$9.2 million in revenue, raises full-year

revenue guidance 225 MyoPro® authorizations and orders with 316

patients in backlog at quarter end 645 additions to the pipeline

result in 1,263 patients in the pipeline as of September 30,

2024

Myomo, Inc. (NYSE American: MYO) (“Myomo” or the

“Company”), a wearable medical robotics company that offers

increased functionality for those suffering from neurological

disorders and upper-limb paralysis, today announced financial

results for the three and nine months ended September 30, 2024.

Financial and operating highlights for the third quarter of 2024

include the following (all comparisons are with the third quarter

of 2023 unless otherwise indicated):

- Product and total revenue was a record $9.2 million, up 83% and

81%, respectively;

- Revenue units were a record 161, up 35%;

- Orders and insurance authorizations were received for a record

225 MyoPro units, up 44%;

- Backlog, which represents insurance authorizations and orders

received but not yet converted to revenue, was a record 316 units

as of September 30, 2024, up 71%;

- A record 645 new candidates were added to the patient pipeline,

up 69%;

- There were 1,263 MyoPro candidates in the patient pipeline as

of September 30, 2024, up 21%;

- Gross margin was 75.4%, up 670 basis points, with gross margin

on product revenues up 700 basis points;

- Cost per pipeline add was $1,618, down 25%; and

- The Company launched its orthotics and prosthetics ("O&P")

channel program at the American Orthotic and Prosthetic Association

(AOPA) National Assembly in September, and began training O&P

clinics to provide the MyoPro to their patients.

Management Commentary

“Myomo delivered a second consecutive quarter of record

financial and operating results as we emphasized outreach and

education to the Medicare population regarding the benefits of the

MyoPro, as well as an unwavering commitment to efficiency, quality

and improving patient outcomes across our organization", said Paul

R. Gudonis, Myomo's chairman and chief executive officer. "Our

focus has been on accelerating revenue growth though our direct

provider sales channel and laying the groundwork for growth in the

O&P channel in 2025 and beyond. Demonstrable progress was made

on both of these areas during the third quarter."

Financial Results

For the Three Months Ended

September 30,

Period- to-Period

Change

For the Nine Months Ended

September 30,

Period- to-Period

Change

2024

2023

$

%

2024

2023

$

%

Product revenue

$

9,207,586

$

5,029,523

$

4,178,063

83

%

$

20,482,742

$

12,719,855

$

7,762,887

61

%

License revenue

—

50,000

(50,000

)

(100

)%

—

1,764,920

(1,764,920

)

(100

)%

Total revenue

9,207,586

5,079,523

4,128,063

81

%

20,482,742

14,484,775

5,997,967

41

%

Cost of revenue

2,262,031

1,590,675

671,356

42

%

5,912,632

4,407,270

1,505,362

34

%

Gross profit

$

6,945,555

$

3,488,848

$

3,456,707

99

%

$

14,570,110

$

10,077,505

$

4,492,605

45

%

Gross margin %

75.4

%

68.7

%

6.7

%

71.1

%

69.6

%

1.5

%

Revenue for the third quarter of 2024 was $9.2 million, up 81%

compared with the third quarter of 2023. Product revenue increased

83% compared with the same period a year ago, driven by growth in

revenue units and by a higher average selling price ("ASP"). Myomo

recognized revenue on 161 MyoPro units in the third quarter of

2024, up 35% over the same quarter a year ago. ASP was

approximately $57,200 in the third quarter, up 35%. A portion of

the increase in ASP reflects payments from supplemental insurance

payers on revenue units recognized in a prior period. Excluding

these payments, ASP was approximately $52,700, up 23%. Effective

July 1, 2024, revenue for Medicare Part B patients is being

recognized at the time of product delivery for the amount expected

to be paid for each patient. Revenue from patients with Medicare

Part B represented 55% of revenue in the third quarter.

Year-to-date revenue was $20.5 million, up 41% compared with the

same period a year ago. Year-to-date product revenue was up 61%

compared with the first nine months of 2023.

Gross margin for the third quarter of 2024 was 75.4%, compared

with 68.7% for the third quarter of 2023. The increase was driven

primarily by a higher ASP. Gross margin on product revenues for the

third quarter of 2023 was 68.4%. Year-to-date gross margin was

71.1% compared with 69.6% for the same period a year ago. Gross

margin on product revenue for the first nine months of 2023 was

65.4%.

Operating expenses for the third quarter of 2024 were $7.9

million, an increase of 43% compared with the third quarter of

2023. The increase was driven primarily by higher payroll expense

due to additional headcount to support the Company's engineering

efforts, as well as the addition of field clinical and

reimbursement capacity and incentive compensation accruals.

Advertising costs of $1.0 million were up 23% over the third

quarter of 2023. Cost per pipeline add was $1,618, a decrease of

25% compared with the third quarter of 2023. Year-to-date operating

expenses were $20.5 million, an increase of 29% compared with the

same period a year ago.

Operating loss for the third quarter of 2024 was $1.0 million,

compared with $2.0 million for the third quarter of 2023. Net loss

for the third quarter of 2024 was $1.0 million, or $0.03 per share,

compared with a net loss of $2.0 million, or $0.06 per share, for

the third quarter of 2023. Year-to-date operating loss was $6.0

million, compared with an operating loss of $5.8 million for the

same period a year ago. Year-to-date net loss was $5.9 million, or

$0.16 per share, compared with a net loss of $5.7 million, or $0.21

per share, for the same period a year ago.

Adjusted EBITDA for the third quarter of 2024 was $(0.6)

million, compared with $(1.7) million for the third quarter of

2023. Year-to-date Adjusted EBITDA was $(5.3) million, compared

with $(4.9) million for the same period a year ago. A

reconciliation of GAAP net loss to this non-GAAP financial measure

appears below.

Operations Update

The patient pipeline was 1,263 patients as of September 30,

2024, compared with 1,046 as of September 30, 2023, an increase of

21%. A record 645 patients were added to the pipeline during the

third quarter of 2024, an increase of 69% compared with the same

period a year ago. The Company generated a record 225

authorizations and orders in the third quarter of 2024, an increase

of 44% compared with the same period a year ago. As a result,

backlog was a record 316 patients as of September 30, 2024, an

increase of 71% compared with September 30, 2023.

Cash Position

Cash, cash equivalents and restricted cash as of September 30,

2024 were $7.0 million. Cash used in operating activities was $1.5

million for the third quarter of 2024, compared with $1.7 million

for the third quarter of 2023. Cash used in operating activities in

the third quarter of 2024 was impacted by a payment delay during

the last two to three weeks of the quarter from the Centers for

Medicare & Medicaid Services ("CMS") due to a transition from

check payments to electronic funds transfer, which is expected to

speed up payments going forward. The delayed payments were

subsequently received in October.

Business Outlook

“We are positioned to deliver sequential revenue growth in the

fourth quarter due to the strength of our backlog," added Mr.

Gudonis. "As a result, we expect fourth quarter revenue to be in

the range of $9.5 million to $10.5 million, resulting in full year

revenue of $30 million to $31 million, up from our previous

guidance of $28 million to $30 million."

"We believe our objective of reaching operating cash flow

breakeven in the fourth quarter is achievable. We also expect to

approach Adjusted EBITDA breakeven in the fourth quarter. We expect

a moderation in cash used to fund growth in working capital, as we

collected in the fourth quarter the Medicare payments that were

delayed from the third quarter," said David Henry, Myomo's chief

financial officer. "Moderation in the growth of working capital in

the fourth quarter is predicated on minimizing growth in days sales

outstanding and receipt of a contractual reimbursement from the

landlord for initial costs associated with the lease on our new

facility."

Conference Call and Webcast

Myomo will hold a conference call today at 4:30 p.m. Eastern

time to discuss these results and answer questions. Participants

are encouraged to pre-register for the call at this link. Callers

who pre-register will receive a conference passcode and unique PIN

to gain immediate access to the call and bypass the live operator.

Participants may pre-register at any time up to and after the start

of the call. Those unable to pre-register may participate by

dialing 844-707-6932 (U.S.) or 412-317-9250 (International). A

webcast of the call will also be available at Myomo’s Investor

Relations page at http://ir.myomo.com/.

A replay of the webcast will be available beginning

approximately one hour after the completion of the live conference

call at http://ir.myomo.com/. A dial-in replay of the call will be

available until November 20, 2024 at 877-344-7529 (U.S. toll-free),

855-669-9658 (Canada toll-free) or 412-317-0088 (International),

with passcode 3377340.

Non-GAAP Financial Measures

Myomo is providing financial information that has not been

prepared in accordance with generally accepted accounting

principles in the United States, or GAAP. This information includes

Adjusted EBITDA. This non-GAAP financial measure is not in

accordance with, or an alternative for, GAAP and may be different

from similar non-GAAP financial measures used by other companies.

Myomo believes the use of this non-GAAP financial measure provides

supplementary information for investors to use in evaluating

operating performance and in comparing Myomo’s financial measures

with other companies in its industry, many of which present similar

non-GAAP financial measures. Adjusted EBITDA is EBITDA adjusted for

stock-based compensation expense and loss on equity investment.

This non-GAAP financial measure is not meant to be considered

superior to or a substitute for results of operations prepared in

accordance with GAAP, and should be viewed in conjunction with GAAP

financial measures. Investors are encouraged to review the

reconciliation of this non-GAAP measure to its most directly

comparable GAAP financial measure. A reconciliation of GAAP to the

non-GAAP financial measures has been provided in the tables

included as part of this press release.

About Myomo

Myomo, Inc. is a wearable medical robotics company that offers

improved arm and hand function for those suffering from

neurological disorders and upper-limb paralysis. Myomo develops and

markets the MyoPro product line. MyoPro is a powered upper-limb

orthosis designed to support the arm and restore function to the

weakened or paralyzed arms of certain patients suffering from CVA

stroke, brachial plexus injury, traumatic brain or spinal cord

injury or other neuromuscular disease or injury. It is currently

the only marketed device that, sensing a patient’s own EMG signals

through non-invasive sensors on the arm, can restore an

individual’s ability to perform activities of daily living,

including feeding themselves, carrying objects and doing household

tasks. Many are able to return to work, live independently and

reduce their cost of care. Myomo is headquartered in Boston,

Massachusetts, with sales and clinical professionals across the

U.S. and representatives internationally. For more information,

please visit www.myomo.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding

the Company’s future business expectations, including expectations

for fourth quarter and full year 2024 revenue, as well as

expectations regarding achieving operating cash flow breakeven and

approaching Adjusted EBITDA breakeven in the fourth quarter of

2024, which are subject to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are only predictions and may differ

materially from actual results due to a variety of factors.

These factors include, among other things:

- our ability to obtain sufficient reimbursement from third-party

payers for our products;

- our ability to navigate factors both within and outside our

control to grow revenues sufficiently to achieve operating cash

flow breakeven on a quarterly basis;

- our revenue concentration with Medicare and with a particular

insurance payer as a result of focusing our efforts on patients

with insurers who have previously reimbursed for the MyoPro;

- our ability to continue normal operations and patient

interactions without supply chain disruption in order to deliver

and fit our custom-fabricated devices;

- our marketing and commercialization efforts;

- our dependence upon external sources for the financing of our

operations, to the extent that we do not achieve or maintain cash

flow breakeven;

- our ability to obtain and maintain our strategic collaborations

and to realize the intended results of such collaborations;

- our ability to effectively execute our business plan and scale

up our operations;

- our expectations as to our product development programs,

including improving our existing products and developing new

products;

- our ability to maintain and grow our reputation and to achieve

and maintain the market acceptance of our products;

- our expectations as to our clinical research program and

clinical results;

- our ability to maintain adequate protection of our intellectual

property and to avoid violation of the intellectual property rights

of others;

- our ability to gain and maintain regulatory approvals;

- our ability to compete and succeed in a highly competitive and

evolving industry; and

- general market, economic, environmental and social factors that

may affect the evaluation, fitting, delivery and sale of our

products to patients.

More information about these and other factors that potentially

could affect our financial results is included in Myomo’s filings

with the Securities and Exchange Commission, including those

contained in the risk factors section of the Company’s annual

report on Form 10-K, quarterly reports on Form 10-Q and other

filings with the Commission. The Company cautions readers not to

place undue reliance on any such forward-looking statements, which

speak only as of the date made. Although the forward-looking

statements in this release of financial information are based on

our beliefs, assumptions and expectations, taking into account all

information currently available to us, we cannot guarantee future

transactions, results, performance, achievements or outcomes. No

assurance can be made to any investor by anyone that the

expectations reflected in our forward-looking statements will be

attained, or that deviations from them will not be material or

adverse. The Company disclaims any obligation subsequently to

revise any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

MYOMO, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

For the Three Months

ended

For the Nine Months

Ended

September 30,

September 30,

2024

2023

2024

2023

Revenue

Product revenue

$

9,207,586

$

5,029,523

$

20,482,742

$

12,719,855

License revenue

—

50,000

—

1,764,920

9,207,586

5,079,523

20,482,742

14,484,775

Cost of revenue

2,262,031

1,590,675

5,912,632

4,407,270

Gross profit

6,945,555

3,488,848

14,570,110

10,077,505

Operating expenses:

Research and development

1,248,870

717,256

3,212,309

1,758,480

Selling, clinical and marketing

3,401,182

2,387,090

8,540,161

6,689,578

General and administrative

3,253,056

2,408,871

8,779,024

7,427,818

7,903,108

5,513,217

20,531,494

15,875,876

Loss from operations

(957,553

)

(2,024,369

)

(5,961,384

)

(5,798,371

)

Other (income) expense, net

Interest income, net

(76,020

)

(112,300

)

(318,555

)

(302,053

)

Other expense, net

—

467

—

6,098

Loss on equity investment

—

70,124

—

99,840

(76,020

)

(41,709

)

(318,555

)

(196,115

)

Loss before income taxes

(881,533

)

(1,982,660

)

(5,642,829

)

(5,602,256

)

Income tax expense

84,876

46,356

280,819

85,204

Net loss

$

(966,409

)

$

(2,029,016

)

$

(5,923,648

)

$

(5,687,461

)

Weighted average number of common

shares outstanding:

Basic and diluted

37,950,515

35,266,361

37,359,366

27,537,357

Net loss per share attributable to

common stockholders

Basic and diluted

$

(0.03

)

$

(0.06

)

$

(0.16

)

$

(0.21

)

MYOMO, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

September 30,

December 31,

2024

2023

(unaudited)

ASSETS

Current Assets:

Cash and cash equivalents

$

6,622,675

$

6,871,306

Short-term investments

—

1,994,662

Accounts receivable, net

3,729,387

2,382,658

Inventories, net

3,383,513

1,803,507

Prepaid expenses and other current

assets

968,569

598,850

Total Current Assets

14,704,144

13,650,983

Restricted cash

375,000

—

Operating lease assets with right of

use

466,962

663,554

Equipment, net

561,325

175,794

Other assets

205,440

91,237

Total Assets

$

16,312,871

$

14,581,568

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable and accrued expenses

6,448,076

4,885,944

Current operating lease liability

205,464

486,143

Income taxes payable

305,861

96,461

Deferred revenue

31,971

8,510

Total Current Liabilities

6,991,372

5,477,058

Non-current operating lease liability

29,165

115,160

Total Liabilities

7,020,537

5,592,218

Commitments and Contingencies

—

—

Stockholders’ Equity:

Preferred stock

—

—

Common stock

3,026

2,715

Additional paid-in capital

111,754,495

105,840,239

Accumulated other comprehensive income

395,734

83,669

Accumulated deficit

(102,854,457

)

(96,930,809

)

Treasury stock, at cost

(6,464

)

(6,464

)

Total Stockholders’ Equity

9,292,334

8,989,350

Total Liabilities and Stockholders’

Equity

$

16,312,871

$

14,581,568

MYOMO, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (unaudited)

For the Nine Months Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net loss

$

(5,923,648

)

$

(5,687,461

)

Adjustments to reconcile net loss to net

cash used in operations:

Depreciation

114,346

136,416

Stock-based compensation

552,580

781,513

Accretion of discount on short-term

investments

(108,999

)

—

Credit losses

5,257

12,626

Loss on equity investment

—

99,840

Amortization of right-of-use assets

196,592

301,053

Other non-cash charges

84,180

(49,271

)

Changes in operating assets and

liabilities:

Accounts receivable

(1,116,352

)

(625,596

)

Inventories

(1,573,193

)

(90,100

)

Prepaid expenses and other current

assets

(614,951

)

(439,584

)

Other assets

(16,640

)

19,797

Accounts payable and accrued expenses

1,895,795

2,141,978

Income taxes payable

202,137

(74,944

)

Operating lease liabilities

(366,675

)

(352,820

)

Deferred revenue

23,460

9,533

Net cash used in operating activities

(6,655,632

)

(3,817,020

)

CASH USED IN INVESTING

ACTIVITIES

1,613,180

(4,324,017

)

CASH PROVIDED BY FINANCING

ACTIVITIES

5,162,409

9,713,426

Effect of foreign exchange rate changes on

cash

6,412

(6,610

)

'Net (decrease) increase in cash and cash

equivalents and restricted cash

126,369

1,565,780

Cash, cash equivalents and restricted

cash, beginning of period

6,871,306

5,345,967

Cash, cash equivalents and restricted

cash, end of period

$

6,997,675

$

6,911,747

MYOMO, INC.

RECONCILIATION OF GAAP NET

LOSS TO ADJUSTED EBITDA

(unaudited)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net loss

$

(966,409

)

$

(2,029,016

)

$

(5,923,648

)

$

(5,687,461

)

Adjustments to reconcile to Adjusted

EBITDA:

Interest income

(76,020

)

(112,300

)

(318,555

)

(302,053

)

Depreciation expense

48,682

35,794

114,346

136,416

Stock-based compensation

324,185

330,394

552,580

781,513

Loss on investment in minority

interest

—

70,124

—

99,840

Income tax expense

84,876

46,356

280,819

85,204

Adjusted EBITDA

$

(584,686

)

$

(1,658,648

)

$

(5,294,458

)

$

(4,886,541

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106431006/en/

For Myomo: ir@myomo.com Investor Relations: Kim Sutton Golodetz

Alliance Advisors IR kgolodetz@allianceadvisors.com

212-838-3777

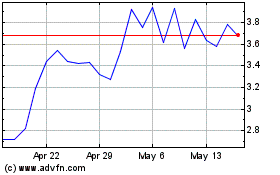

Myomo (AMEX:MYO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Myomo (AMEX:MYO)

Historical Stock Chart

From Jan 2024 to Jan 2025