Growth strategy leads to expansion into North Africa

Highlights:

· Support services contract award in Western Sahara bring countries of operation to six

· Win reflects the Board’s strategy of widening geographic exposure and client base

· Atlas Development actively looking to expand offering which currently encompasses mining, oil and gas, geothermal and infrastructure projects

· Strong balance sheet and current cash in excess of US$10 million available for ‘buy and build’ strategy focussed on building on existing revenue and businesses that through optimisation can maintain Atlas Development’s profit margin

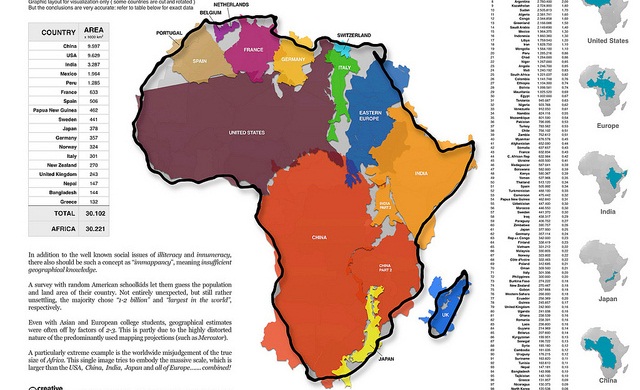

Atlas Development (AIM:ADSS), the Kenyan headquartered, African focussed support services and logistics company, is pleased to announce that it has been engaged to provide civil engineering supervisory, advanced life support, security and risk advisory services to a European and North African focussed oil and gas company operating in Western Sahara. The agreement is in line with the Company’s strategy of leveraging its existing profitable operating platform and experience supplying international companies with critical support services and logistics in East Africa, to expand its geographic exposure and profile.

Atlas Development is continuing to pursue its objective of building a leading multi-divisional African support services business. In this regard, the Board has been focussed on implementing a defined growth strategy that includes geographic expansion and increasing capability. Consequently, the Company has in recent months successfully expanded from Kenya and Ethiopia into Mozambique, Tanzania, Djibouti and now Western Sahara.

To date, Atlas Development has been particularly successful in supporting exploration activity; development plans include expanding capabilities so it can provide services throughout the development and production phases of extractive and infrastructure projects. Opportunities to add services are being sought primarily via acquisition and a number of complementary opportunities are currently being evaluated that would provide additional revenue as well as increase critical mass.

The business currently operates across a number of sectors including oil & gas, mining, geothermal and general infrastructure. The business model remains resilient due to the restructuring implemented in 2014 which focussed on profitability and profit margins. As a continuing process and to ensure value is created for shareholders, the Company is further evaluating its cost base to streamline its structure and maintain current margins.

Carl Esprey, Chief Executive Officer of Atlas Development, said: “We have a streamlined business with a reputation for delivery. Being awarded this contract highlights the Company’s ability to execute on new opportunities in additional jurisdictions and is testament to our ability to service our clients’ requirements in a competitive market, whilst still demonstrating a robust margin model and profitable business framework. Added to this, we have a strong balance sheet with a cash position of in excess of US$10 million which we aim to utilise to expand our business offering, both organically and through acquisition. We operate across a number of sectors, oil & gas, mining, geothermal and infrastructure and I believe Atlas Development is ideally positioned to implement consolidation in the sector and region, targeting long term visible revenues and stable margins.”

Hot Features

Hot Features