false

0001599407

0001599407

2024-12-30

2024-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 31, 2024 (December 30, 2024)

| 1847 Holdings LLC |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-41368 |

|

38-3922937 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 260 Madison Avenue, 8th Floor, New York, NY |

|

10016 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (212) 417-9800 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Common Shares |

|

EFSH |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

On December 30, 2024, the board of directors of

1847 Holdings LLC (the “Company”) declared a dividend of one (1) share of the Company’s newly designated series

E preferred shares for each outstanding common share of the Company to shareholders as of January 10, 2025. The rights, preferences, limitations,

and other matters relating to the series E preferred shares are set forth in a share designation, dated December 30, 2024 (the “Share

Designation”). The following is a summary of the principal terms of the series E preferred shares as set forth in the Share

Designation.

General; Transferability. The series E

preferred shares will be uncertificated and represented in book-entry form. No series E preferred shares may be transferred by the holder

thereof except in connection with a transfer by such holder of any common shares held by such holder, in which case a number of series

E preferred shares equal to the number of common shares to be transferred by such holder will be automatically transferred to the transferee

of such common shares.

Dividend Rights. The Holders of series

E preferred shares, as such, shall not be entitled to receive dividends of any kind on the series E preferred shares.

Liquidation Rights. Subject to the rights

of creditors and the holders of the Company’s series A senior convertible preferred shares, series C senior convertible preferred

shares and series D senior convertible preferred shares, upon any liquidation, dissolution or winding up of the Company, whether voluntarily

or involuntarily, before any payment or distribution of the assets of the Company (whether capital or surplus) shall be made to or set

apart for the holders of the Company’s common shares or allocation shares, each holder of outstanding series E preferred shares

shall be entitled to receive an amount of cash equal to 100% of the stated value ($0.001 per share).

Voting Rights. Each outstanding series

E preferred share shall have 1,000,000 votes per share. The outstanding series E preferred shares shall vote together with the outstanding

common shares as a single class exclusively with respect to the Proposals (as defined in the Share Designation) and shall not be entitled

to vote on any other matter except to the extent required under the Company’s operating agreement or the Delaware Limited Liability

Company Act. Notwithstanding the foregoing, and for the avoidance of doubt, each series E preferred share redeemed pursuant to the Initial

Redemption (as defined below) shall have no voting power with respect thereto, and the holder of each series E preferred share redeemed

pursuant to the Initial Redemption shall have no voting power with respect to any such series E preferred share on the Proposals. Unless

otherwise provided on any applicable proxy or ballot with respect to voting on the Proposals, the vote of each series E preferred share

entitled to vote on the Proposals shall be cast in the same manner as the vote, if any, of the common shares in respect of which such

series E preferred share was issued as a dividend is cast on the Proposals, as applicable, and the proxy or ballot with respect to common

shares held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include all series E preferred shares held

by such holder. Holders of series E preferred shares will not receive a separate ballot or proxy to cast votes with respect to the series

E preferred shares on the Proposals.

Redemption Rights. All series E preferred

shares that are not duly voted by proxy prior to the opening of any meeting of shareholders held to vote on the Proposals shall automatically

be redeemed by the Company as of immediately prior to the opening of such meeting without further action on the part of the Company or

the holder thereof (the “Initial Redemption”). Any outstanding series E preferred shares that have not been redeemed

pursuant to an Initial Redemption shall be redeemed in whole automatically upon the approval by the Company’s shareholders of the

Proposals at any meeting of shareholders held for the purpose of voting on the Proposals (any such redemption, the “Subsequent

Redemption”). In addition, the board of directors may, in its sole discretion and at any time, order redemption of all (but

not part) of the outstanding series E preferred shares by delivering written notice of redemption to each holder of record of outstanding

series E preferred shares not less than two (2) days prior to the redemption date specified in such notice (the “Discretionary

Redemption” and, together with the Initial Redemption and Subsequent Redemption, the “Redemptions”). Each

series E preferred share redeemed in any Redemption shall be redeemed in consideration for the right to receive an amount equal to $0.01

in cash for each ten (10) series E preferred shares that are “beneficially owned” by the “beneficial owner” (as

such terms are defined in the Share Designation) thereof as of immediately prior to the applicable Redemption and redeemed pursuant to

such Redemption; provided, however, that for the avoidance of doubt, the redemption consideration in respect of the series E preferred

shares redeemed in any Redemption: (x) shall entitle the former beneficial owners of less than ten (10) series E preferred shares redeemed

in any Redemption to no cash payment in respect thereof and (y) shall, in the case of a former beneficial owner of a number of series

E preferred shares redeemed pursuant to any Redemption that is not equal to a whole number that is a multiple of ten (10), entitle such

beneficial owner to the same cash payment, if any, in respect of such Redemption as would have been payable in such Redemption to such

beneficial owner if the number of series E preferred shares beneficially owned by such beneficial owner and redeemed pursuant to such

Redemption were rounded down to the nearest whole number that is a multiple of ten (10) (such that, for example, the former beneficial

owner of 25 series E preferred shares redeemed pursuant to any Redemption shall be entitled to receive the same cash payment in respect

of such Redemption as would have been payable to the former beneficial owner of 20 series E preferred shares redeemed pursuant to such

Redemption).

Other Rights. Holders of series E preferred

shares will have no conversion, preemptive or subscription rights for additional securities of the Company.

The foregoing description of the Share Designation

does not purport to be complete and is qualified in its entirety by reference to the full text of the Share Designation filed as Exhibit

4.1 to this report, which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 31, 2024 |

1847 HOLDINGS LLC |

| |

|

| |

/s/ Ellery W. Roberts |

| |

Name: |

Ellery W. Roberts |

| |

Title: |

Chief Executive Officer |

3

Exhibit 4.2

1847 HOLDINGS LLC

SHARE DESIGNATION

OF

SERIES E PREFERRED SHARES

(no par value per share)

The undersigned duly authorized

officer of 1847 Holdings LLC, a Delaware limited liability company (the “Company”), hereby certifies that, pursuant

to the authority conferred upon the board of directors of the Company (the “Board”) by Section 3.3(b) of the Second

Amended and Restated Operating Agreement of the Company, dated January 19, 2018, as amended (as such may be amended, modified or restated

from time to time, the “Operating Agreement”), the Board on December 30, 2024 adopted a resolution which creates a

series of preferred shares of the Company as follows:

RESOLVED, that pursuant to

the authority vested in the Board in accordance with the provisions Section 3.3(b) of the Operating Agreement, a series of preferred shares

is hereby created, and that the designation and number of shares of such series and the voting powers, designations, preferences and relative,

participating, optional or other rights and the qualifications, limitations and restrictions thereof, are as set forth in the Operating

Agreement and this Share Designation, as it may be amended from time to time, as follows:

1. Definitions.

For the purposes hereof, the following terms shall have the following meanings:

“Adjournment Proposal”

means any proposal to adjourn any meeting of shareholders called for the purpose of voting on the Share Increase Proposal, the EIP Increase

Proposal, the Warrant Proposal and the Warrant Adjustment Proposal.

“Allocation Shares”

means the Company’s Allocation Shares, as defined in the Operating Agreement.

“Business Day”

means a day on which the New York Stock Exchange is open for trading and which is not a Saturday, Sunday, or other day on which banks

in New York City are authorized or required by law to close.

“Common Shares”

means the Company’s Common Shares, as defined in the Operating Agreement.

“Dissolution”

means any liquidation, dissolution or winding up of the Company, whether voluntarily or involuntarily; provided, however, that neither

the merger or consolidation of the Company with or into any other entity, nor the sale, lease, exchange or other disposition of all or

substantially all of the Company’s assets shall, in and of itself, be deemed to constitute a Dissolution.

“EIP Increase Proposal”

means any proposal submitted to the Company’s shareholders to adopt an amendment to the Company’s 2023 Equity Incentive Plan,

as amended (the “Plan”), to increase the number of Common Shares reserved under the Plan to 5,000,000 shares.

“Holders”

means the holders of the Series E Preferred Shares.

“Person”

means natural persons, companies, limited liability companies, unlimited liability companies, limited partnerships, general partnerships,

limited liability partnerships, joint ventures, trusts, land trusts, business trusts, or other organizations, irrespective of whether

they are legal entities, and governments and agencies and political subdivisions thereof.

“Pre-Funded Warrants”

means the pre-funded warrants for the purchase of an aggregate 38,873,908 Common Shares issued by the Company to certain purchasers on

December 16, 2024.

“Prior Series A Warrants”

means the Series A Warrants to purchase Common Shares issued by the Company to certain purchasers on October 30, 2024.

“Prior Series B Warrants”

means the Series B Warrants to purchase Common Shares issued by the Company to certain purchasers on October 30, 2024.

“Proposals”

means the Share Increase Proposal, the EIP Increase Proposal, the Warrant Proposal, the Warrant Adjustment Proposal and the Adjournment

Proposal.

“Requisite Holders”

means the Holders of a majority of Series E Preferred Shares then outstanding.

“SEC” means

the U.S. Securities and Exchange Commission.

“Series A Preferred

Shares” means the Company’s Series A Senior Convertible Preferred Shares.

“Series A Warrants”

means the series A warrants for the purchase of an aggregate 42,311,118 Common Shares issued by the Company to certain purchasers on December

16, 2024.

“Series B Warrants”

means the series B warrants for the purchase of an aggregate of 42,311,118 Common Shares issued by the Company to certain purchasers on

December 16, 2024.

“Series C Preferred

Shares” means the Company’s Series C Senior Convertible Preferred Shares.

“Series D Preferred

Shares” means the Company’s Series D Senior Convertible Preferred Shares.

“Share Increase Proposal”

means any proposal submitted to the Company’s shareholders to adopt an amendment to the Operating Agreement to increase the number

of authorized Common Shares from 500,000,000 shares to 2,000,000,000 shares.

“Transfer”

means, directly or indirectly, whether by merger, consolidation, share exchange, division, or otherwise, the sale, transfer, gift, pledge,

encumbrance, assignment or other disposition of the Series E Preferred Shares (or any right, title or interest thereto or therein) or

any agreement, arrangement or understanding (whether or not in writing) to take any of the foregoing actions.

“Warrants”

means the Pre-Funded Warrants, the Series A Warrants and the Series B Warrants.

“Warrant Adjustment

Proposal” means any proposal submitted to the Company’s shareholders to approve (i) an adjustment to the exercise price

and the Floor Price (as defined in the Prior Series A Warrants) of the outstanding Prior Series A Warrants to $0.81 (subject to adjustments

for stock splits, stock combinations, recapitalizations and similar transactions), and a corresponding increase to the number of Common

Shares underlying the Prior Series A Warrants so that the aggregate exercise value shall remain unchanged, and (ii) an adjustment to the

exercise price and the Floor Price (as defined in the Prior Series B Warrants) of the outstanding Prior Series B Warrants to $0.54 (subject

to adjustments for stock splits, stock combinations, recapitalizations and similar transactions), and a corresponding increase to the

number of Common Shares underlying the Prior Series B Warrants so that the aggregate exercise value shall remain unchanged.

“Warrant Proposal”

means any proposal submitted to the Company’s shareholders to approve the issuance of all Common Shares that may be issued upon

exercise of the Warrants, which, for the avoidance of doubt, includes all Common Shares that may be issued as a result of any (i) voluntary

adjustment by the Company, from time to time, of the exercise price of any and all outstanding Series A Warrants and Series B Warrants

pursuant to the terms of the Series A Warrants and the Series B Warrants, (ii) adjustment to the exercise price and number of Common Shares

underlying the Series A Warrants and the Series B Warrants in the event of a Share Combination Event (as defined in the Series A Warrants

and the Series B Warrants), (iii) adjustment to the exercise price and number of Common Shares underlying the Series A Warrants and the

Series B Warrants following the Reset Date (as defined in the Series A Warrants and the Series B Warrants); (iv) adjustment to the exercise

price and number of Common Shares underlying the Series A Warrants and the Series B Warrants following a Dilutive Issuance (as defined

in the Series A Warrants and the Series B Warrants), or (iv) alternative cashless exercise pursuant to Section 2.3 of the Series A Warrants,

as well as to fully implement the adjustments contemplated by the definition of the “Floor Price” contained in the Series

A Warrants and the Series B Warrants.

2. Designation

and Number of Shares; Admission as Member.

(a) There

is hereby created a new series of shares of the Company that are designated as the “Series E Preferred Shares” (the “Series

E Preferred Shares”). The number of shares constituting such series shall be 50,000,000. Each Series E Preferred Share shall

have a stated value of $0.001 per share (the “Stated Value”). Each Series E Preferred Share shall be identical in all

respects to every other Series E Preferred Share.

(b) A Person

shall be admitted as a Member (as defined in the Operating Agreement) and shall become bound by the terms of the Operating Agreement,

including this Share Designation, if such Person purchases or otherwise lawfully acquires any Series E Preferred Shares and becomes the

record holder of such shares in accordance with the provisions of this Share Designation and the Operating Agreement.

3. Ranking.

The Series E Preferred Shares shall, with respect to the distribution of assets upon a Dissolution, be deemed to rank:

(a) senior

to all Common Shares, Allocation Shares and to each other class or series of Additional Securities (as defined in the Operating Agreement)

of the Company that is established in accordance with the Operating Agreement after the date of this Share Designation and that is not

expressly made senior to or on parity with the Series E Preferred Shares as to the distribution of assets upon a Dissolution (the “Junior

Securities”);

(b) on

parity with each class or series of Additional Securities of the Company that is established in accordance with the Operating Agreement

after the date of this Share Designation and that is not expressly subordinated or made senior to the Series E Preferred Shares as to

the distribution of assets upon a Dissolution, whether or not the liquidation prices per share thereof differ from those of the Series

E Preferred Shares (the “Parity Securities”); and

(c) junior

to all of the Company’s indebtedness and other liabilities with respect to assets available to satisfy claims against the Company,

the Series A Preferred Shares, the Series C Preferred Shares, the Series D Preferred Shares and to each other class or series of Additional

Securities of the Company that is expressly made senior to the Series E Preferred Shares as to the distribution of assets upon a Dissolution

(“Senior Securities”).

4. Dividends.

The Holders of Series E Preferred Shares, as such, shall not be entitled to receive dividends of any kind on the Series E Preferred Shares.

5. Liquidation.

(a) Subject

to the rights of the Company’s creditors and the holders of any Senior Securities or Parity Securities, upon any Dissolution, before

any payment or distribution of the assets of the Company (whether capital or surplus) shall be made to or set apart for the holders of

Junior Securities as to the distribution of assets on any Dissolution, each Holder of outstanding Series E Preferred Shares shall be entitled

to receive an amount of cash equal to one hundred percent (100%) of the Stated Value. If, upon any Dissolution, the assets of the Company,

or proceeds thereof, distributable among the Holders of the Series E Preferred Shares shall be insufficient to pay in full the preferential

amount payable to the Holders of the Series E Preferred Shares as described in this Section 5(a) and liquidating payments on any other

shares of any class or series of Parity Securities as to the distribution of assets on any Dissolution, then such assets, or the proceeds

thereof, shall be distributed among the holders of Series E Preferred Shares and any such other Parity Securities ratably in accordance

with the respective amounts that would be payable on such Series E Preferred Shares and any such other Parity Securities if all amounts

payable thereon were paid in full.

(b) Subject

to the rights of the Company’s creditors and the holders of any Senior Securities or Parity Securities, upon any Dissolution, after

payment shall have been made in full to the Holders of the Series E Preferred Shares in accordance with this Section 5, the holders of

any other series or class or classes of Junior Securities shall, subject to the respective terms and provisions (if any) applying thereto,

be entitled to receive any and all assets remaining to be paid or distributed, and the Holders of the Series E Preferred Shares shall

not be entitled to share therein or have any other right or claim to such assets.

(c) Written

notice of any such Dissolution, stating the payment date or dates when, and the place or places where, the amounts distributable in such

circumstances shall be payable, shall be given by first class mail, postage prepaid, not less than twenty (20) nor more than sixty (60)

days prior to the payment date stated therein, to each record Holder of the Series E Preferred Shares at the respective address of such

Holders as the same shall appear on the stock transfer records of the Company.

6. Voting

Rights.

(a) Except

as otherwise provided herein, each outstanding Series E Preferred Share shall have 1,000,000 votes per share. The outstanding Series E

Preferred Shares shall vote together with the outstanding Common Shares as a single class exclusively with respect to the Proposals and

shall not be entitled to vote on any other matter except to the extent required under the Operating Agreement or the Delaware Limited

Liability Company Act. Notwithstanding the foregoing, and for the avoidance of doubt, each Series E Preferred Share redeemed pursuant

to the Initial Redemption (as defined below) shall have no voting power with respect thereto, and the Holder of each Series E Preferred

Share redeemed pursuant to the Initial Redemption shall have no voting power with respect to any such Series E Preferred Share on, the

Proposals.

(b) Unless

otherwise provided on any applicable proxy or ballot with respect to the voting on the Proposals, the vote of each Series E Preferred

Share entitled to vote on the Proposals shall be cast in the same manner as the vote, if any, of the Common Shares in respect of which

such Series E Preferred Share was issued as a dividend is cast on the Proposals, as applicable, and the proxy or ballot with respect to

Common Shares held by any Holder on whose behalf such proxy or ballot is submitted will be deemed to include all Series E Preferred Shares

held by such Holder. Holders of Series E Preferred Shares will not receive a separate ballot or proxy to cast votes with respect to the

Series E Preferred Shares on the Proposals.

7. Redemption.

(a) All

Series E Preferred Shares that are not duly voted by proxy prior to the opening of any meeting of shareholders held to vote on the Proposals,

in the manner as specifically described in the definitive proxy statement (as may be amended and supplemented) filed by the Company with

SEC and made available to the Company’s shareholders in connection with such meeting, shall automatically be redeemed by the Company

as of immediately prior to the opening of such meeting (the “Initial Redemption Time”) without further action on the

part of the Company or the Holder thereof (the “Initial Redemption”).

(b) Any

outstanding Series E Preferred Shares that have not been redeemed pursuant to an Initial Redemption shall be redeemed in whole, but not

in part, automatically upon the approval by the Company’s shareholders of the Proposals at any meeting of shareholders held for

the purpose of voting on the Proposals (any such redemption pursuant to this Section 7(b), the “Subsequent Redemption”).

As used herein, the “Subsequent Redemption Time” shall mean the effective time of the Subsequent Redemption.

(c) Notwithstanding

anything to the contrary herein or otherwise, the Board may, in its sole discretion and at any time, order redemption of all (but not

part) of the outstanding Series E Preferred Shares by delivering written notice of redemption to each Holder of record of outstanding

Series E Preferred Shares not less than two (2) days prior to the redemption date specified in such notice (the “Discretionary

Redemption” and, together with the Initial Redemption and Subsequent Redemption, the “Redemptions”). As used

herein, the “Redemption Time” shall mean (i) with respect to the Initial Redemption, the Initial Redemption Time, (ii)

with respect to the Subsequent Redemption, the Subsequent Redemption Time, and (iii) with respect to the Discretionary Redemption, such

time and date specified by the Board in its sole discretion for the effectiveness of the Discretionary Redemption.

(d) Each

Series E Preferred Share redeemed in any Redemption pursuant to this Section 7 shall be redeemed in consideration for the right to receive

an amount equal to $0.01 in cash for each ten (10) Series E Preferred Shares that are “beneficially owned” by the “beneficial

owner” (as such terms are defined below) thereof as of immediately prior to the applicable Redemption Time and redeemed pursuant

to such Redemption, payable upon the applicable Redemption Time; provided, however, that for the avoidance of doubt, the redemption consideration

in respect of the Series E Preferred Shares redeemed in any Redemption pursuant to this Section 7: (x) shall entitle the former beneficial

owners of less than ten (10) Series E Preferred Shares redeemed in any Redemption to no cash payment in respect thereof and (y) shall,

in the case of a former beneficial owner of a number of Series E Preferred Shares redeemed pursuant to any Redemption that is not equal

to a whole number that is a multiple of ten (10), entitle such beneficial owner to the same cash payment, if any, in respect of such Redemption

as would have been payable in such Redemption to such beneficial owner if the number of Series E Preferred Shares beneficially owned by

such beneficial owner and redeemed pursuant to such Redemption were rounded down to the nearest whole number that is a multiple of ten

(10) (such that, for example, the former beneficial owner of 25 Series E Preferred Shares redeemed pursuant to any Redemption shall be

entitled to receive the same cash payment in respect of such Redemption as would have been payable to the former beneficial owner of 20

Series E Preferred Shares redeemed pursuant to such Redemption). As used herein, a Person shall be deemed the “beneficial owner”

of, and shall be deemed to “beneficially own,” any securities which such Person is deemed to beneficially own, directly

or indirectly, within the meaning of Rule 13d-3 of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended.

(e) From

and after the time at which any Series E Preferred Shares are called for redemption (whether automatically or at the direction of the

Board), such Series E Preferred Shares shall cease to be outstanding, and the only right of the former Holders of such Series E Preferred

Shares, as such, will be to receive the applicable redemption price, if any. The Series E Preferred Shares redeemed by the Company pursuant

to this Share Designation shall, upon such redemption, be automatically retired. Notwithstanding anything to the contrary herein or otherwise,

and for the avoidance of doubt, any Series E Preferred Shares that have been redeemed pursuant to an Initial Redemption shall not be deemed

to be outstanding for the purpose of voting or determining the number of votes entitled to vote on any matter submitted to shareholders

from and after the time of the Initial Redemption. Notice of any meeting of shareholders for the submission to shareholders of the Proposals

shall constitute notice of a redemption of Series E Preferred Shares pursuant to an Initial Redemption and result in the automatic redemption

of the applicable Series E Preferred Shares pursuant to the Initial Redemption at the Initial Redemption Time pursuant to Section 7(a)

hereof. Notice by the Company of the shareholders’ approval of the Proposals, whether by press release or by the filing of a Current

Report on Form 8-K with the SEC, shall constitute a notice of a redemption of Series E Preferred Shares pursuant to a Subsequent Redemption

and result in the automatic redemption of the applicable Series E Preferred Shares pursuant to the Subsequent Redemption at the Subsequent

Redemption Time pursuant to Section 7(b) hereof. In connection with the execution of this Share Designation, the Company has set apart

funds for payment for the redemption of all Series E Preferred Shares pursuant to the Redemptions and shall continue to keep such funds

apart for such payment through the payment of the purchase price for the Redemption of all such Series E Preferred Shares.

8. Transfer.

No Series E Preferred Shares may be Transferred by the Holder thereof except in connection with a transfer by such Holder of any Common

Shares held thereby, in which case a number of Series E Preferred Shares equal to the number of Common Shares to be transferred by such

Holder shall be automatically transferred to the transferee of such Common Shares.

9. Miscellaneous.

(a) Any

and all notices or other communications or deliveries to be provided by the Holders hereunder shall be in writing and delivered by facsimile,

by electronic mail, or sent by a nationally recognized overnight courier service, addressed to the Company at 590

Madison Avenue, 21st Floor, New York, NY 10022, attention: Chief Financial Officer, e-mail address vhoward@1847holdings.com,

or such other facsimile number, e-mail address or address

as the Company may specify for such purposes by notice to the holders delivered in accordance with this Section 9(a). Any and all notices

or other communications or deliveries to be provided by the Company hereunder shall be in writing and delivered by facsimile, by electronic

mail, or sent by a nationally recognized overnight courier service, addressed to each Holder at the facsimile number, e-mail address or

address of such Holder appearing on the books of the Company, or if no such facsimile number, email address or address appears on the

books of the Company, at the principal place of business of such Holder. Any notice or other communication or deliveries hereunder shall

be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile

or electronic mail prior to 5:30 p.m. (New York City time) on any date, (ii) the next Business Day after the date of transmission, if

such notice or communication is delivered via facsimile or electronic mail on a day that is not a Business Day or later than 5:30 p.m.

(New York City time) on any Business Day, (iii) the second Business Day following the date of mailing, if sent by U.S. nationally recognized

overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given.

(b) All

questions concerning the construction, validity, enforcement and interpretation of this Share Designation shall be governed by and construed

and enforced in accordance with the internal laws

of the State of Delaware, without regard to the principles of conflict of laws thereof.

(c) This

Share Designation may be amended, or any provision of this Share Designation may be waived by the Company solely with the affirmative

vote at a duly held meeting or written consent of the Requisite Holders. Any waiver by the Company or a Holder of a breach of any provision

of this Share Designation shall not operate as or be construed to be a waiver of any other breach

of such provision or of any breach of any other provision of this Share Designation or a waiver by any other Holders, except that a waiver

by the Requisite Holders will constitute a waiver of all Holders. The failure of the Company or a Holder to insist upon strict adherence

to any term of this Share Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder)

of the right thereafter to insist upon strict adherence to that term or any other term of this Share Designation on any other occasion.

Any waiver by the Company or a Holder must be in writing.

(d) If

any provision of this Share Designation is invalid, illegal or unenforceable, the balance of this Share Designation shall remain in effect,

and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances.

(e) The

headings contained herein are for convenience only, do not constitute a part of this Share Designation and shall

not be deemed to limit or affect any of the provisions hereof.

* * * * * * *

IN WITNESS WHEREOF, this Share

Designation, which shall be made effective pursuant to Article III of the Operating Agreement, is executed by the undersigned this 30th

day of December, 2024.

| 1847 HOLDINGS LLC |

| |

|

| By: |

/s/ Ellery W. Roberts |

|

| Name: |

Ellery W. Roberts |

|

| Title: |

Chief Executive Officer |

|

7

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

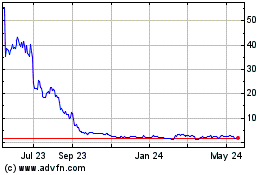

1847 (AMEX:EFSH)

Historical Stock Chart

From Jan 2025 to Feb 2025

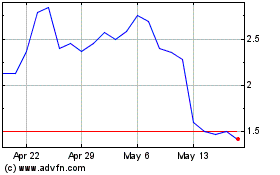

1847 (AMEX:EFSH)

Historical Stock Chart

From Feb 2024 to Feb 2025