UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed by the Registrant |

x |

| Filed by a Party other than the Registrant |

¨ |

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| x |

Definitive Proxy Statement |

| |

|

| ¨ |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material under § 240.14a-12 |

KULR TECHNOLOGY GROUP, INC.

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

KULR Technology Group, Inc.

555 Forge River Road, Suite 100, Webster, Texas

77598

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 22, 2024

10:00 A.M. EASTERN TIME

TO THE SHAREHOLDERS OF KULR TECHNOLOGY GROUP, INC.:

The annual meeting of shareholders (the “Meeting”)

of KULR Technology Group, Inc. (which we refer to as “KULR” or the “Company”) will be a completely virtual

meeting of shareholders.

|

To participate please visit

www.virtualshareholdermeeting.com/KULR2024

There will not be a physical location for the Annual Meeting. |

At the Annual Meeting, the holders of the Company’s outstanding

capital stock will act on the following matters:

| 1. | To elect three directors to serve

until the next annual meeting of shareholders; |

| 2. | To ratify the appointment of Marcum

LLP as the Company’s independent registered public accounting firm; |

| 3. | To approve, on a non-binding advisory

basis, the compensation paid to the Company’s named executive officers. |

We also will transact such other business as may properly come before

the Annual Meeting and any adjournments or postponements of the Annual Meeting.

These matters are more fully described in the

proxy statement accompanying this notice.

Only holders of the Company’s common stock, and the Series A

voting preferred stock, of record at the close of business on September 24, 2024, are entitled to notice of and to vote at the Annual

Meeting. A proxy statement containing important information about the Annual Meeting and the matters being voted upon appears on the following

pages.

The Board of Directors recommends that you

vote “FOR” the proposals set forth in this Notice of Annual Meeting of Shareholders and the Proxy Statement.

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE ANNUAL MEETING

The Company has enclosed a copy of the proxy statement,

the proxy card and the Company’s annual report to shareholders for the year ended December 31, 2023 (the “Annual Report”).

The proxy statement, the Annual Meeting notice and proxy card, or a notice of internet availability of proxy materials and the Annual

Report are also available at http://materials.proxyvote.com/50125G. The Company is paying the costs of the solicitation.

If you have any questions or need assistance voting

your shares of our common stock, please contact the Company at (408) 663-5247.

| |

|

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

|

| |

|

/s/ Michael Mo |

| |

|

Michael Mo |

| |

|

Chief Executive Officer and Chairman |

Webster, Texas

October 10, 2024

PLEASE NOTE: The Annual Meeting will be

held to tabulate the votes cast and to report the results of voting on the items described above. No other business matters are planned

for the Annual Meeting.

Table of Contents

TABLE OF CONTENTS

Table of Contents

Table of Contents

QUESTIONS AND ANSWERS

The following are some questions that you, as a shareholder of the

Company, may have about the Annual Meeting, the proposals being considered at the Annual Meeting, as applicable, and brief answers to

those questions. These questions and answers may not address all questions that may be important to you as a shareholder of the Company.

We encourage you to read carefully the more detailed information contained elsewhere in this proxy statement.

| Q: | Why am I receiving this

proxy statement? |

| A: | These proxy materials describe the proposals on which the Company would

like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy

materials to all shareholders of record entitled to vote at the Annual Meeting. |

| Q: | When and where is the Annual Meeting? |

| A: | This year’s Annual Meeting will be a completely virtual meeting

of shareholders. It will be held via live webcast at www.virtualshareholdermeeting.com/KULR2024 on

November 22, 2024, starting at 10:00 a.m., Eastern Time. |

| Q: | How may I attend and participate

in the Annual Meeting? |

| A: | We will be hosting the Annual Meeting live via the internet. There

will not be a physical location for Meeting. |

Our virtual format allows shareholders

from around the world to participate and ask questions and for us to give thoughtful responses.

Any shareholder can listen to and

participate in the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/KULR2024.

The webcast of the annual meeting will begin at 10:00 a.m. (Eastern Time) on November 22, 2024.

Instructions on how to connect and participate via the internet,

including how to demonstrate proof of stock ownership, are posted at http://materials.proxyvote.com/50125G.

We will have technicians ready to assist

you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual

meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting

log in page.

If you do not have your control number,

you will be able to listen to the meeting only — you will not be able to vote or submit questions.

| Q: | Who is entitled to vote at

the Annual Meeting? |

| A: | Only shareholders who our records show owned shares of our common stock

as of the close of business on September 24, 2024, which is the record date for the Annual Meeting (the “Record Date”),

may vote at the Annual Meeting. You will have one vote for each share of the Company’s common stock that you owned as of the Record

Date. On the Record Date, we had 199,029,705 shares of common stock outstanding entitled to vote, 198,970,867 shares issued, and 199,154,705

shares outstanding due to the existence of treasury stock. |

| A: | Each share of our common stock

entitles its holder to one vote per share, each share of our Series A voting preferred stock entitles its holder equal to one-hundred

(100) votes per share of Series A preferred stock held. |

Table of Contents

| Q: | What am I being asked

to vote on? |

| A: | You will be voting on the following

proposals. |

| |

• |

A proposal to elect three directors to serve until the next annual meeting of shareholders. |

| |

• |

A proposal to ratify the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

| |

• |

A proposal, that is non-binding and advisory, to approve the compensation paid to the Company’s executive officers. |

| Q: | How does the Company’s

Board of Directors recommend that I vote on the proposals set forth in the Notice of Annual Meeting of Shareholders and the Proxy

Statement? |

| A: | Our Board of Directors recommends

that you vote “FOR” the election of each of the nominees for director and “FOR” each of the other proposals set

forth in the Notice of Annual meeting of Shareholders and the Proxy Statement. |

| Q: | Do I have dissenters’

rights if I vote against the proposals? |

| A: | There are no dissenters’

rights available to the Company’s shareholders with respect to any matter to be voted on at the Annual Meeting. |

| Q: | What do I need to do now? |

| A: | We encourage you to read this entire proxy statement, and the documents

we refer to in this proxy statement. Then complete, sign, date and return, as promptly as possible, the enclosed proxy card in the accompanying

reply envelope or grant your proxy electronically over the Internet or by telephone, so that your shares can be voted at the Annual Meeting.

If you hold your shares in “street name,” please refer to the voting instruction forms provided by your broker, bank or other

nominee to vote your shares. |

| Q: | What quorum is required for

the Annual Meeting? |

| A: | A quorum will exist at the Annual Meeting if the holders of a majority

of the shares entitled to vote thereat are represented in person or represented by proxy. Shares of the Company’s common stock that

are voted to abstain are treated as shares that are represented at the Annual Meeting for purposes of determining whether a quorum exists. |

| Q: | Who will tabulate the votes? |

| A: | The Company has designated a representative

of Broadridge Financial Solutions as the Inspector of Election who will tabulate the votes. |

| Q: | What vote is required in order

for the proposals to be approved? |

| A: | The following table sets forth

the required vote for each proposal: |

| |

Proposal |

|

Required Vote |

|

Page Number

(for more details) |

| 1. |

Election of 3 directors. |

|

Majority of the votes cast |

|

8 |

| |

|

|

|

|

|

| 2. |

Ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

|

Majority of the votes cast |

|

13 |

| |

|

|

|

|

|

| 3. |

Non-binding and advisory approval of the compensation paid to the Company’s executive officers. |

|

Majority of the votes cast |

|

17 |

| Q: | What are broker non-votes? |

| A: | Broker non-votes are shares held by brokers that do not have

discretionary authority to vote on the matter and have not received voting instructions from their clients. Brokers holding shares of

record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions

from their customers. The proposed ratification of the appointment of Marcum LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2024 is considered a “routine” matter. Accordingly, brokers

are entitled to vote uninstructed shares only with respect to the ratification of the appointment of Marcum LLP as our independent registered

public accounting firm. |

Table of Contents

| Q: | How do I vote my shares

if I am a record holder? |

| A: | If you are a record holder of shares (that is, the shares are registered

with our transfer agent in your name and not the name of your broker or other nominee), you are urged to submit your proxy as soon as

possible, so that your shares can be voted at the Annual Meeting in accordance with your instructions. Registered shareholders may vote

in person at the Annual Meeting, or by sending a personal representative to the Annual Meeting with an appropriate proxy, or by one of

the following methods: |

| |

• |

By Internet. www.proxyvote.com; |

| |

• |

By Telephone. 1-800-690-6903; |

| |

• |

By Mail. If you received our proxy materials in the mail, you can complete, sign and date the included proxy card and return the proxy card in the prepaid envelope provided. |

Please note that the Internet

and telephone voting facilities for registered shareholders will close at 11:59 p.m., Eastern Time, on the day before the Annual

Meeting date. For more information, please see “The Annual Meeting — How to Vote Your Shares” below.

| Q: | How do I vote my shares

if I hold my shares in “street name” through a bank, broker or other nominee? |

| A: | If you hold your shares as a beneficial

owner through a bank, broker or other nominee, you should have received instructions on how to vote your shares from your broker, bank

or other nominee. Please follow their instructions carefully. You must provide voting instructions to your bank, broker or other nominee

by the deadline provided in the materials you receive from your bank, broker or other nominee to ensure your shares are voted in the

way you would like at the Annual Meeting. |

| Q: | If my bank, broker or other

nominee holds my shares in “street name,” will such party vote my shares for me? |

| A: | For all “non-routine”

matters, not without your direction, your broker, bank or other nominee will be permitted to vote your shares on any “non-routine”

proposal only if you instruct your broker, bank or other nominee on how to vote. Under applicable stock exchange rules, brokers, banks

or other nominees have the discretion to vote your shares on routine matters if you fail to instruct your broker, bank or other nominee

on how to vote your shares with respect to such matters. The proposals to be voted upon by our shareholders described in this proxy statement,

except for the ratification of the appointment of our independent registered public accounting firm, are “non-routine” matters,

and brokers, banks and other nominees therefore cannot vote on these proposals without your instructions. The proposed ratification of

the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2024 is considered a “routine” matter. Accordingly, brokers, banks and other nominees are entitled to vote uninstructed shares

only with respect to the ratification of the appointment of Marcum LLP as our independent registered public accounting firm. Therefore,

it is important that you instruct your broker, bank or nominee on how you wish to vote your shares. |

You should follow the procedures provided

by your broker, bank or other nominee regarding the voting of your shares of the Company’s common stock. Without instructions, a

broker non-vote will result, and your shares will not be voted, on all “non-routine” matters.

Table of Contents

| A: | A proxy is your legal designation of another person, referred to as

a “proxy,” to vote shares of stock. The written document describing the matters to be considered and voted on at the Annual

Meeting is called a “proxy statement.” Our Board of Directors has designated Michael Mo, our Chief Executive Officer and Shawn

Canter, our Chief Financial Officer, and each of them, with full power of substitution, as proxies for the Annual Meeting. |

| Q: | If a shareholder gives a proxy,

how are the shares voted? |

| A: | When proxies are properly dated, executed and returned, the shares

represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the shareholder. If no specific

instructions are given on properly-executed returned proxies, however, the shares will be voted in accordance with the recommendations

of our Board of Directors as described above. If any matters not described in this proxy statement are properly presented at the Annual

Meeting, the proxy holders will use their own judgment to determine how to vote your shares. |

| Q: | What happens if I do not

vote or return a proxy? |

| A: | A quorum will exist at the Annual Meeting if the holders of thirty-three-and-one-third

percent (33 1/3%) of the outstanding securities of the Company entitled to vote thereat are represented in person (virtually) or

represented by proxy. Your failure to vote on the proposals, by failing to either submit a proxy or attend the Annual Meeting if you are

a shareholder of record, may result in the failure of a quorum to exist at the Annual Meeting. |

| Q: | What happens if I abstain? |

| A: | If you abstain, whether by proxy or in person at the Annual Meeting,

or if you instruct your broker, bank or other nominee to abstain your abstention will not be counted for or against the proposals, but

will be counted as “present” at the Annual Meeting in determining whether or not a quorum exists. |

| Q: | Can I revoke my proxy

or change my vote? |

| A: | You may change your vote at any time prior to the vote at the Annual

Meeting. To revoke your proxy instructions and change your vote if you are a holder of record, you must (i) vote again on a later

date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted),

(ii) advise our Chief Financial Officer at our principal executive offices (555 Forge River Road, Suite 100, Webster, Texas 77598)

in writing before the proxy holders vote your shares, or (iii) deliver later dated and signed proxy instructions (which must be received

prior to the Annual Meeting). If you hold shares in “street name,” you should refer to the instructions you received from

your broker, bank or other nominee. Attendance in and of itself at the Annual Meeting will not revoke a proxy. For shares you hold beneficially

but not of record, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a

valid proxy from your broker or nominee giving you the right to vote your shares. |

| Q: | What should I do if I

receive more than one set of voting materials? |

| A: | You may receive more than one

set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For

example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage

account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive

more than one proxy card. Please complete, date, sign and return (or vote via the Internet or telephone with respect to) each proxy card

and voting instruction card that you receive to ensure that all of your shares are counted. |

| Q: | What is “householding”? |

| A: | We have adopted a procedure approved

by the U.S. Securities and Exchange Commission (the “SEC”) called “householding” for shareholders who have

the same address and last name and do not participate in electronic delivery of proxy materials. In some instances, only one copy of

the proxy materials is being delivered to multiple shareholders sharing an address, unless we have received instructions from one or

more of the shareholders to continue to deliver multiple copies. This procedure reduces our printing costs and postage fees. |

Table of Contents

We will deliver promptly, upon oral

or written request, a separate copy of the applicable materials to a shareholder at a shared address to which a single copy was delivered.

If you wish to receive a separate copy of the proxy materials you may call us at (408) 663-5247, or send a written request to KULR

Technology Group, Inc., 555 Forge River Road, Suite 100, Webster, Texas 77598, Attention: Chief Financial Officer. If you have received

only one copy of the proxy materials, and wish to receive a separate copy for each shareholder in the future, you may call us at the telephone

number or write us at the address listed above. Alternatively, shareholders sharing an address who now receive multiple copies of the

proxy materials may request delivery of a single copy, also by calling us at the telephone number or writing to us at the address listed

above.

| Q: | Where can I find the voting

results of the Annual Meeting? |

| A: | The Company intends to announce preliminary voting results at the Annual

Meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the Annual Meeting. All

reports the Company files with the SEC are publicly available when filed. |

| Q: | What if I have questions

about lost stock certificates or need to change my mailing address? |

| A: | You may contact our transfer agent,

VStock Transfer, LLC at (212) 828-8436, or by email at action@vstocktransfer.com, if you have lost your stock certificate. You may

email VStock Transfer, LLC at action@vstocktransfer.com if you need to change your mailing address. |

| Q: | Who can help answer my additional

questions about the proposals or the other matters discussed in this proxy statement? |

| A: | If you have questions about the

proposals or other matters discussed in this proxy statement, you may contact the Company by mail at KULR Technology Group, Inc.

555 Forge River Road, Suite 100, Webster, Texas 77598, Attention: Chief Financial Officer. |

Table of Contents

THE ANNUAL

MEETING

We are furnishing this proxy statement to

our shareholders as part of the solicitation of proxies by our Board of Directors for use at the Annual Meeting of shareholders to

be held on November 22, 2024, or continuation thereof. We began distributing this Proxy Statement, Annual Meeting notice and proxy

card, or a notice of internet availability of proxy materials on or about October 11, 2024. The Proxy Statement, the Annual Meeting

notice and proxy card, or a notice of internet availability of proxy materials, and the Annual Report are also available at http://materials.proxyvote.com/50125G.

Date, Time and Place

The Annual Meeting of the Company’s shareholders will be held

via live webcast at www.virtualshareholdermeeting.com/KULR2024 on November 22, 2024, starting

at 10:00 a.m., Eastern Time.

Matters to be Considered

The purpose of the Annual Meeting is for

shareholders of the Company to consider and vote on the following proposals.

Proposal No. 1

The Election of Directors |

|

To elect three directors to serve until the next annual

meeting of shareholders. |

| |

|

|

Proposal No. 2

Ratification of Independent Registered

Public Accounting Firm |

|

To ratify the appointment of Marcum LLP as our independent registered

public accounting firm for the year ending December 31, 2024. |

| |

|

|

Proposal No. 3

Approval of Executive Officer Compensation |

|

To approve, on an advisory basis, the compensation of the named executive officers. |

Record Date; Shares Outstanding and Entitled

to Vote

The close of business on September 24, 2024, has been fixed as

the Record Date for determining those Company shareholders entitled to notice of and to vote at the Annual Meeting. As of the close of

business on the Record Date for the Annual Meeting, there were 199,029,705 shares of common stock outstanding and entitled to vote, 198,970,867

shares issued, and 199,154,705 shares outstanding due to the existence of treasury stock, held by 157 holders of record, and there were

730,000 shares of Series A voting preferred stock outstanding and entitled to vote, held by 1 holder of record. Each share of the Company’s

common stock entitles its holder to one vote at the Annual Meeting on all matters properly presented at the Annual Meeting. Each share

of the Series A voting preferred stock entitles its holder to 100 votes at the Annual Meeting on all matters properly presented at the

Annual Meeting.

Quorum

A quorum of shareholders is necessary to hold a valid meeting. A quorum

will exist at the Annual Meeting if thirty-three-and-one-third percent (33 1/3%) of the outstanding securities of the Company entitled

to vote thereat are represented in person (virtually) or represented by proxy. Shares of the Company’s common stock that are voted

to abstain are treated as shares that are represented at the Annual Meeting for purposes of determining whether a quorum exists. Broker

non-votes do not count for voting purposes, but are considered “present” at the Annual Meeting for purposes of determining

whether a quorum exists.

Vote Required

Directors shall be elected by the vote of a majority

of the shares represented whether in person or by proxy.

Ratification of our independent registered public accounting firm,

and approval of the Say-on-Pay Proposal requires the affirmative vote of a majority of the votes cast at the Annual Meeting, whether in

person or by proxy, provided that a quorum is present. An abstention will not be counted for or against the proposals, and therefore will

not affect the vote outcome. Failure of record holders to submit a signed proxy card, grant a proxy electronically over the Internet or

by telephone will have no effect on the outcome of the votes for such items, although such failure may contribute to a quorum not being

present at such meeting. Broker non-votes will have no effect on the outcome of the votes for all proposals except for the ratification

of the appointment of our independent registered public accounting firm, for which we do not expect any broker non-votes.

Table of Contents

Recommendations of our Board of Directors

The Board of Directors also recommends that you

vote “FOR” the election of each of the nominees for director and vote “FOR” the other proposals set forth in the

Notice of Annual Meeting of Shareholders and the Proxy Statement.

Ownership of Directors and Executive

Officers

As of the Record Date, our directors

and executive officers held an aggregate of approximately 11.21% of the shares of the Company’s common stock entitled to vote at

the Annual Meeting, and our Chief Executive Officer holds 100% of the outstanding shares of the Series A voting preferred stock. Our directors

and executive officers hold approximately 35.04% of the aggregate votes entitled to be cast at the Annual Meeting.

How to Vote Your Shares

Shareholders of record may submit a proxy

via the Internet, by telephone or by mail, or they may vote by participating in the Annual Meeting and voting live via the

internet.

| |

• |

Submitting a Proxy via the Internet: You may vote by proxy via the Internet by following the instructions provided in the notice. |

| |

• |

Submitting a Proxy by Telephone: Call toll-free 1-800-690-6903 and have your proxy card in your hand when you call, then follow the instructions. |

| |

• |

Submitting a Proxy by Mail: If you choose to submit a proxy for your shares by mail, simply mark the enclosed proxy card, date and sign it, and return it in the postage paid envelope provided. |

If your shares are held in the name of a broker,

bank or other nominee, you will receive instructions from the shareholder of record that you must follow for your shares to be voted.

Please follow their instructions carefully.

How to Change Your Vote

If you are the shareholder of record, you may

revoke your proxy or change your vote prior to your shares being voted at the Annual Meeting by:

| |

• |

sending a written notice of revocation or a duly executed proxy card, in either case, dated later than the prior proxy card relating to the same shares, to KULR Technology Group, Inc., 555 Forge River Road, Suite 100, Webster, Texas 77598, Attention: Chief Financial Officer; or |

| |

• |

submitting a proxy at a later date by telephone or via the Internet,

if you have previously voted by telephone or via the Internet in connection with the Annual Meeting. |

If you are the beneficial owner of shares held

in the name of a broker, bank or other nominee, you may change your vote by:

| |

• |

submitting new voting instructions to your broker, bank or other nominee in a timely manner following the voting procedures received from your broker, bank or other nominee. |

See the section entitled “— How

to Vote Your Shares” above for information regarding certain voting deadlines.

Counting Your Vote

All properly executed proxies delivered and

not properly revoked will be voted at the Annual Meeting as specified in such proxies. If you provide specific voting instructions,

your shares of the Company’s common stock will be voted as instructed. If you hold shares in your name and sign and return a

proxy card or submit a proxy by telephone or via the Internet without giving specific voting instructions, your shares will be voted

“FOR” the election of each of the nominees for director and “FOR” the proposals set forth in the Notice of

Annual Meeting of Shareholders and the Proxy Statement.

Proxies solicited may be voted only at the Annual Meeting and any postponement

of the Annual Meeting and will not be used for any other meeting.

Table of Contents

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Proposal

Three directors are to be elected at the

Annual Meeting to serve until the next annual meeting of the Company’s shareholders. Unless otherwise instructed, the persons

named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the nominees listed below.

Although it is not contemplated that any nominee will decline or be unable to serve as a director, in such event, proxies will be

voted by the proxy holder for such other persons as may be designated by the Board of Directors, unless the Board of Directors

reduces the number of directors to be elected.

The following table sets forth the nominees for

directors on the Board of Directors. Certain biographical information about the nominees as of the Record Date can be found below in the

section titled “Directors and Officers.”

Nominees for Directors

| Name |

|

Age |

|

Position(s) with the Company |

|

Date First Elected or Appointed |

| Michael Mo |

|

53 |

|

Chief Executive Officer and Chairman |

|

March 2011 |

| Joanna D. Massey* |

|

56 |

|

Lead Director, Member of the Audit Committee, Chair of the Compensation Committee, Chair of the Nominating and Corporate Governance Committee |

|

June 2021 |

| Donna H. Grier* |

|

66 |

|

Director, Chairperson of the Audit Committee, Member of the Compensation Committee, Member of the Nominating and Corporate Governance Committee |

|

April 2024 |

* Denotes independent director.

There are no arrangements

or understandings known to us between any of the nominees listed above and any other person pursuant to which that person was or is to

be selected as a director or nominee, other than any arrangements or understandings with persons acting solely as directors or officers

of KULR.

Required Shareholder Vote and Recommendation

of Our Board of Directors

The directors shall be elected by the majority

vote of the shares represented by proxy. Broker non-votes and failures of record holders to submit a signed proxy card, grant a proxy

electronically over the Internet or by telephone will have no effect on the outcome of the vote on the election of directors.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU

VOTE

“FOR” EACH OF THE NOMINEES IN THIS PROPOSAL NO. 1.

Table of Contents

DIRECTORS, OFFICERS AND KEY EMPLOYEES

Set forth below are the Company’s Directors,

and Executive Officers and key employees as of December 31, 2023, together with an overview of their professional experience and

expertise.

| Name |

|

Age |

|

Position(s) Held |

|

Director Since |

| Michael Mo |

|

53 |

|

Chief Executive Officer and Chairman |

|

March 2011 |

| Dr. William Walker |

|

34 |

|

Chief Technology Officer |

|

N/A |

| Keith Cochran* |

|

59 |

|

President and Chief Operating Officer* |

|

N/A* |

| Michael Carpenter |

|

60 |

|

Vice President of Engineering |

|

N/A |

| Dr. Joanna D. Massey |

|

56 |

|

Lead Director |

|

June 2021 |

| Morio Kurosaki* |

|

67 |

|

Director* |

|

June 2021* |

| Donna H. Grier+ |

|

66 |

|

Director+ |

|

April 2024+ |

| Shawn Canter |

|

53 |

|

Chief Financial Officer |

|

N/A |

*denotes resignation subsequent to December 31, 2023

+denotes appointment subsequent to December 31, 2023

Directors are elected annually and hold office

until the next annual meeting of the shareholders of the Company. Each officer shall hold office until his successor shall have been duly

elected or appointed or until his death or until he shall resign or shall have been removed by the Board.

Michael Mo has served

as our CEO and Director of the Company since March 16, 2011. Mr. Mo is a technology entrepreneur and successful investor with

over 20 years of experience in technology management, product development and marketing. In 2013, he co-founded KULR Technology, Inc.

and has been serving as its CEO since then. From 2007 to 2015, Mr. Mo served as Senior Director of Business Development at Amlogic, Inc.,

a California high-tech company. Mr. Mo received his Master of Science in Electrical Engineering from the University of California

at Santa Barbara in 1995. Mr. Mo’s years of experience with KULR and decades of experience in technology management make him an

asset to the Board.

Dr.

William Walker was appointed Chief Technology Officer (“CTO”), effective November 1, 2022. Dr. Walker who originally joined

the company in March 2022 as Director of Engineering, has significant experience in professional and research related activities focused

on thermo-electrochemical testing and analysis of lithium-ion (Li-ion) battery assemblies and related thermal management products designed

for space exploration applications. Prior to joining the Company, from October 2021 to March 2022, Dr. Walker was a Research Scientist

at Underwriters Laboratories Inc.. From June 2012 to October 2021, Dr. Walker was employed by the National Aeronautics and Space Administration

(NASA) Johnson Space Center (JSC) where he focused on designing battery assemblies for human spaceflight applications capable of safely

mitigating the effects of thermal runaway and preventing cell-to-cell propagation. Dr. Walker was recognized with a NASA Trailblazer award

and with the RNASA Stellar Award for early career contributions to Li-ion battery thermal analysis and calorimetry methods. Dr. Walker

continues to be engaged in the academic and professional communities focused on battery safety. Dr. Walker received his B.S. in Mechanical

Engineering at West Texas A&M University (WTAMU) and a Ph.D. in Materials Science and Engineering at the University of Houston (UH).

Keith Cochran, prior

to his resignation on August 20, 2024, Mr. Cochran was our President and Chief Operating Officer from March 1, 2021. Prior to joining

the company, Mr. Cochran had spent twenty-four years in various management roles at Jabil Greenpoint (NYSE: JBL) and most recently

as Senior Vice President of its Global Business Unit in Singapore, where he led a smartphone technology division responsible for $3.7

billion in revenues. Mr. Cochran is based in the United States and has vast international experience working with partners in Singapore, India,

Brazil, Mexico, China, France, Hungary and other countries. Mr. Cochran has a Bachelor of Science in Business Operations from Devry

Institute of Technology.

Michael G. Carpenter has

served as KULR’s Vice President of Engineering since June 2017. Prior to joining KULR, Mr. Carpenter had been employed

by Energy Science Laboratories, Inc. (“ESLI”) since December 1983, serving as Director of the PCM Heatsink Group,

Quality Manager, Facility Security Officer (FSO) in the Defense Industrial Security Program from 1988 to 1995. He also served as a Safety

Officer when he joined ESLI in 1983. Mr. Carpenter received his B.S. in Applied Mechanics from the University of California, San

Diego in 1983.

Shawn

Canter was appointed as Chief Financial Officer ("CFO”) effective March 31, 2023. Mr. Canter is a seasoned corporate executive

and board member with over 25 years of experience leading teams in hands-on roles in both institutional and early/growth stage companies

bringing solutions to complex situations. He gained significant financial and transactional experience as an executive in mergers and

acquisitions (“M&A”) at Goldman Sachs and at Bank of America’s investment banking division where he also served

as Chief Operating Officer of M&A. Mr. Canter will be responsible for financial management and driving a disciplined fiscal strategy

while scaling the Company through its commercialization phase. Mr. Canter received a bachelor’s degree in economics and a master’s

degree in organizational behavior from Stanford University, as well as a JD and an MBA from the University of Michigan.

Table of Contents

Non-Executive Directors

Dr. Joanna Massey has

served as a member of the Company’s board of directors since June 7, 2021 and was appointed Lead Director on November 1, 2022.

Dr. Massey is an experienced C-level communications marketing executive and board director, who advises executive teams at Fortune

500 companies, startups and nonprofits. Dr. Massey is also an author and corporate speaker. Dr. Massey has worked for over 25

years strategizing on global brand reputation management at companies, such as Condé Nast, Lionsgate, CBS, Viacom, Discovery and

Hasbro. Dr. Massey has been the CEO of The Marketing Communications Think Tank since she founded the company in May 2021. Dr. Massey

has also been an adjunct professor at Columbia University teaching a graduate-level course in corporate communication since 2019. From

2017 to 2019, Dr. Massey was the head of communications at Condé Nast. During her time at Condé Nast, Dr. Massey

was responsible for all internal and external communications. From 2015 to 2017, Dr. Massey was the Senior Vice President of Lionsgate,

During her time at Lionsgate, Dr. Massey handled quarterly reporting, M&A activities and crisis communications, and managed corporation

communications for the company’s motion picture, television, digital properties, games, location-based entertainment, streaming

video on demand, home entertainment and ancillary businesses worldwide. Dr. Massey has been President & CEO of J.D. Massey

Associates, Inc., a portfolio company with multiple divisions that manage marketing communications, executive training and publishing,

since she founded the Company in 2012. Dr. Massey received an M.B.A from the University of Southern California and a Ph.D. in psychology

from Sofia University. Dr. Massey’s expertise advising C-level executives, as well as her knowledge of governance, risk, and M&A,

make her an asset to the Board.

Morio Kurosaki, prior

to his resignation effective April 15, 2024, served as a member of the Company’s board of directors since June 7, 2021. Mr. Kurosaki

founded IT-Farm Corporation (“IT-Farm”), a Japanese venture capital firm, in 1999. Mr. Kurosaki has been the President

of IT-Farm since IT-Farm’s inception. Mr. Kurosaki has led early investments in notable companies such as Zoom Video Communications

(Nasdaq: ZM); ContextLogic (Nasdaq: WISH); Treasure Data, acquired by ARM Holdings (Nasdaq: NVDA); Tubi, acquired by Fox Corporation (Nasdaq:

FOX); Red Hot Labs, acquired by Google (Nasdaq: GOOGL); lvl5, acquired by DoorDash (NYSE: DASH); Accel Technology, acquired by Marvell

Technology Group (Nasdaq: MRVL), and Extreme DA, acquired by Synopsis (Nasdaq: SNPS). Mr. Kurosaki has also served as Asia-Pacific

advisory member of ARM Holdings, acquired by SoftBank Group Corporation (OTCMKTS: SFTBY). Mr. Kurosaki started his business career

at Intel Japan, thereafter, joining Western Digital Corporation (Nasdaq: WDC) as one of the earliest members of WDC’s Japanese division.

Mr. Kurosaki’s business experience with listed public companies makes him an asset to the Board.

Donna H. Grier has

served as a member of the Company’s board of directors since April 15, 2024. Ms. Grier, is an experienced finance executive, with

expertise in finance, internal audit, mergers & acquisitions (M&A) and business process improvement. Since June 2020, Ms. Grier

has been, and continues to be a director and audit & risk management committee chair at Global Advanced Metals, a privately held supplier

of tantalum products. Since April 2023, she has also been a director and the audit committee chair at 4BMining, a privately held iron

ore producer. Additionally, Ms. Grier also serves as the chair of the board of trustees for Washington & Jefferson College, since

July 2022. From November 2018 until August 2020, Ms. Grier served as a director and audit committee chair of Pyxus International, a global

agricultural company (NYSE:PYX). Prior to her retirement in 2019, Ms. Grier held the positions of vice president-treasurer and vice president-general

auditor & chief ethics and compliance officer at E. I. DuPont de Nemours, over the course of 10 years. Between 2004 and 2008, Ms.

Grier was the finance director and chief financial officer of DuPont’s safety & protection business where she oversaw all financial

aspects of the $5.5B division consisting of strategic business units including advanced materials, building innovations, safety solutions

and chemical solutions. Ms. Grier also headed all financial aspects of DuPont Europe, from 1999 until 2003. Ms. Grier earned her MBA from

the Booth School of Business at the University of Chicago and a BA in Economics and Psychology from Washington & Jefferson College.

Table of Contents

CORPORATE GOVERNANCE

The Company is committed to maintaining strong

corporate governance practices that benefit the long-term interests of our Shareholders by providing for effective oversight and management

of the Company. The Company’s governance policies, including its Code of Ethics and Committee Charters can be found on the Company’s

website at https://www.kulrtechnology.com/governance-documents/.

The Nominating and Corporate Governance Committee

regularly reviews the Company’s corporate governance policies, Code of Business Conduct and Ethics, and Committee Charters.

The Board conducts an annual self-evaluation in

order to assess whether the directors, the committees, and the Board are functioning effectively.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct

and Ethics that applies to all directors, officers, and employees. The Company’s Code of Business Conduct and Ethics can be found

on our website at https://www.kulrtechnology.com/governance-documents/.

Involvement in Certain Legal Proceedings

Except as disclosed in the bios above, the Company’s

Directors and Executive Officers have not been involved in any of the following events during the past ten years:

| |

1. |

any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| |

2. |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

3. |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; |

| |

4. |

being found by a court of competent jurisdiction in a civil action, the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

5. |

being subject of, or a party to, any federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

6. |

being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Leadership Structure

Our board leadership structure consists of a Chairman

of the Board of Directors who is also our CEO. Each year, our Board of Directors assesses these roles and the board leadership structure

to ensure the interests of KULR and its shareholders are best served. Mr. Mo holds the Chairman and CEO position at KULR. We do not

have an express policy on whether the roles of Chair of the Board and CEO should be combined or separated. Instead, the Board prefers

to maintain the flexibility to determine which leadership structure best serves the interests of KULR and our shareholders based on the

evolving needs of the company. Although we have a combined Chair of the Board and CEO leadership structure, we have added a Lead Independent

Director position to complement the Chair of the Board’s role and to serve as the principal liaison between the nonemployee directors

and the CEO. The Lead Independent Director, among other things, takes responsibility for scheduling board meetings and setting meeting

agendas and ensuring that management provides sufficient information for the Board of Directors to remain informed about and maintains

proper oversight of our operations.

Table of Contents

A number of factors support

the leadership structure chosen by the Board, including, among others:

| |

· |

Mr. Mo has extensive knowledge of all aspects of KULR and its business and risks, its industry and its customers. |

| |

· |

Mr. Mo is intimately involved in the day-to-day operations of KULR and is best positioned to elevate the most critical business issues for consideration by the Board of Directors. |

| |

· |

The Board of Directors believes having Mr. Mo serve in both capacities allows him to more effectively execute KULR’s strategic initiatives and business plans and confront its challenges. |

| |

· |

A combined Chairman and CEO structure provides KULR with decisive and effective leadership with clearer accountability to our shareholders and customers. |

| |

· |

This structure allows one person to speak for and lead the company and the Board. |

Board Committees

Our Board of Directors has established three standing

committees: an audit committee, a nominating and corporate governance committee and a compensation committee, which are described below.

Members of these committees are elected annually at the regular board meeting held in conjunction with the annual shareholders’

meeting. Our corporate governance guidelines and the charter of each committee is available on our website at https://www.kulrtechnology.com/governance-documents/.

Audit Committee

The Audit Committee, among other things, is responsible

for:

| |

• |

Appointing, approving the compensation of, overseeing the work of, and assessing the independence, qualifications, and performance of the independent auditor; |

| |

• |

reviewing the internal audit function, including its independence, plans, and budget; |

| |

• |

approving, in advance, audit and any permissible non-audit services performed by our independent auditor; |

| |

• |

reviewing our internal controls with the independent auditor, the internal auditor, and management; |

| |

• |

reviewing the adequacy of our accounting and financial controls as reported by the independent auditor, the internal auditor, and management; and |

| |

• |

overseeing our major risk exposures regarding the Company’s accounting and financial reporting policies, and the activities of our internal audit function. |

The Board has affirmatively determined that each

member of the Audit Committee meets the additional independence criteria applicable to audit committee members under SEC rules and

the NYSE American Stock Market. The Board of Directors has adopted a written charter setting forth the authority and responsibilities

of the Audit Committee. The Board has affirmatively determined that each member of the Audit Committee is financially literate. Donna

H. Grier meets the qualifications of an Audit Committee financial expert. The Audit Committee consists of Donna H. Grier and Joanna D.

Massey. Ms. Grier is the chair of the Audit Committee. Prior to Ms. Grier joining the board of directors of the Company effective as of

April 15, 2024, Morio Kurosaki served as the chair of the Audit Committee. During 2023, the Audit Committee met 5 times.

The Audit Committee’s charter is available

at https://www.kulrtechnology.com/governance-documents/.

Compensation Committee

Our Compensation Committee has the responsibility

for, among other things, (i) reviewing and approving the chief executive officer’s compensation based on an evaluation in light

of corporate goals and objectives, (ii) reviewing and recommending to the Board the compensation of all other executive officers,

(iii) reviewing and recommending to the Board incentive compensation plans and equity plans, (iv) reviewing and discussing with

management the Company’s Compensation Discussion and Analysis and related information to be included in the annual report on Form 10-K

and proxy statements, and (v) reviewing and recommending to the Board for approval procedures relating to Say on Pay Votes.

Table of Contents

When appropriate, the Compensation Committee may,

in carrying out its responsibilities, form and delegate authority to subcommittees.

The Compensation Committee has the authority,

at the Company’s expense, to select, retain, and obtain any outside advisors who could assist it in carrying out its responsibilities,

including compensation consultants or independent legal counsel.

The Board has adopted a written charter setting

forth the authority and responsibilities of the Compensation Committee. The members of our Compensation Committee are Dr. Joanna

Massey and Donna H. Grier, with Dr. Massey serving as the chair of our Compensation Committee. The Board has affirmatively determined

that each member of the Compensation Committee meets the additional independence criteria applicable to compensation committee members

under SEC rules and the NYSE American Stock Market. Prior to Ms. Grier joining the board of directors of the Company effective as

of April 15, 2024, Morio Kurosaki served as the Co-chair of the of the Compensation Committee. During 2023, the Compensation Committee

met 4 times.

The Compensation Committee’s Charter is

available at https://www.kulrtechnology.com/governance-documents/.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee

has the responsibility to assist the Board in, among other things, (i) identifying and screening individuals qualified to become

members of our board of directors, consistent with criteria approved by our board of directors, (ii) recommending to the Board the

approval of nominees for director, (ii) developing and recommending to our board of directors a set of corporate governance guidelines,

and (iv) overseeing the evaluation of our board of director. The Board of Directors has adopted a written charter setting forth the

authority and responsibilities of the Nominating and Corporate Governance Committee. The members of our Nominating and Corporate Governance

Committee are Dr. Joanna Massey and Donna H. Grier, with Dr. Massey serving as the Chair of our Nominating and Corporate Governance

Committee. Prior to Ms. Grier joining the board of directors of the Company effective as of April 15, 2024, Morio Kurosaki served

as a member of the Nominating and Corporate Governance Committee. During 2023, the Nominating and Corporate Governance Committee met 2

times.

The Nominating and Corporate

Governance Committee considers any director candidates recommended by the Company's shareholders pursuant to the procedures set forth

in the Company's Corporate Governance Guidelines.

The Nominating and Corporate Governance

Committee’s Charter is available at https://www.kulrtechnology.com/governance-documents/.

Board of Director Meetings and Attendance

Our Board of Directors met 6 times during 2023

and also approved Board resolutions or acted by unanimous written consent 6 times. Each of the then-members of our Board of Directors

was present at 100% of the meetings of the Board and committees held in 2023.

PROPOSAL NO. 2 — RATIFICATION OF

THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Proposal

The Board of Directors has appointed Marcum LLP

as our independent registered public accounting firm for the fiscal year ended December 31, 2024 and has further directed that the

selection of Marcum LLP be submitted to a vote of the Company’s shareholders at the Annual Meeting for ratification.

As described below, the shareholder vote is not

binding on the Board of Directors. If the appointment of Marcum LLP is not ratified, the Board of Directors will evaluate the basis for

the shareholders’ vote when determining whether to continue the firm’s engagement, but may ultimately determine to continue

the engagement of the firm or another audit firm without re-submitting the matter to shareholders. Even if the appointment of Marcum LLP

is ratified, the Board of Directors may in its sole discretion terminate the engagement of the firm and direct the appointment of another

independent auditor at any time during the year if it determines that such an appointment would be in the best interests of our Company

and our shareholders.

Table of Contents

Representatives of Marcum LLP are not expected

to attend the Annual Meeting.

Fees

The aggregate fees billed to us by our principal

independent public accountant for services rendered for the years ended December 31, 2023 and 2022, are set forth in the table

below:

| |

|

For the Fiscal Year Ended |

|

| |

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Audit Fees |

|

$ |

339,025 |

|

|

$ |

208,060 |

|

| Tax Fees |

|

|

- |

|

|

|

- |

|

| Total |

|

$ |

339,025 |

|

|

$ |

208,060 |

|

Fee Category

Audit Fees

Audit fees consist

of fees billed for services rendered by Marcum LLP during the years ended December 31, 2023 and 2022 for the audit and quarterly

reviews of our financial statements, as well as registration statements and comfort letters.

Tax Fees

Tax

fees were not incurred with our independent auditors during the years ended December 31, 2023 and 2022 in connection with the

preparation and filing of our income tax returns.

Audit Committee

The Audit Committee, among other things, is responsible

for:

| |

• |

Appointing, approving the compensation of, overseeing the work of, and assessing the independence, qualifications, and performance of the independent auditor; |

| |

• |

reviewing the internal audit function, including its independence, plans, and budget; |

| |

• |

approving, in advance, audit and any permissible non-audit services performed by our independent auditor; |

| |

• |

reviewing our internal controls with the independent auditor, the internal auditor, and management; |

| |

• |

reviewing the adequacy of our accounting and financial controls as reported by the independent auditor, the internal auditor, and management; and |

| |

• |

overseeing our major risk exposures regarding the Company’s accounting and financial reporting policies, and the activities of our internal audit function. |

The Board has affirmatively determined that each

member of the Audit Committee meets the additional independence criteria applicable to audit committee members under SEC rules and

the NYSE American Stock Market. The Board of Directors has adopted a written charter setting forth the authority and responsibilities

of the Audit Committee. The Board has affirmatively determined that each member of the Audit Committee is financially literate. Donna

H. Grier meets the qualifications of an Audit Committee financial expert. The Audit Committee consists of Donna H. Grier and Joanna D.

Massey. Ms. Grier is the chair of the Audit Committee. Prior to Ms. Grier joining the board of directors of the Company effective as of

April 15, 2024, Morio Kurosaki served as the chair of the Audit Committee.

Based on the review and the discussions described

above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 for filing with the SEC.

Table of Contents

The Audit Committee also considered whether the

non-audit services rendered by our independent registered public accounting firm are compatible with an auditor maintaining independence.

The Audit Committee has determined that the rendering of such services is compatible with Marcum LLP maintaining its independence.

Required Shareholder Vote and Recommendation

of Our Board of Directors

Approval of our independent registered public accounting firm requires

the affirmative vote of a majority of the votes cast at the Annual Meeting, whether in person or by proxy, provided that a quorum is present.

An abstention will not be counted for or against the proposal, and therefore will not affect the vote outcome.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU

VOTE

“FOR” THIS PROPOSAL NO. 2.

Table of Contents

AUDIT COMMITTEE REPORT

The Board of Directors has reviewed and discussed

with management our audited financial statements for the fiscal year ended December 31, 2023, which were audited by Marcum LLP, our

independent registered public accounting firm. The Board of Directors discussed with Marcum LLP the matters required to be discussed pursuant

to Public Company Accounting Oversight Board (United States) Auditing Standard 1301 (Communication with Audit Committee). The Board

of Directors received the written disclosures and letter from the independent registered public accounting firm required by applicable

requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Board of Directors

concerning independence and discussed with the independent registered public accounting firm the independent registered public accounting

firm’s independence. The Board of Directors also considered whether the provision of services other than the audit of our financial

statements for the fiscal year ended December 31, 2023, were compatible with maintaining Marcum LLP’s independence. Based on

these reviews and discussions, the audit committee recommended to the company's board of directors that the audited financial statements

be included in the company's annual report on Form 10-K.

The Board of Directors has selected Marcum LLP

as our independent auditor for 2024.

| |

|

Respectfully submitted by the Audit Committee, |

| |

|

|

| |

|

Donna H. Grier and Dr. Joanna Massey |

PROPOSAL NO. 3 - ADVISORY VOTE ON EXECUTIVE

COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer

Protection Act (the “Dodd-Frank Act”) requires the Company’s shareholders to have the opportunity to cast a non-binding

advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s Named Executive Officers

included in the summary compensation table and related disclosures. As discussed in the “Executive Compensation” section herein,

the Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

We believe that our compensation policies for

the Named Executive Officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term

interests of the Company’s shareholders. This advisory shareholder vote, commonly referred to as a “say-on-pay vote,”

gives you as a shareholder the opportunity to approve or not approve the compensation of the Named Executive Officers that is disclosed

in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

Because your vote is advisory, it will not be

binding on either the Board of Directors or the Company. However, the Company’s Compensation Committee will take into account the

outcome of the shareholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. In

addition, your non-binding advisory votes described in this Proposal 4 will not be construed: (1) as overruling any decision by the

Board of Directors, any Board committee or the Company relating to the compensation of the Named Executive Officers, or (2) as creating

or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU

VOTE

“FOR” THIS, NON-BINDING, ADVISORY PROPOSAL NO. 3.

Table of Contents

EXECUTIVE COMPENSATION

The following table sets forth the compensation

for the Company’s fiscal years ended December 31, 2023 and 2022 earned by or awarded to, as applicable, our principal

executive officer, principal financial officer and the Company’s other most highly compensated executive officers as of December 31,

2023. In this Proxy Statement, we refer to such officers as the Company’s “Named Executive Officers.”

Summary Compensation Table

The following Summary Compensation

Table sets forth all compensation earned in all capacities during the fiscal years ended December 31, 2023 and 2022 by (i) our

principal executive officer, (ii) our two most highly compensated executive officers, other than our principal executive officer,

who were serving as executive officers as of December 31, 2023 and whose total compensation for the 2023 fiscal year, as determined

by Regulation S-K, Item 402, exceeded $100,000, (iii) a person who would have been included as one of our two most highly compensated

executive officers, other than our principal executive officer, but for the fact that he was not serving as one of our executive officers

as of December 31, 2023 (the individuals falling within categories (i), (ii) and (iii) are collectively referred to as the “Named

Executive Officers”):

| |

|

|

|

|

|

|

|

|

|

Stock |

|

Option |

|

Total |

|

| Name and Principal Position |

|

Year |

|

Salary |

|

Bonus |

|

Awards |

|

Awards |

|

Earned |

|

| Michael Mo |

|

2023 |

|

$ |

333,649 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

333,649 |

|

| Chief Executive Officer |

|

2022 |

|

$ |

306,159 |

|

$ |

— |

|

$ |

1,443,000 |

|

$ |

— |

|

$ |

1,749,159 |

(1) |

| Shawn Canter |

|

2023 |

|

$ |

188,369 |

|

$ |

— |

|

$ |

1,380,000 |

|

$ |

— |

|

$ |

1,568,369 |

(2) |

| Chief Financial Officer |

|

2022 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

| William Walker |

|

2023 |

|

$ |

223,703 |

|

$ |

— |

|

$ |

266,000 |

|

$ |

— |

|

$ |

489,703 |

(3) |

| Chief Technology Officer |

|

2022 |

|

$ |

151,250 |

|

$ |

12,000 |

|

$ |

309,000 |

|

$ |

— |

|

$ |

472,250 |

(4) |

| (1) |

Includes the incremental value of an equity modification for 1,500,000 shares of the Company’s common stock previously deemed to be earned upon achieving market capitalization milestones up to $4 billion, which will now vest in four equal increments over four years. |

| (2) |

Includes cash compensation earned from date of hire March 31, 2023 through December 31, 2023. Also includes 1,500,000 shares of the Company’s common stock which vest in five equal increments over five years. |

| (3) |

Includes 350,000 shares of the Company’s common stock which vest in four equal increments over four years. |

| (4) |

Includes cash compensation earned from date of hire March 16, 2022 through December 31, 2022. Also includes 150,000 shares of the Company’s common stock which vest in four equal increments over four years. |

Pay vs. Performance

The following table sets forth compensation information

for our principal executive officer, referred to below as our “PEO”, and our other named executive officers, or “Other

NEOs”, for purposes of comparing their compensation to the value of our shareholders’ investments and our net income (loss),

calculated in accordance with SEC regulations, for fiscal years 2023, 2022 and 2021.

| Year |

|

Summary

Compensation

Table Total for

PEO (1) |

|

|

Compensation

Actually Paid to

PEO (2) |

|

|

Average

Summary

Compensation

Table Total for

Non-PEO

NEOs (3) |

|

|

Average

Compensation

Actually Paid to

Non-PEO

NEOs (4) |

|

|

Value of Initial

Fixed $100

Investment

Based On Total

Shareholder

Return (5) |

|

|

Net Income

(Loss) |

|

| 2023 |

|

$ |

333,649 |

|

|

$ |

(1,143,851) |

|

|

$ |

1,029,036 |

|

|

$ |

311,223 |

|

|

$ |

12.93 |

|

|

$ |

(23,693,556) |

|

| 2022 |

|

$ |

1,749,159 |

|

|

$ |

(610,841 |

) |

|

$ |

1,038,907 |

|

|

$ |

(1,641,593 |

) |

|

$ |

81.63 |

|

|

$ |

(19,436,479 |

) |

| 2021 |

|

$ |

2,812,661 |

|

|

$ |

2,950,661 |

|

|

$ |

8,337,991 |

|

|

$ |

8,816,571 |

|

|

$ |

187.76 |

|

|

$ |

(11,911,151 |

) |

Table of Contents

| (1) |

The dollar amounts reported are the amounts of total compensation reported for our PEO, Michael Mo, in the Summary Compensation Table of our Form 10-K for fiscal years 2023, 2022 and 2021. |

| (2) |

The dollar amounts reported represent the amount of “compensation actually paid”, as computed in accordance with SEC rules. The dollar amounts reported are the amounts of total compensation reported for Mr. Mo during the applicable year, but also include (i) the year-end value of equity awards granted during the reported year, (ii) the change in the value of equity awards that were unvested at the end of the prior year, measured through the date the awards vested, or through the end of the reported fiscal year, (iii) value of equity awards issued and vested during the reported fiscal year, and (iv) reduced by the value of equity awards granted in prior years that were forfeited in subsequent years. |

| (3) |

The dollar amounts reported are the average of the total compensation reported for our Other NEOs, other than our PEO, namely Mr. Canter for 2023, Mr. Walker for 2023 and 2022, and Mr. Cochran for 2022 and 2021. |

| (4) |

The dollar amounts reported represent the average amount of “compensation actually paid”, as computed in accordance with SEC rules, for our Other NEOs, other than our PEO. The dollar amounts reported are the average of the total compensation reported for our Other NEOs, other than our PEO in the Summary Compensation Table for fiscal years 2023, 2022 and 2021, but also include (i) the year-end value of equity awards granted during the reported year, (ii) the change in the value of equity awards that were unvested at the end of the prior year, measured through the date the awards vested, or through the end of the reported fiscal year, (iii) value of equity awards issued and vested during the reported fiscal year, and (iv) reduced by the value of equity awards granted in prior years that were forfeited in subsequent years. |

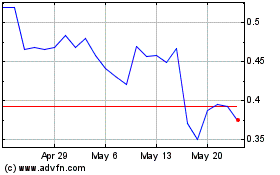

| (5) |

Assumes an investment of $100 for the period starting on January 1, 2021 through the end of the listed fiscal year. The closing prices of the Company’s common stock as reported on Nasdaq, as applicable, on the following trading days were: (i) $1.47 on December 31, 2020; (ii) $2.76 on December 31, 2021; (iii) $1.20 on December 30, 2022; and (iv) $0.19 on December 29, 2023. |

To calculate the amounts of compensation actually

paid each of the PEO and Other NEOs reported in the table above, the following amounts were deducted from and added (as applicable) to

compensation as reported in the Summary Compensation Table:

| | |

PEO | | |

Other

NEOs | |

| | |

2023 | | |

2022 | | |

2021 | | |

2023 | | |

2022 | | |

2021 | |

| Summary Compensation Table Total | |

$ | 333,649 | | |

$ | 1,749,159 | | |

$ | 2,812,661 | | |

$ | 1,029,036 | | |

$ | 1,038,907 | | |

$ | 8,337,991 | |

| Less:

Grant Date Fair Value of Equity Awards (1) | |

| - | | |

| (1,443,000 | ) | |

| (2,579,000 | ) | |

| (823,000 | ) | |

| (823,000 | ) | |

| (8,131,420 | ) |

| Less: Prior

Year-End Fair Value of Equity Awards Granted in Prior Years that Forfeited During the Fiscal Year | |

| - | | |

| (2,717,000 | ) | |

| - | | |

| - | | |

| (1,545,000 | ) | |

| - | |

| Add:

Year-End Fair Value of Equity Awards Granted in the Year | |

| - | | |

| 1,800,000 | | |

| 2,717,000 | | |

| 175,750 | | |

| 990,000 | | |

| 8,610,000 | |

| Add:

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards | |

| (1,136,250 | ) | |

| - | | |

| - | | |

| (56,813 | ) | |

| (1,170,000 | ) | |

| - | |

| Add:

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year | |

| (341,250 | ) | |

| - | | |

| - | | |

| (13,750 | ) | |

| (132,500 | ) | |

| - | |

| Compensation Actually Paid | |

$ | (1,143,851 | ) | |

$ | (610,841 | ) | |

$ | 2,950,661 | | |

$ | 311,223 | | |

$ | (1,641,593 | ) | |

$ | 8,816,571 | |

(1) Represents the grant date fair value of the equity awards as reported in the Summary Compensation Table.

In accordance with Item 402(v) requirements, the fair values of unvested

and outstanding equity awards were remeasured as of the end of each fiscal year, and as of each vesting date, during the years displayed

in the table above. For a discussion of the assumptions made in the valuation of grants, see Note 16 to the Consolidated Financial Statements

included in our Form 10-K.

Relationship Between Pay and Performance

Our “total shareholder return,” as

set forth in the above table, decreased by 87% during the three-year period ended December 31, 2023, while our net loss increased by 99%

over that same three-year period. “Compensation Actually Paid” to our PEO decreased from $2,950,661 in 2021 to $(1,143,851)

in 2023; and “Compensation Actually Paid” to our Other NEOs decreased from $8,816,571 in 2021 to $311,223 in 2023.

Our executive compensation program seeks to align

executive officers’ long-term interests with those of our shareholders to incentivize a long-term increase in shareholder value,

and therefore does not specifically align the Company’s performance measures with Compensation Actually Paid (as defined

by SEC rules) for a particular year. Compensation Actually Paid in the tables above is calculated pursuant to SEC rules and reflects

cash compensation actually paid as well as changes to the fair values of equity awards during the applicable fiscal years based on year-end

or vesting date stock prices, as well as various accounting valuation assumptions, and does not reflect the actual amounts earned during

the year by our PEO and Other NEOs. Compensation Actually Paid fluctuates annually largely due to the change in our stock price from year

to year.

Table of Contents

Employment Agreements

We have not entered into employment

agreements with our officers and directors and our Board of Directors has the sole discretion to pay salaries and incentive bonuses, including

merit-based cash and equity bonuses.

On November 1, 2022, the Board,

at the recommendation of the Compensation Committee, in connection with Dr. William Walker’s appointment as Chief Technology Officer,

approved an annual salary of $210,000 and the grant of 100,000 shares of the Company’s common stock, which grant vests in four equal

annual installments. Subsequently, in recognition of his continued services to the Company, the Board, at the recommendation of the Compensation

Committee, approved an additional grant of 350,000 shares of the Company’s common stock, which shall vest in four equal annual installments.

Effective March 31, 2023,

the Board, at the recommendation of the Compensation Committee, in connection with Shawn Canter’s appointment as Chief Financial

Officer, approved an annual salary of $250,000 and the grant of 1,500,000 shares of the Company’s common stock, which grant vests

in five equal annual installments.

Change in Control

We are not aware of any arrangement

that might result in a change in control of the Company.

Table of Contents

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table discloses