false

0001599407

0001599407

2024-11-19

2024-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 19, 2024

| 1847 Holdings LLC |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue, 21st Floor, New York, NY |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 417-9800 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On November 19, 2024, 1847 Holdings LLC issued

a press release regarding its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished

as Exhibit 99.1 to this report.

The information furnished with this Item 2.02,

including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing

under Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as expressly set forth by specific

reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: November 19, 2024 |

1847 HOLDINGS LLC |

| |

|

| |

/s/ Ellery W. Roberts |

| |

Name: Ellery W. Roberts |

| |

Title: Chief Executive Officer |

- 2 -

Exhibit 99.1

1847 Announces Transformative

Initiatives in the First Nine Months of 2024, Reports Third Quarter 2024 Financial Results and Provides Business Update

Achieves 6.3% Revenue

Growth for the First Nine Months of 2024 Compared to 2023

NEW

YORK, NY / ACCESSWIRE / November 19, 2024 / 1847 Holdings LLC ("1847"

or the "Company") (NYSE American: EFSH), a holding company specializing in identifying over-looked, deep value investment opportunities

in middle market businesses, today provided a business update and reported financial results for the third quarter ended September 30,

2024.

Q3 2024 Highlights

and Subsequent Events

| · | Cash

and cash equivalents, and restricted cash of $10.2 million as of September 30, 2024 |

| · | Disposition

of ICU Eyewear; eliminated $4.8 million of net liabilities from the balance sheet |

| · | Sold

High Mountain Door & Trim Inc. ("HMDT"), a division of 1847 Cabinets for approximately

$17 million, more than double the original purchase price |

| · | Completed

$11.1 million public offering; eliminated $6.9 million of additional debt from the balance

sheet |

| · | Signed

definitive agreement to acquire the previously announced millwork, cabinetry, and door manufacturer

based in Las Vegas, Nevada (the "Target") with unaudited revenue of $33.1 million

and net income of $10.4 million for the trailing twelve months ended September 30, 2024.

Scheduled to close on or before December 3, 2024 |

Mr. Ellery W. Roberts, CEO of 1847 Holdings, commented,

“We believe the past few months have been transformative for 1847 Holdings as we executed a series of strategic initiatives designed

to position the Company for sustained growth and maximize shareholder value over the long term. We remain committed to executing our strategic

arbitrage model—acquiring undervalued companies, enhancing their performance, and selling them for a profit. This strategy allows

us to leverage market inefficiencies by acquiring assets at lower valuations, improving their operational or financial performance, and

then unlocking value through sales or spin-offs at higher valuations. A prime example of our strategy is the recent sale of HMDT. By effectively

executing our approach to enhance asset value—sometimes beyond what is reflected in the Company’s reported financials—we

were able to sell the business for $17 million, more than double its original purchase price, despite a trailing twelve month net loss

of approximately $2.3 million attributable to 1847 Holdings. This highlights our ability to unlock value through operational improvements

and strategic decision-making.

“We aim to replicate

this model with our next acquisition Target, which reported a net income of $10.4 million for the trailing twelve months ending September

30, 2024, with a purchase price of approximately $18.75 million. We ended the third quarter of 2024 with $10.2 million of cash and cash

equivalents, and restricted cash that can be used in part to close this transaction. Additionally, the successful completion of our $11.1

million public offering allowed us to eliminate $6.9 million of debt, significantly strengthening our balance sheet. The disposition

of ICU Eyewear further reduced net liabilities by $4.8 million. With a strong acquisition pipeline, we expect the upcoming acquisition

to significantly boost profitability, deliver substantial cash flow, and negate the need for near-term capital raises. We believe these

efforts establish a robust platform for sustainable growth and enhanced shareholder value. By leveraging our industry expertise and operational

acumen, we intend to continue to identify and capitalize on high-return opportunities, reinforcing our proven growth model. We remain

dedicated to driving value through strategic acquisitions as we expand and fortify our portfolio for long-term success," concluded

Mr. Roberts.

Q3 2024 Financial

Highlights

Total revenues were $4,759,090

for the three months ended September 30, 2024, as compared to $4,676,365 for the three months ended September 30, 2023.

| · | Revenues

from the construction segment increased by $12,336, or 0.3%, to $3,805,621 for the three

months ended September 30, 2024 from $3,793,285 for the three months ended September 30,

2023. The increase in revenues was primarily attributed to an increase in new multi-family

projects and an increase in the average customer contract value. |

| · | Revenues

from the automotive supplies segment increased by $70,389, or 8.0%, to $953,469 for the three

months ended September 30, 2024 from $883,080 for the three months ended September 30, 2023.

The increase in revenues was primarily attributed to an improved supply chain with manufacturers,

although inventory challenges within the supply chain to meet customer demands continue to

persist. |

Total cost of revenues was $2,002,772 for the

three months ended September 30, 2024, as compared to $1,869,779 for the three months ended September 30, 2023.

| · | Cost

of revenues for the construction segment increased by $181,309, or 14.6%, to $1,425,247 for

the three months ended September 30, 2024 from $1,243,938 for the three months ended September

30, 2023. |

| · | Cost

of revenues for the automotive supplies segment decreased by $48,316, or 7.7%, to $577,525

for the three months ended September 30, 2024 from $625,841 for the three months ended September

30, 2023. |

Total personnel expenses

were $2,406,855 for the three months ended September 30, 2024, as compared to $1,663,261 for the three months ended September 30, 2023.

Total general and administrative

expenses were $2,205,498 for the three months ended September 30, 2024, as compared to $1,427,256 for the three months ended September

30, 2023.

Total professional fees

were $711,024 for the three months ended September 30, 2024, as compared to $592,202 for the three months ended September 30, 2023.

Total operating expenses

were $8,172,328 for the three months ended September 30, 2024, as compared to $5,883,608 for the three months ended September 30, 2023,

resulting in a loss from operations of $3,413,238 for the three months ended September 30, 2024, as compared to a loss from operations

of $1,207,243 for the three months ended September 30, 2023.

Total other expense, net,

was $2,501,551 for the three months ended September 30, 2024, as compared to $4,379,472 for the three months ended September 30, 2023.

Such change was primarily due to a decrease of interest expense of $975,919, a decrease of amortization of debt discounts of $554,156,

an increase in gain on change in fair value of warrant liabilities of $109,300 and an increase in gain on change in fair value of derivative

liabilities of $3,166,458, offset by an increase in loss on extinguishment of debt of $1,642,701 and an increase in other expense of

$1,285,211.

Net loss from continuing

operations was $5,557,789 for the three months ended September 30, 2024, as compared to a net loss of $5,136,715 for the three months

ended September 30, 2023.

About 1847 Holdings

LLC

1847 Holdings LLC (NYSE

American: EFSH), a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel

Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment

thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle

market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently

acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure

and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary

at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to

1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit.

For the latest insights,

follow 1847 on Twitter.

Forward-Looking Statements

This

press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking

statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic

performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking

statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our

actual results, performance or financial condition to be materially different from the expectations of future results, performance or

financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might

cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

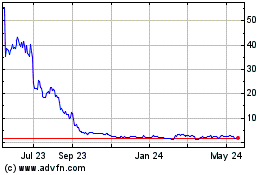

1847 (AMEX:EFSH)

Historical Stock Chart

From Feb 2025 to Mar 2025

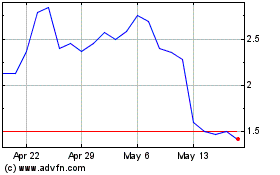

1847 (AMEX:EFSH)

Historical Stock Chart

From Mar 2024 to Mar 2025