Contracts for Difference (CFD) are financial market instruments that allow traders to speculate on price changes of assets without owning the underlying assets themselves.

For example, you can hold a CFD contract where the underlying asset is oil. Your profit or loss from buying and selling the CFD contract will depend on how the oil price changes. However, you don’t need to physically own barrels of oil.

CFD trading is available across a wide range of markets. Common underlying assets include company stocks, energy resources, currencies, stock indices, and other financial instruments.

Topics Covered in This Article:

- How much can you earn trading CFDs?

- Key features and risks of CFD trading

- How CFD prices are formed

How Much Can You Earn Trading CFDs?

The earning potential in CFD trading is theoretically unlimited, but it heavily depends on market conditions, a trader’s skills, and the strategies they employ.

However, high earning potential is paired with significant risks, especially due to the use of leverage. Leverage can magnify both potential profits and potential losses.

To start trading CFDs, you need to choose a Forex broker and open an account. Most brokers offer CFD trading on currency pairs and other instruments.

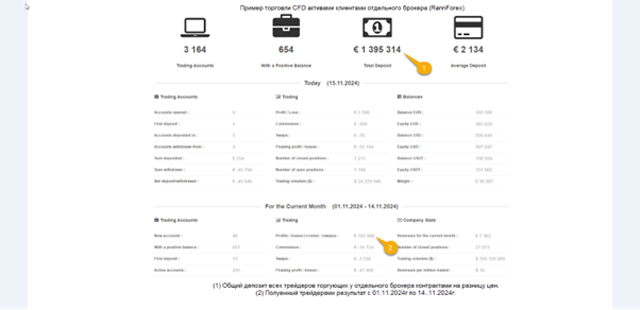

Example: One broker reports that the total profit of its clients over 10 trading days amounted to €182,880, with a total deposit of €1,335,314. This translates to an overall client profit of about 15% over 10 days.

While this information may seem appealing, traders must ask themselves whether such returns are realistic on a consistent basis. For context, currency pairs in the Forex market rarely change in value by more than 5-10% annually.

To achieve returns of 15% or more in a few weeks, traders often rely on:

- Exploiting small price fluctuations through frequent trades.

- Using leverage to amplify their trading capacity.

What Is Leverage in CFD Trading?

Leverage allows traders to open positions much larger than their actual capital. For instance, with just $10 in your account, you can open a CFD position worth $1,000 or more. However, if the value of the CFD decreases by $10, the broker will automatically close the trade. This is the essence of CFD trading with leverage—high potential profits paired with significant risks.

Key Features of CFD Trading

- Accessibility:

- To trade CFDs, you need to open an account with a broker.

- Traders can profit from both rising and falling prices. For example, a short position means betting on a price decrease.

- Taxation:

- In some countries, CFD income may be taxed differently compared to traditional asset trading.

- Leverage:

- Leverage enables traders to open positions far exceeding their real capital. While this increases potential profits, it also raises risks.

Risks of CFD Trading:

- Market Risk:

- CFD prices can change rapidly due to various factors, such as important news releases or other events.

- Credit Risk:

- There is a risk that the broker or counterparty may go bankrupt.

- Liquidity:

- Low popularity of certain CFDs can make it difficult to buy or sell them at the desired price.

- Regulatory Changes:

- CFD trading regulations may vary across countries and can impact your trading activity.

How Are CFD Prices Determined?

CFD quotes are provided by liquidity providers and passed on to brokers, who display the prices to clients. Some brokers immediately transfer trades to liquidity providers, which sets them apart from others.

One of the first providers of quotes for CFD trading was Thomson Reuters, which later evolved into a leading currency liquidity aggregator.

Conclusion

CFD trading involves an agreement between a buyer and a seller to exchange the difference in the value of an asset from the time the contract is opened to when it is closed.

When trading CFDs, neither party owns the underlying asset and will not own it in the future. However, this does not prevent traders from earning profits by speculating on price changes.

Hot Features

Hot Features