Shares in Legal & General (LSE:LGEN) soared on Friday after the FTSE 100 company announced the sale of its US insurance business to Japanese firm Meiji Yasuda for £1.8 billion.

The terms of the deal mean that Meiji Yasuda will own L&G’s US protection business and have a 20% economic interest in its pension risk transfer (PRT) business.

L&G will retain 80% of existing and new PRT through reinsurance arrangements. PRT involves buying up pension liabilities from corporate pension schemes.

L&G said the £1.8 billion valuation represents a “compelling multiple” to expected 2024 earnings.

The protection business is expected to generate operating profits of around $90 million in 2024, while its anticipated net assets are around $850 million.

£400 million of the proceeds will be reinvested into the PRT business, while £1 billion will be paid back to shareholders.

“This would be incremental to the group’s existing distribution policy. L&G therefore expects to return the equivalent of c. 40 per cent of its market cap to shareholders over 2025-2027 through a combination of dividends and buybacks,” the company said.

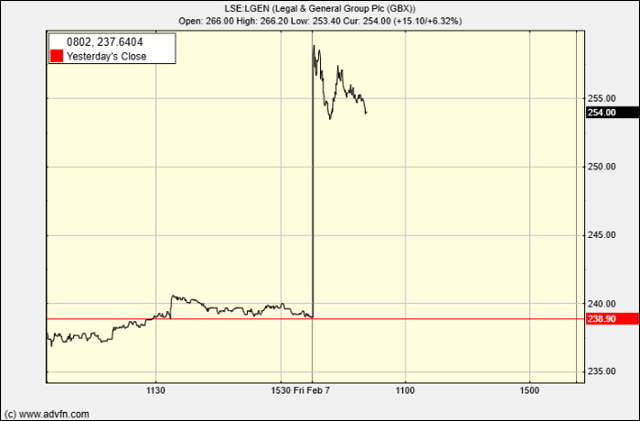

Shares in Legal & General rose over 8% in early trade.

Meiji Yasuda also intends to acquire a roughly 5% shareholding in L&G, with the two firms set to work closely together on both PRT and global private assets.

“This strategic partnership brings together two highly complementary global businesses, with a shared ambition for growth, and will enable us to capitalise on the large market opportunities in US PRT while driving scale and profitability in global asset management,” Simões said.

Simões, who took over from long-time boss Nigel Wilson last January, is attempting to streamline L&G’s business model.

Hot Features

Hot Features