Gold Resource Corporation (NYSE American:

GORO) (the “Company”) is pleased to announce its

third quarter operational results from its Don David Gold Mine

(“DDGM”) near Oaxaca, Mexico, and a corporate update on its other

activities.

2024 Q3 Summary include:

- Produced and sold 1,357 ounces of gold and 181,434 ounces of

silver

- Produced and sold 1,473 tonnes of zinc, 98 tonnes of copper,

and 467 tonnes of lead

- Working capital of $6.1 million and cash balance of $1.4

million at September 30, 2024

Don David Gold Mine:

- In the third quarter of 2024, the Don David Gold Mine (“DDGM”)

in Mexico produced and sold a total of 3,526 gold equivalent

(“AuEq”) ounces, comprised of 1,357 gold ounces and 181,434 silver

ounces at an average sales price per ounce of $2,561 and $30.61,

respectively.

- Beginning in the third quarter, the DDGM underground diamond

drilling program progressed positively with two drill rigs in

operation. Until the new drill stations are developed to further

test the Three Sisters system, the focus of the drilling

strategically shifted to infill the northwest extension of the

Arista vein system, targeting the Marena North, Santa Cecilia, and

Splay 31 veins to further define, expand, and upgrade the Mineral

Resources in this area. To preserve cash, the infill drilling was

suspended on August 1, 2024 . The grade control drilling continued

as planned during the third quarter, focusing on maximizing the

potential economic returns of the mineralization scheduled for

future production in both the Arista and Switchback vein

systems.

- There were no lost time incidents during the quarter, resulting

in a “zero” year-to-date Lost Time Injury Frequency Rate (“LTIFR”)

safety record. Safety is paramount for the Company. The Company

strives to continue its excellent track record each quarter and

seeks to improve safety measures, awareness, and training on an

ongoing basis.

- DDGM submitted a tax refund request for the 2023 overpaid taxes

for approximately $3.8 million (or $76 million pesos). This amount

is expected to be refunded in 2025.

Corporate and Financial:

- Gold Resource Corporation and its subsidiaries (“we,” “our,”

“us,” or the “Company”) has $6.1 million in working capital and

$1.4 million in cash as of September 30, 2024.

- Net loss was $10.5 million or $0.11 per share for the quarter,

which was mainly attributable to the decrease in net sales because

the Company’s production was significantly impacted by the lack of

availability of critical mining equipment and the lack of multiple

faces to mine, in addition to the unfavorable weather conditions

impacting the mining and processing operations.

- Total cash cost after co-product credits for the quarter was

$3,560 per AuEq ounce, and total all-in sustaining cost (“AISC”)

after co-product credits for the quarter was $5,072 per AuEq ounce.

(See Item 2—Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Non-GAAP Measures for a

reconciliation of non-GAAP measures to applicable GAAP

measures).

Liquidity Update:

Tonnes and grade, with respect to the Company’s mining

operations at DDGM, have declined during 2024 and are below budget,

especially in the third quarter. There are several factors that

caused these declines. The Company has encountered significant

issues with equipment availability due to the age and condition of

some of the critical mining equipment in use at the mine. Due to

the continued challenges with equipment availability and the

decreased cash due to prior production shortfalls, the Company has

not been able to maintain its projected timeline for development of

future production zones. As a result, the Company is currently

mining only one face at a time in areas that are accessible. The

current lack of other available production zones has placed

additional pressure on the Company’s ability to achieve its

production estimates, as any problems encountered at the current

production zone cannot be offset by producing elsewhere in the

mine. In addition, the mill also experienced some mechanical issues

and wet ore handling difficulties due to unusually high rain fall

that resulted in lower throughput and a production shortfall. To

minimize the mechanical issues and return the mine to a cash

positive position, capital is necessary to replace some of the

mining fleet and upgrade the mill.

The Company believes that the mine has significant potential to

generate positive cash flow based on the information to date from

the new areas of the Three Sisters, as well as other areas that

have been discovered near the existing mining zones. In order to

develop access and better define these new areas, an investment

must be made in the equipment and mine plan. Without the addition

of these areas to the life-of-mine plan, the Company does not

believe that the mine will generate sufficient free cash flow in

the near term.

The Company’s inability to achieve its production estimates have

created a substantial doubt about its ability to continue as a

going concern. The Company currently anticipates that it will

require approximately $7 million to obtain additional mining

equipment and mill upgrades. These amounts include approximately

$2.5 million in upgrades at the mill, including approximately $1.0

million to install a new filter to increase capacity in the filter

plant and approximately $0.7 million to obtain a spare ball gear.

These investments also include approximately $4.5 million in mining

equipment to replace old or inefficient equipment, including

underground loaders, bolters, and drills. The Company also expects

to require approximately $8 million in working capital in order to

fund the initial development to access the Three Sisters and Splay

31 systems, although not all of this capital will be required

immediately. Due to the 2024 production challenges described above,

the Company does not believe that the mine will generate sufficient

cashflow to fund these improvements. The Company is evaluating

various financing options in order to fund this development in the

near term.

If the Company is unable to obtain this additional capital and

successfully develop these new mining areas, the continued

operation of the mine may not be possible beyond November 2024. If

continued operation of the mine is not possible, the Company may be

compelled to place the mine on “care and maintenance” status, which

would likely trigger significant severance and other costs which

the Company may not be able to pay

2024 Capital and Exploration Investment Summary

For the nine months ended

September 30, 2024

2024 full year

guidance

2024

2023

Sustaining Investments:

Underground Development

$

3,812

$

3,464

Other Sustaining Capital

2,711

1,485

Infill Drilling

977

3,315

Surface and Underground Exploration

Development & Other

65

1,131

Subtotal of Sustaining Investments:

7,565

9,395

$

8.8 - 11.0 million

Growth Investments:

DDGM growth:

Surface Exploration / Other

1,812

2,058

Underground Exploration Drilling

38

1,916

Underground Exploration Development

-

356

Back Forty growth:

Back Forty Project Optimization &

Permitting

549

1,265

Subtotal of Growth Investments:

2,399

5,595

$

3.2 - 5.2 million

Total Capital and Exploration:

$

9,964

$

14,990

$

12.0 - 16.2 million

Trending Highlights

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Operating Data

Total tonnes milled

117,781

113,510

116,626

111,254

98,889

93,687

83,690

Average Grade

-

Gold (g/t)

2.33

1.59

1.52

1.44

1.89

1.27

0.54

Silver (g/t)

94

86

73

85

88

102

83

Copper (%)

0.37

0.37

0.32

0.39

0.37

0.26

0.19

Lead (%)

1.73

1.64

1.29

1.39

1.25

1.00

1.01

Zinc (%)

3.88

3.72

3.24

2.95

2.82

2.59

2.63

Metal production (before payable metal

deductions)

Gold (ozs.)

7,171

4,637

4,443

4,077

4,757

2,947

944

Silver (ozs.)

322,676

289,816

247,159

282,487

251,707

263,023

194,525

Copper (tonnes)

336

334

276

341

280

181

93

Lead (tonnes)

1,559

1,389

1,048

1,072

812

616

576

Zinc (tonnes)

3,837

3,569

3,223

2,884

2,310

2,020

1,741

Metal produced and sold

Gold (ozs.)

6,508

4,287

3,982

3,757

3,557

2,724

1,357

Silver (ozs.)

294,815

274,257

208,905

258,252

216,535

234,560

181,434

Copper (tonnes)

332

327

245

327

264

197

98

Lead (tonnes)

1,417

1,317

947

820

667

491

467

Zinc (tonnes)

3,060

3,141

2,571

2,182

1,682

1,771

1,473

Average metal prices realized

Gold ($ per oz.)

$

1,915

$

2,010

$

1,934

$

1,985

$

2,094

$

2,465

$

2,561

Silver ($ per oz.)

$

23.04

$

24.93

$

23.61

$

23.14

$

23.29

$

30.49

$

30.61

Copper ($ per tonne)

$

9,172

$

8,397

$

8,185

$

8,205

$

8,546

$

10,428

$

8,832

Lead ($ per tonne)

$

2,158

$

2,153

$

2,196

$

2,122

$

1,977

$

2,235

$

2,065

Zinc ($ per tonne)

$

3,195

$

2,485

$

2,195

$

2,516

$

2,483

$

2,871

$

2,854

Gold equivalent ounces sold

Gold Ounces

6,508

4,287

3,982

3,757

3,557

2,724

1,357

Gold Equivalent Ounces from Silver

3,547

3,402

2,550

3,011

2,408

2,901

2,169

Total AuEq oz

10,055

7,689

6,532

6,768

5,965

5,625

3,526

Financial Data

Total sales, net (in thousands)

$

31,228

$

24,807

$

20,552

$

21,141

$

18,702

$

20,782

$

13,272

Production Costs (in thousands)

$

19,850

$

20,302

$

18,957

$

17,034

$

16,108

$

17,768

$

17,198

Production Costs/Tonnes Milled

$

169

$

179

$

163

$

153

$

163

$

190

$

205

Operating Cash Flows (in thousands)

$

1,024

($

551)

($

7,475)

$

1,783

$

1,482

($

63)

($

3,372)

Net loss (in thousands)

($

1,035)

($

4,584)

($

7,341)

($

3,057)

($

4,021)

($

27,734)

($

10,495)

Loss per share - basic

($

0.01)

($

0.05)

($

0.08)

($

0.03)

($

0.05)

($

0.30)

($

0.11)

Q3 2024 Conference Call

The Company has elected to forego hosting a Q3 2024 conference

call.

About GRC:

Gold Resource Corporation is a gold and silver producer,

developer, and explorer with its operations centered on the Don

David Gold Mine in Oaxaca, Mexico. Under the direction of an

experienced board and senior leadership team, the Company’s focus

is to unlock the significant upside potential of its existing

infrastructure and large land position surrounding the mine in

Oaxaca, Mexico and to develop the Back Forty Project in Michigan,

USA. For more information, please visit the Company’s website,

located at www.goldresourcecorp.com.

Forward-Looking Statements:

This press release contains forward-looking statements that

involve risks and uncertainties. The statements contained in this

press release that are not purely historical are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended. When used in this press release, the words “plan,”

“target,” “anticipate,” “believe,” “estimate,” “intend” and

“expect” and similar expressions are intended to identify such

forward-looking statements. Such forward-looking statements

include, without limitation, (i) the Company’s anticipated

near-term capital needs and potential sources of capital and (ii)

the Company’s ability to continue to operate the Don David Gold

Mine in the absence of additional capital. All forward-looking

statements in this press release are based upon information

available to Gold Resource Corporation as of the date of this press

release, and the Company assumes no obligation to update any such

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties, and there can be no assurance

that such statements will prove to be accurate. The Company’s

actual results could differ materially from those discussed in this

press release. Also, there can be no assurance that production will

continue at any specific rate. Forward-looking statements are

subject to risks and uncertainties, including the ability of the

Company to obtain additional capital on favorable terms or at all,

production levels of the DDGM, possibility of lower than

anticipated revenue or higher than anticipated costs at the Don

David Gold Mine, volatility in commodity prices, and declines in

general economic conditions. Additional risks related to the

Company may be found in the periodic and current reports filed with

the Securities and Exchange Commission by the Company, including

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, which are available on the SEC’s website at

www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105090530/en/

Chet Holyoak Chief Financial Officer Chet.holyoak@grc-usa.com

www.GoldResourceCorp.com

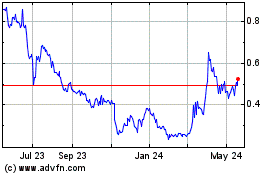

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Jan 2025 to Feb 2025

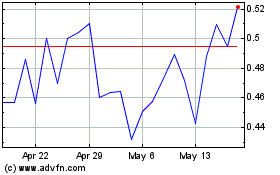

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Feb 2024 to Feb 2025