

Apollo Hospitals Enterprise India 36,693 1.4

Jiangsu Hengrui Medicine China 32,354 1.3

Shandong Pharmaceutical China 23,138 0.9

BGI Genomics China 21,304 0.8

Takeout* China 12,984 0.5

Less: Gross exposure added through financed swaps (195,211) (7.5)

Total OTC Swaps (21,454) (0.8)

Total investments including OTC Swaps 2,581,822 100.0

* Basket Swap. See Glossary.

Summary

Market value % of

Investments £'000 investments

Quoted equities 2,402,609 93.1

Unquoted equities 194,986 7.5

Unquoted debt securities 5,681 0.2

Equity swaps (21,454) (0.8)

Total of all investments 2,581,822 100.0

** DCC = deferred contingent consideration.

See note 1 for further details in relation to the OTC Swaps.

Interim Management Report

Principal Risks and Uncertainties

The Directors continue to review the Company's key risk register which

identifies the risks and uncertainties that the Company is exposed to and the

controls in place and the actions being taken to mitigate them. This is set

against the backdrop of increased levels of risk and uncertainty in evidence

since early 2020, as a result of the impact of the COVID?19 pandemic. The

Directors have considered the impact of this continued uncertainty on the

Company's financial position and, based on the information available to them at

the date of this report, have concluded that no adjustments are required to the

accounts as at 30 September 2021.

A review of the half-year and the outlook for the Company can be found in the

Chairman's Statement and the Review of Investments. The principal risks and

uncertainties faced by the Company include the following:

* Exposure to market risks and those additional risks specific to the sectors

in which the Company invests, such as political interference in drug

pricing.

* Macro events may have an adverse impact on the Company's performance by

causing exchange rate volatility, changes in tax or regulatory

environments, and/or a fall in market prices. Emerging markets, which a

portion of the portfolio is exposed to, can be subject to greater political

uncertainty and price volatility than developed markets.

* Unquoted investments are more difficult to buy, sell or value and so

changes in their valuations may be greater than for listed assets.

* The risk that the individuals responsible for managing the Company's

portfolio may leave their employment or may be prevented from undertaking

their duties.

* The risk that following the failure of a counterparty, the Company could be

adversely affected through either delay in settlement or loss of assets.

* The Board is reliant on the systems of the Company's service providers and

as such disruption to, or a failure of, those systems could lead to a

failure to comply with law and regulations leading to reputational damage

and/or financial loss to the Company.

* The risk that investing in companies that disregard Environmental, Social

and Governance (ESG) factors will have a negative impact on investment

returns and also that the Company itself may become unattractive to

investors if ESG is not appropriately considered in the Portfolio Manager's

decision making process.

* The risk, particularly if the investment strategy and approach are

unsuccessful, that the Company may underperform resulting in the Company

becoming unattractive to investors and a widening of the share price

discount to NAV per share. Also, falls in stock markets, such as those

experienced as a consequence of the COVID?19 pandemic, and the risk of a

global recession, are likely to adversely affect the performance of the

Company's investments.

Information on these risks is given in the Annual Report for the year ended 31

March 2021.The Board believes that the Company's principal risks and

uncertainties have not changed materially since the date of that report and are

not expected to change materially for the remaining six months of the Company's

financial year.

Related Party Transactions

During the first six months of the current financial year no material

transactions with related parties have taken place which have affected the

financial position or the performance of the Company during the period.

Going Concern

The Directors believe, having considered the Company's investment objectives,

risk management policies, capital management policies and procedures, nature of

the portfolio and expenditure projections, that the Company has adequate

resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future and, more specifically, that there are no material uncertainties

relating to the Company that would prevent its ability to continue in such

operational existence for at least twelve months from the date of the approval

of this half yearly financial report. For these reasons, they consider there is

reasonable evidence to continue to adopt the going concern basis in preparing

the accounts. In reviewing the position as at the date of this report, the

Board has considered the guidance issued by the Financial Reporting Council.

As part of their assessment, the Directors have given careful consideration to

the next continuation vote to be held in 2024 and also consequences for the

Company resulting from the continuing uncertainty arising from the COVID-19

pandemic. As previously reported, stress testing was also carried out in May

2021, which modelled the effects of substantial falls in markets and

significant reductions in market liquidity, on the Company's net asset value,

its cash flows and its expenses.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its knowledge:

i. the condensed set of financial statements contained within the Half Year

Report have been prepared in accordance with Financial Reporting Standard

104 (Interim Financial Reporting); and

ii. the interim management report includes a true and fair review of the

information required by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

a. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the

current financial year and that have materially affected the financial

position or performance of the entity during that period; and any changes

in the related party transactions described in the last annual report that

could do so.

The Half Year Report has not been reviewed or audited by the Company's

auditors.

This Half Year Report contains certain forward?looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking information.

For and on behalf of the Board

Sir Martin Smith

Chairman

17 November 2021

Income Statement

For the Six Months Ended 30 September 2021

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2021 30 September 2020

Revenue Capital Revenue Capital

Return Return Total Return Return Total

£'000 £'000 £'000 £'000 £'000 £'000

(Losses)/gains on investments - (5,449) (5,449) - 382,487 382,487

Foreign exchange losses - (4,482) (4,482) - (5,501) (5,501)

Income from investments (note 2) 11,246 - 11,246 7,785 - 7,785

AIFM, portfolio management, and (483) 9,706 9,223 (403) (22,106) (22,509)

performance fees (note 3)

Other expenses (467) - (467) (750) - (750)

Net return/(loss) before finance 10,296 (225) 10,071 6,632 354,880 361,512

charges and taxation

Finance charges (16) (308) (324) (14) (259) (273)

Net return/(loss) before finance 10,280 (533) 9,747 6,618 354,621 361,239

Taxation (1,287) - (1,287) (992) - (992)

Net return/(loss) after taxation 8,993 (533) 8,460 5,626 354,621 360,247

Return/(loss) per share (note 4) 13.8p (0.8)p 13.0p 9.9p 623.0p 632.9p

The "Total" column of this statement is the Income Statement of the Company.

The "Revenue" and "Capital" columns are supplementary to this and are prepared

under guidance published by The Association of Investment Companies.

All revenue and capital items in the above statement derive from continuing

operations.

The Company has no recognised gains and losses other than those shown above and

therefore no separate Statement of Total Comprehensive Income has been

presented.

The accompanying notes are an integral part of these statements.

Statement of Changes in Equity

For the Six Months Ended 30 September 2021

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2021 2020

£'000 £'000

Opening shareholders' funds 2,381,425 1,538,298

Issue of new shares 41,676 192,754

Return for the period 8,460 360,247

Dividends paid - revenue (10,085) (10,512)

Closing shareholders' funds 2,421,476 2,080,787

Statement of Financial Position

As at 30 September 2021

(Unaudited) (Audited)

30 September 31 March

2021 2021

£'000 £'000

Fixed assets

Investments 2,603,276 2,416,038

Derivatives - OTC swaps 21,226 18,864

2,624,502 2,434,902

Current assets

Debtors 19,486 18,172

Cash and cash equivalents 60,277 29,595

79,763 47,767

Current liabilities

Creditors: amounts falling due within one year (240,109) (92,932)

Derivative - OTC Swaps (42,680) (8,312)

(282,789) (101,244)

Net current assets/(liabilities) (203,026) (53,477)

Total net assets 2,421,476 2,381,425

Capital and reserves

Ordinary share capital 16,359 16,078

Share premium account 837,752 796,357

Capital reserve 1,542,095 1,542,628

Capital redemption reserve 8,221 8,221

Revenue reserve 17,049 18,141

Total shareholders' funds 2,421,476 2,381,425

Net asset value per share - (note 5) 3,700.7p 3,703.0p

Cash Flow Statement

For the Six Months Ended 30 September 2021

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2021 2020

Note £'000 £'000

Net cash (outflow)/inflow from operating 7 (13,453) 485

activities

Purchases of investments and derivatives (540,411) (505,070)

Sales of investments and derivatives 384,014 546,830

Realised gain/(loss) on foreign exchange (1,770) (5,282)

transactions

Net cash (outflow)/inflow from investing (158,167) 36,478

activities

Issue of shares 44,253 191,353

Equity dividends paid (10,085) (10,512)

Interest paid (324) (273)

Net cash inflow from financing activities 33,844 180,568

(Increase)/decrease in net debt (137,776) 217,531

Cash flows from operating activities includes interest received of £780,000

(2020: £1,290,000) and dividends received of £10,650,000 (2020: £7,629,000).

Reconciliation of Net Cash Flow Movement to Movement in Net Debt

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2021 2020

£'000 £'000

(Increase)/decrease in net debt resulting from cashflows (137,776) 217,531

Losses on foreign currency cash and cash equivalents (2,712) (219)

Movement in net debt in the period/year (140,488) 217,312

Net debt at 1 April (20,301) (150,516)

Net debt at period/year (160,789) 66,796

Notes to the Financial Statements

1. Accounting Policies

The condensed Financial Statements for the six months to 30 September 2021

comprise the Company's primary financial statements together with the related

notes below. They have been prepared in accordance with FRS 104 'Interim

Financial Reporting', the AIC's Statement of Recommended Practice issued in

October 2019 ('SORP') and using the same accounting policies as set out in the

Company's Annual Report and Financial Statements at 31 March 2021.

Going Concern

After making enquiries, and having reviewed the Investments, Statement of

Financial Position and projected income and expenditure for the next 12 months,

the Directors have a reasonable expectation that the Company has adequate

resources to continue in operation for the foreseeable future. The Directors

have therefore adopted the going concern basis in preparing these condensed

financial statements.

Fair Value

Under FRS 102 and FRS 104 investments have been classified using the following

fair value hierarchy:

Level 1 - Quoted market prices in active markets

Level 2 - Prices of a recent transaction for identical instruments

Level 3 - Valuation techniques that use:

i. observable market data; or

ii. non-observable data

AS OF 30 SEPTEMBER 2021 Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Investments held at fair value through profit 2,402,609 ... 200,667 2,603,276

or loss

Derivatives: OTC swaps (assets) - 21,226 - 21,226

Derivatives: OTC swaps (liabilities) - (42,680) - (42,680)

Financial instruments measured at fair value 2,402,609 (21,454) 200,667 2,581,822

AS OF 31 MARCH 2021 Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Investments held at fair value through 2,275,409 - 140,629 2,416,038

profit or loss

Derivatives: OTC swaps (assets) - 18,864 - 18,864

Derivatives: OTC swaps (liabilities) - (8,312) - (8,312)

Financial instruments measured at fair 2,275,409 10,552 140,629 2,426,590

value

2. Income

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2021 2020

£'000 £'000

Investment income 11,246 7,785

Total 11,246 7,785

3. AIFM, Portfolio Management and Performance Fees

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2021 30 September 2020

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

AIFM fee 82 1,565 1,647 74 1,398 1,472

Portfolio management fee 401 7,617 8,018 329 6,261 6,590

Performance fee charge for the - (18,888) (18,888) - 14,447 14,447

period*

483 (9,706) (9,223) 403 22,106 22,509

* During the six months ended 30 September 2021, due to underperformance

against the Benchmark in the period, a reversal of prior period provisions

totalling £18,888,000 occurred (six months ended 30 September 2020: charge

of £14,447,000).

As at 30 September 2021 no performance fees were accrued or payable (31 March

2021: £31,748,000 accrued). Of the 31 March 2021 accrual £12,860,000

crystallised and became payable as at 30 June 2021 and £18,888,000 reversed due

to underperformance, as noted above. The performance fee paid related to

outperformance generated as at 30 June 2020 that was maintained to 30 June

2021.

The maximum amount that could become payable by 30 September 2022 is £

18,888,000. This would only be payable in full if the current period's

underperformance is reversed and the outperformance achieved as at 31 March

2021 is re-attained.

See glossary for further information on the performance fee.

4. Return/(Loss) Per Share

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2021 2020

£'000 £'000

The return per share is based on the following figures:

Revenue return 8,993 5,626

Capital (loss)/return (533) 354,621

Total return 8,460 360,247

Weighted average number of shares in issue for the period 65,108,269 56,922,562

Revenue return per share 13.8p 9.9p

Capital (loss)/return per share (0.8)p 623.0p

Total return per share 13.0p 632.9p

The calculation of the total, revenue and capital returns per ordinary share is

carried out in accordance with IAS 33, "Earnings per Share (as adopted in the

EU)".

5. Net Asset Value Per Share

The net asset value per share is based on the assets attributable to equity

shareholders of £2,421,476,000 (31 March 2021: £2,381,425,000) and on the

number of shares in issue at the period end of 65,432,755 (31 March 2021:

64,310,255).

6. Transaction Costs

Purchase transaction costs for the six months ended 30 September 2021 were £

461,000 (six months ended 30 September 2020: £831,000).

Sales transaction costs for the six months ended 30 September 2021 were £

403,000 (six months ended 30 September 2020: £473,000).

These costs comprise mainly commission.

7. Reconciliation of Operating Return to Net Cash Inflow from Operating

Activities

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 30

September September

2021 2020

£'000 £'000

Gains before finance costs and taxation 10,071 361,512

Add: capital loss/(less: capital gain) before finance charges 225 (354,880)

and taxation

Revenue return before finance charges and taxation 10,296 6,632

Expenses charged to capital 9,706 (22,106)

(Increase)/decrease in other debtors (133) 1,198

(Decrease)/increase in provisions, and other creditors and (31,781) 15,294

accruals

Net taxation suffered on investment income (1,293) (428)

Amortisation (248) (105)

Net cash (outflow)/inflow from operating activities (13,453) 474

8. Principal Risks and Uncertainties

The principal risks facing the Company are listed in the Interim Management

Report. An explanation of these risks and how they are managed is contained in

the Strategic Report and note 16 of the Company's Annual Report & Accounts for

the year ended 31 March 2021.

9. Comparative Information

The condensed financial statements contained in this half year report do not

constitute statutory accounts as defined in section 434 of the Companies Act

2006. The financial information for the half years ended 30 September 2021 and

30 September 2020 has not been audited or reviewed by the Company's auditor.

The information for the year ended 31 March 2021 has been extracted from the

latest published audited financial statements of the Company. Those financial

statements have been filed with the Registrar of Companies. The report of the

auditor on those financial statements was unqualified, did not include a

reference to any matters to which the auditors drew attention by way of

emphasis without qualifying the report, and did not contain statements under

either section 498 (2) or 498 (3) of the Companies Act 2006.

Earnings for the first six months should not be taken as a guide to the results

for the full year.

Glossary of Terms and Alternative Performance Measures (APMs)

Alternative Investment Fund Managers Directive (AIFMD)

Agreed by the European Parliament and the Council of the European Union and

transported into UK legislation, the AIFMD classifies certain investment

vehicles, including investment companies, as Alternative Investment Funds

('AIFs') and requires them to appoint an Alternative Investment Fund Manager

('AIFM') and depositary to manage and oversee the operations of the investment

vehicle. The Board of the Company retains responsibility for strategy,

operations and compliance and the Directors retain a fiduciary duty to

shareholders.

Benchmark

The performance of the Company is measured against the MSCI World Health Care

Index on a net total return, sterling adjusted basis.

The net total return is calculated by reinvesting dividends after the deduction

of withholding taxes.

Discount or Premium (APM)

A description of the difference between the share price and the net asset value

per share. The size of the discount or premium is calculated by subtracting the

share price from the net asset value per share and is usually expressed as a

percentage (%) of the net asset value per share. If the share price is higher

than the net asset value per share the result is a premium. If the share price

is lower than the net asset value per share, the shares are trading at a

discount.

Emerging Biotechnology

Biotechnology companies with a market capitalisation less than U.S.$10bn.

Equity Swaps

An equity swap is an agreement in which one party (counterparty) transfers the

total return of an underlying equity position to the other party (swap holder)

in exchange for a one-off payment at a set date. Total return includes dividend

income and gains or losses from market movements. The exposure of the holder is

the market value of the underlying equity position.

Your Company uses two types of equity swap:

* funded, where payment is made on acquisition. They are equivalent to

holding the underlying equity position with the exception of additional

counterparty risk and not possessing voting rights in the underlying; and,

* financed, where payment is made on maturity. As there is no initial outlay,

financed swaps increase economic exposure by the value of the underlying

equity position with no initial increase in the investments value - there

is therefore embedded leverage within a financed swap due to the deferral

of payment to maturity.

The Company employs swaps for two purposes:

* To gain access to individual stocks in the Indian, Chinese and other

emerging markets, where the Company is not locally registered to trade or

is able to gain in a more cost efficient manner than holding the stocks

directly; and,

* To gain exposure to thematic baskets of stocks (a Basket Swap). Basket

Swaps are used to build exposure to themes, or ideas, that the Portfolio

Manager believes the Company will benefit from and where holding a Basket

Swap is more cost effective and operationally efficient than holding the

underlying stocks or individual swaps.

Leverage (APM)

Leverage is defined in the AIFMD as any method by which the AIFM increases the

exposure of an AIF. In addition to the gearing limit the Company also has to

comply with the AIFMD leverage requirements. For these purposes the Board has

set a maximum leverage limit of 140% for both methods. This limit is expressed

as a % with 100% representing no leverage or gearing in the Company. There are

two methods of calculating leverage as follows:

The Gross Method is calculated as total exposure divided by Shareholders'

Funds. Total exposure is calculated as net assets, less cash and cash

equivalents, adding back cash borrowing plus derivatives converted into the

equivalent position in their underlying assets.

The Commitment Method is calculated as total exposure divided by Shareholders

Funds. In this instance total exposure is calculated as net assets, less cash

and cash equivalents, adding back cash borrowing plus derivatives converted

into the equivalent position in their underlying assets, adjusted for netting

and hedging arrangements.

See the definition of Options and Equity Swaps for more details on how exposure

through derivatives is calculated.

As at As at

30 September 2021 31 March

2021

Fair Exposure* Fair Value Exposure*

Value

£'000 £'000 £'000 £'000

Investments 2,603,276 2,603,276 2,416,038 2,416,038

OTC equity swaps (21,454) 173,757 10,552 145,636

2,581,822 2,777,033 2,426,590 2,561,674

Shareholders' funds 2,421,476 2,381,425

Leverage % 14.7% 7.6%

* Calculated in accordance with AIFMD requirements using the Commitment

Method

MSCI World Health Care Index (The Company's Benchmark)

The MSCI information (relating to the Benchmark) may only be used for your

internal use, may not be reproduced or redisseminated in any form and may not

be used as a basis for or a component of any financial instruments or products

or indices. None of the MSCI information is intended to constitute investment

advice or a recommendation to make (or refrain from making) any kind of

investment decision and may not be relied on as such. Historical data and

analysis should not be taken as an indication or guarantee of any future

performance analysis, forecast or prediction. The MSCI information is provided

on an "as is" basis and the user of this information assumes the entire risk of

any use made of this information. MSCI, each of its affiliates and each other

person involved in or related to compiling, computing or creating any

MSCI information (collectively, the "MSCI Parties") expressly disclaims all

warranties (including, without limitation, any warranties of originality,

accuracy, completeness, timeliness, non-infringement, merchantability and

fitness for a particular purpose) with respect to this information. Without

limiting any of the foregoing, in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental, punitive,

consequential (including, without limitation lost profits) or any other

damages. (www.msci.com)

Nav Total Return ('APM')

The theoretical total return on shareholders' funds per share, reflecting the

change in NAV assuming that dividends paid to shareholders were reinvested at

NAV at the time the shares were quoted ex?dividend. A way of measuring

investment management performance of investment trusts which is not affected by

movements in discounts/premiums.

Six months One year

to to

30 31 March

September

2021 2021

(p) (p)

Opening NAV per share 3,703.0 2,868.9

(Decrease)/increase in NAV per share (2.3) 834.1

Closing NAV per share 3,700.7 3,703.0

% Change in NAV per share (0.1)% 29.1%

Impact of reinvested dividends 0.5% 0.9%

NAV per share Total Return 0.4% 30.0%

Ongoing Charges ('APM')

Ongoing charges are calculated by taking the Company's annualised ongoing

charges, excluding finance costs, taxation, performance fees and exceptional

items, and expressing them as a percentage of the average daily net asset value

of the Company over the year.

Six months One year

to to

30 31 March

September

2021 2021

£'000 £'000

AIFM & Portfolio Management fees 9,665 17,068

Other Expenses 467 1,338

Total Ongoing Charges 10,132 18,406

Performance fees paid/crystallised 12,860 -

Total 22,992 18,406

Average net assets 2,384,758 2,112,164

Ongoing Charges (annualised) 0.8% 0.9%

Ongoing Charges (annualised, including performance fees paid 1.3% 0.9%

or crystallised during the period)

Performance Fee

Dependent on the level of long-term outperformance of the Company, a

performance fee can be become payable. The performance fee is calculated by

reference to the amount by which the Company's net asset value ('NAV')

performance has outperformed the Benchmark.

The fee is calculated quarterly by comparing the cumulative performance of the

Company's NAV with the cumulative performance of the Benchmark since the launch

of the Company in 1995. Provision is also made within the daily NAV per share

calculation as required and in accordance with generally accepted accounting

standards. The performance fee amounts to 15.0% of any outperformance over the

Benchmark (see page 44 of the Company's Annual Report & Accounts for the year

ended 31 March 2021 for further information).

In order to ensure that only sustained outperformance is rewarded, at each

quarterly calculation date any performance fee payable is based on the lower

of:

i. The cumulative outperformance of the investment portfolio over the

Benchmark as at the quarter end date; and

ii. The cumulative outperformance of the investment portfolio over the

Benchmark as at the corresponding quarter end date in the previous year.

The effect of this is that outperformance has to be maintained for a

twelve-month period before the related fee is paid.

In addition, a performance fee only becomes payable to the extent that the

cumulative outperformance gives rise to a total fee greater than the total of

all performance fees paid to date.

Share Price Total Return (APM)

Return to the investor on mid-market prices assuming that all dividends paid

were reinvested.

Six months One year to

to

30 September 31 March

2021 2021

Opening share price 3,695.0 2,920.0

Increase in share price (70.0) 775.0

Closing share price 3,625.0 3,695.0

% Change in share price (1.9)% 26.5%

Impact of reinvested dividends 0.4% 0.9%

Share price Total Return (1.5)% 27.4%

For and on behalf of

Frostrow Capital LLP, Secretary

17 November 2021

- ENDS -

END

(END) Dow Jones Newswires

November 17, 2021 02:00 ET (07:00 GMT)

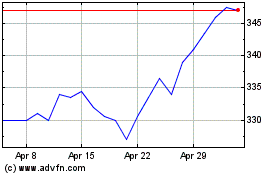

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Jun 2024 to Jul 2024

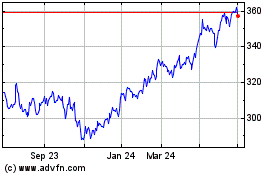

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Jul 2023 to Jul 2024