false

0000319458

0000319458

2023-08-14

2023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report August 14, 2023

(Date of earliest event reported)

Enservco Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36335

|

|

84-0811316

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

14133 County Road 9½

Longmont, Colorado 80504

(Address of principal executive offices) (Zip Code)

(303) 333-3678

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, $0.005 par value

|

ENSV

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

The Company issued a press release on August 14, 2023 reporting the Company’s 2023 Second Quarter financial results and financial results for the six-month period ended June 30, 2023.

Item 9.01. Exhibits.

(d) Exhibits

A press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on August 18, 2023.

| |

Enservco Corporation

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Richard A. Murphy

|

| |

|

Richard A. Murphy, Executive Chair and CEO

|

Exhibit 99.1

Enservco Corporation Reports 2023 Second Quarter Financial Results

| |

●

|

9th consecutive quarter of YOY revenue growth, continued improvement in profit metrics

|

| |

●

|

Q2 revenue up 8% year over year to $3.7 million from $3.5 million

|

| |

●

|

Q2 adjusted EBITDA improves to $1.0 million loss from $1.6 million loss

|

| |

●

|

Six-month revenue up 5% year over year to $12.6 million from $12.0 million

|

| |

●

|

Six-month adjusted EBITDA loss of $14,000 vs. loss of $1.4 million

|

| |

●

|

Company continues to de-lever balance sheet, reducing long-term debt to $4.6 million from $7.6 million since 2022 year-end and from $36 million at peak debt in 2019

|

| |

●

|

Cross River Partners converts more than $1.3 million in convertible debt to equity in second quarter

|

Longmont, CO – August 14, 2023 – Enservco Corporation (NYSE American: ENSV), a diversified national provider of specialized well-site services to the domestic onshore conventional and unconventional oil and gas industries, today reported financial results for its second quarter and six-month period ended June 30, 2023.

“We are pleased to report continued growth momentum, highlighted by our ninth consecutive quarter of year-over-year revenue growth,” said Rich Murphy, Executive Chairman. “In what is traditionally one of our two slower, off-season quarters, we grew revenue by 8% year over year on the strength of a 147% increase in completion services, which more than offset a 7% decline in production services. Similarly, our six-month revenue increased by 5% year over year as completion services grew 12% and offset a 2% decline in production services. It is worth noting that the decline in revenues within production services for both the second quarter and six months was primarily related to our decision to exit our North Dakota operations, but that decline was substantially offset by significant gains within the more profitable Texas operations.

“We also continued to drive improvements in profit metrics,” Murphy added. “Adjusted EBITDA improved by $0.5 million and $1.3 million for the three and six-month periods, respectively, reflecting enhanced segment profitability and substantial cost reductions at the SG&A level. Net loss in the second quarter improved by $1.4 million, reflecting higher revenue and the positive impact of cost reductions. The six-month net loss was higher year over year due to the Company recognizing a $4.3 million gain on debt extinguishment in the same period last year. Absent that one-time gain, this year’s six-month net loss would have shown solid improvement year over year.

Murphy added, “We continued to focus on debt reduction in the second quarter and are pleased to report that Cross River Partners converted approximately $1.3 million in convertible debt to equity in the period. That transaction, combined with the sale of non-revenue-generating surplus equipment, contributed to a further decline in total long-term debt to $4.6 million from $7.6 million at 2022 year-end and from a high of $36 million in 2019 when the Company began its debt reduction program. We expect to further de-lever our business over time while focusing on growing our core business and adding new revenue streams.”

Second Quarter Results

Revenue in the second quarter increased 8% year over year to $3.7 million from $3.5 million due to a 147% increase in completion services, which offset a 7% decline in production services revenue.

Adjusted EBITDA in the second quarter improved by approximately $0.5 million to a loss of $1.0 million compared to a loss of $1.6 million in the same quarter last year.

Net loss in the second quarter improved by $1.3 million to ($2.6 million), or ($0.14) per basic and diluted share, versus ($3.9 million), or ($0.34) per basic and diluted share, in the same quarter last year. The reduced net loss was attributable to a combination of higher revenue and cost reductions across the business, including a 43% decrease in sales, general and administrative expense in the quarter.

Six Month Results

Revenue through six months increased 5% year over year to $12.6 million from $12.0 million. The increase was attributable to 12% growth in completion services, partially offset by a 2% decline in production services.

Adjusted EBITDA through six months improved by $1.3 million to ($14,000) from ($1.4 million) over the same period last year.

Net loss through six months was ($3.6 million), or ($0.22) per basic and diluted share, compared to ($0.8 million), or ($0.07) per basic and diluted share, in the same period last year when the Company booked a non-recurring $4.3 million gain on debt extinguishment. As in the second quarter, the Company achieved meaningful cost reductions at both the operating and corporate levels through six months.

Conference Call Information

Management will hold a conference call to discuss these results on Tuesday, August 15 at 9:00 a.m. ET. The call will be accessible by dialing 877-545-0523 (973-528-0016 for international callers). Access code 173030. A telephonic replay will be available through August 29, 2023, by calling 877-481-4010 (919-882-2331 for international callers) and entering the Replay ID # 48952. To listen to the webcast, participants should go to the ENSERVCO website at www.enservco.com and link to the “Investors” page at least 10 minutes early to register and download any necessary audio software. A replay of the webcast will be available until September 15, 2023. The webcast also is available here: https://www.webcaster4.com/Webcast/Page/2228/48952

About Enservco

Through its various operating subsidiaries, Enservco provides a range of oilfield services, including hot oiling, acidizing, frac water heating, and related services. The Company has a broad geographic footprint covering seven major domestic oil and gas basins and serves customers in Colorado, Montana, New Mexico, North Dakota, Oklahoma, Pennsylvania, Ohio, Texas, Wyoming, West Virginia, Utah, Michigan, Illinois, Florida, and Louisiana. Additional information is available at www.enservco.com.

*Note on non-GAAP Financial Measures

This press release and the accompanying tables include a discussion of EBITDA and Adjusted EBITDA, which are non-GAAP financial measures provided as a complement to the results provided in accordance with generally accepted accounting principles ("GAAP"). The term "EBITDA" refers to a financial measure that we define as earnings (net income or loss) plus or minus net interest taxes, depreciation and amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation and, when appropriate, other items that management does not utilize in assessing Enservco’s operating performance (as further described in the attached financial schedules). None of these non-GAAP financial measures are recognized terms under GAAP and do not purport to be an alternative to net income as an indicator of operating performance or any other GAAP measure. We have reconciled Adjusted EBITDA to GAAP net loss in the Consolidated Statements of Operations table at the end of this release. We intend to continue to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting.

Cautionary Note Regarding Forward-Looking Statements

This news release contains information that is "forward-looking" in that it describes events and conditions Enservco reasonably expects to occur in the future. Expectations for the future performance of Enservco are dependent upon a number of factors, and there can be no assurance that Enservco will achieve the results as contemplated herein. Certain statements contained in this release using the terms "may," "expects to," “should,” and other terms denoting future possibilities, are forward-looking statements. The accuracy of these statements cannot be guaranteed as they are subject to a variety of risks, which are beyond Enservco's ability to predict, or control and which may cause actual results to differ materially from the projections or estimates contained herein. Among these risks are those set forth in Enservco’s annual report on Form 10-K for the year ended December 31, 2022, and subsequently filed documents with the SEC. Forward looking statements in this news release that are subject to risk include the ability to further de-lever the business. It is important that each person reviewing this release understand the significant risks attendant to the operations of Enservco. The Company disclaims any obligation to update any forward-looking statement made herein.

Contact:

Mark Patterson

Chief Financial Officer

Enservco Corporation

mpatterson@enservco.com

v3.23.2

Document And Entity Information

|

Aug. 14, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Enservco Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 14, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36335

|

| Entity, Tax Identification Number |

84-0811316

|

| Entity, Address, Address Line One |

14133 County Road 9½

|

| Entity, Address, City or Town |

Longmont

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80504

|

| City Area Code |

303

|

| Local Phone Number |

333-3678

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ENSV

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000319458

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

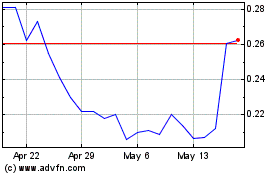

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Jan 2025 to Feb 2025

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Feb 2024 to Feb 2025