TIDMZNWD

RNS Number : 2818Q

Zinnwald Lithium PLC

17 October 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

Zinnwald Lithium plc / EPIC: ZNWD.L / Market: AIM / Sector:

Mining

17 October 2023

Zinnwald Lithium plc ('Zinnwald Lithium' or the 'Company')

Operational Update

Zinnwald Lithium plc, the European focused lithium company

developing the integrated Zinnwald Lithium Project (the 'Project')

in Germany, is pleased to provide an operational update on its

recent activities.

HIGHLIGHTS

-- Completed a 84 hole, 27km in-fill drill campaign with

positive results supporting the Company's expectations of a

significant increase in the size of the Zinnwald resource.

-- Ongoing drilling and mineral processing testwork supports

inclusion of Albite Granite ("AG") into the Mineral Resource

Estimate ('MRE'), anticipated to be published in Q4 2023.

-- Average lithium mineralisation true widths within the AG zone

have a vertical thickness of 113 metres.

-- Commenced detailed mine design based on large dimension lithological units.

-- Completed confirmatory Mineral Processing bench scale

testwork by Metso, and now carrying out pilot scale tests of the

material.

-- Advanced regional exploration strategy with the granting of

the Bärenstein exploration license, the acquisition of the drill

core and geological data from the previous holders of the Sadisdorf

exploration license, and the start of further exploration drilling

at Falkenhain.

-- Marko Uhlig to be appointed as Managing Director of Zinnwald

Lithium GmbH, as part of further strengthening of Owners' team in

Germany.

-- Bankable Feasibility Study ('BFS') remains targeted for

completion early in the first half of 2024.

Zinnwald Lithium CEO, Anton du Plessis, commented : "We are

delighted with the progress that has been made in recent months

post the fundraise. Completing the drill campaign is a major

milestone which, together with our forthcoming expanded MRE, will

form a firm foundation on which to base our BFS. The geological

work is supported by the ongoing metallurgical testwork programme

being undertaken in conjunction with a frontrunner in sustainable

technologies, Metso, where early mineral processing results are

extremely encouraging.

"The significant scale of the deposit indicated by the results

of the campaign thus far reinforce our view that the Zinnwald

Lithium Project can be a major supplier to the European battery

sector and a meaningful economic contributor to the region and

local community. This is amplified by the exciting potential of our

other exploration licenses , which may further expand one of

Europe's largest lithium opportunities."

OPERATIONAL UPDATE

Zinnwald Lithium continues to make significant progress in the

development of its flagship Zinnwald Lithium Project in

Germany.

In-fill and Resource Delineation Drill Programme

On 15 September 2023, the Company finished its drill programme

at its core Zinnwald License area, totalling 26,969m of diamond

core drilling across 84 drill holes. This campaign has more than

doubled the total number of holes completed in the license area,

including the historic drill campaigns. The map below charts the

location of all drilled holes across the various drill campaigns.

The Company was able to deploy up to six drill rigs simultaneously,

which allowed the completion of the programme within a tight

timeframe. The Company's purpose-built core facility allowed the

processing of more than 400 metres of core per week with the

achievement of greater than 95% core recovery.

The results of the infill drilling campaign have, as expected,

increased the Company's level of confidence in the geological model

of the orebody ( see relevant graphics (Fig. 1, 2 and 3) included

at the end of this

release ). As previously noted, the Company's objectives for the programme were to:

-- Increase drillhole and data density in all parts of the

deposit to further optimise the geological model (Fig. 1) to

support Bankable Feasibility Study ('BFS') level mine planning,

metallurgical and geotechnical engineering workstreams;

-- Raise the confidence level of the previous geological model

and eventually generate solid Indicated and Measured Mineral

Resources that can be converted to Mineral Reserves in the BFS

applying all economic factors generated during the next few

months;

-- Prove the existence of two mineral domains and optimise the

geological model accordingly (Fig. 2&3):

o An upper high-grade Quartz-Mica-Greisen ('HG', previously Ore

type 1) with a maximal thickness of 75 m. The average Li grade is

3,062 ppm (0.66 % Li2O);

o A lower greisenised Albite-Granite ('AG', previously Ore type

2) that reflects the shape of the granite cupola and an average

vertical thickness of 133 m. The average Li grade is 2,176 ppm

(0.42 % Li2);

-- Generate additional geological and geometallurgical data to

support inclusion of the AG-lithology in order to upgrade the

existing MRE;

-- Improve resolution of the extents of the high grade Greisen mineralisation ('HGG'); and

-- Improve confidence in available existing historical drillhole data.

The Company is currently finalising the updating of the

geological and mineralisation/domaining model and anticipates

publishing the updated MRE in Q4 2023. SRK Consulting (UK) ('SRK')

has been commissioned to complete this updated MRE.

Additionally, the Company carried out extensive surveying

programmes such as a LIDAR underground survey of existing/historic

mine workings and a geotechnical investigation of drill core was

undertaken to assist in mine planning. The Company has also

completed underground structural mapping comparing structural data

from both drill core and in situ surveys. These have corresponded

closely and will assist in the completion of a detailed mine

model.

The latest results from the current drill and survey programme

have improved the confidence in the geological model Significant

recent drill intersections and assay results include:

-- ZGLi 047/2023:

o HGG: 19.55 m (88.45-108.00 m) @ 0.71 % Li2O

o AG: 163.18 m (112.82 m - 276.00) @0.44 % Li2O

-- ZGLi 050/2023:

o HGG : 41.91 m (75.42-117.33 m) @ 0.66 % Li2O

o AG: 122.0 m (133.0-255.0 m) @ 0.46 % Li2O

-- ZGLi 063/2023:

o HGG : 30.85 m (113.6-144.45m) @ 0.78 % Li2O

o AG: 98.9 m (145.1-244.0m) @ 0.50 % Li2O

-- ZGLi 068/2023:

o HGG : 42.75 m (87.25-130.0m) @ 0.70 % Li2O

o AG: 117 m (144.0-261.0m) @ 0.42 % Li2O

-- ZGLi 085/2023:

o HGG : 66.1 m (171.0-237.1m) @ 0.94 % Li2O

o AG: 103.13 m (237.1-340.23m) @ 0.52 % Li2O

Hydrogeology

In September 2023, the Company started a hydrogeology drilling

programme to produce a hydrogeological underground and surface

model. This represents an essential piece of work for both

technical and planning as well as environmental impact assessment

('EIA') permitting requirements.

As part of this programme, seven groundwater ('GW') monitoring

wells will be completed, of which five deep drillings reach the

granite dome of Zinnwald, and two shallow drillings penetrate the

Ryolite rock of the hanging wall. It is currently anticipated that

the drilling programme will be completed in February 2024 and the

Company has deployed two drill rigs for the purpose. As at the date

of this release, three have been completed, of which two have been

converted to GW monitoring wells, while the other is under ongoing

geophysical and hydrogeological investigation. The Company is

supported by a group of consultants in this effort, including SRK,

Geologische Landesuntersuchung Freiberg GmbH ('GLU'), Fugro, and

CSA Global.

Mine Planning

Inclusion of the laterally and vertically extensive Albite

Granite domain has the potential to not only significantly increase

the Project's Mineral Resource base but will also allow

consideration of higher productivity mining methods.

As the drilling programme, geological modelling, geotechnical

investigations, and minerals processing testwork progressed,

strategic mine planning was started by SRK. Large scale sub-level

stoping with subsequent backfill has been determined to be the

optimal mining method. Sub-level stoping offers higher capacity,

lower operating expenditure and easier backfill process than Room

and Pillar-method assumed in the earlier studies.

The large dimensions of the currently assumed lithological

domains will allow substantially higher Lithium grade than the

life-of-mine average during the early production years.

The detailed mine design commenced in October.

Metallurgical Process Development / Testwork

The Company is undertaking a confirmatory metallurgical testwork

programme together with Metso.

Bench scale minerals processing testwork was completed by Metso

during September 2023. This clearly indicated that Lithium recovery

and concentrate mass pull from the previously untested Albite

Granite-lithology are suitable for a simple flow sheet consisting

of a comminution circuit and a rougher-scavenger wet magnetic

separation circuit.

The material used in the tests was from a representative sample

selected in consultation with SRK earlier this year and

incorporates a mix of both HGG and AG. The main findings were:

-- A simple flow can be applied;

-- A simulated Run of Mine sample Li-recovery is c.85 % with a mass pull of c.20%;

-- Li-recovery from HGG is clearly above 85%;

-- Li-recovery from AG is clearly above 80%;

-- The same flow sheet is suitable for both of the ore types; and

-- Both of the ore types can be processed individually or at any

mix without compromising the recoveries.

Pilot scale tests of the material are currently being carried

out by UVR-FIA in its facilities in Freiberg, Germany under

supervision by Metso.

The pilot test will produce sufficient zinnwaldite concentrate

to confirm the earlier calcination testwork and enough quartz sand

to be tested for environmental qualities. The material for both

tests will be available in October 2023.

Exploration Licenses

Whilst the primary focus is on the development of its core

Zinnwald License, the Company continues to develop its other highly

prospective exploration license areas that surround the Zinnwald

license. The Company now has licenses over almost 10,000 hectares

in an area that has been one of the mainstays of German mining for

almost 800 years. The Company believes that these license areas

offer highly prospective opportunities for the longer-term

expansion of the Zinnwald Project as a whole and potentially

provide a Phase 2 production opportunity to further expand one of

Europe's largest lithium opportunities.

Falkenhain

As noted in the previous operational update, the Company has

already completed its first of 10 permitted exploration drill holes

as well as re-assayed available historic core from the license

area. The first hole showed the potential for a significant lithium

resource (140m depth had 51m grading at 3,421 ppm li) in an area

that lies within 2.5 km of the location under consideration for the

mineral processing site. The Company has now commenced drilling the

first of the next block of three additional exploration drill holes

and will publish the results of these holes when available in Q1

2024.

Altenberg

This license area contains the step out from the core Zinnwald

mining license. The Company has identified 80 historic mining areas

within this license, as well as 42 Greisen occurrences and 25

lithium anomalies. The Company will continue to develop its

long-term exploration plans for this area.

Sadisdorf

The Company has now acquired the historic core and other data

from the previous owners of the Sadisdorf license, which it will

now re-test and evaluate to support its plans for a potential

exploration programme. In 2017, the previous owners published a

JORC compliant inferred resource of 25Mt with an average grade of

0.45% Li(2) O (average 2,053 ppm Li).

Bärenstein

On 6 July 2023, the Company announced that it had been granted

the Bärenstein exploration Licence covering approximately 4,933.9

hectares. As shown in the map below, the Bärenstein Licence closes

the gap between Falkenhain and Altenberg Exploration licences. This

greenfield Licence holds significant mineral potential and was

historically mined for tin and silver between the 15th and 19th

centuries. The Bärenstein Licence area includes land that is being

evaluated for the future mining and processing operations of the

Project.

Infrastructure

The work defining the optimal solutions for the required

infrastructure has continued based on the potential for higher

production levels supported by the results of the drilling campaign

and the metallurgical testwork carried out. The Company will hire a

major German consulting group with experience concerning materials

handling, road, and rail infrastructure as well as all civil works

in October 2023. The group will, using trade-off studies, evaluate

the most suitable, economical and environmentally friendly options

for all surface facilities. It is anticipated to start the

infrastructure part of the BFS by the end of October 2023.

Sustainability / ESG Matters

Zinnwald continues to comply with the QCA corporate governance

code and its guidance on sustainability matters and today publishes

its annual QCA Corporate Governance statement. The Company views

sustainability as a guiding principle of its development strategy

and is dedicated to delivering on the commitments to its

shareholders, future investors, clients, employees, local

communities, and other stakeholders. It believes that transparency

and ethical behaviour are central to any successful group and

undertakes all development with respect for the environment and

neighbouring communities.

Environmental

The Saxony Mining Authority ("SOBA") is the ultimate permitting

authority for the mandatory Framework Operating Permit ('MFOP'),

which will cover all matters that require permitting under the

national mining act. As previously announced, the Company formally

submitted its Scoping Document to SOBA on 21 April 2023, which

started the formal permitting process for the construction and

operation in Germany. Based on information in the Scoping Document,

SOBA arranged a Scoping Meeting with Stakeholders on 22 August

2023. The meeting served as a platform to discuss the Project plans

and to receive the first feedback from Stakeholders on all aspects

of the Project. The feedback will be taken forward in subsequent

formal application stages. Based on the Scoping Meeting feedback,

the Company engaged with the State Directorate, department for

spatial planning, in Dresden, and initiated the process of "Early

Spatial Planning Procedure". This will ensure that the Company

remains on track with the upcoming public hearings and in the

permitting process.

The Project's permitting has been supported by GLU, which has

extensive experience of mine and resource project permitting in the

region. The Company has maintained international best practice in

the permitting by keeping a transparent approach to project

development and stakeholder engagement as well as community

relations. The Company also anticipates engaging another

environmental and social consulting group to cover aspects of

social impacts under United Nations Framework Classification for

Resources (UNFC) standards.

Social

Engagement with the local community of Zinnwald has always been

a high priority to the Company. In May 2023, the Company held a

well-attended information event at the Zinnwald town hall that

outlined the on-going drill-campaign as well as future development

plans. The next Town Hall meeting will be held in the village of

Bärenstein in October 2023.

Over the last few months, the Company has operated with six

drill rigs in the town and its vicinity, often drilling in

residents' gardens and the general reception has been positive. The

Company is currently completing the rehabilitation of the drilling

area. A dedicated community relations campaign accompanies the

drilling programme until full completion and will continue during

the hydrogeology drilling campaign. The Company applies the highest

standards and international best practice with regards to health

and safety measures for drilling campaigns.

Personnel

The Company is pleased to announce that Marko Uhlig will be

joining the team as Managing Director of Zinnwald Lithium GmbH.

Marko is a seasoned professional manager with a wealth of

commercial experience gained over a career of more than 30 year. He

has worked in Germany as well as internationally for companies

including ThyssenKrupp AG and SKW Metallurgie AG and is a graduate

of Freiberg University.

In addition, the Company continues to expand its Owners' team in

Germany and has made a number of critical hires across several

functional areas including process engineering and permitting.

These hires all have extensive experience within Germany and

abroad, working in both large and more entrepreneurial early-stage

companies. The local Project team now comprises sixteen full time

staff of which five are female. In total the Company has twenty

full-time professionals working across disciplines in both the

Freiberg and London office locations.

Governance

The Company continues to develop its formal engagement process

with its main stakeholders and the development of its Materiality

Risk Assessment for the Project. This will enable the Company to

better tailor its operational policies, activities and reporting to

the risks identified.

The Company has completed its formal rebranding of the Group and

its subsidiary, previously known as Deutsche Lithium GmbH, under

the banner of Zinnwald Lithium to reflect the strong ties to the

local community and the town bearing its name, as well as its

positioning it as a German project established to serve the German

car industry. The Company's shareholder base also continues to

evolve towards an ultimate majority German and EU ownership.

EU MARKET DEVELOPMENTS

The EU has continued to develop its response to the US Inflation

Reduction Act and, on 14 September 2023, the EU Parliament formally

passed the Critical Raw Materials Act ('CRMA'), which was

originally announced in March 2023 and defines Lithium as both a

"Critical and Strategic" raw material. The CRMA proposes benchmarks

of 10% of the EU's annual consumption of Lithium for extraction and

50% for processing; proposals to simplify permitting procedures;

and a plan to identify selected strategic projects to benefit from

EU financial support. Whilst the CRMA has not yet identified any

specific strategic projects, the Company believes it has a strong

case to meet the four key criteria for classification, namely:

-- Contribute to security of EU's supply of critical raw

materials. The Project's PEA has already identified annual

production of 12,000 tonnes of Lithium, enough for more than

320,000 EVs per annum. The Company hopes to increase this potential

production in its BFS.

-- Be or become technically feasible within a reasonable

timeframe. The Company has already proven that it can produce

battery grade lithium hydroxide from a flowsheet developed in

conjunction with internationally renowned engineering groups and

using well established processes.

-- Be implemented sustainably. The Project is being developed along internationally best practice sustainability lines and will be permitted under some of the most stringent environmental legislation. The Project's process is a relatively benign, low waste operation utilising existing infrastructure with multiple potential uses for its waste streams, including the production of high-grade fertiliser.

-- Have cross border benefits beyond member state concerned

(including downstream). The Project envisions purchasing both

equipment and engineering services from other member states, as

well as likely sourcing of reagent raw materials from local

suppliers cross-border.

OUTLOOK

The strategy of the Company is to deliver a Project that is

meaningful in terms of scale, attractive in terms of its economic

attributes and is based on a robust technical foundation. It is the

Board's view that a project that delivers these attributes stands

the greatest chance of attracting the necessary financing and

support to achieve successful construction. The current and ongoing

work streams are fundamental to this, with some important progress

already made and several key milestones coming up. These include

the publication of an updated MRE within the current quarter,

ongoing metallurgical testwork, continued work on its

hydrogeological drill campaigns, detailed mining planning, and a

BFS that brings all of these work streams together in the first

half of 2024. Alongside this, the team is working on permitting and

commercial aspects. The Company remains well financed with a

current cash position of EUR16.6m and the Board looks forward to

updating the market on progress on all of these fronts as the

Company's various work streams continue.

Figure 1 Overview map indicating the Zinnwald licence area

with all collar points (black: historic drillings; blue: Drilling

campaign 2012 to 2017; red: Drilling campaign 2022 to 2023)

of the drill holes drilled to date. The highlighted stars

visualise the drill holes whose intersections were published

in this RNS. The profile sections along the black lines shown

in Figures 2 and 3 provide a more detailed view.

Figure 2 The NW-SE profile section presents the drill holes

of the past drilling campaigns (between 2012 and 2017) with

a blue collar point and the drill holes of the 2022 to 2023

drilling campaign (red collar point). The drill holes shown

are colour-coded according to the lithologies and show the Li2O%

values of each drill hole. The reported intersections in the

two domains (green: greisenised albite granite, blue: HG Greisen)

are highlighted.

Figure 3 The W-E profile section presents the drill holes of

the past drilling campaigns (between 2012 and 2017) with a blue

collar point and the drill holes of the 2022 to 2023 drilling

campaign (red collar point). The drill holes shown are colour-coded

according to the lithologies and show the Li2O% values of each

drill hole. The reported intersections in the two domains (green:

greisenised albite granite, blue: HG Greisen) are highlighted.

The technical information relating to geology, the drill

programme, mining and processing in this announcement has been

reviewed on behalf of Zinnwald Lithium by Martin Pittuck CEng, FGS,

MIMMM of SRK Consulting. Mr Pittuck is a Corporate Consultant of

SRK Consulting Ltd. Mr Pittuck has sufficient experience relevant

to the style of mineralisation and type of deposit under

consideration, and to the activity which he is undertaking to

qualify as a Competent Person in accordance with the guidance note

for Mining, Oil & Gas Companies issued by the London Stock

Exchange in respect of AIM Companies, which outlines standards of

disclosure for mineral projects. Mr Pittuck consents to the

inclusion in this announcement of the matters based on his

information in the form and context in which it appears.

*ENDS*

For further information visi t www.zinnwaldlithium.com or

contact:

Anton du Plessis Zinnwald Lithium info@zinnwaldlithium.com

Cherif Rifaat plc

David Hart Allenby Capital

Dan Dearden-Williams (Nominated Adviser) +44 (0) 20 3328 5656

---------------------- --------------------------------

Oberon Capital

Michael Seabrook Ltd

Adam Pollock (Joint Broker) +44 (0) 20 3179 5300

---------------------- --------------------------------

Tamesis Partner

Richard Greenfield LLP

Charles Bendon (Joint Broker) +44 (0) 20 3882 2868

---------------------- --------------------------------

Isabel de Salis St Brides Partners zinnwald@stbridespartners.co.uk

Paul Dulieu (Financial PR)

---------------------- --------------------------------

Notes

AIM quoted Zinnwald Lithium plc (EPIC: ZNWD.L) is focused on

becoming an important supplier of lithium hydroxide to Europe's

fast-growing battery sector. The Company owns 100% of the Zinnwald

Lithium Project in Germany, which has an approved mining licence,

is located in the heart of Europe's chemical and automotive

industries and has the potential to be one of Europe's more

advanced battery grade lithium projects.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEASEKFSXDFFA

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

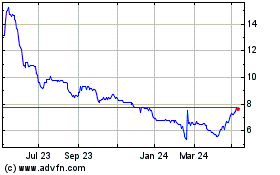

Zinnwald Lithium (LSE:ZNWD)

Historical Stock Chart

From Nov 2024 to Dec 2024

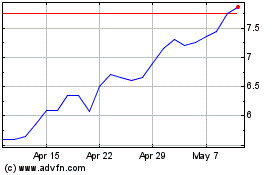

Zinnwald Lithium (LSE:ZNWD)

Historical Stock Chart

From Dec 2023 to Dec 2024