UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number 001-38628

SilverCrest Metals Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

570 Granville Street, Suite 501

Vancouver, British Columbia V6C 3P1

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SILVERCREST METALS INC. |

|

| |

|

|

|

| Date: October 9, 2024 |

By: |

/s/ Sean Deissner |

|

| |

Name: |

Sean Deissner |

|

| |

Title: |

VP, Financial Reporting |

|

INDEX TO EXHIBITS

EXHIBIT 99.1

Form 51-102F3

MATERIAL CHANGE REPORT

| Item 1 | Name and Address of Company |

SilverCrest Metals Inc. (“SilverCrest“)

570 Granville Street, Suite 501

Vancouver, British Columbia V6C 3P1

| Item 2 | Date of Material Change |

October 3, 2024

A joint news release was disseminated by SilverCrest

and Coeur Mining, Inc. (“Coeur”) on October 4, 2024 through Canada Newswire and subsequently filed under SilverCrest’s

profile on SEDAR+ at www.sedarplus.ca

| Item 4 | Summary of Material Change |

On October 4, 2024, SilverCrest and Coeur announced

that they entered into a definitive arrangement agreement dated October 3, 2024 (the “Agreement”), pursuant to which,

among other things, a wholly owned subsidiary of Coeur will acquire all of the issued and outstanding common shares of SilverCrest (the

“SilverCrest Shares”) by way of a court approved plan of arrangement (the “Plan of Arrangement”)

under the Business Corporations Act (British Columbia) for consideration of 1.6022 Coeur common shares (each whole share, a “Coeur

Share”) for each SilverCrest Share (the “Transaction”). Immediately following the completion of the Transaction,

SilverCrest will be a wholly owned subsidiary of Coeur and the SilverCrest Shares will be delisted from the Toronto Stock Exchange and

the NYSE American Stock Exchange (“NYSE American”).

| Item 5 | Full Description of Material Change |

| 5.1 | Full Description of Material Change |

The Transaction

On October 4, 2024, SilverCrest and Coeur announced

that they entered into the Agreement, pursuant to which, among other things, a wholly owned subsidiary of Coeur will acquire all of the

issued and outstanding SilverCrest Shares. The Transaction will be implemented by way of the Plan of Arrangement, subject to the satisfaction

of certain conditions as described in more detail below.

Under the terms of the Agreement, SilverCrest

shareholders will receive 1.6022 Coeur Shares for each SilverCrest Share (the “Exchange Ratio”). The Exchange Ratio

implies consideration of $11.34 per SilverCrest Share, based on the closing price of the Coeur Shares on the New York Stock Exchange (“NYSE”)

on October 3, 2024. This represents an 18% premium based on the 20-day volume-weighted average prices of Coeur and SilverCrest each as

at October 3, 2024 on the NYSE and NYSE American, respectively, and a 22% premium to the October 3, 2024 closing price of SilverCrest

on the NYSE American. This implies a total equity value of approximately $1.7 billion based on SilverCrest’s common shares outstanding.

Upon completion of the Transaction, existing Coeur stockholders and SilverCrest shareholders will own approximately 63% and 37% of the

outstanding common shares of the combined company, respectively.

All figures are in U.S. dollars unless denoted

otherwise.

The proposed Transaction will be effected pursuant

to the Plan of Arrangement, which is required to be approved by a British Columbia court. The Transaction will also require approval by:

(i) 66 2/3 percent of the votes cast by the shareholders of SilverCrest; (ii) 66 2/3 percent of the votes cast by the shareholders and

option holders of SilverCrest, voting together as a single class; and (iii) a simple majority of votes cast by the shareholders of SilverCrest,

excluding those votes attached to SilverCrest Shares held by persons required to be excluded pursuant to Multilateral Instrument 61-101

– Protection of Minority Security Holder in Special Transaction, at a special meeting of SilverCrest shareholders and optionholders

expected to be held around January 2025 (collectively, the “SilverCrest Securityholder Approval”). The issuance of

Coeur Shares as consideration pursuant to the Transaction and an amendment to the Coeur certificate of incorporation to increase the number

of authorized Coeur Shares is also subject to approval by the Coeur stockholders at a special meeting also expected to be held around

January 2025 (collectively, the “Coeur Stockholder Approval”). The directors and senior officers of SilverCrest and

Coeur have entered into customary voting support agreements, pursuant to which they have committed to vote their common shares held in

favour of the Transaction. Additionally, upon closing of the Transaction, N. Eric Fier and one other current SilverCrest director are

expected to join Coeur’s board of directors.

Conditions to Completion of the Transaction

The obligation of the parties to consummate

the Transaction is subject to customary closing conditions, including, among others: (i) the SilverCrest Securityholder Approval; (ii)

the Coeur Stockholder Approval; (iii) approval of the Transaction by a British Columbia court; (iv) approval of the Transaction under

Mexican Antitrust Law (as defined in the Agreement) (the “Mexico Antitrust Approval”); (v) approval of the listing

of the Coeur Shares to be issued under the Transaction on the NYSE (subject only to official notice of issuance); (vi) the absence of

any law or order prohibiting the consummation of the Transaction; (vii) the appointment of two of SilverCrest’s directors to the

board of directors of Coeur, to be effective at the Effective Time (as defined in the Agreement); and (viii) SilverCrest shareholders

not having validly exercised dissent rights in connection with the Transaction with respect to more than 5% of the issued and outstanding

SilverCrest Shares.

Representations, Warranties and Covenants

The Agreement contains customary representations,

warranties and covenants by each of Coeur and SilverCrest including, among others, covenants by each of Coeur and SilverCrest to conduct

its business in the ordinary course consistent with past practice during the period between the date of the Agreement and the Effective

Time and to not engage in certain kinds of transactions or take certain actions during this period without the prior written consent of

the other party (subject to certain exceptions specified in the Agreement). In addition, each of Coeur and SilverCrest and their respective

representatives are subject to reciprocal “non-solicitation” restrictions on their ability to, among other things, solicit

proposals or offers that constitute or may reasonably be expected to constitute or lead to an Acquisition Proposal (as defined in the

Agreement), except as permitted pursuant to certain “fiduciary out” provisions that allow the applicable board of directors

to respond to a Superior Proposal (as defined in the Agreement), subject to the right of the other party to match such proposal.

Termination

The Agreement may be terminated in certain customary

circumstances, including, among others, in circumstances where: (i) the Effective Time has not occurred prior to May 19, 2025 (which

date, if the Mexico Antitrust Approval has not been obtained and all other conditions to closing have been satisfied or waived on such

date, will be automatically extended to August 19, 2025); (ii) any law is enacted, made or enforced that makes the consummation of

the Transaction illegal; (iii) the SilverCrest Securityholder Approval is not obtained; (iv) the Coeur Stockholder Approval is not

obtained; (v) Coeur or SilverCrest materially breaches its representations, warranties or covenants contained in the Agreement, subject

to certain conditions; (vi) Coeur or SilverCrest materially breaches its non-solicitation obligations; or (vii) Coeur or SilverCrest

accepts a Superior Proposal.

If the Agreement is terminated in certain specified

circumstances, SilverCrest or Coeur would be required to pay the other party a termination fee of $60 million and $100 million, respectively.

Further, a reciprocal expense reimbursement fee of up to a maximum amount of $17 million is payable by one party to the other party in

certain circumstances if the Transaction is not completed.

Board of Directors’ Recommendations

After consultation with its outside financial

and legal advisors, the board of directors of Coeur have unanimously approved the Transaction. The board of directors of Coeur recommends

that Coeur stockholders vote in favour of the Transaction.

SilverCrest appointed a special committee of

independent directors to consider and make a recommendation with respect to the Transaction. Based on the unanimous recommendation of

the SilverCrest special committee of independent directors, and after consultation with its outside financial and legal advisors, the

board of directors of SilverCrest has unanimously approved the Transaction. The board of directors of SilverCrest recommends that SilverCrest

securityholders vote in favour of the Transaction.

Cormark Securities Inc. and Raymond James Ltd.

have each provided fairness opinions to the SilverCrest board of directors, and Scotiabank has provided a fairness opinion to

the SilverCrest special committee, to the effect that, as of the date thereof, and based upon and subject to the assumptions, limitations

and qualifications stated in each such opinion, the consideration received is fair, from a financial point of view, to the shareholders

of SilverCrest.

Additional Information

Additional information regarding the Transaction

will be provided in the Coeur proxy statement and SilverCrest information circular. The Transaction is expected to be completed in the

first quarter of 2025.

The foregoing description of the Transaction

and the Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement.

A copy of the Agreement has been filed on SilverCrest’s SEDAR+ profile and is available for viewing at www.sedarplus.ca.

| 5.2 | Disclosure for Restructuring Transactions |

Not applicable.

| Item 6 | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7 | Omitted Information |

No information has been omitted on the basis that it is confidential

information.

N. Eric Fier, Chief Executive Officer

Phone: +1 (604) 694-1730

October 9, 2024

Cautionary Note Regarding Forward Looking Information

Certain statements in this document concerning

the proposed Transaction, including any statements regarding the expected timetable for completing the Transaction and any other statements

regarding SilverCrest’s future expectations, beliefs, plans, assumptions or future events or performance that are not historical

facts are “forward-looking” statements based on assumptions currently believed to be valid. Forward-looking statements are

all statements other than statements of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,”

“predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,”

“potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,”

“strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify

forward-looking statements. Specific forward-looking statements include, but are not limited to, statements regarding Coeur’s or

SilverCrest’s plans and expectations with respect to the proposed Transaction. The forward-looking statements are intended to be

subject to the safe harbor provided by Section 27A of the Securities Act, Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities laws.

These forward-looking statements involve

significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited

to, the possibility that shareholders of SilverCrest may not approve the Transaction or stockholders of Coeur may not approve the stock

issuance or the charter amendment; the risk that any other condition to closing of the Transaction may not be satisfied; the risk that

the closing of the Transaction might be delayed or not occur at all; the anticipated timing of mailing proxy statements and circulars

regarding the Transaction; the risk that the either Coeur or SilverCrest may terminate the Agreement and either Coeur or SilverCrest is

required to pay a termination fee to the other party; potential adverse reactions or changes to business or employee relationships of

Coeur or SilverCrest, including those resulting from the announcement or completion of the Transaction; the diversion of management time

on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Coeur and SilverCrest; the effects

of the business combination of Coeur and SilverCrest, including the combined company’s future financial condition, results of operations,

strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes

in capital markets and the ability of the combined company to finance operations in the manner expected; the risk that Coeur or SilverCrest

may not receive the required stock exchange and regulatory approvals of the Transaction; the expected listing of shares on the NYSE; the

risk of any litigation relating to the proposed Transaction; the risk of changes in governmental regulations or enforcement practices;

the effects of commodity prices, life of mine estimates; the timing and amount of estimated future production; the risks of mining activities;

and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation

of the Transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation,

strategies for the combined company’s operations, gold and silver market conditions, legal, economic and regulatory conditions,

and environmental matters are only forecasts regarding these matters.

Additional factors that could cause results

to differ materially from those described above can be found in Coeur’s Annual Report on Form 10-K for the year ended December 31,

2023, and subsequent Quarterly Reports on Form 10-Q, which are on file with the SEC and available from Coeur’s website at www. coeur.com

under the “Investors” tab, and in other documents Coeur files with the SEC and in SilverCrest’s annual information form

for the year ended December 31, 2023, which is on file with the SEC and on SEDAR+ and available from SilverCrest’s website

at www.silvercrestmetals.com under the “Investors” tab, and in other documents SilverCrest files with the SEC or on SEDAR+.

All forward-looking statements speak only

as of the date they are made and are based on information available at that time. Neither Coeur nor SilverCrest assumes any obligation

to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were

made or to reflect the occurrence of unanticipated events except as required by applicable securities laws. As forward-looking statements

involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

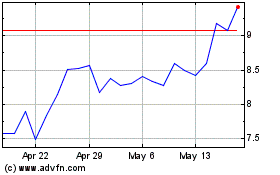

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Nov 2024 to Dec 2024

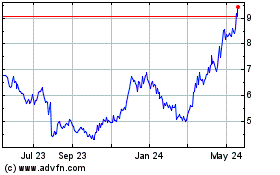

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Dec 2023 to Dec 2024