Cardano Bulls Eye $10 Target – Analyst Reveals Key Levels To Break

March 09 2025 - 11:30AM

NEWSBTC

Cardano (ADA) has been caught in massive volatility and extreme

price swings, making it one of the most unpredictable assets in the

crypto market. Following US President Donald Trump’s announcement

of a US Strategic Crypto Reserve, which included Cardano, ADA’s

price skyrocketed over 80% in less than a day, fueling speculation

about its long-term role in institutional adoption. Related

Reading: 330,000 Ethereum Withdrawn From Exchanges In 72 Hours –

Supply Squeeze Incoming? However, the excitement was short-lived,

as negative macroeconomic sentiment and fears surrounding global

trade wars triggered a sharp 35% decline within just two days. As

uncertainty grips the financial markets, traders remain cautious

about whether ADA can regain momentum or if more downside is ahead.

Despite the recent sell-off, top analyst Ali Martinez shared a

technical analysis suggesting that Cardano remains positioned for a

potential surge toward $10. According to his insights, bulls must

reclaim key technical levels for a strong recovery, with ADA still

showing bullish potential despite short-term weakness. With

Cardano’s price action at a critical point, the coming days will be

crucial in determining its next move. If bulls can stabilize ADA

above key support, the potential for another explosive rally

remains on the table. Cardano Could Start A Massive Move Cardano

(ADA) has been overperforming compared to the broader crypto market

over the past week, showing relative strength despite ongoing

volatility. However, price action remains confined within a range

that first began forming in November 2024, preventing a clear

breakout in either direction. Related Reading: Litecoin Holds

Bullish Outlook As the MVRV Ratio Signals Strength – Analyst If

bulls can hold the current levels, ADA could soon attempt a push

above multi-year highs, setting the stage for a significant bullish

move. However, analysts remain cautious as prices are still low,

and investor sentiment remains fearful amid macroeconomic

uncertainty and trade war tensions. Many traders are waiting for

confirmation of a breakout, as momentum has yet to fully shift in

favor of the bulls. Martinez’s technical analysis on X reveals that

Cardano is still positioned for a potential surge toward $10.

According to Martinez, for this bullish scenario to unfold, ADA

must maintain support above $0.80 while successfully breaking

through the key $1.20 resistance level. These price points serve as

crucial pivot zones, and their validation or failure will likely

determine Cardano’s short-term trend. The next trading sessions

will be crucial, as a break above $1.20 could trigger a strong

upward move, while failure to hold above $0.80 could lead to

further downside risk. With ADA currently at a pivotal moment,

traders are closely monitoring price action to gauge whether bulls

can regain control or if continued consolidation is ahead. Price

Action Details: Technical Analysis Cardano (ADA) is currently

trading at $0.80 after failing to hold above the key $1 level.

Despite recent strong performance compared to the broader market,

ADA has struggled to maintain bullish momentum, leaving traders

uncertain about its next move. For bulls to regain control, ADA

must reclaim the $1 mark and push above the critical $1.17

resistance level. A break and hold above this zone could trigger a

massive rally, potentially sending Cardano to multi-year highs.

Such a move would signal renewed buying interest, boosting

confidence among investors and traders who are watching ADA’s

long-term potential. Related Reading: Solana Consolidates In A Wide

Range – Big Move On The Horizon? However, failure to break above $1

and hold the crucial $0.80 support level could expose Cardano to

further downside risk. A breakdown below $0.80 would likely send

ADA into lower demand zones, extending its consolidation phase and

delaying any significant recovery. Featured image from Dall-E,

chart from TradingView

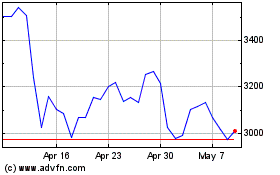

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025