0001460602

false

0001460602

2023-06-30

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 30, 2023

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416

|

|

98-0583166

|

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

June 30, 2023, Orgenesis Inc. (“Orgenesis”), Morgenesis LLC (“Morgenesis”), a recently

formed subsidiary of Orgenesis holding all the assets of Orgenesis’ point of care

services business for treating patients (“POCare Services”), and MM OS Holdings, L.P. (“MM”), an

affiliate of Metalmark Capital Partners, entered into Amendment No. 2 (the “UPA Amendment”) to the Unit Purchase Agreement

dated November 4, 2022 (the “UPA”). Pursuant to the UPA Amendment, MM agreed to make an investment of $1,000,000 in cash

in exchange for 100,000 additional Class A Preferred Units of Morgenesis to support the continued

expansion of the POCare Services business. Morgenesis received the additional $1,000,000 investment on July 3, 2023 and following

such investment, Orgenesis currently holds approximately 73% of the issued and outstanding equity interests of Morgenesis.

In

connection with the entry into the UPA Amendment, each of Orgenesis, Morgenesis and MM entered into Amendment

No. 1 to the Second Amended and Restated Limited Liability Company Agreement (the “LLC Agreement

Amendment”) to change the name of Morgenesis to “Octomera LLC” and to amend Morgenesis’ board composition. Pursuant

to the LLC Agreement Amendment, the board of managers of Octomera (the “Octomera Board”) will be comprised of five (5) managers,

two (2) of which will be appointed by Orgenesis, one (1) of which will be an industry expert appointed by MM, and two (2) of which will

be appointed by MM. The Octomera Board will remain the same as the existing Morgenesis board and is as follows: Vered Caplan and Mark

Cohen as the two (2) Orgenesis designees, Claudia Zylberberg as the MM industry expert, and Howard Hoffen and John Eppel as the two (2)

MM designees.

The

foregoing descriptions of the UPA Amendment and the LLC Agreement Amendment do not purport to be complete and are qualified in their

entirety by reference to the provisions of each of the UPA Amendment and the LLC Agreement Amendment, copies of which are filed as Exhibit

10.1 and Exhibit 10.2 to this Current Report on Form 8-K and are incorporated herein by reference.

Item

8.01. Other Events.

As

a result of the amendment to the composition of the Morgenesis Board pursuant to the LLC Agreement Amendment described above, Orgenesis

expects to deconsolidate Morgenesis (renamed Octomera LLC) from its consolidated financial statements as of June 30, 2023 and

to record its equity interest in Morgenesis as an equity method investment. Orgenesis is currently evaluating the impact of deconsolidation

on its financial position and results of operations for the second quarter of 2023.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| ORGENESIS

INC. |

|

| |

|

|

| By: |

/s/

Neil Reithinger |

|

| |

Neil

Reithinger |

|

| |

Chief

Financial Officer, Treasurer and Secretary |

|

| |

July

7, 2023 |

|

Exhibit

10.1

Amendment

No. 2 to UNIT purchase agreement

THIS

AMENDMENT NO. 2 TO UNIT PURCHASE AGREEMENT (this “Amendment”), dated as of June 30, 2023, is by and between MM OS

Holdings, L.P., a Delaware limited partnership (“Investor”), Morgenesis LLC, a Delaware limited liability company

(the “Company”) and Orgenesis Inc., a Nevada corporation (“Orgenesis Parent”) (each of the foregoing

persons, a “Party” and, collectively, the “Parties”). Capitalized terms used but not defined herein

shall have the meanings given to them in the Agreement (as defined below).

WHEREAS,

the Parties entered into that certain Unit Purchase Agreement, dated as of November 4, 2022 (as amended, the “Agreement”);

WHEREAS,

this Amendment is being executed and delivered pursuant to Section 9.9 of the Agreement, which provides that the Agreement may be amended

only if such amendment is in writing and signed by Investor and Orgenesis Parent; and

WHEREAS,

the Parties desire to amend certain terms of the Agreement, pursuant to, and in accordance with, Section 9.9 of the Agreement, as set

forth herein.

NOW,

THEREFORE, in consideration of the covenants set forth herein, and for other good and valuable consideration the receipt and sufficiency

of which is hereby acknowledged, the Parties hereby agree as follows:

Section

1. Amendment to Section 1.4(a) of the Agreement. The following sentence is hereby added after the first sentence of Section

1.4(a) of the Agreement:

“On or about June 30, 2023, the Investor shall make an investment in the Company equal to $1,000,000 in cash, in exchange

for 100,000 additional Class A Preferred Units, which proceeds shall be used by the Company to support the continued expansion of the

Business.”

Section

2. Upon receipt of the investment provided in Section 1.4(a) above, Schedule A of the UPA shall be replaced with Schedule A attached

hereto.

Section

3. Effect of Amendment. From and after the date hereof, each reference in the Agreement to “this Agreement,”

“hereof,” “hereunder” or words of like import referring to the Agreement (or any schedule thereof) shall be deemed

a reference to the Agreement (and such schedule) as amended by this Amendment. Except as and to the extent expressly modified by this

Amendment, the Agreement is not otherwise being amended, modified or supplemented and shall remain in full force and effect in accordance

with its terms.

Section

4. General Provisions. The provisions of Sections 9.4-9.13 and 9.16-9.18 of the Agreement shall apply mutatis mutandis

to this Amendment.

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered as of the day and year first above written.

| |

INVESTOR:

|

| |

|

| |

MM

OS Holdings, L.P. |

| |

|

| |

By: |

/s/

Howard Hoffen |

| |

Name: |

Howard

Hoffen |

| |

Title: |

Authorized

Signatory |

| |

COMPANY:

|

| |

|

| |

MORGENESIS

LLC |

| |

|

| |

By: |

/s/

Vered Caplan |

| |

Name: |

Vered

Caplan |

| |

Title: |

Chief

Executive Officer |

| |

ORGENESIS

PARENT:

|

| |

|

| |

ORGENESIS

INC. |

| |

|

| |

By: |

/s/

Vered Caplan |

| |

Name: |

Vered

Caplan |

| |

Title: |

Chief

Executive Officer |

Schedule

A – Capital Contribiton

[Signature Page to Amendment No. 2 to Unit Purchase Agreement]

Schedule A

Exhibit

10.2

FIRST

AMENDMENT TO THE SECOND AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT OF MORGENESIS LLC

FIRST

AMENDMENT TO THE SECOND AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT OF Morgenesis LLC (this “Amendment”

to the “LLC Agreement”), dated as of June 30, 2023, by and among Morgenesis LLC (the “Company”),

Orgenesis Inc. (“Orgenesis”) and MM OS Holdings, L.P. (“MM”). Capitalized terms used but not otherwise

defined herein shall have the meanings ascribed to them in the LLC Agreement.

W

I T N E S S E T H :

WHEREAS,

the Company and the other parties hereto are parties to the LLC Agreement;

WHEREAS,

the parties hereto desire to amend the LLC Agreement as set forth herein;

WHEREAS,

pursuant to Section 51 of the LLC Agreement, the LLC Agreement may be amended by a written agreement executed and delivered by Orgenesis

with the prior written consent of MM; and

WHEREAS,

MM, by executing and delivering this Amendment, hereby consents to the form and terms of this Amendment.

WHEREAS,

MM and Orgenesis have agreed to amend the Unit Purchase Agreement, dated November 4, 2022 as of the dated above (as amended, the “Amendment

No. 2 to the UPA”).

NOW,

THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION

1 Amendments.

(a)

The second sentence of Section 30 of the LLC Agreement is hereby amended and restated in its entirety as set forth below:

“The

initial Board as of the date hereof shall be comprised of (i) Vered Caplan, (ii) Mark Cohen, (iii) Howard Hoffen, (iv) John Eppel and

(v) Claudia Zylberberg, and shall be appointed as follows (subject to Sections 30(b) and 30(c)): (a) two Managers shall be appointed

by Orgenesis (each, an “Orgenesis Manager”), (b) one Manager shall be an industry expert appointed by MM (the “Industry

Expert Manager”) and (c) two Managers shall be appointed by MM (each, an “MM Manager”).”

(b)

The LLC Agreement is hereby amended to reflect the change of the name of the Company from “Morgenesis LLC” to “Octomera

LLC.” All references in the LLC Agreement to “Morgenesis LLC” are hereby deleted and “Octomera LLC” is

hereby substituted in lieu thereof.

(c)

Upon the effectiveness of Amendment No. 2 to the UPA, Schedule A of the LLC Agreement shall be replaced with Schedule A attached hereto.

SECTION

2 Reference to and Effect on the LLC Agreement. Each reference in the LLC Agreement to “this Agreement”, “hereunder”,

“hereof”, “herein”, or words of like import shall, except where the context otherwise requires, be deemed a reference

to the LLC Agreement as amended hereby. No reference to this Amendment need be made in any instrument or document at any time referring

to the LLC Agreement, and a reference to the LLC Agreement in any of such instruments or documents will be deemed to be a reference to

the LLC Agreement as amended hereby. Except as expressly provided in this Amendment, all provisions of the LLC Agreement remain in full

force and effect and are not modified by this Amendment, and the parties hereby ratify and confirm each and every provision thereof.

SECTION

3 Miscellaneous. Section 47 (Separability of Provisions), Section 48 (Notices), Section 49 (Entire Agreement),

Section 50 (Governing Law), Section 51 (Amendments) and Section 52 (Third Party Beneficiaries) of the LLC Agreement

are hereby incorporated by reference, mutatis mutandis.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the date first above written.

| |

COMPANY |

| |

|

| |

Morgenesis

LLC |

| |

|

| |

By: |

/s/

Vered Caplan |

| |

Name: |

Vered

Caplan |

| |

Title: |

Chief

Executive Officer |

| |

MEMBERS |

| |

|

| |

Orgenesis,

Inc. |

| |

|

| |

By: |

/s/

Vered Caplan |

| |

Name: |

Vered Caplan |

| |

Title: |

Chief Executive Officer |

| |

MM

OS Holdings, L.P. |

| |

|

| |

By: |

/s/

Howard Hoffen |

| |

Name: |

Howard

Hoffen |

| |

Title: |

Authorized

Signatory |

[Signature Page to First Amendment to Second Amended and Restated LLC Agreement of Morgenesis LLC]

Schedule

A

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

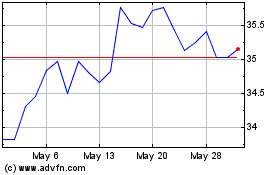

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Mar 2024 to Mar 2025