Corient Acquires Multi-Family Office Business of Geller, Expanding U.S. Wealth Management Presence and Deepening Family Office Capabilities

January 15 2025 - 6:15AM

Business Wire

Prominent New York-based MFO firm with $10.4

billion in assets joining Corient

All data as at November 30, 2024.

Corient, one of the largest and fastest-growing national

wealth advisors in the U.S., today announced it has acquired the

multi-family office business of Geller & Company (“Geller

MFO”). Geller MFO is a premier New York City-based multi-family

office with $10.4 billion in assets under management and

advisement. This move reinforces Corient’s presence in one of the

nation’s largest markets and deepens the firm’s family office

capabilities.

Geller & Company LLC was founded in 1984 by Martin Geller, a

pioneer in the multi-family office industry. Geller MFO provides a

bespoke family office experience to ultra-high-net-worth (UHNW)

individuals and families through a sophisticated, integrated family

office platform that includes personal CFO and financial

management, tax advisory and compliance, estate and generational

wealth planning, financial reporting and accounting, and integrated

investment management. In joining Corient, the Geller MFO team and

its clients will gain access to a highly differentiated technology

platform, operational, regulatory and compliance infrastructure,

expanded investment capabilities, enhanced trust services,

significant scale, and increased capital.

“The fact that a firm of Geller’s stature has chosen to join

Corient speaks to the tremendous quality of our firm and the value

of our differentiated private partnership structure and business

model,” said Kurt MacAlpine, Partner and Chief Executive Officer of

Corient. “I’m excited to welcome Marty Geller as a leader in our

MFO business and his highly experienced team. We look forward to

adding their significant tax and CFO expertise and other

capabilities to our own, further enhancing our ability to provide

clients with bespoke wealth management solutions that go beyond

traditional wealth advisement.”

Mr. Geller said, “The Geller team has always put our clients at

the center of everything we do – delivering objective advice and

services as well as building lifelong relationships through the

exceptional talent of our team and collaborative, high performance

culture. We have been incredibly impressed with Corient and how its

core strengths and culture align closely with our own. We firmly

believe that Corient and Geller coming together will set the

standard of what it means to be a family office in the UHNW space,

which will result in continued advancement in how we develop our

talent and service our multigenerational clients.”

Corient is a fiduciary, fee-only wealth management firm that is

distinguished by its private partnership model, similar to leading

professional services firms. This approach fosters collaboration

and teamwork in pursuit of the shared vision to deliver unrivaled

client excellence. Since its founding in 2020, Corient has grown

rapidly and today has more than 240 partners and over 1,200

employees managing approximately $182 billion in assets on behalf

of high-net-worth and ultra-high-net-worth individuals, families

and businesses across the United States.

About Corient

Corient Private Wealth LLC is an integrated national U.S. wealth

management firm providing comprehensive solutions to

ultra-high-net-worth and high-net-worth clients. We combine the

personal service, creativity and objective advice of a boutique

with the power of an exclusive network of experienced advisors,

capabilities and solutions to create a profoundly different wealth

experience. As fiduciaries, we put our clients at the center of

everything we do. We focus on exceeding expectations, simplifying

lives and establishing lasting legacies. Headquartered in Miami,

Corient is a subsidiary of Toronto-based CI Financial Corp. (TSX:

CIX), a global asset and wealth management company with

approximately US$380.5 billion (C$532.7 billion) in assets as at

November 30, 2024. For more information, visit corient.com.

On November 25, 2024, CI Financial announced that it has entered

into a definitive agreement with an affiliate of Mubadala Capital,

the alternative asset management arm of Mubadala Investment

Company, to take the firm private. Read the public announcement

here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250115069200/en/

Media Relations United States Jimmy Moock Managing

Partner, StreetCred 610-304-4570 jimmy@streetcredpr.com

corient@streetcredpr.com Canada Murray Oxby Vice-President,

Corporate Communications 416-681-3254 moxby@ci.com

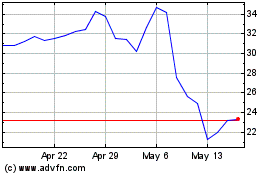

CompX (AMEX:CIX)

Historical Stock Chart

From Jan 2025 to Feb 2025

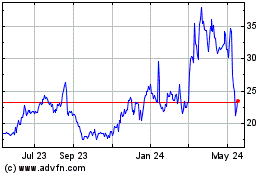

CompX (AMEX:CIX)

Historical Stock Chart

From Feb 2024 to Feb 2025