Ex-Ripple Director Explains XRP Price Slide Amid Good News

June 12 2024 - 6:00AM

NEWSBTC

Via X, Sean McBride, a former director at Ripple, offered an

analysis of the perplexing downtrend of the XRP price despite a

series of ostensibly positive developments surrounding Ripple and

the XRP Ledger (XRPL). McBride’s insights come at a time when XRP’s

underperformance in a bullish market continues to baffle investors

and industry observers alike. Why Is XRP Price Down Despite A Slew

Of Positive News? Despite recent bullish periods in the broader

crypto market, XRP has notably failed to capitalize on these gains.

In a conversation with X users, McBride attributed this lackluster

performance to the ongoing legal battle between Ripple and the US

Securities and Exchange Commission (SEC), highlighting the critical

impact of impending judicial decisions on XRP’s valuation. Related

Reading: Crypto Analyst Predicts XRP Price Will Rally 50,000% To

$250, Here’s When On July 13, 2023, Judge Torres’s ruling that XRP

is not a security led to a temporary surge by 100% to $0.93,

demonstrating the market’s sensitivity to legal developments.

However, eleven months later, XRP’s price has halved, reflecting

ongoing concerns about the possible long-term implications of the

SEC’s actions and the potential for an appeal, which McBride

acknowledges could happen unless the ruling is unfavorable to

Ripple. “Nothing significant is going to happen with the price of

XRP until Judge Torres makes her decision. So anyone expecting

anything different is delusional,” McBride explained, adding “once

Torres makes her decision, I think we find out a bit more about

what’s actually behind the curtain. This could open up the door for

US institutions working with Ripple to ‘flip the switch’. We will

just have to wait and see if that’s the case.” Despite the

overshadowing legal drama, Ripple has not been short on positive

news. Recently, Ripple announced the creation of the XRPL Japan and

Korea Fund on June 11, 2024, a significant initiative with an

allocation of 1 billion XRP aimed at catalyzing the growth and

development of the XRPL ecosystem in East Asia. Additionally,

Ripple’s strategic acquisitions have been notable. The company has

successfully finalized its acquisition of Standard Custody &

Trust Company. In May 2023, Ripple further expanded its services by

acquiring blockchain firm Metaco for $250 million, and in April, it

announced plans to launch a stablecoin aimed at bolstering the XRP

Ledger ecosystem. Related Reading: Crypto Analyst Predicts XRP At

$0.75 In July Despite Year-Long Slump Commenting on these strategic

shifts by Ripple, McBride noted, “Ripple is perfect, they don’t

make any mistakes. Their executives fart rainbows. Everything they

have done turns to gold. Wake the f*ck up people. If you think

that’s how Ripple operates, you’re sorely mistaken. They are

vocally self-critical, employees have backbone; disagree and

commit. Ripple has changed their strategy many times.” Notably,

Ripple has been proactive in securing over 40 Money Transmitter

Licenses (MTLs), necessary for its payment operations across the

United States. “The next big piece of this is clear legislation in

the US. Hopefully that is on the way with the recent developments

in Congress and Trump’s commitment to Crypto (assuming he becomes

President),” McBride remarked. In response to a user’s inquiry

about the likelihood of an SEC appeal if Ripple receives a

favorable ruling, McBride commented, “Shouldn’t stop what’s

happening in the US from happening, IMO, unless of course the

ruling is not in Ripple’s favor.” Addressing another user’s

observation about a perceived shift in his tone regarding Ripple

and XRP, McBride reassured, “No, not at all. I’m still very

positive on Ripple and XRP. […] I’m a big fan, but that doesn’t

mean I’m blind to the realities of what’s happening.” At press

time, XRP traded at $0.4818. Featured image created with DALL·E,

chart from TradingView.com

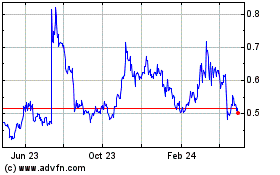

Ripple (COIN:XRPUSD)

Historical Stock Chart

From May 2024 to Jun 2024

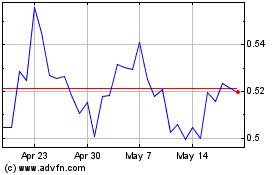

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024