As filed with the Securities and Exchange Commission on December 8, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CleanSpark, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Nevada |

|

87-0449945 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

CleanSpark, Inc.

2370 Corporate Circle, Suite 160

Henderson, Nevada 89074

(Address of Principal Executive Offices) (Zip Code)

CleanSpark, Inc. 2017 Incentive Plan

(Full title of the plan)

Zachary K. Bradford

Chief Executive Officer and President

CleanSpark, Inc.

2370 Corporate Circle, Suite 160

Henderson, Nevada 89074

(Name and address of agent for service)

(702) 989-7692

(Telephone number, including area code, of agent for service)

Please send copies of all communications to:

Mark D. Wood

Katten Muchin Rosenman LLP

525 W. Monroe Street

Chicago, IL 60661

(312) 902-5200

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by CleanSpark, Inc. (the “Registrant”) for the purpose of registering additional shares of the Registrant’s Common Stock, par value $0.001 per share (the “Common Stock”), under the Registrant’s 2017 Incentive Plan, as amended (the “Plan”).

On March 8, 2023, the Registrant’s stockholders approved an amendment to the Plan to, among other things, add an evergreen provision to, on April 1st and October 1st of each year, automatically increase the maximum number of shares of Common Stock available under the Plan to fifteen percent (15%) of the Registrant’s outstanding shares of Common Stock, in each case as of the last day of the immediately preceding month (the “Evergreen Provision”). Effective October 1, 2023, the number of shares of Common Stock available for grant and issuance under the Plan was therefore increased by 9,485,169 as a result of the Evergreen Provision. This Registration Statement registers an aggregate of 9,485,169 such additional shares of Common Stock, which were available for grant and issuance under the Plan pursuant to the aforementioned increase.

Pursuant to General Instruction E of Form S-8, the contents of the Registration Statements on Form S-8 of the Registrant filed with the Securities and Exchange Commission (the “SEC”) on June 19, 2017 (Registration No. 333-218831), November 9, 2020 (Registration No. 333-249959), September 30, 2021 (Registration No. 333-259917) and April 6, 2023 (Registration No. 333-271178), including any amendments thereto or filings incorporated therein, are incorporated herein by this reference to the extent not replaced hereby.

PART I

Information Required in the Section 10(a) Prospectus

The information called for in Part I of Form S-8 to be contained in the Section 10(a) prospectus is not being filed with or included in this Registration Statement (by incorporation by reference or otherwise) in accordance with the rules and regulations of the SEC. The documents containing the information specified in Part I of Form S-8 will be

delivered to the participants in the Plan covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

PART II

Information Required in the Registration Statement

Item 3. Incorporation of Documents by Reference.

The Registrant hereby incorporates by reference into this Registration Statement the following documents filed with the SEC:

•Our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, and filed with the SEC on December 1, 2023;

•Our Current Reports on Form 8-K filed with the SEC on October 11, 2023 and October 27, 2023 (except that, with respect to each of the foregoing Current Reports, any portions thereof which are furnished and not filed shall not be deemed incorporated by reference into this Registration Statement); and

•The description of our Common Stock contained in our Registration Statement on Form 8-A, dated January 22, 2020, and any amendment or report filed with the SEC for the purpose of updating the description.

The Registrant also incorporates by reference into this Registration Statement all information contained in additional documents (other than portions of the documents that are furnished under Item 2.02 or Item 7.01 of a Current Report on Form 8-K and exhibits furnished on such form that relate to such items, unless otherwise indicated therein) that it files with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, prior to the filing of a post-effective amendment to this Registration Statement which indicates that all of the shares of common stock offered have been sold or which deregisters all of such shares then remaining unsold.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. The modifying or superseding statement need not state that it has

modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. You should not assume that the information in this Registration Statement or in the documents incorporated by reference is accurate as of any date other than the date of this Registration Statement or those documents.

Item 8. Exhibits.

|

|

Exhibit Number |

Description |

|

|

4.3 |

Certificate of Designation, incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed with the SEC on April 16, 2015. |

4.4 |

Certificate of Designation, incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on April 18, 2019. |

5.1* |

Opinion of Brownstein Hyatt Farber Schreck, LLP. |

23.1* |

Consent of MaloneBailey, LLP, independent registered public accounting firm. |

23.2* |

Consent of Brownstein Hyatt Farber Schreck, LLP (filed as part of Exhibit 5.1). |

24.1* |

Power of Attorney (contained on the signature page of this registration statement on Form S-8). |

99.1 |

CleanSpark, Inc. 2017 Incentive Plan, incorporated by reference to Exhibit 10.12 to the Company’s Registration Statement on Form S-8 filed with the SEC on June 19, 2017. |

99.2 |

First Amendment to CleanSpark, Inc. 2017 Equity Incentive Plan, form of such exhibit was previously included as Appendix B to our definitive Information Statement on Schedule 14C filed on July 28, 2020 and incorporated by this reference. |

99.3 |

Second Amendment to CleanSpark, Inc. 2017 Incentive Plan, incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 17, 2021. |

99.4 |

Third Amendment to CleanSpark, Inc. 2017 Incentive Plan, incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 9, 2023. |

107* |

Fee Table. |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Henderson, State of Nevada, on December 8, 2023.

|

|

|

|

|

|

CLEANSPARK, INC. |

|

|

By: |

|

/s/ Zachary K. Bradford |

|

|

Zachary K. Bradford Chief Executive Officer and President |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Zachary K. Bradford and Gary A. Vecchiarelli, and each of them, as his or her true and lawful attorney-in-fact and agent with the full power of substitution, for him or her in any and all capacities, to sign any and all amendments to this Registration Statement, including any and all pre-effective and post-effective amendments and to file such amendments thereto, with exhibits thereto and other documents in connection therewith, with the SEC, granting unto said attorneys-in-fact and agents, and each of them full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or his or her substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on behalf of the registrant in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Title |

|

Date |

|

|

|

|

|

/s/ Zachary K. Bradford |

|

Chief Executive Officer, President and Director (Principal Executive Officer) |

|

December 8, 2023 |

Zachary K. Bradford |

|

|

|

|

|

|

|

/s/ Gary A. Vecchiarelli |

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

|

December 8, 2023 |

Gary A. Vecchiarelli |

|

|

|

|

|

|

|

/s/ S. Matthew Schultz |

|

Chairman of the Board of Directors, Executive Chairman |

|

December 8, 2023 |

S. Matthew Schultz |

|

|

|

|

|

|

|

/s/ Larry McNeill |

|

Director |

|

December 8, 2023 |

Larry McNeill |

|

|

|

|

|

|

/s/ Dr. Thomas L. Wood |

|

Director |

|

December 8, 2023 |

Dr. Thomas L. Wood |

|

|

|

|

|

|

/s/ Roger P. Beynon |

|

Director |

|

December 8, 2023 |

Roger P. Beynon |

|

|

|

|

|

|

/s/ Amanda Cavaleri |

|

Director |

|

|

December 8, 2023 |

|

Amanda Cavaleri |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brownstein Hyatt Farber Schreck, LLP 702.382.2101 main 100 North City Parkway, Suite 1600

Las Vegas, Nevada 89106 |

December 8, 2023

CleanSpark, Inc.

2370 Corporate Circle, Suite 160

Henderson, Nevada 89074

To the addressee set forth above:

We have acted as local Nevada counsel to CleanSpark, Inc., a Nevada corporation (the “Company”), in connection with the filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”), relating to the registration of 9,485,169 shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), issuable under the CleanSpark, Inc. 2017 Incentive Plan (as amended to date, the “Plan”). This opinion letter is being delivered at your request pursuant to the requirements of Item 601(b)(5) of Regulation S-K under the Act.

In our capacity as such counsel, we are familiar with the proceedings taken and proposed to be taken by the Company in connection with the authorization and issuance of the Shares as contemplated by the Plan and as described in the Registration Statement. For purposes of this opinion letter, and except to the extent set forth in the opinion expressed below, we have assumed that all such proceedings have been or will be timely completed in the manner contemplated by the Plan, and as presently proposed in the Registration Statement.

For purposes of issuing the opinion hereinafter expressed, we have made such legal and factual examinations and inquiries, including an examination of originals or copies certified or otherwise identified to our satisfaction as being true copies of (i) the Registration Statement, (ii) the Plan, (iii) the Company’s articles of incorporation and bylaws, each as amended to date, and (iv) such other agreements, instruments, corporate records (including resolutions of the board of directors and any committee thereof) and other documents, or forms thereof, as we have deemed necessary or appropriate. We have also obtained from officers and other representatives and agents of the Company and from public officials, and have relied upon, such certificates, representations, assurances and public filings as we have deemed necessary or appropriate for the purpose of issuing this opinion letter.

Without limiting the generality of the foregoing, we have, with your permission, assumed without independent verification that (i) each natural person executing a document has or will have sufficient legal

CleanSpark, Inc.

December 8, 2023

Page 2

capacity to do so; (ii) all documents submitted to us as originals are authentic, the signatures on all documents we reviewed are genuine, and all documents submitted to us as certified, conformed, photostatic, electronic or facsimile copies conform to the original document; (iii) all corporate records made available to us by the Company, and all public records we have reviewed, are accurate and complete; (iv) after any issuance of the Shares, the total number of issued and outstanding shares of Common Stock, together with the total number of shares of Common Stock then reserved for issuance or obligated to be issued by the Company pursuant to any agreement or arrangement, or otherwise, including the Plan, will not exceed the total number of shares of Common Stock then authorized under the Company’s articles of incorporation; and (v) the maximum number of shares of Common Stock available under the Plan does not exceed 15% of the Company’s outstanding shares of Common Stock as of September 30, 2023.

We are qualified to practice law in the State of Nevada. The opinion set forth herein is expressly limited to and based exclusively on the general corporate laws of the State of Nevada, and we do not purport to be experts on, or to express any opinion with respect to the applicability thereto or the effect thereon of, the laws of any other jurisdiction. We express no opinion concerning, and we assume no responsibility as to laws or judicial decisions related to, or any orders, consents or other authorizations or approvals as may be required by, any federal laws, rules or regulations, including, without limitation, any federal securities laws, rules or regulations, or any state securities or “blue sky” laws, rules or regulations.

Based on the foregoing and in reliance thereon, and having regard to legal considerations and other information that we deem relevant, we are of the opinion that the Shares have been duly authorized by the Company and, if, when and to the extent issued in accordance with all applicable terms and conditions set forth in the Plan and in exchange for the consideration required thereunder, and as described in the Registration Statement, the Shares will be validly issued, fully paid and non-assessable.

The opinion expressed herein is based upon the applicable laws of the State of Nevada and the facts in existence on the date of this opinion letter. In delivering this opinion letter to you, we disclaim any obligation to update or supplement the opinion set forth herein or to apprise you of any changes in any laws or facts after such time as the Registration Statement is declared effective. No opinion is offered or implied as to any matter, and no inference may be drawn, beyond the strict scope of the specific issues expressly addressed by the opinion set forth herein.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Brownstein Hyatt Farber Schreck, LLP

26434628

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated December 1, 2023 with respect to the audited consolidated financial statements of CleanSpark, Inc. and its subsidiaries (collectively, the “Company”) (which report expresses an unqualified opinion) and the effectiveness of internal control over financial reporting (which report expresses an adverse opinion) included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

December 8, 2023

Exhibit 107

Form S-8

(Form Type)

CleanSpark, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title(1) |

Fee Calculation Rule |

Amount Registered(1) |

Proposed Maximum Offering Price Per Share |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Common Stock, $0.001 par value per share |

Rule 457(c) and Rule 457(h) |

9,485,169(2) |

$6.76(3) |

$64,119,742.44(3) |

$147.60 per $1,000,000 |

$9,464.07 |

Total Offering Amounts |

|

$64,119,742.44 |

|

$9,464.07 |

Total Fee Offsets |

|

|

|

$- |

Net Fee Due |

|

|

|

$9,464.07 |

|

|

(1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock, par value $0.001 per share (the “Common Stock”), that become issuable under the Registrant’s 2017 Incentive Plan (the “Plan”) in respect of the securities identified in the table above by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration that increases the number of the outstanding shares of the Registrant’s Common Stock.

|

(2) |

Represents the aggregate of 9,485,169 shares of Common Stock added to the shares reserved for issuance under the Plan effective October 1, 2023 pursuant to an “evergreen” provision contained in the Plan.

|

(3) |

Estimated solely for the purpose of calculating the registration fee. Calculated pursuant to Rules 457(c) and 457(h) under the Securities Act based on the average of the high and low prices per share of the Registrant’s Common Stock as reported on The Nasdaq Capital Market on December 1, 2023, which was $6.76. |

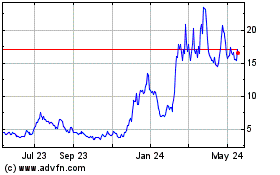

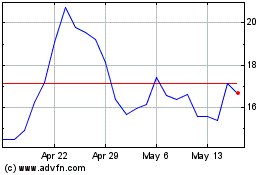

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2024 to May 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From May 2023 to May 2024