true

0001173420

0001173420

2024-11-30

2024-11-30

0001173420

2024-05-31

0001173420

2025-01-13

iso4217:USD

xbrli:shares

--11-30FY2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended November 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: 001-31913

NOVAGOLD RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

|

British Columbia

|

N/A

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

201 South Main Street, Suite 400

Salt Lake City, Utah, USA

|

84111

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

| (801) 639-0511 |

|

(Registrant’s Telephone Number, Including Area Code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares

|

NG

|

NYSE American

Toronto Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☐

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

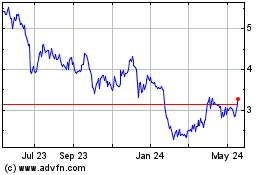

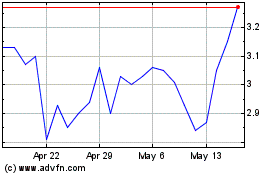

Based on the last sale price on the NYSE American LLC (“NYSE American”) of the registrant’s common shares on May 31, 2024 (the last business day of the registrant’s most recently completed second fiscal quarter) of $3.93 per share, the aggregate market value of the voting common shares held by non-affiliates was approximately $967,700,000.

As of January 13, 2025, the registrant had 334,646,571 common shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than April 1, 2025, in connection with the registrant’s fiscal year 2024 annual meeting of shareholders, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Explanatory Note

NOVAGOLD RESOURCES INC. is filing this Amendment No. 1 (the “Amendment No. 1”) to our Annual Report on Form 10-K for the fiscal year ended November 30, 2024 as filed with the SEC on January 23, 2025 (the “Original Form 10-K”). This Amendment No. 1 amends Part IV, Item 15 to correct a typographical error in the Report of Independent Registered Public Accounting Firm related to the financial statements of Donlin Gold LLC for the three-year period ended November 30, 2024, which are included in the Original Form 10-K pursuant to Rule 3-09 of Regulation S-K. The original audit report to the Donlin Gold LLC financial statements inadvertently omitted a reference to the audit of the financial statements for the fiscal year ended November 30, 2022, despite the fact that all three fiscal years—2024, 2023, and 2022—had been audited.

The corrected audit report, which properly includes an opinion covering all three fiscal years and related financial statements of Donlin Gold LLC are filed as part of this Amendment No. 1 and are included as financial statement schedules in Item 15, “Exhibits and Financial Statement Schedules” of this Amendment No. 1.

The consent of PricewaterhouseCoopers LLP, independent auditors for Donlin Gold LLC, is filed as an exhibit to this Amendment No. 1, as well as the certifications required under Section 302 and 906 of the Sarbanes-Oxley Act of 2002.

No other changes have been made to the Form 10-K as originally filed, and this Amendment No. 1 does not reflect any events occurring after the filing of the Original Form 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K and the Company's other filings with the SEC.

NOVAGOLD RESOURCES INC.

PART IV

Item 15. Exhibits and Financial Statement Schedules

(a)(1) Financial Statements

| |

The Reports of Independent Registered Public Accounting Firm (PCAOB ID 271) are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

| |

|

| |

The Consolidated Balance Sheets are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

| |

|

| |

The Consolidated Statements of Loss and Comprehensive Loss are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

| |

|

| |

The Consolidated Statements of Cash Flows are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

| |

|

| |

The Consolidated Statements of Equity are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

| |

|

| |

The Notes to Consolidated Financial Statements are filed as part of the Form 10-K under “Item 8. Financial Statements and Supplementary Data” filed with the SEC on January 23, 2025

|

(a)(2) Financial Statement Schedules

Schedule A – The Financial Statements of Donlin Gold LLC as of November 30, 2024 and 2023 and for the years ended November 30, 2024, 2023 and 2022.

No other financial statement schedules are filed as part of this report because such schedules are not applicable or the required information is shown in the Consolidated Financial Statements or Notes thereto. See section Item 8. Financial Statements and Supplementary Data.

(a)(3) Executive Compensation Plans and Arrangements

Employment Agreement between the Registrant and Gregory A. Lang, dated January 9, 2012, identified in exhibit list below.

Employment Agreement between NOVAGOLD Resources Alaska, Inc. (a wholly-owned subsidiary of the Registrant) and Gregory A. Lang dated January 9, 2012, identified in exhibit list below.

Employment Agreement between NOVAGOLD USA, Inc. and David Ottewell, dated September 10, 2012, identified in exhibit list below.

Employment Agreement between NovaGold USA, Inc. and Richard A. Williams dated January 8, 2013, identified in exhibit list below.

Employment Agreement between NovaGold USA, Inc. and Peter Adamek dated July 25, 2024, identified in exhibit list below.

2004 Stock Award Plan of NOVAGOLD Resources Inc. (as amended) identified in exhibit list below.

NOVAGOLD Resources Inc. Employee Share Purchase Plan identified in exhibit list below.

NOVAGOLD Resources Inc. 2009 Performance Share Unit Plan identified in exhibit list below.

NOVAGOLD Resources Inc. 2009 Non-Employee Directors Deferred Share Unit Plan identified in exhibit list below.

NOVAGOLD RESOURCES INC.

(b) Exhibits

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

|

|

Certificate of Continuance (British Columbia) dated June 10, 2013 (incorporated by reference to Exhibit 99.1 to the Form 6-K dated June 19, 2013)

|

|

|

|

Certificate of Discontinuance (Nova Scotia) dated June 10, 2013 (incorporated by reference to Exhibit 99.2 to the Form 6-K dated June 19, 2013)

|

|

|

|

Notice of Articles (British Columbia) dated June 10, 2013 (incorporated by reference to Exhibit 99.3 to the Form 6-K dated June 19, 2013)

|

|

|

|

Amended and Restated Articles of NOVAGOLD RESOURCES INC. dated May 12,2021 (incorporated by reference to Appendix A to Registrant’s definitive proxy statement filed with the Securities and Exchange Commission on March 25, 2021)

|

|

|

|

Description of Common Shares**

|

|

|

|

Amendment dated January 13, 2010 to Limited Liability Company Agreement dated December 1, 2007 between Donlin Gold LLC, Barrick Gold U.S. Inc. and NOVAGOLD Resources Alaska, Inc. (incorporated by reference to Exhibit 10.2 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

Limited Liability Company Agreement dated December 1, 2007 between Donlin Gold LLC, Barrick Gold U.S. Inc. and NOVAGOLD Resources Alaska, Inc. (incorporated by reference to Exhibit 10.8 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

2004 Stock Award Plan of NOVAGOLD Resources Inc. (as amended) (incorporated by reference to Appendix A to Registrant’s definitive proxy statement, filed with the Securities and Exchange Commission on March 24, 2023)

|

|

|

|

NOVAGOLD Resources Inc. Employee Share Purchase Plan (incorporated by reference to Exhibit 10.12 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

NOVAGOLD Resources Inc. 2009 Performance Share Unit Plan (as amended) (incorporated by reference to Appendix C to Registrant’s definitive proxy statement, filed with the Securities and Exchange Commission on March 24, 2023)

|

|

|

|

NOVAGOLD Resources Inc. 2009 Non-Employee Directors Deferred Share Unit Plan (as amended) (incorporated by reference to Appendix E to Registrant’s definitive proxy statement, filed with the Securities and Exchange Commission on March 24, 2023)

|

|

|

|

Employment Agreement between the Registrant and Gregory A. Lang dated January 9, 2012. (incorporated by reference to Exhibit 10.15 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

Employment Agreement between the Registrant’s wholly-owned subsidiary, NovaGold USA, Inc., and David Ottewell, dated September 10, 2012. (incorporated by reference to Exhibit 10.17 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

Amendment dated July 15, 2010 to Limited Liability Company Agreement dated December 1, 2007 between Donlin Gold LLC, Barrick Gold U.S. Inc. and NOVAGOLD Resources Alaska, Inc. (incorporated by reference to Exhibit 10.18 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

Amendment dated June 1, 2011 to Limited Liability Company Agreement dated December 1, 2007 between Donlin Gold LLC, Barrick Gold U.S. Inc. and NOVAGOLD Resources Alaska, Inc. (incorporated by reference to Exhibit 10.19 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

NOVAGOLD RESOURCES INC.

|

|

|

Employment Agreement between the Registrant’s wholly-owned subsidiary, NOVAGOLD Resources Alaska, Inc., and Gregory A. Lang, dated January 9, 2012. (incorporated by reference to Exhibit 10.20 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2013, filed with the Securities and Exchange Commission on February 12, 2014)

|

|

|

|

Share Purchase Agreement, dated July 25, 2018, by and among NOVAGOLD RESOURCES INC., Newmont Mining Corporation and Newmont Canada FN Holdings ULC (incorporated by reference to Exhibit 99.3 of the Form 8-K/A, filed with the Securities and Exchange Commission on October 3, 2018)

|

|

|

|

Employment Agreement between the Registrant’s wholly-owned subsidiary, NovaGold USA, Inc., and Richard A. Williams, dated January 8, 2013. (incorporated by reference to Exhibit 10.1 to Registrant’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2024, filed with the Securities and Exchange Commission on October 2, 2024)

|

|

|

|

Employment Agreement between the Registrant’s wholly-owned subsidiary, NovaGold USA, Inc., and Peter Adamek, dated July 25, 2024. (incorporated by reference to Exhibit 10.2 to Registrant’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2024, filed with the Securities and Exchange Commission on October 2, 2024)

|

|

|

|

Registrant’s Insider Trading Policy adopted January 29, 2014, and amended May 18, 2023 (incorporated by reference to Exhibit 19.1 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2023, filed with the Securities and Exchange Commission on January 24, 2024)

|

|

|

|

Subsidiaries of the registrant**

|

|

|

|

Consent of PricewaterhouseCoopers LLP

|

|

|

|

Consent of Wood Canada Limited**

|

|

|

|

Consent of Paul Chilson**

|

|

|

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

|

|

S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA (incorporated by reference to Exhibit 96.1 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2021, filed with the Securities and Exchange Commission on January 26, 2022)

|

|

|

|

Registrant’s Incentive Compensation Recovery Policy dated November 17, 2023 (incorporated by reference to Exhibit 97.1 to Registrant’s Annual Report on Form 10-K for the year ended November 30, 2023, filed with the Securities and Exchange Commission on January 24, 2024)

|

|

101

|

|

The following materials are filed herewith: (i) Inline XBRL Instance, (ii) Inline XBRL Taxonomy Extension Schema, (iii) Inline XBRL Taxonomy Extension Calculation, (iv) XBRL Taxonomy Extension Labels, (v) XBRL Taxonomy Extension Presentation, and (vi) Inline XBRL Taxonomy Extension Definition**

|

|

104

|

|

Cover Page Interactive Data File – The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

|

|

*

|

|

Confidential treatment has been granted for certain portions of this Exhibit pursuant to Rule 24b-2 of the Exchange Act, which portions have been omitted and filed separately with the SEC

|

|

**

|

|

Previously filed or furnished with the Original Form 10-K.

|

NOVAGOLD RESOURCES INC.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NOVAGOLD RESOURCES INC. |

| |

|

|

| |

By: |

/s/ Gregory A. Lang |

| |

Name: |

Gregory A. Lang |

| |

Title: |

President and Chief Executive Officer |

| Date: March 10, 2025 |

|

|

Item 15.(a)(2) Schedule A

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Donlin Gold LLC

Opinion

We have audited the accompanying financial statements of Donlin Gold LLC (the “Company”), which comprise the balance sheets as of November 30, 2024 and November 30, 2023, and the related statements of loss and comprehensive loss, equity, and cash flows for each of the three years in the period ended November 30, 2024, including the related notes (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of November 30, 2024 and November 30, 2023, and the results of its operations and its cash flows for each of the three years in the period ended November 30, 2024 in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (“US GAAS”). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the financial statements are available to be issued.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with US GAAS, we:

| |

• |

Exercise professional judgment and maintain professional skepticism throughout the audit.

|

| |

•

|

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

|

| |

• |

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

|

| |

• |

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

|

| |

• |

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ PricewaterhouseCoopers LLP

Vancouver, Canada

January 21, 2025

DONLIN GOLD LLC

BALANCE SHEETS

(U.S. dollars in thousands)

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

Cash

|

|

$ |

6,590 |

|

|

$ |

5,907 |

|

|

Inventory

|

|

|

190 |

|

|

|

244 |

|

|

Accounts receivable

|

|

|

417 |

|

|

|

285 |

|

|

Prepaid expenses

|

|

|

293 |

|

|

|

385 |

|

|

Current assets

|

|

|

7,490 |

|

|

|

6,821 |

|

|

Plant and equipment (note 4)

|

|

|

1,932 |

|

|

|

2,910 |

|

|

Mineral property (note 5)

|

|

|

65,308 |

|

|

|

65,230 |

|

|

Total assets

|

|

$ |

74,730 |

|

|

$ |

74,961 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

3,667 |

|

|

$ |

2,620 |

|

|

Due to related parties (note 6)

|

|

|

228 |

|

|

|

716 |

|

|

Current liabilities

|

|

|

3,895 |

|

|

|

3,336 |

|

|

Reclamation and remediation (note 7)

|

|

|

1,640 |

|

|

|

1,482 |

|

|

Total liabilities

|

|

|

5,535 |

|

|

|

4,818 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (notes 3 and 8)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

Partners’ contributions

|

|

|

597,998 |

|

|

|

573,104 |

|

|

Accumulated deficit

|

|

|

(528,803 |

) |

|

|

(502,961 |

) |

|

Total equity

|

|

|

69,195 |

|

|

|

70,143 |

|

|

Total liabilities and equity

|

|

$ |

74,730 |

|

|

$ |

74,961 |

|

DONLIN GOLD LLC

STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(U.S. dollars in thousands)

| |

|

Years ended November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drilling, studies and engineering

|

|

$ |

7,277 |

|

|

$ |

20,576 |

|

|

$ |

37,914 |

|

|

General and administrative

|

|

|

5,993 |

|

|

|

5,498 |

|

|

|

5,976 |

|

|

Permitting and environmental

|

|

|

4,745 |

|

|

|

3,470 |

|

|

|

4,816 |

|

|

Mineral property leases

|

|

|

3,421 |

|

|

|

3,234 |

|

|

|

3,605 |

|

|

Community relations

|

|

|

3,266 |

|

|

|

3,057 |

|

|

|

3,066 |

|

|

Depreciation

|

|

|

1,060 |

|

|

|

1,143 |

|

|

|

856 |

|

|

Accretion

|

|

|

80 |

|

|

|

79 |

|

|

|

93 |

|

| |

|

|

25,842 |

|

|

|

37,057 |

|

|

|

56,326 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

$ |

(25,842 |

) |

|

$ |

(37,057 |

) |

|

$ |

(56,326 |

) |

DONLIN GOLD LLC

STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

| |

|

Years ended November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(25,842 |

) |

|

$ |

(37,057 |

) |

|

$ |

(56,326 |

) |

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

1,060 |

|

|

|

1,143 |

|

|

|

856 |

|

|

Other adjustments (Accretion and leases)

|

|

|

80 |

|

|

|

73 |

|

|

|

75 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

92 |

|

|

|

(4 |

) |

|

|

51 |

|

|

Inventory

|

|

|

54 |

|

|

|

88 |

|

|

|

(30 |

) |

|

Accounts receivable

|

|

|

(132 |

) |

|

|

(92 |

) |

|

|

(51 |

) |

|

Accounts payable and accrued liabilities

|

|

|

559 |

|

|

|

(1,225 |

) |

|

|

1,481 |

|

|

Net cash used in operations

|

|

|

(24,129 |

) |

|

|

(37,074 |

) |

|

|

(53,944 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures - plant and equipment

|

|

|

(82 |

) |

|

|

(58 |

) |

|

|

(2,145 |

) |

|

Net cash used in investing

|

|

|

(82 |

) |

|

|

(58 |

) |

|

|

(2,145 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ contributions

|

|

|

24,894 |

|

|

|

35,504 |

|

|

|

56,870 |

|

|

Net cash provided from financing activities

|

|

|

24,894 |

|

|

|

35,504 |

|

|

|

56,870 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase/(Decrease) in cash during the year

|

|

|

683 |

|

|

|

(1,628 |

) |

|

|

781 |

|

|

Cash at beginning of year

|

|

|

5,907 |

|

|

|

7,535 |

|

|

|

6,754 |

|

|

Cash at end of year

|

|

$ |

6,590 |

|

|

$ |

5,907 |

|

|

$ |

7,535 |

|

DONLIN GOLD LLC

STATEMENTS OF EQUITY

(U.S. dollars in thousands)

| |

|

Barrick contributions

|

|

|

NOVAGOLD contributions

|

|

|

Accumulated deficit

|

|

|

Total equity

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 1, 2021

|

|

$ |

240,365 |

|

|

$ |

240,365 |

|

|

$ |

(409,578 |

) |

|

$ |

71,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ cash contribution

|

|

|

28,435 |

|

|

|

28,435 |

|

|

|

— |

|

|

|

56,870 |

|

|

Net loss

|

|

|

— |

|

|

|

— |

|

|

|

(56,326 |

) |

|

|

(56,326 |

) |

|

November 30, 2022

|

|

$ |

268,800 |

|

|

$ |

268,800 |

|

|

$ |

(465,904 |

) |

|

$ |

71,696 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ cash contribution

|

|

|

17,752 |

|

|

|

17,752 |

|

|

|

— |

|

|

|

35,504 |

|

|

Net loss

|

|

|

— |

|

|

|

— |

|

|

|

(37,057 |

) |

|

|

(37,057 |

) |

|

November 30, 2023

|

|

$ |

286,552 |

|

|

$ |

286,552 |

|

|

$ |

(502,961 |

) |

|

$ |

70,143 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ cash contribution

|

|

|

12,447 |

|

|

|

12,447 |

|

|

|

— |

|

|

|

24,894 |

|

|

Net loss

|

|

|

— |

|

|

|

— |

|

|

|

(25,842 |

) |

|

|

(25,842 |

) |

|

November 30, 2024

|

|

$ |

298,999 |

|

|

$ |

298,999 |

|

|

$ |

(528,803 |

) |

|

$ |

69,195 |

|

DONLIN GOLD LLC

NOTES TO FINANCIAL STATEMENTS

(U.S. dollars in thousands)

NOTE 1 – NATURE OF OPERATIONS AND ECONOMIC DEPENDANCE

On December 1, 2007, Barrick Gold U.S. Inc. (“Barrick”) and NOVAGOLD Resources Alaska, Inc. (“NOVAGOLD”), formed Donlin Gold LLC, a Delaware limited liability corporation, (the “Company”) to advance the Donlin Gold Project in Alaska. Barrick and NOVAGOLD each own a 50% interest in the Company. Donlin Gold LLC has a board of four directors, with two nominees selected by each company. All significant decisions related to Donlin Gold LLC require the approval of both companies. The Company currently depends on Barrick and NOVAGOLD for all of its funding and has received commitments from its shareholders that they will fund the Company for the next twelve months from the date of the financial statement. These financial statements have been prepared pursuant to Rule 3-09 of SEC Regulation S-X for inclusion in NOVAGOLD Resources Inc.’s 10-K, as the Company is an equity investee of NOVAGOLD Resources Alaska, Inc., a wholly owned subsidiary of NOVAGOLD Resources Inc.

The Company’s Board of Directors approved the Project's Updated Feasibility Study in July 2012. The Company subsequently initiated the permitting process. The U.S. Army Corps of Engineers (the “Corps”) issued the final Environmental Impact Statement (EIS) on April 27, 2018. On August 13, 2018, the Corps and the Bureau of Land Management (BLM) issued a joint Federal Record of Decision (ROD) for the Donlin Gold Project along with their respective federal permit authorizations. Several major State of Alaska authorizations have also been issued, including the approval of the Donlin Gold Reclamation and Closure Plan, Waste Management Permit, Water Discharge Permit, Permit to Appropriate Water, Title 16 Fish Habitat Permits for the mine area and right of way agreements with the State and BLM. At the end of 2024, four appeals remained active in both the State of Alaska and U.S. Federal courts concerning permits granted for the project. These include: the appeal of the Alaska Department of Environmental Conservation (ADEC) Clean Water Act Section 401 Certificate of Reasonable Assurance at the State Superior Court level; appeals regarding the state pipeline right-of-way and the water rights in the State’s Supreme Court; and one appeal concerning the EIS, ROD, and associated federal permits in the U.S. Federal Court.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Presentation

These financial statements are presented in United States dollars ($) and have been prepared in accordance with accounting principles generally accepted in the United States (GAAP).

Use of estimates

The preparation of the Company’s financial statements requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and the related disclosure of contingent assets and liabilities at the date of the Financial Statements and the reported amounts of revenues and expenses during the reporting period. The significant area requiring the use of management estimates and assumptions relates to environmental, reclamation and closure obligations. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Accordingly, actual results will differ from amounts estimated in these financial statements.

Plant and equipment

On initial recognition, plant and equipment are recorded at cost subject to a ten-thousand-dollar threshold for capitalization. Plant and equipment are subsequently measured at cost less accumulated depreciation. Depreciation is recorded over the estimated useful life of the assets at the following annual rates:

Computer equipment – 5 years straight-line;

Computer software – 5 years straight-line;

Furniture and equipment – 5 years straight-line; and

Leasehold improvements – straight-line over the lease term.

Depreciation methods, useful lives and residual values are reviewed in each financial year and adjusted if appropriate.

DONLIN GOLD LLC

NOTES TO FINANCIAL STATEMENTS

(U.S. dollars in thousands)

Leases

The Company reviews all contracts and determines if the arrangement represents or contains a lease, at inception. Operating leases would be included in Right of use assets and Lease obligations (current and long-term) in the Balance Sheets. The Company does not have any finance leases.

Operating lease ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the lease commencement date based on the estimated present value of lease payments over the lease term. The Company uses its estimated incremental borrowing rate based on the information available at the lease commencement date in determining the present value of future payments. The operating lease ROU asset also includes any upfront lease payments made and excludes lease incentives and initial direct costs incurred. The Company’s lease terms may include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term. Leases with a term of 12 months or less are not recorded on the balance sheet. The Company’s lease agreements do not contain any residual value guarantees.

Mineral properties

All direct costs related to the acquisition of mineral property interests are capitalized. Mineral property exploration expenditures are expensed when incurred. When it has been established that a mineral deposit is commercially mineable, an economic analysis has been completed and permits are obtained, the costs subsequently incurred to develop a mine on the property prior to the start of mining operations are capitalized. Capitalized costs will be amortized following commencement of commercial production using the unit of production method over the estimated life of proven and probable reserves.

Asset retirement obligations

The Company records a liability based on the best estimate of costs for site closure and reclamation activities that the Company is legally or contractually required to undertake. The liability is estimated using expected discounted cash flows based on engineering and environmental reports and accreted to full value over time through periodic charges to income. Adjustments to the reclamation obligation arising from changes in estimates are recorded as a component of the mineral property.

Income taxes

The Company is not a taxable entity for income tax purposes. Accordingly, no recognition is given to income taxes for financial reporting purposes. Tax on the net income (loss) of the Company is borne by the owners through the allocation of taxable income (loss). Net income for financial statement purposes may differ significantly from taxable income for the owners as a result of differences between the tax basis and financial reporting basis of assets and liabilities and the taxable income allocation requirements under the shareholders agreement.

Impairment of long-lived assets

Management assesses the possibility of impairment in the carrying value of its long-lived assets whenever events or circumstances indicate that the carrying amounts of the asset or assets group may not be recoverable. Management calculates the estimated undiscounted future net cash flows relating to the asset or assets. When the carrying value of an asset exceeds the related undiscounted cash flows, the asset is written down to its estimated fair value, which is usually determined using discounted future cash flows. Management’s estimates of mineral prices, mineral reserves, foreign exchange rates, production levels and operating, capital and reclamation costs are subject to risk and uncertainties that may affect the determination of the recoverability of the long-lived asset. It is possible that material changes could occur that may adversely affect management’s estimates.

DONLIN GOLD LLC

NOTES TO FINANCIAL STATEMENTS

(U.S. dollars in thousands)

Cash and cash equivalents

Cash and cash equivalents consist of cash held at a single financial institution. The fair value of the Company’s financial assets, which includes cash, approximates their carrying values due to their short-term nature.

Trade payables

The fair value of the Company’s financial liabilities, such as accounts payable and accrued liabilities approximates their carrying values due to their short-term nature.

Due to related parties

The amounts due to Barrick and NOVAGOLD are non-interest bearing, unsecured and are due on demand.

NOTE 3 – LEASES

The Company currently leases office space under a short-term operating lease with a lease term of one year. The lease requires monthly lease payments during that year.

The Company performed evaluations of its contracts and determined its identified leases are operating and short-term leases. No variable leases with non-cancelable terms greater than one month were identified.

Operating lease expenses are included on the Statements of Loss in General and administrative expense and Mineral property leases and include the following components for the year ended November 30, 2024:

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Operating lease cost

|

|

|

— |

|

|

|

75 |

|

|

Variable lease cost

|

|

|

— |

|

|

|

— |

|

|

Short-term lease cost

|

|

|

944 |

|

|

|

671 |

|

| |

|

$ |

944 |

|

|

$ |

746 |

|

There are no future minimum lease payments under non-cancellable operating leases as of November 30, 2024.

Other information regarding leases for the year ended November 30, 2024, includes the following:

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash paid for operating leases

|

|

$ |

— |

|

|

$ |

87 |

|

|

Right-of-use assets obtained in exchange for lease liabilities

|

|

$ |

— |

|

|

$ |

— |

|

NOTE 4 – PLANT AND EQUIPMENT

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Plant and equipment

|

|

$ |

8,378 |

|

|

$ |

8,296 |

|

|

Accumulated depreciation

|

|

|

(6,446 |

) |

|

|

(5,386 |

) |

| |

|

$ |

1,932 |

|

|

$ |

2,910 |

|

DONLIN GOLD LLC

NOTES TO FINANCIAL STATEMENTS

(U.S. dollars in thousands)

NOTE 5 – MINERAL PROPERTY

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Acquisition cost

|

|

|

64,000 |

|

|

|

64,000 |

|

|

Asset retirement cost

|

|

|

1,308 |

|

|

|

1,230 |

|

| |

|

$ |

65,308 |

|

|

$ |

65,230 |

|

The Donlin Gold Project is located in the Kuskokwim region of southwestern Alaska on private, Alaska Native-owned mineral and surface land and Alaska state mining claims. The property is under lease for subsurface mineral rights from Calista Corporation and surface land rights from The Kuskokwim Corporation, two Alaska Native corporations. The mineral property was jointly owned by Barrick and NOVAGOLD through an unincorporated joint venture prior to the formation of the Company. Upon formation of the Company, the mineral property contributed was recorded based on the predecessor accounting values of Barrick and NOVAGOLD. As such, mineral property includes the historic acquisition cost as the partners’ initial contribution to the Company.

NOTE 6 – RELATED PARTY TRANSACTIONS

The Company received management, administrative services, and third party contracted services on behalf of the Company from Barrick for $452 in 2024, $332 in 2023, and $1,288 in 2022, and received from NOVAGOLD third party contracted services on behalf of the Company for $815 in 2024, $923 in 2023, and $681 in 2022. Both Barrick and NOVAGOLD amounts are included in General and Administrative, and drilling, studies and engineering expense.

The Company has accounts payable to Barrick at November 30, 2024 of $84 (2023: $474) for reimbursement of management, administrative services, and third party contracted services on behalf of the Company and to NOVAGOLD of $144 (2023: $243) for reimbursement of third party contracted services on behalf of the Company.

NOTE 7 – RECLAMATION AND REMEDIATION

Significant reclamation and closure activities include rehabilitation and decommissioning of the camp and drill sites. Although the ultimate amount or timing of reclamation costs cannot be predicted with certainty, the estimated discounted cash flows required to settle the Company’s obligations for work undertaken at the site to date is $1,640.

| |

|

At November 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Reclamation and Remediation

|

|

|

1,482 |

|

|

|

1,403 |

|

|

Changes in estimated costs and timing

|

|

|

78 |

|

|

|

— |

|

|

Accretion

|

|

|

80 |

|

|

|

79 |

|

| |

|

$ |

1,640 |

|

|

$ |

1,482 |

|

During the year, the discounted reclamation cost estimate was accreted resulting in a change in the measurement of the liability of $80 with a revised estimate of timing and amount resulting in an adjustment of $78. The estimated cash flows are assumed to commence in five years from the balance sheet date.

NOTE 8 – MINERAL PROPERTY LEASES

The Company leases certain assets, such as mineral property leases, that are an exception to applying lease accounting under ASC 842. These mineral property leases coincide with the currently projected Donlin Gold mine life, with provisions for a further extension, should production continue beyond that. Future minimum annual mineral property lease payments are $3,567 in 2025, $3,567 in 2026, $3,567 in 2027, $3,567 in 2028, and $3,567 in 2029 totaling $17,835.

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-117370, No. 333-134871, No. 333-136493, No. 333-164083, No. 333-171630, No. 333-197648, and No. 333-239776) of NOVAGOLD RESOURCES INC. of our report dated January 21, 2025 relating to the financial statements of Donlin Gold LLC, which appears in this Form 10-K/A.

/s/ PricewaterhouseCoopers LLP

Chartered Professional Accountants

Vancouver, Canada

March 10, 2025

Exhibit 31.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

PURSUANT TO RULE 13a-14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

I, Gregory A. Lang, certify that:

1. I have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of NOVAGOLD Resources Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| |

By: |

/s/ Gregory A. Lang |

| |

Gregory A. Lang |

| Date: March 10, 2025 |

President and Chief Executive Officer |

Exhibit 31.2

CERTIFICATION OF CHIEF FINANCIAL OFFICER

PURSUANT TO RULE 13a-14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

I, Peter Adamek, certify that:

1. I have reviewed this Amendment No. 1 to the Annual Report on Form 10-K of NOVAGOLD Resources Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| |

By:

|

/s/ Peter Adamek

|

| |

Gregory A. Lang

|

|

Date: March 10, 2025

|

Vice President and Chief Financial Officer

|

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. §1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with this Amendment No. 1 to the Annual Report of NOVAGOLD Resources Inc. (the “Company”) on Form 10-K for the year ended November 30, 2024, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Gregory A. Lang, Chief Executive Officer of the Company, certify that:

1. The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date: March 10, 2025 |

By:

|

/s/ Gregory A. Lang

|

| |

Gregory A. Lang

|

|

|

President and Chief Executive Officer

|

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. §1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with this Amendment No. 1 to the Annual Report of NOVAGOLD Resources Inc. (the “Company”) on Form 10-K for the year ended November 30, 2024, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I, Peter Adamek, Chief Financial Officer of the Company, certify that:

1. The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date: March 10, 2025 |

By:

|

/s/ Peter Adamek

|

| |

Gregory A. Lang

|

|

|

Vice President and Chief Financial Officer

|

v3.25.0.1

Document And Entity Information - USD ($)

|

Nov. 30, 2024 |

Jan. 13, 2025 |

May 31, 2024 |

| Document Information [Line Items] |

|

|

|

| Entity, Registrant Name |

NOVAGOLD RESOURCES INC.

|

|

|

| Current Fiscal Year End Date |

--11-30

|

|

|

| Document, Fiscal Period Focus |

FY

|

|

|

| Document, Fiscal Year Focus |

2024

|

|

|

| Document, Type |

10-K/A

|

|

|

| Document, Annual Report |

true

|

|

|

| Document, Period End Date |

Nov. 30, 2024

|

|

|

| Document, Transition Report |

false

|

|

|

| Entity, File Number |

001-31913

|

|

|

| Entity, Incorporation, State or Country Code |

A1

|

|

|

| Entity, Address, Address Line One |

201 South Main Street, Suite 400

|

|

|

| Entity, Address, City or Town |

Salt Lake City

|

|

|

| Entity, Address, State or Province |

UT

|

|

|

| Entity, Address, Postal Zip Code |

84111

|

|

|

| City Area Code |

801

|

|

|

| Local Phone Number |

639-0511

|

|

|

| Title of 12(b) Security |

Common Shares

|

|

|

| Trading Symbol |

NG

|

|

|

| Security Exchange Name |

NYSE

|

|

|

| Entity, Well-known Seasoned Issuer |

Yes

|

|

|

| Entity, Voluntary Filers |

No

|

|

|

| Entity, Current Reporting Status |

Yes

|

|

|

| Entity, Interactive Data, Current |

Yes

|

|

|

| Entity, Filer Category |

Large Accelerated Filer

|

|

|

| Entity, Small Business |

false

|

|

|

| Entity, Emerging Growth Company |

false

|

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Document, Financial Statement Error Correction Flag |

false

|

|

|

| Entity, Shell Company |

false

|

|

|

| Entity, Public Float |

|

|

$ 967,700,000

|

| Entity, Common Stock Shares, Outstanding |

|

334,646,571

|

|

| Amendment Description |

NOVAGOLD RESOURCES INC. is filing this Amendment No. 1 (the “Amendment No. 1”) to our Annual Report on Form 10-K for the fiscal year ended November 30, 2024 as filed with the SEC on January 23, 2025 (the “Original Form 10-K”). This Amendment No. 1 amends Part IV, Item 15 to correct a typographical error in the Report of Independent Registered Public Accounting Firm related to the financial statements of Donlin Gold LLC for the three-year period ended November 30, 2024, which are included in the Original Form 10-K pursuant to Rule 3-09 of Regulation S-K. The original audit report to the Donlin Gold LLC financial statements inadvertently omitted a reference to the audit of the financial statements for the fiscal year ended November 30, 2022, despite the fact that all three fiscal years—2024, 2023, and 2022—had been audited.

The corrected audit report, which properly includes an opinion covering all three fiscal years and related financial statements of Donlin Gold LLC are filed as part of this Amendment No. 1 and are included as financial statement schedules in Item 15, “Exhibits and Financial Statement Schedules” of this Amendment No. 1.

The consent of PricewaterhouseCoopers LLP, independent auditors for Donlin Gold LLC, is filed as an exhibit to this Amendment No. 1, as well as the certifications required under Section 302 and 906 of the Sarbanes-Oxley Act of 2002.

No other changes have been made to the Form 10-K as originally filed, and this Amendment No. 1 does not reflect any events occurring after the filing of the Original Form 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K and the Company's other filings with the SEC.

|

|

|

| Amendment Flag |

true

|

|

|

| Entity, Central Index Key |

0001173420

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |