Zegona Communications PLC ZEGONA SHARE BUYBACK PROGRAMME -- PROGRESS UPDATE (4615S)

July 09 2020 - 1:00AM

UK Regulatory

TIDMZEG

RNS Number : 4615S

Zegona Communications PLC

09 July 2020

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY

MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN SPAIN) OR

ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION, PUBLICATION OR

RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona")

LEI: 213800ASI1VZL2ED4S65

9 JULY 2020

ZEGONA SHARE BUYBACK PROGRAMME - PROGRESS UPDATE

On 24 June 2020 Zegona announced a Buyback(1) programme of its

Ordinary Shares(2) for an aggregate purchase price of up to GBP10

million. Zegona's Board has set a Buyback Policy(3) that allows

shares to be acquired at prices up to the Underlying Asset Value

Per Share(4) .

As part of this programme, Barclays Bank plc, on behalf of

Zegona, has purchased the following number of Ordinary Shares:

Date of purchase: 8 July 2020

Number of shares purchased: 23,000

Volume weighted average price paid per GBP1.160000

share:

Lowest price paid per share: GBP1.160000

Highest price paid per share: GBP1.160000

Zegona intends to cancel these shares.

Detailed information about the individual purchases is available

below.

ENQUIRIES

Tavistock (Public Relations adviser)

Tel: +44 (0)20 7920 3150

Lulu Bridges - lulu.bridges@tavistock.co.uk

Jos Simson - jos.simson@tavistock.co.uk

Trade details:

Transaction reference

Purchase date Purchase time Volume Price Platform number

--------------- ------------- ------- ------------ --------- ---------------------

8 JULY 2020 14:39 23,000 GBP1.160000 XLON qu537q7d8dmz

1. The "Buyback" is Zegona's on-market share buyback programme

for an aggregate purchase price of up to GBP10 million, announced

on 24 June 2020

2. Ordinary shares of GBP0.01 each in the capital of Zegona ("Ordinary Shares")

3. Zegona's "Buyback Policy" is that shares may be acquired at

prices up to the Underlying Asset Value per Share on the day of

purchase, subject also to normal market practice as regards buyback

pricing, as set out in the Important Notices section of Zegona's

buyback programme announcement dated 24 June 2020

4. The "Underlying Asset Value per Share" is defined for any day

as the value in pounds sterling on the previous trading day of

Zegona's investment in Euskaltel (using the EUR/GBP FX rate on that

day) and net cash balance divided by the number of Zegona Ordinary

Shares in issue

5. These figures should be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interests, or a change to their

interest, in Zegona under the FCA's Disclosure Guidance and

Transparency Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSSSMFAAESSEDW

(END) Dow Jones Newswires

July 09, 2020 02:00 ET (06:00 GMT)

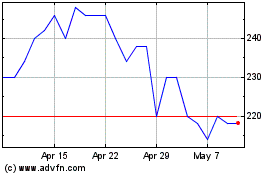

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Jan 2025 to Feb 2025

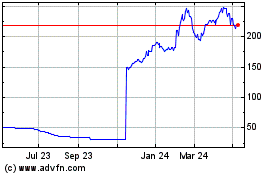

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Feb 2024 to Feb 2025