false

0001101396

0001101396

2024-02-12

2024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): February 12, 2024

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

|

|

Georgia

|

|

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

1-15583

|

|

58-2508794

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2750 Premiere Pkwy., Suite 100,

Duluth, Georgia 30097

|

|

30097

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

(678) 775-6900

|

|

|

(Registrant's Telephone Number Including Area Code)

|

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Large accelerated filer

|

Accelerated filer

|

Non-accelerated filer

|

Smaller reporting company |

Emerging growth company

|

|

☐

|

☒

|

☐

|

☒ |

☐

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common |

DLA |

NYSE American |

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2024, Delta Apparel, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended December 30, 2023.

A copy of the press release is attached as Exhibit 99.1 hereto, incorporated herein by reference, and also made available through the Company's website at www.deltaapparelinc.com.

Item 7.01. Regulation FD Disclosure.

Robert W. Humphreys, Chairman and Chief Executive Officer, and senior management will hold a conference call on Monday, February 12, 2024, at 4:30 p.m. Eastern Time, to discuss financial results. The conference call will be broadcast through the Company’s website at www.deltaapparelinc.com. Investors may listen to the call by selecting the webcast link on the homepage of the website. A replay of the webcast will be available within one hour of the call and accessible on the above website through March 12, 2024.

The information in this Current Report on Form 8-K, including the exhibit, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DELTA APPAREL, INC.

|

|

|

|

|

|

|

|

|

|

Date:

|

February 12, 2024

|

/s/ Justin M. Grow

|

|

|

|

Justin M. Grow

|

|

|

|

Executive Vice President and Chief Administrative Officer

|

Exhibit 99.1

Delta Apparel Reports First Quarter Fiscal 2024 Results

Focus on Cost Restructuring and Capital Optimization Continues

February 12, 2024, DULUTH, GA --(BUSINESS WIRE)-- Delta Apparel, Inc. (NYSE American: DLA), a leading provider of core activewear, lifestyle apparel, and on-demand digital print strategies, today announced financial results for its fiscal year 2024 first quarter ended December 30, 2023.

Chairman and Chief Executive Officer Robert W. Humphreys commented, “Many of the unfavorable market dynamics we saw across our business and the activewear industry last year persisted during our first quarter. We continued to take decisive action to improve our balance sheet and streamline our cost structure and operations. Our debt and inventory levels were down more than 20% year-over-year and we are very near completion of our plan to reduce our offshore manufacturing footprint down to two countries and consolidate production in our more efficient Central American platform. We completed similar consolidation work in our DTG2Go digital print business and significantly reduced other areas of our workforce to better align our cost structure with the lower demand we continue to see across much of our business.

Our Salt Life business registered sales growth for the quarter on the strength of its direct-to-consumer channels, and its recently opened retail location in Virginia has exceeded expectations to date. At Activewear, we continued to see sluggish overall activity across its three go-to-market channels and the excess global manufacturing capacity in the market continued to drive pricing pressure. On-quality performance and other operational metrics in our DTG2Go business continued to improve and shipments in our digital first business were above our internal plan, but overall demand during the holiday season came in below original forecasts.”

Mr. Humphreys concluded, “With the challenging start to our fiscal year and demand across most of our markets generally expected to be flat relative to last year, we remain tightly focused on managing liquidity and working capital across all aspects of our business and will continue to look for areas where we can generate efficiencies and further streamline operations. We will also continue to evaluate strategic options with the best interest of our shareholders in mind and remain committed to monetizing our real estate portfolio through a sale-leaseback transaction for the right value proposition.”

For the first quarter ended December 30, 2023:

| |

●

|

Net sales were $79.9 million compared to prior year period net sales of $107.3 million. Salt Life Group segment net sales were $10.3 million and up slightly compared to the prior year period. Net sales in the Delta Group segment were $69.6 million compared to $97.0 million in the prior year period.

|

| |

●

|

Gross margins were 10.9% compared to 12.7% in the prior year period, driven primarily by production curtailments. Adjusted for the cost impacts of these product curtailments (“Production Curtailment Costs”), first quarter gross margins were 12.6%. Delta Group segment gross margins were 5.8% compared to 7.8% in the prior year period. Adjusted for the Production Curtailment Costs, Delta Group segment gross margins were 8%. Salt Life Group segment gross margins were 45.4% versus 57.0% in the prior year period. Salt Life’s gross margins for the quarter were negatively impacted to some degree by the timing of inventory receipts, which should reverse in the second quarter.

|

| |

●

|

Selling, general, and administrative expenses (“SG&A”) decreased from $18.9 million in the prior year period to $18.6 million, while SG&A as a percentage of sales increased over the prior year period to 23.3%.

|

| |

●

|

Operating loss increased from $2.6 million in the prior year period to an operating loss of $4.9 million. Adjusting for the Production Curtailment Costs and costs associated with the restructuring of our offshore manufacturing footprint down to two countries and related initiatives (“Restructuring Costs”), operating loss was $2.8 million. Delta Group segment operating income improved from $0.1 million to $0.5 million. Adjusted for the Production Curtailment Costs and Restructuring Costs, Delta Group segment operating income was $2.7 million, or 3.8% of sales. The Salt Life Group segment experienced an operating loss of $2.1 million, compared to operating income of $0.3 million in the prior year period.

|

| |

●

|

Net interest expense was $3.6 million compared to $2.9 million in the prior year period, with the increase driven by the elevated interest rate environment partially offset by lower borrowings.

|

| |

●

|

Earnings before interest, taxes, depreciation and amortization (“EBITDA”) was a loss of $1.3 million. Adjusted for the Production Curtailment Costs and Restructuring Costs, EBITDA was positive at $853 thousand. Delta Group segment EBITDA was $3.5 million. Adjusted for the Production Curtailment Costs and Restructuring Costs, Delta Group segment EBITDA was $5.7 million. Salt Life Group segment EBITDA was a loss of $1.6 million.

|

| |

●

|

Net loss increased to $8.5 million, or $1.22 per share, from a loss of $3.6 million, or $0.51 per share. Adjusted for the Production Curtailment Costs and Restructuring Costs, net loss was $6.6 million, or $0.94 per share.

|

| |

●

|

Net inventory as of December 30, 2023, was $196.3 million, a sequential decrease of almost $16 million, or 8%, from September 2023 and a year-over-year decrease of $62.5 million, or 24%, from December 2022.

|

| |

●

|

Debt outstanding under our U.S. revolving credit facility was $110.8 million at December 30, 2023, a reduction of $31.5 million from the prior year December and $42.3 million from March 2023. Total net debt, including capital lease financing and cash on hand, was $144.4 million as of December 30, 2023, an approximately 26% reduction from $194.3 million at March 2023 and an approximately 22% reduction from $185.2 million at December 2022.

|

| |

●

|

Cash on hand and availability under our U.S. revolving credit facility totaled $7.4 million as of December 30, 2023, a decrease of $19.8 million from December 2022 and $6.8 million from September 2023. We believe we will need to obtain additional liquidity in the near term to fund our operations and meet the obligations specified in our U.S. revolving credit facility, and we are currently exploring a variety of options toward that end.

|

| |

●

|

Capital spending was $300 thousand during the first quarter compared to $2.1 million during the prior year first quarter.

|

Conference Call

On February 12, 2024, at 4:30 p.m. ET, the Company’s senior management will hold a conference call to discuss its financial results. The Company invites you to join the call by dialing 888-886-7786. If calling from outside the United States, the dial-in number is 416-764-8658. A live webcast of the conference call will be available at www.deltaapparelinc.com. Please visit the website at least 15 minutes early to register for the teleconference webcast and download any necessary software. A replay of the call will be available through March 12, 2024. To access the telephone replay, participants should dial toll-free 844-512-2921. International callers can dial 412-317-6671. The access code for the replay is 35636211.

Non-GAAP Financial Measures

Reconciliations of GAAP gross margins to non-GAAP gross margins, GAAP operating income to non-GAAP operating income, GAAP net income to non-GAAP net income, GAAP net income to non-GAAP EBITDA, GAAP net income to non-GAAP adjusted EBITDA, and GAAP operating income to non-GAAP EBITDA and adjusted EBITDA are presented in tables accompanying the selected financial data included in this release and provide useful information to evaluate the Company’s operational performance. A description of the amounts excluded on a non-GAAP basis are provided in conjunction with these tables. Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP EBITDA and non-GAAP adjusted EBITDA should be evaluated in light of the Company’s financial statements prepared in accordance with GAAP.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries DTG2Go, LLC, Salt Life, LLC, and M.J. Soffe, LLC, is a vertically-integrated, international apparel company that designs, manufactures, sources, and markets a diverse portfolio of core activewear and lifestyle apparel products under the primary brands of Salt Life®, Soffe®, and Delta. The Company is a market leader in the direct-to-garment digital print and fulfillment industry, bringing proprietary DTG2Go technology and innovation to customer supply chains. The Company specializes in selling casual and athletic products through a variety of distribution channels and tiers, including outdoor and sporting goods retailers, independent and specialty stores, better department stores and mid-tier retailers, mass merchants and e-retailers, the U.S. military, and through its business-to-business e-commerce sites. The Company’s products are also made available direct-to-consumer on its websites at www.saltlife.com, www.soffe.com and www.deltaapparel.com as well as through its branded retail stores. The Company’s operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 6,600 people worldwide. Additional information about the Company is available at www.deltaapparelinc.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain “forward-looking” statements that involve risks and uncertainties. Any number of factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, our ability to access capital or that it will be available on terms acceptable to us or at all; the general U.S. and international economic conditions; the impact of the COVID-19 pandemic and government/social actions taken to contain its spread on our operations, financial condition, liquidity, and capital investments, including recent labor shortages, inventory constraints, and supply chain disruptions; significant interruptions or disruptions within our manufacturing, distribution or other operations; deterioration in the financial condition of our customers and suppliers and changes in the operations and strategies of our customers and suppliers; the volatility and uncertainty of cotton and other raw material prices and availability; the competitive conditions in the apparel industry; our ability to predict or react to changing consumer preferences or trends; our ability to successfully open and operate new retail stores in a timely and cost-effective manner; the ability to grow, achieve synergies and realize the expected profitability of acquisitions; changes in economic, political or social stability at our offshore locations or in areas in which we, or our suppliers or vendors, operate; our ability to attract and retain key management; the volatility and uncertainty of energy, fuel and related costs; material disruptions in our information systems related to our business operations; compromises of our data security; significant changes in our effective tax rate; significant litigation in either domestic or international jurisdictions; recalls, claims and negative publicity associated with product liability issues; the ability to protect our trademarks and other intellectual property; changes in international trade regulations; our ability to comply with trade regulations; changes in employment laws or regulations or our relationship with employees; negative publicity resulting from violations of manufacturing standards or labor laws or unethical business practices by our suppliers and independent contractors; the inability or refusal of suppliers or other third-parties, including those related to transportation, to fulfill the terms of their contracts with us; continued operating losses and restrictions on our ability to borrow capital or service our indebtedness; interest rate fluctuations increasing our obligations under our variable rate indebtedness; the ability to raise additional capital; the impairment of acquired intangible assets; foreign currency exchange rate fluctuations; the illiquidity of our shares; price volatility in our shares and the general volatility of the stock market; and the other factors set forth in the "Risk Factors" contained in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and as updated in our subsequently filed Quarterly Reports on Form 10-Q. Except as may be required by law, Delta Apparel, Inc. expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

Company Contact:

Justin Grow, 864-232-5200 x6604

investor.relations@deltaapparel.com

Investor Relations Contact:

ICR, Inc.

Investors:

Tom Filandro, 646-277-1235

SELECTED FINANCIAL DATA:

(In thousands, except per share amounts)

| |

|

Three Months Ended

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$ |

79,934 |

|

|

$ |

107,295 |

|

|

Cost of Goods Sold

|

|

|

71,187 |

|

|

|

93,672 |

|

|

Gross Profit

|

|

|

8,747 |

|

|

|

13,623 |

|

| |

|

|

|

|

|

|

|

|

|

Selling, General and Administrative Expenses

|

|

|

18,614 |

|

|

|

18,870 |

|

|

Other Income, Net

|

|

|

(4,921 |

) |

|

|

(2,621 |

) |

|

Operating Loss

|

|

|

(4,946 |

) |

|

|

(2,626 |

) |

| |

|

|

|

|

|

|

|

|

|

Interest Expense, Net

|

|

|

3,577 |

|

|

|

2,890 |

|

| |

|

|

|

|

|

|

|

|

|

Loss Before Provision For (Benefit From) Income Taxes

|

|

|

(8,523 |

) |

|

|

(5,516 |

) |

| |

|

|

|

|

|

|

|

|

|

Provision For (Benefit From) Income Taxes

|

|

|

10 |

|

|

|

(1,917 |

) |

| |

|

|

|

|

|

|

|

|

|

Consolidated Net Loss

|

|

|

(8,533 |

) |

|

|

(3,599 |

) |

| |

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Non-Controlling Interest

|

|

|

6 |

|

|

|

34 |

|

| |

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Shareholders

|

|

$ |

(8,527 |

) |

|

$ |

(3,565 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

7,003 |

|

|

|

6,954 |

|

|

Diluted

|

|

|

7,003 |

|

|

|

6,954 |

|

| |

|

|

|

|

|

|

|

|

|

Net Loss per Common Share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(1.22 |

) |

|

$ |

(0.51 |

) |

|

Diluted

|

|

$ |

(1.22 |

) |

|

$ |

(0.51 |

) |

| |

|

December 2023

|

|

|

September 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

377 |

|

|

$ |

187 |

|

|

$ |

327 |

|

|

Receivables, Net

|

|

|

34,488 |

|

|

|

47,868 |

|

|

|

61,514 |

|

|

Inventories, Net

|

|

|

196,348 |

|

|

|

212,365 |

|

|

|

258,891 |

|

|

Prepaids and Other Assets

|

|

|

3,526 |

|

|

|

2,542 |

|

|

|

4,114 |

|

|

Total Current Assets

|

|

|

234,739 |

|

|

|

262,962 |

|

|

|

324,846 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncurrent Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, Plant & Equipment, Net

|

|

|

62,598 |

|

|

|

65,611 |

|

|

|

72,771 |

|

|

Goodwill and Other Intangibles, Net

|

|

|

49,822 |

|

|

|

50,391 |

|

|

|

61,324 |

|

|

Deferred Income Taxes

|

|

|

7,822 |

|

|

|

7,822 |

|

|

|

1,342 |

|

|

Operating Lease Assets

|

|

|

56,909 |

|

|

|

55,464 |

|

|

|

49,313 |

|

|

Investment in Joint Venture

|

|

|

9,751 |

|

|

|

10,082 |

|

|

|

9,045 |

|

|

Other Noncurrent Assets

|

|

|

3,263 |

|

|

|

2,906 |

|

|

|

2,800 |

|

|

Total Noncurrent Assets

|

|

|

190,165 |

|

|

|

192,276 |

|

|

|

196,595 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

424,904 |

|

|

$ |

455,238 |

|

|

$ |

521,441 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable and Accrued Expenses

|

|

$ |

77,308 |

|

|

$ |

80,321 |

|

|

$ |

100,652 |

|

|

Income Taxes Payable

|

|

|

700 |

|

|

|

710 |

|

|

|

321 |

|

|

Current Portion of Finance Leases

|

|

|

8,246 |

|

|

|

8,442 |

|

|

|

8,603 |

|

|

Current Portion of Operating Leases

|

|

|

9,741 |

|

|

|

9,124 |

|

|

|

8,585 |

|

|

Current Portion of Long-Term Debt

|

|

|

117,275 |

|

|

|

16,567 |

|

|

|

9,514 |

|

|

Total Current Liabilities

|

|

|

213,270 |

|

|

|

115,164 |

|

|

|

127,675 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncurrent Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-Term Taxes Payable

|

|

|

2,131 |

|

|

|

2,131 |

|

|

|

2,841 |

|

|

Deferred Income Taxes

|

|

|

- |

|

|

|

- |

|

|

|

2,232 |

|

|

Long-Term Finance Leases

|

|

|

12,007 |

|

|

|

14,029 |

|

|

|

18,465 |

|

|

Long-Term Operating Leases

|

|

|

48,259 |

|

|

|

47,254 |

|

|

|

42,015 |

|

|

Long-Term Debt

|

|

|

7,260 |

|

|

|

126,465 |

|

|

|

148,899 |

|

|

Total Noncurrent Liabilities

|

|

|

69,657 |

|

|

|

189,879 |

|

|

|

214,452 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

96 |

|

|

|

96 |

|

|

|

96 |

|

|

Additional Paid-In Capital

|

|

|

60,643 |

|

|

|

61,315 |

|

|

|

60,559 |

|

|

Equity Attributable to Non-Controlling Interest

|

|

|

(713 |

) |

|

|

(707 |

) |

|

|

(690 |

) |

|

Retained Earnings

|

|

|

124,860 |

|

|

|

133,387 |

|

|

|

163,035 |

|

|

Accumulated Other Comprehensive Gain (Loss)

|

|

|

- |

|

|

|

- |

|

|

|

210 |

|

|

Treasury Stock

|

|

|

(42,909 |

) |

|

|

(43,896 |

) |

|

|

(43,896 |

) |

|

Total Equity

|

|

|

141,977 |

|

|

|

150,195 |

|

|

|

179,314 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity

|

|

$ |

424,904 |

|

|

$ |

455,238 |

|

|

$ |

521,441 |

|

Reconciliation of GAAP Measures Gross Margin, Operating (Loss) Income, and Net (Loss) Income to Non-GAAP Measures Adjusted Gross Margin, Adjusted Operating (Loss) Income, and Adjusted Net (Loss) Income

Unaudited

(in thousands)

|

Reconciliation of Gross Margin to Adjusted Gross Margin – Unaudited

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Gross Margin

|

|

$ |

8,747 |

|

|

$ |

13,623 |

|

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

|

3,370 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Gross Margin

|

|

$ |

10,095 |

|

|

$ |

16,993 |

|

| |

|

|

12.6 |

% |

|

|

15.8 |

% |

|

Reconciliation of Operating Loss to Adjusted Operating (Loss) Income – Unaudited

|

|

|

|

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating Loss

|

|

$ |

(4,946 |

) |

|

$ |

(2,626 |

) |

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

|

3,370 |

|

|

Restructuring Costs (2)

|

|

|

813 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Operating (Loss) Income

|

|

$ |

(2,785 |

) |

|

$ |

744 |

|

|

Reconciliation of Net Loss to Adjusted Net (Loss) Income – Unaudited

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$ |

(8,527 |

) |

|

$ |

(3,565 |

) |

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

|

3,370 |

|

|

Restructuring Costs (2)

|

|

|

813 |

|

|

|

- |

|

|

Tax Impact

|

|

|

(216 |

) |

|

|

(3,540 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjusted Net (Loss) Income

|

|

$ |

(6,582 |

) |

|

$ |

(3,735 |

) |

|

Reconciliation of GAAP Measure Delta Group Segment Gross Margin to Non-GAAP Measure Delta Group Segment Adjusted Gross Margin - Unaudited

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Gross Margin

|

|

$ |

4,058 |

|

|

$ |

7,760 |

|

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

|

3,370 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Gross Margin

|

|

$ |

5,406 |

|

|

$ |

11,130 |

|

| |

|

|

7.8 |

% |

|

|

11.5 |

% |

|

Reconciliation of GAAP Measure Delta Group Segment Operating Income to Non-GAAP Measure Delta Group Segment Adjusted Operating Income - Unaudited

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating Income

|

|

$ |

492 |

|

|

$ |

123 |

|

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

|

3,370 |

|

|

Restructuring Costs (2)

|

|

|

813 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Operating Income

|

|

$ |

2,653 |

|

|

$ |

3,493 |

|

(1) Production Curtailment Costs consist of unabsorbed fixed costs, temporary unemployment benefit payments, and other expense items resulting from the Company’s decision to reduce production levels to better align with the significantly reduced demand across the activewear industry due to high inventory levels stemming from the heavy replenishment activity following pandemic-related supply chain challenges.

(2) Restructuring Costs consist of employee severance benefits paid in connection with the transition of our more expensive Mexico manufacturing capacity to our more efficient Central America manufacturing platform, employee severance benefits paid in connection with leadership restructuring, and additional cost items incurred from restructuring activities.

Reconciliations of GAAP Net Loss to Non-GAAP Measures Earnings Before Interest Taxes Depreciation and Amortization ("EBITDA"), Adjusted Net Loss, and Adjusted EBITDA

Unaudited

(in thousands)

|

Reconciliation of GAAP Measure Net Loss to Non-GAAP Measures EBITDA, Adjusted Net Loss,and Adjusted EBITDA – Unaudited

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

| |

|

|

|

|

|

Net Loss

|

|

$ |

(8,527 |

) |

| |

|

|

|

|

|

Interest Expense, Net

|

|

|

3,577 |

|

|

Provision For Income Taxes

|

|

|

10 |

|

|

Delta Group Segment Depreciation and Amortization

|

|

|

3,041 |

|

|

Salt Life Group Segment Depreciation and Amortization

|

|

|

534 |

|

|

Unallocated Depreciation and Amortization

|

|

|

57 |

|

| |

|

|

|

|

|

EBITDA

|

|

|

(1,308 |

) |

| |

|

|

|

|

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

Restructuring Costs (2)

|

|

|

813 |

|

|

Tax Impact

|

|

|

(216 |

) |

| |

|

|

|

|

|

Adjusted Net Loss

|

|

|

(6,582 |

) |

| |

|

|

|

|

|

Interest Expense, Net

|

|

|

3,577 |

|

|

Provision For Income Taxes

|

|

|

226 |

|

|

Delta Group Segment Depreciation and Amortization

|

|

|

3,041 |

|

|

Salt Life Group Segment Depreciation and Amortization

|

|

|

534 |

|

|

Unallocated Depreciation and Amortization

|

|

|

57 |

|

| |

|

|

|

|

|

Adjusted EBITDA

|

|

$ |

853 |

|

|

Reconciliation of GAAP Measure Delta Group Segment Operating Income to Non-GAAP Measures Delta Group Segment EBITDA, Adjusted Delta Group Segment Operating Income, and Adjusted Delta Group Segment EBITDA – Unaudited

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

| |

|

|

|

|

|

Delta Group Segment Operating Income

|

|

$ |

492 |

|

| |

|

|

|

|

|

Delta Group Segment Depreciation and Amortization

|

|

|

3,041 |

|

| |

|

|

|

|

|

Delta Group Segment EBITDA

|

|

|

3,533 |

|

| |

|

|

|

|

|

Production Curtailment Costs (1)

|

|

|

1,348 |

|

|

Restructuring Costs (2)

|

|

|

813 |

|

| |

|

|

|

|

|

Adjusted Delta Group Segment Operating Income

|

|

|

2,653 |

|

| |

|

|

|

|

|

Delta Group Segment Depreciation and Amortization

|

|

|

3,041 |

|

| |

|

|

|

|

|

Adjusted Delta Group Segment EBITDA

|

|

$ |

5,694 |

|

|

Reconciliation of GAAP Measure Salt Life Group Segment Operating Loss to Non-GAAP Measure Salt Life Group Segment EBITDA – Unaudited

|

|

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

| |

|

|

|

|

|

Salt Life Group Segment Operating Loss

|

|

$ |

(2,130 |

) |

| |

|

|

|

|

|

Salt Life Group Segment Depreciation and Amortization

|

|

|

534 |

|

| |

|

|

|

|

|

Salt Life Group Segment EBITDA

|

|

$ |

(1,596 |

) |

(1) Production Curtailment Costs consist of unabsorbed fixed costs, temporary unemployment benefit payments, and other expense items resulting from the Company’s decision to reduce production levels to better align with the significantly reduced demand across the activewear industry due to high inventory levels stemming from the heavy replenishment activity following pandemic-related supply chain challenges.

(2) Restructuring Costs consist of employee severance benefits paid in connection with the transition of our more expensive Mexico manufacturing capacity to our more efficient Central America manufacturing platform, employee severance benefits paid in connection with leadership restructuring, and additional cost items incurred from restructuring activities.

Delta Apparel, Inc.

Statement of Income

FY24 Q1

| |

|

Three Months Ending

|

|

| |

|

December 2023

|

|

|

December 2022

|

|

| |

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$ |

79,934 |

|

|

$ |

107,295 |

|

|

Cost of good sold

|

|

|

71,187 |

|

|

|

93,672 |

|

|

Gross profit

|

|

|

8,747 |

|

|

|

13,623 |

|

| |

|

|

10.9 |

% |

|

|

12.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

18,614 |

|

|

|

18,870 |

|

|

Goodwill Impairment

|

|

|

- |

|

|

|

- |

|

|

Other income, net

|

|

|

(4,921 |

) |

|

|

(2,621 |

) |

|

Operating loss

|

|

|

(4,946 |

) |

|

|

(2,626 |

) |

| |

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

3,577 |

|

|

|

2,890 |

|

|

Loss before provision for (benefit from) income taxes

|

|

|

(8,523 |

) |

|

|

(5,516 |

) |

|

Benefit from income taxes

|

|

|

10 |

|

|

|

(1,917 |

) |

|

Consolidated net loss

|

|

|

(8,533 |

) |

|

|

(3,599 |

) |

|

Less: Net loss attributable to non-controlling interest

|

|

|

6 |

|

|

|

34 |

|

|

Net loss attributable to shareholders

|

|

$ |

(8,527 |

) |

|

$ |

(3,565 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic loss per share

|

|

$ |

(1.22 |

) |

|

$ |

(0.51 |

) |

|

Diluted loss per share

|

|

$ |

(1.22 |

) |

|

$ |

(0.51 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

7,003 |

|

|

|

6,954 |

|

|

Dilutive effect of stock awards

|

|

|

- |

|

|

|

- |

|

|

Weighted average number of shares assuming dilution

|

|

|

7,003 |

|

|

|

6,954 |

|

| |

|

|

|

|

|

|

|

|

|

Adjustments

|

|

|

|

|

|

|

|

|

|

Production Curtaliment Costs

|

|

|

(1,348 |

) |

|

|

(3,370 |

) |

|

SG&A Severance

|

|

|

(813 |

) |

|

|

- |

|

|

Tax Impact

|

|

|

216 |

|

|

|

3,540 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Results

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$ |

79,934 |

|

|

$ |

107,295 |

|

|

Cost of good sold

|

|

|

69,839 |

|

|

|

90,302 |

|

|

Gross profit

|

|

|

10,095 |

|

|

|

16,993 |

|

| |

|

|

12.6 |

% |

|

|

15.8 |

% |

| |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

17,801 |

|

|

|

18,870 |

|

|

Other income, net

|

|

|

(4,921 |

) |

|

|

(2,621 |

) |

|

Operating (loss) income

|

|

|

(2,785 |

) |

|

|

744 |

|

| |

|

|

(3.5% |

) |

|

|

0.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

3,577 |

|

|

|

2,890 |

|

|

(Loss) Income before (benefit from) provision for income taxes

|

|

|

(6,362 |

) |

|

|

(2,146 |

) |

|

(Benefit from) provision for income taxes

|

|

|

226 |

|

|

|

1,623 |

|

|

Consolidated net (loss)income

|

|

|

(6,588 |

) |

|

|

(3,769 |

) |

|

Less: Net loss attributable to non-controlling interest

|

|

|

6 |

|

|

|

34 |

|

|

Net (loss) income attributable to shareholders

|

|

$ |

(6,582 |

) |

|

$ |

(3,735 |

) |

| |

|

|

(8.2% |

) |

|

|

-3.5 |

% |

| |

|

|

|

|

|

|

|

|

|

Basic (loss) income per share

|

|

$ |

(0.94 |

) |

|

$ |

(0.54 |

) |

|

Diluted (loss) income per share

|

|

$ |

(0.94 |

) |

|

$ |

(0.54 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding

|

|

|

7,003 |

|

|

|

6,954 |

|

|

Dilutive effect of stock awards

|

|

|

- |

|

|

|

2 |

|

|

Weighted average number of shares assuming dilution

|

|

|

7,003 |

|

|

|

6,956 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 12, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DELTA APPAREL, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 12, 2024

|

| Entity, Incorporation, State or Country Code |

GA

|

| Entity, File Number |

1-15583

|

| Entity, Tax Identification Number |

58-2508794

|

| Entity, Address, Address Line One |

2750 Premiere Pkwy

|

| Entity, Address, Address Line Two |

Suite 100

|

| Entity, Address, City or Town |

Duluth

|

| Entity, Address, State or Province |

GA

|

| Entity, Address, Postal Zip Code |

30097

|

| City Area Code |

678

|

| Local Phone Number |

775-6900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common

|

| Trading Symbol |

DLA

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001101396

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

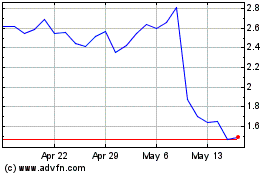

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Dec 2023 to Dec 2024