UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024.

Commission File Number 001-38628

| | |

| SilverCrest Metals Inc. |

| (Translation of registrant’s name into English) |

| | |

570 Granville Street, Suite 501 Vancouver, British Columbia V6C 3P1 Canada |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| Date: October 10, 2024 | /s/ Sean Deissner______________ Sean Deissner Vice President, Financial Reporting |

INDEX TO EXHIBITS

SilverCrest Provides Third Quarter Operational Results and Conference Call Details

Record Revenue, Positioned to Meet or Exceed 2024 Sales Guidance

TSX: SIL | NYSE American: SILV For Immediate Release

VANCOUVER, BC – October 10, 2024 – SilverCrest Metals Inc. (“SilverCrest” or the “Company”) is pleased to provide interim operational results for the third quarter of 2024 (“Q3 2024”) from the Company’s Las Chispas Operation located in Sonora, Mexico. All amounts are expressed in U.S. dollars, unless otherwise noted. Certain amounts shown in this news release may not total to exact amounts due to rounding differences.

Q3 2024 Operating Highlights

•Recovered 14,928 ounces (“oz”) gold and 1.41 million ounces silver, or 2.60 million silver equivalent (“AgEq”)1 ounces.

•Sold 15,204 ounces gold and 1.45 million ounces silver, or 2.66 million AgEq ounces.

•Generated record revenue of $80.4 million, a 10% increase from Q2 2024.

•Average realized prices of $2,472/oz gold and $29.48/oz silver, increases of 11% and 6% respectively from Q2 2024.

•Treasury assets increased 29% from Q2 2024 to $158.2 million, including $120.9 million cash and $37.4 million bullion.

N. Eric Fier, CEO commented, “We are pleased to announce another quarter of record revenues, a testament to consistent performance from the Las Chispas Operation, coupled with strong metal prices. With silver equivalent sales of 7.9 million ounces in the first three quarters of the year, we are well positioned to deliver at or above the top end of our 2024 annual sales guidance of 10 to 10.3 million ounces AgEq. Our treasury assets continued to grow with increases to both our cash (up 23%) and bullion holdings (up 56%) leading to an ending position of $158.2 million.

Ore mined in the quarter increased by 24% from the previous quarter and continues to track ahead of plan as we benefit from maintaining two underground mining contractors. This acceleration of our mining rate has allowed us to increase our operational flexibility. During the quarter, our team successfully performed capacity testing at the plant which resulted in higher throughput for a portion of the quarter. As planned, we expect plant throughput to return to the range of 1,200 tonnes per day for the remainder of the year.

We are proud to deliver another strong quarter of operational results and look forward to releasing our full financial results on November 12, 2024.”

1 Silver equivalent (“AgEq”) ratio used in this news release of 79.51:1 based on the Las Chispas Operation Technical Report, dated September 5, 2023 with an effective date of July 19, 2023.

Q3 2024 Operational Highlights

| | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | Nine months ended

September 30, |

| | Unit | 2024 | 2023 | 2024 | 2023 |

| Ore mined | tonnes | 124,229 | 83,800 | 309,985 | 222,300 |

Ore milled (a) | tonnes | 121,775 | 114,500 | 325,793 | 326,900 |

| Average daily mill throughput | tpd | 1,324 | 1,245 | 1,189 | 1,197 |

| | | | | | |

| Gold (Au) | | | | | |

| Average processed grade | gpt | 3.87 | 4.35 | 4.35 | 4.42 |

Process recovery | % | 98.5% | 98.3% | 98.5% | 98.1% |

| Recovered | oz | 14,928 | 15,700 | 44,950 | 45,600 |

| Sold | oz | 15,204 | 14,500 | 44,704 | 42,100 |

| Average realized price | $/oz | 2,472 | 1,931 | 2,258 | 1,933 |

| | | | | | |

| Silver (Ag) | | | | | |

| Average processed grade | gpt | 366 | 413 | 416 | 427 |

Process recovery | % | 98.3% | 98.1% | 98.2% | 96.1% |

| Recovered | million oz | 1.41 | 1.49 | 4.28 | 4.31 |

| Sold | million oz | 1.45 | 1.53 | 4.30 | 4.34 |

| Average realized price | $/oz | 29.48 | 23.41 | 26.94 | 23.60 |

| | | | | | |

| Silver equivalent (AgEq) | | | | | |

Average processed grade | gpt | 674 | 759 | 762 | 778 |

Process recovery | % | 98.4% | 98.2% | 98.4% | 97.0% |

| Recovered | million oz | 2.60 | 2.74 | 7.85 | 7.93 |

| Sold | million oz | 2.66 | 2.68 | 7.85 | 7.69 |

(a) Ore milled includes material from stockpiles and ore mined.

Q3 2024 Conference Call

The Company’s unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2024 will be released after market on November 12, 2024.

A conference call to discuss the Company’s Q3 2024 operational and financial results will be held Wednesday, November 13, 2024 at 8:00 a.m. PT / 11:00 a.m. ET. To participate in the conference call, please dial the numbers below.

Date & Time: Wednesday, November 13, 2024 at 8:00 a.m. PT / 11:00 a.m. ET

Telephone: North America Toll Free: 1-800-274-8461

Conference ID: SILVER (745837)

Webcast: https://silvercrestmetals.com/investors/presentations/

Qualified Persons Statement

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier, CPG, P.Eng, CEO for SilverCrest, who has reviewed and approved its contents.

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals producer headquartered in Vancouver, BC. The Company’s principal focus is its Las Chispas Operation in Sonora, Mexico. SilverCrest has an ongoing initiative to increase its asset base by expanding current resources and reserves, acquiring, discovering, and developing high value precious metals projects and ultimately operating multiple silver-gold mines in the Americas. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” and “forward-looking information” (collectively “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation. These include, without limitation, statements with respect to: the amount of future production of gold and silver over any period; the strategic plans and expectations for the Company’s operation and exploration program; working capital requirements; expected recoveries; expected cash costs and outflows; and the timing of release of the Company’s unaudited condensed interim consolidated financial statements for the three months and nine months ended September 30, 2024. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: present and future business strategies; continued commercial operations at the Las Chispas Operation; the environment in which the Company will operate in the future, including the price of gold and silver; estimates of capital and operating costs; production estimates; estimates of mineral resources, mineral reserves and metallurgical recoveries and mining operational risk; the reliability of mineral resource and mineral reserve estimates; mining and development costs; the conditions in general economic and financial markets; availability of skilled labour; timing and amount of expenditures related to exploration programs; and effects of regulation by governmental agencies and changes in Mexican mining legislation. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; fluctuations in gold and silver prices; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

| | | | | |

For Further Information: SilverCrest Metals Inc. |

Contact: Telephone: Fax: Toll Free: Email: Website: | Lindsay Bahadir, Senior Manager Investor Relations and Organizational Effectiveness +1 (604) 694-1730 +1 (604) 357-1313 1-866-691-1730 (Canada & USA) info@silvercrestmetals.com www.silvercrestmetals.com |

570 Granville Street, Suite 501 Vancouver, British Columbia V6C 3P1 |

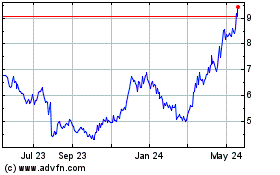

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Jan 2025 to Feb 2025

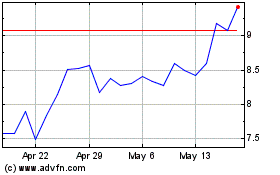

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Feb 2024 to Feb 2025