AMCON Distributing Company (“AMCON” or “the Company”) (NYSE

American: DIT), an Omaha, Nebraska based Convenience and

Foodservice Distributor, is pleased to announce fully diluted

earnings per share of $7.15 on net income available to common

shareholders of $4.3 million for the fiscal year ended September

30, 2024.

“We have seen our strategic plan come to full bloom in fiscal

2024. AMCON has grown its footprint geographically, expanded within

our existing footprint, and enhanced our foodservice capability. We

are now the third largest Convenience Distributor in the United

States measured by territory covered. Our new Springfield, Missouri

facility is fully operational and provides the infrastructure

necessary to advance our foodservice initiatives. AMCON’s

long-standing core operating philosophy is providing a superior

level of customer service. Our customer-centric approach has guided

us through these challenging times and ensured that AMCON’s

customers received a consistent and timely flow of goods and

services,” said Christopher H. Atayan, AMCON’s Chairman and Chief

Executive Officer. He further noted, “We continue to actively seek

strategic acquisition opportunities for operators who want to align

with our customer focused approach philosophy and further the

legacy of their enterprises.”

The wholesale distribution segment reported revenues of $2.7

billion and operating income of $31.3 million for fiscal 2024 and

the retail health food segment reported revenues of $42.5 million

and operating income of $0.1 million for fiscal 2024.

“We continue to drive the growth of our foodservice business

through our Henry’s Foods (“Henry’s”) subsidiary. Henry’s offers a

breadth and depth of proprietary foodservice programs and

associated store level merchandising that is unparalleled in the

convenience distribution industry. Through Henry’s, we now have the

capability to offer turn-key solutions that will enable our

customer base to compete head-on with the Quick Service Restaurant

industry. We are investing heavily in our foodservice and

technology platforms and associated staffing for these strategic

focus areas as we deploy these capabilities across our entire

organization,” said Andrew C. Plummer, AMCON’s President and Chief

Operating Officer. Mr. Plummer continued, “In particular, we now

have integrated state of the art advertising, design, print and

electronic display programs that we believe provide our customers a

competitive edge.”

“We continue our relentless daily focus on managing the

Company’s balance sheet and maximizing our liquidity position. At

September 30, 2024, our shareholders’ equity was $111.7 million,”

said Charles J. Schmaderer, AMCON’s Chief Financial Officer. Mr.

Schmaderer also added, “We are investing capital to develop our

recently acquired 250,000 square foot distribution facility in

Colorado City, Colorado, which will support our customers’ growth

initiatives in the Intermountain Region.”

AMCON, and its subsidiaries Team Sledd, LLC and Henry’s Foods,

Inc., is a leading Convenience and Foodservice Distributor of

consumer products, including beverages, candy, tobacco, groceries,

foodservice, frozen and refrigerated foods, automotive supplies and

health and beauty care products with thirteen (13) distribution

centers in Colorado, Illinois, Indiana, Minnesota, Missouri,

Nebraska, North Dakota, South Dakota, Tennessee and West Virginia.

Through its Healthy Edge Retail Group, AMCON operates fifteen (15)

health and natural product retail stores in the Midwest and

Florida.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED BALANCE

SHEETS

September

September

2024

2023

ASSETS

Current assets:

Cash

$

672,788

$

790,931

Accounts receivable, less allowance for

credit losses of $2.3 million at September 2024 and $2.4 million at

September 2023

70,653,907

70,878,420

Inventories, net

144,254,843

158,582,816

Income taxes receivable

718,645

1,854,484

Prepaid expenses and other current

assets

12,765,088

13,564,056

Total current assets

229,065,271

245,670,707

Property and equipment, net

106,049,061

80,607,451

Operating lease right-of-use assets,

net

25,514,731

23,173,287

Goodwill

5,778,325

5,778,325

Other intangible assets, net

4,747,234

5,284,935

Other assets

2,952,688

2,914,495

Total assets

$

374,107,310

$

363,429,200

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

54,498,225

$

43,099,326

Accrued expenses

15,802,727

14,922,279

Accrued wages, salaries and bonuses

8,989,355

8,886,529

Current operating lease liabilities

7,036,751

6,063,048

Current maturities of long-term debt

5,202,443

1,955,065

Current mandatorily redeemable

non-controlling interest

1,703,604

1,703,604

Total current liabilities

93,233,105

76,629,851

Credit facilities

121,272,004

140,437,989

Deferred income tax liability, net

4,374,316

4,917,960

Long-term operating lease liabilities

18,770,001

17,408,758

Long-term debt, less current

maturities

16,562,908

11,675,439

Mandatorily redeemable non-controlling

interest, less current portion

6,507,896

7,787,227

Other long-term liabilities

1,657,295

402,882

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 630,362 shares outstanding at September 2024 and

608,689 shares outstanding at September 2023

9,648

9,431

Additional paid-in capital

34,439,735

30,585,388

Retained earnings

108,552,565

104,846,438

Treasury stock at cost

(31,272,163

)

(31,272,163

)

Total shareholders’ equity

111,729,785

104,169,094

Total liabilities and shareholders’

equity

$

374,107,310

$

363,429,200

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

OPERATIONS

Fiscal Years Ended

September

2024

2023

Sales (including excise taxes of $569.5

million and $564.6 million, respectively)

$

2,710,981,108

$

2,539,994,999

Cost of sales

2,528,626,652

2,369,150,102

Gross profit

182,354,456

170,844,897

Selling, general and administrative

expenses

154,878,763

137,301,668

Depreciation and amortization

9,495,179

7,576,646

164,373,942

144,878,314

Operating income

17,980,514

25,966,583

Other expense (income):

Interest expense

10,413,228

8,550,431

Change in fair value of mandatorily

redeemable non-controlling interest

1,040,968

1,307,599

Other (income), net

(936,171

)

(1,193,840

)

10,518,025

8,664,190

Income from operations before income

taxes

7,462,489

17,302,393

Income tax expense

3,126,000

5,706,000

Net income available to common

shareholders

$

4,336,489

$

11,596,393

Basic earnings per share available to

common shareholders

$

7.24

$

19.85

Diluted earnings per share available to

common shareholders

$

7.15

$

19.46

Basic weighted average shares

outstanding

599,020

584,148

Diluted weighted average shares

outstanding

606,782

595,850

Dividends paid per common share

$

1.00

$

5.72

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

SHAREHOLDERS’ EQUITY

Additional

Common Stock

Treasury Stock

Paid-in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

Balance, October 1, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,903,201

$

96,784,353

$

92,829,435

Dividends on common stock, $5.72 per

share

—

—

—

—

—

(3,534,308

)

(3,534,308

)

Compensation expense and issuance of stock

in connection with equity-based awards

26,263

263

—

—

3,682,187

—

3,682,450

Repurchase of common stock

—

—

(2,363

)

(404,876

)

—

—

(404,876

)

Net income available to common

shareholders

—

—

—

—

—

11,596,393

11,596,393

Balance, September 30, 2023

943,272

$

9,431

(334,583

)

$

(31,272,163

)

$

30,585,388

$

104,846,438

$

104,169,094

Dividends on common stock, $1.00 per

share

—

—

—

—

—

(630,362

)

(630,362

)

Compensation expense and issuance of stock

in connection with equity-based awards

21,673

217

—

—

3,854,347

—

3,854,564

Net income available to common

shareholders

—

—

—

—

—

4,336,489

4,336,489

Balance, September 30, 2024

964,945

$

9,648

(334,583

)

$

(31,272,163

)

$

34,439,735

$

108,552,565

$

111,729,785

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

CASH FLOWS

September

September

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income available to common

shareholders

$

4,336,489

$

11,596,393

Adjustments to reconcile net income

available to common shareholders to net cash flows from (used in)

operating activities:

Depreciation

8,957,478

7,161,468

Amortization

537,701

415,178

(Gain) loss on sales of property and

equipment

(177,467

)

(133,659

)

Equity-based compensation

2,489,781

2,717,370

Deferred income taxes

(543,644

)

2,589,372

Provision for credit losses

(64,705

)

(133,924

)

Inventory allowance

62,349

(138,820

)

Change in fair value of contingent

consideration

(124,992

)

—

Change in fair value of mandatorily

redeemable non-controlling interest

1,040,968

1,307,599

Changes in assets and liabilities, net of

effects of business combinations:

Accounts receivable

5,900,380

(138,956

)

Inventories

29,003,285

(7,728,394

)

Prepaid and other current assets

2,227,044

(679,229

)

Other assets

(38,193

)

(163,340

)

Accounts payable

11,397,485

2,213,085

Accrued expenses and accrued wages,

salaries and bonuses

1,221,322

1,574,050

Other long-term liabilities

511,231

298,914

Income taxes payable and receivable

1,135,839

(1,034,889

)

Net cash flows from (used in) operating

activities

67,872,351

19,722,218

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(20,429,805

)

(11,561,347

)

Proceeds from sales of property and

equipment

416,546

151,808

Acquisition of Burklund

(15,464,397

)

—

Acquisition of Richmond Master

(6,631,039

)

—

Acquisition of Henry's

—

(54,865,303

)

Net cash flows from (used in) investing

activities

(42,108,695

)

(66,274,842

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facilities

2,517,192,464

2,512,309,723

Repayments under revolving credit

facilities

(2,536,358,449

)

(2,463,134,172

)

Proceeds from borrowings on long-term

debt

—

7,000,000

Principal payments on long-term debt

(3,765,153

)

(2,349,065

)

Repurchase of common stock

—

(404,876

)

Dividends on common stock

(630,362

)

(3,534,308

)

Redemption and distributions to

non-controlling interest

(2,320,299

)

(2,975,323

)

Net cash flows from (used in) financing

activities

(25,881,799

)

46,911,979

Net change in cash

(118,143

)

359,355

Cash, beginning of period

790,931

431,576

Cash, end of period

$

672,788

$

790,931

Supplemental disclosure of cash flow

information:

Cash paid during the period for interest,

net of amounts capitalized

$

9,985,313

$

8,311,375

Cash paid during the period for income

taxes, net of refunds

2,520,127

4,141,370

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

1,016,948

$

1,015,534

Purchase of property financed with

promissory note

8,000,000

—

Portion of Burklund acquisition financed

with promissory note

3,900,000

—

Portion of Burklund acquisition financed

with contingent consideration

1,578,444

—

Issuance of common stock in connection

with the vesting of equity-based awards

1,296,372

2,044,805

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108892732/en/

Charles J. Schmaderer AMCON Distributing Company Ph

402-331-3727

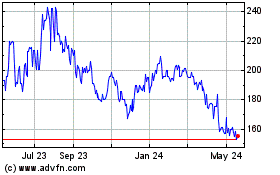

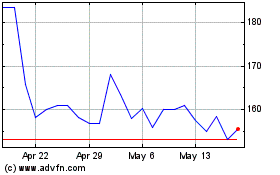

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Nov 2024 to Dec 2024

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Dec 2023 to Dec 2024