UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number 001-38628

SilverCrest Metals Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

570 Granville Street, Suite 501

Vancouver, British Columbia V6C 3P1

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SILVERCREST METALS INC. |

|

| |

|

|

|

| Date: February 6, 2025 |

By: |

/s/ Sean Deissner |

|

| |

Name: |

Sean Deissner |

|

| |

Title: |

VP, Financial Reporting |

|

INDEX TO EXHIBITS

EXHIBIT 99.1

AMENDMENT TO PLAN OF ARRANGEMENT

THIS AMENDMENT is made as of February

5, 2025.

BY AND AMONG:

COEUR MINING, INC., a corporation existing

under the laws of the State of Delaware (the “Parent”),

- and -

1504648 B.C. UNLIMITED LIABILITY COMPANY,

an unlimited liability company existing under the laws of the Province of British Columbia (“Parent Canadian Sub”),

- and -

COEUR ROCHESTER, INC., a company existing

under the laws of the State of Delaware (“Parent U.S. Sub”),

- and -

SILVERCREST METALS INC., a corporation

existing under the laws of the Province of British Columbia (the “Company”),

- and -

COMPAÑÍA MINERA LA LLAMARADA,

S.A. DE C.V., a company existing under the laws of Mexico (“Company Mexican Sub”).

RECITALS:

| A. | The Parent, Parent Canadian Sub, Parent U.S. Sub, the Company and Company Mexican Sub (collectively, the

“Parties”, each a “Party”) are parties to an arrangement agreement dated as of October 3, 2024 pursuant

to which, among other things, Coeur has agreed to acquire, through Coeur Canadian Sub and as of the Effective Date, all of the issued

and outstanding common shares of SilverCrest (the “Arrangement Agreement”). |

| B. | The Parties hereby wish to amend the Plan of Arrangement in accordance with Section 5.2 of the Plan of

Arrangement and Section 9.5 of the Arrangement Agreement, as provided in this Amendment. |

| C. | In the reasonable opinion of Company and Parent, the amendments set forth herein are of an administrative

or ministerial nature required to give effect to the implementation of the Plan of Arrangement and are not adverse to the financial or

economic interests of any of the Company Shareholders or holders of Company Options. |

THEREFORE, in consideration of the mutual

covenants contained herein (the receipt and sufficiency of which are hereby acknowledged), the Parties agree as follows:

Article 1

Interpretation

Capitalized terms used but not defined in this

Amendment have the meanings ascribed to them in the Arrangement Agreement.

| 1.2 | Interpretation not Affected by Headings |

The division of this Amendment into Articles,

Sections, subsections and paragraphs and the insertion of headings are for convenience of reference only and shall not affect in any way

the meaning or interpretation of this Amendment. Unless the contrary intention appears, references in this Amendment to an Article, Section,

subsection or paragraph or both refer to the Article, Section, subsection or paragraph, respectively, bearing that designation in this

Amendment.

In this Amendment, unless the contrary intention

appears, words importing the singular include the plural and vice versa, and words importing gender shall include all genders.

Article 2

amendments

| 2.1 | Amendment to Section 1.1 of the Plan of Arrangement |

Section 1.1 of the Plan of Arrangement is hereby

amended by amending and restating the following definition:

“Effective Time” means

5:00 a.m. on the Effective Date or such other time as Parent and Company agree to in writing before the Effective Date;

| 2.2 | Amendment to Section 1.5 of the Plan of Arrangement |

Section 1.5 of the Plan of Arrangement is hereby

amended and restated in its entirety as follows:

1.5 Date

for Any Action

If the date on which any action is required

to be taken hereunder by a Party is not a business day, such action shall be required to be taken on the next succeeding day which is

a business day. Notwithstanding the forgoing, for the purposes of Section 2.3(h), if the date on which any action is required to be taken

hereunder by a Party is not a business day, such action shall be taken on the next succeeding calendar day (which, for greater certainty,

may be a Saturday, a Sunday or a statutory or civic holiday in New York, New York, Mexico City, Mexico, or Vancouver, British Columbia).

Article 3

General Provisions

| 3.1 | Ratification and Confirmation |

The Plan of Arrangement, as amended herein,

is set forth in Schedule A hereto and remains in full force and effect and is hereby ratified and confirmed. Provisions of the Arrangement

Agreement and Plan of Arrangement that have not been amended by this Amendment remain in full force and effect, unamended. All rights

and liabilities that have accrued to any Party under the Arrangement Agreement up to the date of this Amendment remain unaffected by this

Amendment.

| 3.2 | Arrangement Agreement Provisions |

The provisions of Article 5 of the Arrangement

Agreement shall apply, mutatis mutandis, to this Amendment.

| 3.3 | Counterparts, Execution |

This Amendment may be executed in one or more

counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument.

The Parties shall be entitled to rely upon delivery of an executed facsimile or similar executed electronic copy of this Amendment, and

such facsimile or similar executed electronic copy shall be legally effective to create a valid and binding agreement between the Parties.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF the Parties have

executed this Amendment as of the date first written above.

| |

COEUR MINING, INC. |

|

| |

|

|

|

|

| |

By: |

(Signed)

“Mitchell J. Krebs” |

|

| |

|

Name: |

Mitchell J. Krebs |

|

| |

|

Title: |

Chairman, President and Chief

Executive Officer

|

|

| |

1504648 B.C. UNLIMITED LIABILITY COMPANY |

|

| |

|

|

|

|

| |

By: |

(Signed)

“Mitchell J. Krebs” |

|

| |

|

Name: |

Mitchell J. Krebs |

|

| |

|

Title: |

President |

|

| |

COEUR ROCHESTER INC. |

|

| |

|

|

|

|

| |

By: |

(Signed)

“Mitchell J. Krebs” |

|

| |

|

Name: |

Mitchell J. Krebs |

|

| |

|

Title: |

President |

|

| |

SILVERCREST METALS INC. |

|

| |

|

|

|

|

| |

By: |

(Signed)

“N. Eric Fier” |

|

| |

|

Name: |

N. Eric Fier |

|

| |

|

Title: |

Chief Executive Officer |

|

| |

COMPAÑÍA MINERA LA LLAMARADA, S.A. DE C.V. |

|

| |

|

|

|

|

| |

By: |

(Signed)

“N. Eric Fier” |

|

| |

|

Name: |

N. Eric Fier |

|

| |

|

Title: |

President |

|

[Signature Page to Amendment to Plan of Arrangement]

Schedule A

AMENDED AND RESTATED PLAN OF ARRANGEMENT

(Please see attached)

PLAN OF ARRANGEMENT

UNDER SECTION 288 OF THE

BUSINESS CORPORATIONS ACT (BRITISH COLUMBIA)

Article

1

DEFINITIONS AND INTERPRETATION

In this Plan of Arrangement, unless the context

otherwise requires:

“Amalco” has the meaning

given to it in Section 2.3(k);

“Amalco Shares” means the

common shares in the authorized share structure of Amalco;

“Amalco Directors” means

Mitchell J. Krebs, Thomas S. Whelan and Anne Beckelheimer;

“Amalco Officers” means

Mitchell J. Krebs as President, Michael Routledge as Vice President, Casey M. Nault as Corporate Secretary, Emilie Schouten as Vice President,

Kenneth J. Watkinson as Vice President, Anne Beckelheimer as Treasurer, Kyle J. Swanson as Assistant Secretary and Brad Vujtech as Assistant

Treasurer;

“Amalgamation” has the meaning

given to it in Section 2.3(k);

“Applicable Federal Rate”

means the interest rate provided for under Section 1274(d) of the U.S. Tax Code;

“Arrangement” means the

arrangement of Company under Part 9, Division 5 of the BCBCA on the terms and subject to the conditions set out in this Plan of Arrangement,

subject to any amendments or variations thereto made in accordance with the terms of the Arrangement Agreement, this Plan of Arrangement,

or made at the direction of the Court in the Final Order (with the prior written consent of both Company and Parent, each acting reasonably);

“Arrangement Agreement”

means the arrangement agreement dated October 3, 2024 among Parent, Parent Canadian Sub, Parent U.S. Sub, Company Mexican Sub and Company

to which this Plan of Arrangement is attached as Schedule A, including all schedules annexed thereto, together with the Company Disclosure

Letter and the Parent Disclosure Letter, as the same may be amended, supplemented or otherwise modified from time to time in accordance

with the terms thereof;

“Arrangement Resolution”

means the special resolution of the Company Securityholders approving the Plan of Arrangement, which is to be considered and, if thought

fit, passed at the Company Meeting, substantially in the form and content of Schedule B to the Arrangement Agreement;

“Authorization” means, with

respect to any Person, any authorization, order, permit, approval, grant, agreement, licence, classification, restriction, registration,

consent, order, right, notification, condition, franchise, privilege, certificate, judgment, writ, injunction, award, determination,

direction or decision having the force of Law,

of, from or required by any Governmental Entity having jurisdiction over such Person;

“BCBCA” means the Business

Corporations Act (British Columbia) and the regulations made thereunder, as now in effect and as they may be promulgated or amended

from time to time;

“Bullion” means all gold

bullion and silver bullion, whether finished goods produced by or on behalf of Company and its affiliates or acquired from third parties;

“business day” means any

day, other than a Saturday, a Sunday or a statutory or civic holiday in New York, New York, Mexico City, Mexico, or Vancouver, British

Columbia;

“Company” means SilverCrest

Metals Inc., a corporation existing under the laws of the Province of British Columbia;

“Company Canadian Sub” means

NorCrest Metals Inc., a corporation existing under the laws of the Province of British Columbia, Canada, that is a direct wholly owned

subsidiary of the Company;

“Company Canadian Sub Shares”

means the common shares in the authorized share structure of Company Canadian Sub;

“Company DSU Plan” means

the deferred share unit plan of Company effective December 19, 2019;

“Company DSUs” means the

outstanding deferred share units granted under the Company DSU Plan and the Company Share Unit Plan;

“Company Equity Incentive Plans”

means, collectively, the Company Share Unit Plan, the Company Option Plans and the Company DSU Plan;

“Company Incentive Awards”

means, collectively, the Company DSUs, Company RSUs, Company Options and Company PSUs;

“Company Loan” has the meaning

given to it in Section 2.3(c);

“Company Meeting” means

the special meeting of Company Securityholders, including any adjournment or postponement thereof, to be called and held in accordance

with the Interim Order to consider the Arrangement Resolution and for any other purpose as may be set out in the Company Circular and

agreed to in writing by Parent;

“Company Mexican Sub” means

Compañía Minera La Llamarada, S.A. de C.V., a company existing under the laws of Mexico that is an indirect wholly owned

subsidiary of Company;

“Company Optionholder” means

a holder of Company Options;

“Company Option Plans” means,

collectively, the New Company Option Plan and the Legacy Company Option Plan;

“Company Options” means

the outstanding options to purchase Company Shares granted under the Company Option Plans;

“Company PSUs” means the

outstanding performance share units granted under the Company Share Unit Plan;

“Company RSUs” means the

outstanding restricted share units granted under the Company Share Unit Plan;

“Company Securityholders”

means the Company Shareholders and the Company Optionholders;

“Company Shareholders” means

the registered and/or beneficial holders of Company Shares, as the context requires;

“Company Shares” means the

common shares in the authorized share structure of Company;

“Company Share Unit Plan”

means the equity share unit plan of the Company effective June 3, 2021;

“Consideration” means the

consideration to be received by the Company Shareholders (other than Dissenting Shareholders) pursuant to this Plan of Arrangement for

their Company Shares, consisting of such number of Parent Shares equal to the Exchange Ratio for each Company Share;

“Consideration Shares” means

the Parent Shares to be issued to the Company Shareholders pursuant to this Plan of Arrangement;

“Court” means the Supreme

Court of British Columbia;

“Depositary” means Computershare

Investor Services Inc., or such other Person as Parent and Company may appoint (acting reasonably) to act as depositary in respect of

the Arrangement;

“Dissent Rights” has the

meaning ascribed thereto in Section 4.1(a);

“Dissent Shares” means the

Company Shares held by a Dissenting Shareholder in respect of which the Dissenting Shareholder has validly exercised Dissent Rights;

“Dissenting Shareholder”

means a registered Company Shareholder who has properly and validly dissented in respect of the Arrangement Resolution in strict compliance

with the Dissent Rights, who has not withdrawn or been deemed to have withdrawn such exercise of Dissent Rights and who is ultimately

determined to be entitled to be paid the fair value of its Company Shares, but only in respect of the Dissent Shares;

“DRS Advice” has the meaning

specified in Section 3.1;

“Effective Date” means the

date upon which the Arrangement becomes effective in accordance with Section 2.11(a) of the Arrangement Agreement;

“Effective Time” means 5:00

a.m. on the Effective Date or such other time as Parent and Company agree to in writing before the Effective Date;

“Exchange Ratio” means 1.6022;

“Final Order” means the

final order of the Court made pursuant to Section 291 of the BCBCA, in a form and substance acceptable to Company and Parent, each acting

reasonably, approving the Arrangement, including as such order may be amended, supplemented, modified or varied by the Court (with the

consent of both Company and Parent, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such

appeal is withdrawn or denied, as affirmed or as amended (provided that any such amendment is acceptable to both Company and Parent, each

acting reasonably) on appeal;

“Governmental Entity” means:

(a) any international, federal, provincial, territorial, state, regional, municipal, local or other government, governmental or public

department, central bank, court, tribunal, arbitral body, international arbitration institution, commission, board, ministry bureau, agency

or entity, domestic or foreign; (b) any stock exchange, including the TSX, the NYSE and the NYSE American; (c) any subdivision, agent,

commission, board or authority of any of the foregoing; or (d) any quasi-governmental or private body or self-regulatory organization

exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing;

“In-The-Money Value” means,

in respect of a stock option at a particular time, the amount, if any, by which (a) the aggregate fair market value at that time of the

stock subject to such option exceeds (b) the exercise price of such option;

“including” means including

without limitation, and “include” and “includes” have a corresponding meaning;

“Interim Order” means the

interim order of the Court made pursuant to Section 291 of the BCBCA, in a form and in substance acceptable to Company and Parent, each

acting reasonably, providing for, among other things, the calling and holding of the Company Meeting, including as such order may be amended,

supplemented, modified or varied by the Court (with the consent of Company and Parent, each acting reasonably);

“Law” or “Laws”

means all laws (including common law), by-laws, statutes, rules, regulations, principles of law and equity, orders, rulings, ordinances,

judgements, injunctions, determinations, awards, decrees or other requirements, whether domestic or foreign, that are binding upon or

applicable to such Person or its business, and the terms and conditions of any Authorization of or from any Governmental Entity, and,

for greater certainty, includes Securities Laws and applicable common law, and the term “applicable” with respect to

such Laws and in a context that refers to a Party, means such Laws as are applicable to such Party and/or its Subsidiaries or their business,

undertaking, property or securities and emanate from a Person having jurisdiction over the Party and/or its Subsidiaries or its or their

business, undertaking, property or securities;

“Legacy Company Option Plan”

means the legacy stock option plan of Company effective August 24, 2015, as amended;

“Letter of Transmittal”

means the letter of transmittal to be delivered to registered Company Shareholders for use in connection with the Arrangement;

“Liens” means any hypothecs,

mortgages, pledges, assignments, liens, charges, security interests, encumbrances and adverse rights or claims or other third party interests

or encumbrances of any kind, whether contingent or absolute, and any agreement, option, lease, sublease, restriction, easement, right-of-way,

right or privilege (whether by Law, contract or otherwise) capable of becoming any of the foregoing;

“New Company Option Plan”

means the stock option plan of Company effective June 15, 2022;

“Notice of Dissent” means

a written notice provided by a Company Shareholder that is a registered holder of Company Shares to Company setting forth such Company

Shareholder’s objection to the Arrangement Resolution and exercise of Dissent Rights;

“NYSE” means the New York

Stock Exchange;

“NYSE American” means the

NYSE American Stock Exchange;

“Parent” means Coeur

Mining, Inc., a corporation existing under the laws of the State of Delaware;

“Parent Canadian Sub” means

1504648 B.C. Unlimited Liability Company, an unlimited liability corporation existing under the laws of the Province of British Columbia,

Canada, that is a direct or indirect wholly owned subsidiary of Parent;

“Parent Canadian Sub Shares”

means the common shares in the authorized share structure of Parent Canadian Sub;

“Parent Replacement Options”

means the options to acquire Parent Shares to be issued in exchange for Company Options pursuant to this Plan of Arrangement;

“Parent Shares” means the

common stock in the capital of Parent;

“Parent U.S. Sub” means

Coeur Rochester, Inc.

“Parties” means, together,

Parent, Parent Canadian Sub, Parent U.S. Sub, Company, Company Canadian Sub, Company Mexican Sub and Amalco (upon and following the Amalgamation),

and “Party” means any one of them as the context requires;

“Person” includes an individual,

partnership, association, body corporate, trustee, executor, administrator, legal representative, government (including any Governmental

Entity) or any other entity, whether or not having legal status;

“Plan of Arrangement” means

this plan of arrangement and any amendments or variations hereto made in accordance with this plan of arrangement or upon the direction

of the Court in the Final Order with the consent of Company and Parent, each acting reasonably;

"Registrar" means the Registrar

of Companies for the Province of British Columbia duly appointed under Section 400 of the BCBCA;

“Specified Cash Balance”

means: (i) an amount to be specified by Parent no less than twenty-four (24) hours prior to the Effective Time; or (ii) in case no amount

is specified pursuant to clause (i) no less than twenty-four (24) hours prior to the Effective Time, an amount that results in cash in

value of no less than $25 million United States dollars as of the Effective Date remaining with the Company Mexican Sub;

“Tax Act” means the Income

Tax Act (Canada) and the regulations made thereunder, as now in effect and as they may be promulgated or amended from time to time;

“TSX” means the Toronto

Stock Exchange; and

“U.S. Securities Act” means

the United States Securities Act of 1933, as amended and the rules and regulations promulgated thereunder.

| 1.2 | Interpretation Not Affected by Headings |

The division of this Plan of Arrangement into

Articles and Sections and the insertion of headings are for convenience of reference only and shall not affect in any way the meaning

or interpretation of this Plan of Arrangement. Unless the contrary intention appears, references in this Plan of Arrangement to an Article,

Section or Step by number or letter or both refer to the Article, Section or Step, respectively, bearing that designation in this Plan

of Arrangement.

In this Plan of Arrangement, unless the contrary

intention appears, words importing the singular include the plural and vice versa, and words importing gender include all genders.

Unless otherwise specified, time periods within

or following which any payment is to be made or act is to be done shall be calculated by excluding the day on which the period commences

and including the day on which the period ends. Where the last day of any such time period is not a business day, such time period shall

be extended to the next business day following the day on which it would otherwise end.

If the date on which any action is required

to be taken hereunder by a Party is not a business day, such action shall be required to be taken on the next succeeding day which is

a business day. Notwithstanding the forgoing, for the purposes of Section 2.3(h), if the date on which any action is required to be taken

hereunder by a Party is not a business day, such action shall be taken on the next succeeding calendar day (which, for greater certainty,

may be a Saturday, a Sunday or a statutory or civic holiday in New York, New York, Mexico City, Mexico, or Vancouver, British Columbia).

Unless otherwise stated, all references in

this Plan of Arrangement to sums of money are expressed in lawful money of Canada and “$” refers to Canadian dollars.

| 1.7 | No Strict Construction |

The language used in this Plan of Arrangement

is the language chosen by the Parties to express their mutual intent, and no rule of strict construction shall be applied against any

Party.

A reference to a statute includes all rules

and regulations made pursuant to such statute and, unless otherwise specified, the provisions of any statute or regulation or rule which

amends, supplements or supersedes any such statute or any such regulation or rule.

This Plan of Arrangement shall be governed,

including as to validity, interpretation and effect, by the laws of the Province of British Columbia and the laws of Canada applicable

therein.

Time is of the essence in the performance of

the Parties’ respective obligations hereunder.

In this Plan of Arrangement, unless otherwise

specified, any references to time are to local time, Vancouver, British Columbia.

Capitalized terms that are used herein but

not defined shall have the meanings ascribed thereto in the Arrangement Agreement.

Article

2

THE ARRANGEMENT

This Plan of Arrangement is made pursuant to,

and is subject to the provisions of, the Arrangement Agreement, except in respect of the sequence of the steps comprising the Arrangement,

which shall occur in the order set out in this Plan of Arrangement.

This Plan of Arrangement will become effective

at the Effective Time (except as otherwise provided herein) and will be binding from and after the Effective Time on Parent, Parent Canadian

Sub, Parent U.S. Sub, Company, Company Canadian Sub, Company Mexican Sub, Amalco (upon and following the Amalgamation), the Depositary,

the Company Shareholders, including the Dissenting Shareholders, and the holders of Company Options, in each case, without any further

authorization, act or formality on the part of any Person, except as expressly provided herein.

The following steps shall occur and shall be

deemed to occur, commencing at the Effective Time, sequentially in the following order, with each such step after the first occurring

five minutes after the preceding step (except where otherwise indicated), and without any further authorization, act or formality on the

part of any Person:

Transfer of Bullion and Payment of Intercompany

Debt

| (a) | All Bullion beneficially owned by the Company, in specie, in bullion accounts or otherwise, shall

be, and shall be deemed to be, transferred to Company Canadian Sub pursuant to Section 85 of the Tax Act and, in consideration therefor,

Company Canadian Sub shall (i) allot and issue one (1) Company Canadian Sub Share to Company, and (ii) issue a U.S. dollar denominated,

non-interest bearing, demand promissory note in favour of Company with a principal amount equal to Company’s cost amount of the

Bullion (for the purpose of the Tax Act), and Company and Company Canadian Sub shall file a joint election under Section 85 of the Tax

Act and applicable provincial tax Laws with an elected amount determined by Company in its sole discretion. |

| (b) | Company

Canadian Sub shall transfer, and shall be deemed to transfer, all Bullion referred to in

Step 2.3(a) to Parent U.S. Sub and, in consideration therefor, Parent U.S. Sub shall issue

and deliver to Company Canadian Sub a U.S. dollar denominated promissory note, with a principal

amount equal to the purchase price of the Bullion, being the fair market value thereof, bearing

interest at the short-term Applicable Federal Rate for U.S. tax purposes on the Effective

Date plus 2% per annum, having a maturity date that is December 31 of the year following

the Effective Date. |

| (c) | Company Mexican Sub shall transfer a cash amount: |

| (i) | to Company equal to the lesser of (A) the principal amount outstanding under the intercompany indebtedness

owing by Company Mexican Sub to Company (the “Company Loan”) and (B) Company Mexican Sub’s Specified Cash

Balance; |

| (ii) | if Company Mexican Sub’s Specified Cash Balance less the repayment described in (i) is positive,

to Company equal to the lesser of (C) any accrued interest on the Company Loan and (D) Company Mexican Sub’s Specified

Cash Balance less the amount of the repayment described in (i); and |

| (iii) | if Company Mexican Sub’s Specified Cash Balance less the repayments described in (i) and (ii) is

positive, to Company Canadian Sub equal to the lesser of (E) the interest owing on that certain intercompany loan between Company

Mexican Sub and Company Canadian Sub and (F) Company Mexican Sub’s Specified Cash Balance less the amount of the repayments

described in (i) and (ii); and |

following Step 2.3(c), such amounts

determined by this Step 2.3(c) shall be, and shall be deemed to be, repaid by Company Mexican Sub.

Dissenting Shareholders

| (d) | Each Dissent Share shall be and shall be deemed to be transferred and assigned by the holder thereof without

any further act or formality on its part, free and clear of all Liens, to Company in accordance with, and for the consideration contemplated

in, Section 4.1, and: |

| (i) | such Dissenting Shareholder shall cease to be, and shall be deemed to cease to be, the registered holder

of each such Dissent Share and the name of such registered holder shall be, and shall be deemed to be, removed from the central securities

register of Company in respect of each such Dissent Share, and at such time each Dissenting Shareholder will have only the rights set

out in Section 4.1; |

| (ii) | such Dissenting Shareholder shall be deemed to have executed and delivered all consents, releases, assignments

and waivers, statutory or otherwise, required to transfer and assign each such Dissent Share; and |

| (iii) | Company shall be the holder of all of the outstanding Dissent Shares, free and clear of all Liens, and

the central securities register of Company shall be revised accordingly. |

Issuance of Company Shares to Parent

Canadian Sub

| (e) | Each Company Shareholder, other than a Dissenting Shareholder, shall transfer and assign their Company

Shares, free and clear of any Liens, to Parent Canadian Sub in exchange for the Consideration for each such Company Share so transferred,

and in respect of the Company Shares so transferred: |

| (i) | the registered holder thereof shall cease to be, and shall be deemed to cease to be, the registered holder

of each such Company Share and the name of such registered holder shall be removed from the central securities register of Company; |

| (ii) | the registered holder thereof shall be deemed to have executed and delivered all consents, releases, assignments

and waivers, statutory or otherwise, required to transfer and assign each such Company Share; and |

| (iii) | Parent Canadian Sub shall be the holder of all of the outstanding Company Shares, free and clear of all

Liens, and the central securities register of Company shall be revised accordingly. |

| (f) | Concurrently with Section 2.3(e), in consideration for the Consideration issued and delivered to the Company Shareholders by Parent on behalf and for the benefit of Parent Canadian Sub pursuant to Section 2.3(e), Parent Canadian Sub shall issue to Parent the number of Parent Canadian Sub Shares having an aggregate fair market value and capital equal to the aggregate fair market value of such Consideration issued to the Company Shareholders in Section 2.3(e). |

Treatment of Company Options

| (g) | 30 minutes following Step 2.3(f), and notwithstanding any vesting or exercise or other provisions

to which a Company Option might otherwise be subject (whether by contract, the conditions of grant, applicable Law or the terms of the

applicable Company Option Plan governing such Company Option), each Company Option outstanding immediately prior to the Effective Time

shall, without any further action by or on behalf of a holder, be exchanged for a Parent Replacement Option exercisable to purchase from

Parent the number of Parent Shares equal to the product of (A) the number of Company Shares subject to the Company Option immediately

before the Effective Time multiplied by (B) the Exchange Ratio (provided that if the foregoing would result in the issuance of a fraction

of a Parent Share on any particular exercise of Parent Replacement Options, then the number of Parent Shares otherwise issued shall be

rounded down to the nearest whole number of Parent Shares). The exercise price per Parent Share subject to any such Parent Replacement

Option shall be an amount equal to the quotient of (X) the exercise price per Company Share underlying the exchanged Company Option immediately

prior to the Effective Time divided by (Y) the Exchange Ratio (provided that the aggregate exercise price payable on any particular exercise

of Parent Replacement Options shall be rounded up to the nearest whole cent). It is intended that (i) the provisions of Subsection

7(1.4) of the Tax Act apply to the aforesaid exchange of options and (ii) such exchange of options be treated as other than the grant

of a new stock right or a change in the form of payment pursuant to Section 1.409A-1(b)(5)(v)(D) of the U.S. Treasury Regulations. Accordingly,

and notwithstanding the foregoing, if required, the exercise price of a Parent Replacement Option will be adjusted such that the In-The-Money

Value of the Parent Replacement Option immediately after the exchange does not exceed the In-The-Money Value of the Company Option for

which it was exchanged immediately before the exchange. All terms and conditions of a Parent Replacement Option, including the term to

expiry, conditions to and manner of exercising, will be the same as the Company Option for which it was exchanged, and shall be governed

by the terms of the applicable Company Option Plan and any document evidencing a Company Option shall thereafter evidence and be deemed

to evidence such Parent Replacement Option, provided that the provisions of Section 7.1 of the New Company Option Plan shall apply to

all Parent Replacement Options that would otherwise be governed by the Legacy Company Option Plan for a period of ninety (90) days following

the Effective Time. |

Amalgamation of Company and Company Canadian

Sub

| (h) | At 9:00 a.m. on the day following the Effective Date, the notice of articles of Company shall be altered

to the extent necessary for Company to become an unlimited liability company as contemplated pursuant to Section 51.31(1) of the BCBCA,

such that (i) the statement required under Section 51.11 of the BCBCA shall be included in the notice of articles of the Company; (ii)

the name of Company shall be changed to “SilverCrest Metals ULC” and Company shall thereupon be an unlimited liability company

under the BCBCA and, as soon as practicable thereafter, Parent Canadian Sub, as sole shareholder of Company, shall return all share certificates

representing the Company Shares for inclusion on the face of each such certificate the statement required pursuant to Section 51.2 of

the BCBCA; and (iii) Parent Canadian Sub shall elect to be classified as an association taxable |

as a corporation for U.S. federal income

tax purposes effective the day following the Effective Date.

| (i) | 30 minutes following Step 2.3(h), the notice of articles of Company Canadian Sub shall be altered to the

extent necessary for Company Canadian Sub to become an unlimited liability company as contemplated pursuant to Section 51.31(1) of the

BCBCA, such that (i) the statement required under Section 51.11 of the BCBCA shall be included in the notice of articles of Company; and

(ii) the name of Company shall be changed to “NorCrest Metals ULC” and Company shall thereupon be an unlimited liability company

under the BCBCA and, as soon as practicable thereafter, Company, as sole shareholder of Company Canadian Sub, shall return all share certificates

representing the Company Canadian Sub Shares for inclusion on the face of each such certificate the statement required pursuant to Section

51.2 of the BCBCA. |

| (j) | 30 minutes following Step 2.3(i), the capital of the Company Canadian Sub Shares shall be reduced to $1. |

| (k) | 30 minutes following Step 2.3(j), Company and Company Canadian Sub shall amalgamate to form one corporate

entity, being a British Columbia unlimited liability company, with the same effect as if they were amalgamated under Section 270 of the

BCBCA (the “Amalgamation”), except that the separate legal existence of Company Canadian Sub shall not cease (Company

Canadian Sub, as such surviving entity, “Amalco”) notwithstanding the notation on the corporate register maintained

by the Registrar or the issue of a Certificate of Amalgamation evidencing the amalgamation of the Company and Company Canadian Sub to

form Amalco. Without limiting the foregoing, upon the occurrence of the Amalgamation, the separate legal existence of Company will cease

without Company being liquidated or wound-up, and Company and Company Canadian Sub will continue as one company, and the property of Company

(other than Company Canadian Sub Shares and any amounts receivable between Company and Company Canadian Sub, which are cancelled on the

Amalgamation) will become the property of Amalco. For greater certainty, the Parties intend that the Amalgamation will qualify as an amalgamation

for purposes of Subsection 87(11) of the Tax Act. On and after the Amalgamation, the following shall apply: |

| (i) | Name. The name of Amalco shall be “NorCrest Metals ULC”; |

| (ii) | Registered Office. The registered office of Amalco shall be the registered office of Company Canadian

Sub; |

| (iii) | Business and Powers. There shall be no restrictions on the business that Amalco may carry on or

on the powers it may exercise; |

| (iv) | Authorized Share Capital. Amalco shall be authorized to issue an unlimited number of Amalco Shares; |

| (v) | Shares. Each Company Share shall be exchanged into one fully paid and non-assessable Amalco Share,

and each Company Canadian Sub Share shall be |

cancelled without any repayment of capital.

No other securities will be issued and no assets will be distributed by Amalco in connection with the Amalgamation;

| (vi) | Restrictions on Transfer. The restrictions on the issue, transfer or ownership of Company Shares

shall apply to Amalco Shares, mutatis mutandis; |

| (vii) | Initial Directors. The initial directors of Amalco shall be the Amalco Directors; |

| (viii) | Initial Officers. The initial officers of Amalco shall be the Amalco Officers; |

| (ix) | Capital. The aggregate of the capital of the issued and outstanding Amalco Shares shall be equal

to the aggregate of the capital of the issued and outstanding Company Shares immediately before the Amalgamation; |

| (x) | Effect of Amalgamation. Upon the amalgamation of Company Canadian Sub and Company to form Amalco

becoming effective pursuant to Section 2.3(k): |

| (A) | Amalco shall possess all the property, rights, privileges and interests (other than the Company Canadian Sub Shares and any amounts

receivable between Company and Company Canadian Sub, which are cancelled on the Amalgamation) and be subject to all liabilities (other

than amounts receivable between Company and Company Canadian Sub, which are cancelled on the Amalgamation), including civil, criminal

and quasicriminal, and all contracts, disabilities and debts of Company and Company Canadian Sub; |

| (B) | Amalco is liable for all of the liabilities and obligations of Company and Company Canadian Sub (other

than amounts receivable between Company and Company Canadian Sub, which are cancelled on the Amalgamation), and all rights of creditors

or others have been, and will continue to be, unimpaired by the Amalgamation, and all liabilities and obligations of Company and Company

Canadian Sub, whether arising by contract or otherwise, may be enforced against Amalco to the same extent as if such obligations had been

incurred or contracted by it; |

| (C) | any existing cause of action, claim or liability to prosecution has not been and will not be affected; |

| (D) | a civil, criminal or administrative action or proceeding pending by or against either Company or Company

Canadian Sub may be continued by or against Amalco; |

| (E) | a conviction against, or ruling, order or judgment in favor of or against Company or Company Canadian

Sub may be enforced by or against Amalco; and |

| (F) | Amalco shall be deemed to be the party plaintiff or the party defendant, as the case may be, in any civil

action commenced by or |

against Company or Company Canadian Sub

before the amalgamation has become effective;

| (xi) | Notice of Articles. The notice of articles and articles of Amalco shall be substantially in the

form of the Company Canadian Sub notice of articles and articles, with the addition of the statement required under Section 51.11 of the

BCBCA; |

| (xii) | Articles. The articles of Amalco shall be in the form of the Company Canadian Sub articles. |

The exchanges and cancellations provided

for in this Section 2.3 will be deemed to occur on the Effective Date or the day following the Effective Date, as applicable, notwithstanding

that certain procedures related thereto are not completed until after the Effective Date.

Article

3

DELIVERY OF CONSIDERATION

| 3.1 | Deposit and Payment of Consideration |

| (a) | Following receipt of the Final Order and no later than the business day prior to the Effective Date, Parent

shall deposit in escrow, or cause to be deposited in escrow, with the Depositary, sufficient Parent Shares to satisfy the Consideration

payable to the Company Shareholders in accordance with Section 2.3, which shall be held by the Depositary in escrow as agent and

nominee for such former Company Shareholders for distribution to such former Company Shareholders in accordance with the provisions of

this Article 3. |

| (b) | Upon surrender to the Depositary for cancellation of a certificate or a direct registration statement

(DRS) advice (a “DRS Advice”) which immediately prior to the Effective Time represented one or more Company Shares

that were transferred under the Arrangement, together with a duly completed and executed Letter of Transmittal and such other documents

and instruments as the Depositary or Parent may reasonably require, the holder of the Company Shares represented by such surrendered certificate

or DRS Advice shall be entitled to receive in exchange therefor, and the Depositary shall deliver to such holder (in each case less any

amounts withheld pursuant to Section 3.7 (if any)), the Consideration that such holder has the right to receive, and the certificate

or DRS Advice so surrendered shall forthwith be cancelled. |

| (c) | In the event of a transfer of ownership of Company Shares which was not registered in the transfer records

of Company, the Consideration that such holder has the right to receive, subject to Section 2.3, shall be delivered to the transferee

if the certificate or DRS Advice which immediately prior to the Effective Time represented Company Shares that were exchanged for the

Consideration under the Arrangement is presented to the Depositary, accompanied by all documents reasonably required to evidence and effect

such transfer. |

| (d) | After the Effective Time and until surrendered for cancellation as contemplated by Section 3.1(b),

each certificate or DRS Advice that immediately prior to the Effective Time |

represented one or more Company Shares,

other than the Dissent Shares, shall be deemed at all times to represent only the right to receive in exchange therefor the Consideration

that the holder of such certificate or DRS Advice is entitled to receive in accordance with Section 2.3, less any amounts withheld

pursuant to Section 3.7 (if any).

| 3.2 | Distributions with Respect to Unsurrendered Certificates |

No dividends or other distributions

declared or made after the Effective Time with respect to Consideration Shares with a record date after the Effective Time shall be paid

to the holder of any unsurrendered certificate which immediately prior to the Effective Time represented outstanding Company Shares that

were exchanged for Consideration Shares pursuant to Section 2.3(e) until the holder of such certificate shall surrender such certificate

in accordance with Section 3.1. Subject to applicable law, at the time of such surrender of any such certificate (or, in the case

of clause (ii) below, at the appropriate payment date), there shall be paid to the holder of the certificates representing Company Shares

that were exchanged for Consideration Shares pursuant to Section 2.3(e), without interest, (i) the amount of dividends or other

distributions with a record date after the Effective Time theretofore paid with respect to the Consideration Shares to which such holder

is entitled pursuant hereto, and (ii) to the extent not paid under clause (i), on the appropriate payment date, the amount of dividends

or other distributions with a record date after the Effective Time but prior to surrender and the payment date subsequent to surrender

payable with respect to such Consideration Shares.

| 3.3 | Deemed Fully Paid and Non-Assessable Shares |

All Consideration Shares issued pursuant to

this Plan of Arrangement shall be deemed to be validly issued and outstanding as fully paid and non-assessable shares.

No fractional Consideration

Shares shall be issued upon the exchange of Company Shares pursuant to Sections 2.3(e) and 3.1. Where the aggregate number of Parent

Shares to be issued to a Company Shareholder pursuant to Sections 2.3(e) and 3.1 as consideration under the Arrangement would result

in a fractional Consideration Share being issuable, such fractional Consideration Share shall be rounded up to the nearest whole Parent

Share in the event that a Company Shareholder is entitled to a fractional share representing 0.5 or more of a Parent Share and shall be

rounded down to the nearest whole Parent Share in the event that a Company Shareholder is entitled to a fractional share representing

less than 0.5 of a Parent Share.

In the event that any certificate which, immediately

prior to the Effective Time, represented one or more outstanding Company Shares, which were exchanged in accordance with Section 2.3(e)

shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the holder claiming such certificate to be

lost, stolen or destroyed, the Depositary shall deliver in exchange for such lost, stolen or destroyed certificate, the aggregate Consideration

which such holder is entitled to receive in accordance with this Plan of Arrangement. When authorizing such delivery of the aggregate

Consideration which such holder is entitled to receive in exchange for such lost, stolen or destroyed certificate, the holder to whom

the Consideration is to be delivered shall, as a

condition precedent to the delivery of such

Consideration, give a bond satisfactory to Parent and the Depositary in such amount as Parent and the Depositary may direct (each acting

reasonably), or otherwise indemnify Parent and the Depositary and/or any of their respective representatives or agents in a manner satisfactory

to Parent and the Depositary (each acting reasonably), against any claim that may be made against Parent or the Depositary and/or any

of their respective representatives or agents with respect to the certificate alleged to have been lost, stolen or destroyed.

Any certificate or DRS Advice which immediately

prior to the Effective Time represented outstanding Company Shares that were exchanged pursuant to Section 2.3(e) that is not deposited

with all other instruments required by Section 3.1 on or prior to the sixth anniversary of the Effective Date shall cease to represent

a claim or interest of any kind or nature as a securityholder of Company, Parent Canadian Sub, Amalco. On such date, the Consideration

Shares, as applicable, to which the former holder of the certificate or DRS Advice referred to in the preceding sentence was ultimately

entitled shall be deemed to have been surrendered for no consideration to Parent Canadian Sub (or its successor(s)). None of Parent, Parent

Canadian Sub, Company, Amalco or the Depositary shall be liable to any Person in respect of any Consideration Shares (or dividends, distributions

and interest in respect thereof) delivered to a public official pursuant to any applicable abandoned property, escheat or similar law.

| 3.7 | Withholding Rights; Tax Consequences |

Parent, Company, the Depositary,

their respective Subsidiaries and any other Person on their behalf, shall be entitled to deduct and withhold from any amounts payable

to any Person pursuant to the Arrangement or under this Plan of Arrangement (including without limitation, any amounts payable pursuant

to Section 2.3, Article 3 and Article 4 of this Plan of Arrangement), and from all dividends, interest, and other amounts payable

or distributable to former Company Shareholders or former holders of Company Incentive Awards, such amounts as Parent, Company, the Depositary

and their respective Subsidiaries or any Person on behalf of any of the foregoing, is or may be required or permitted to deduct or withhold

with respect to such payment under the Tax Act, the U.S. Tax Code, or any provision of local, state, federal, provincial or foreign Law,

in each case, as amended, or under the administrative practice of the relevant Governmental Entity administering such Law, and to request

from any recipient of any payment hereunder any necessary tax forms or any other proof of exemption from withholding or any similar information. To

the extent that amounts are so deducted or withheld, such deducted or withheld amounts shall be treated for all purposes hereof as having

been paid to the Person to whom such amounts would otherwise have been paid. In any case where the amount so required or permitted to

be deducted or withheld from any payment to a holder exceeds the cash portion of the consideration otherwise payable, Parent, Company,

the Depositary, their respective Subsidiaries and any Person on behalf of the foregoing, as the case may be, is authorized to sell or

otherwise dispose of such portion of the Consideration as is necessary in order to fully fund such liability, and such Person shall remit

any unapplied balance of the net proceeds of such sale to the holder.

| 3.8 | Transfer Free and Clear |

For greater certainty, any

transfer or exchange of securities pursuant to this Plan of Arrangement

shall be free and clear of any Liens or other

claims of third parties of any kind.

Under no circumstances shall interest accrue

or be paid by Company, Parent, Parent Canadian Sub, Amalco, the Depositary or any other Person to any Company Shareholder or other Persons

depositing certificates or DRS Advices pursuant to this Plan of Arrangement in respect of the Company Shares immediately existing prior

to the Effective Time.

Article

4

RIGHTS OF DISSENT

| (a) | Pursuant to the Interim Order, Company Shareholders who are registered holders of Company Shares as of

the record date of the Company Meeting may exercise rights to dissent in connection with the Arrangement under Division 2 of Part 8 of

the BCBCA, as modified by this Article 4, the Interim Order and the Final Order (“Dissent Rights”), with respect to

all (but not less than all) of the Company Shares held by such Company Shareholder, provided that the Notice of Dissent contemplated by

Section 242 of the BCBCA, as may be modified by the Interim Order, must be received by Company by 4:00 p.m. on the date that is at least

two business days prior to the date of the Company Meeting, or any date to which the Company Meeting may be postponed or adjourned, and

provided further that holders who duly exercise such Dissent Rights and who: |

| (i) | are ultimately entitled to be paid the fair value of their Dissent Shares: (A) will be entitled to be

paid the fair value of such Dissent Shares by Company, which fair value, notwithstanding anything to the contrary contained in the BCBCA,

shall be the fair value of such Dissent Shares determined as of the close of business on the day immediately before the approval of the

Arrangement Resolution; (B) shall be deemed not to have participated in the transactions in Article 2 (other than Section 2.3(d),

if applicable); (C) shall be deemed to have transferred and assigned such Dissent Shares, free and clear of any Liens, to Company in accordance

with Section 2.3(d); and (D) will not be entitled to any other payment or consideration, including any payment that would be payable

under the Arrangement had such holders not exercised their Dissent Rights in respect of such Company Shares; and |

| (ii) | are ultimately not entitled, for any reason, to be paid fair value for their Company Shares, shall be

deemed to have participated in the Arrangement, as of the Effective Time, on the same basis as a non-dissenting registered holder of Company

Shares, and shall be entitled to receive only the Consideration pursuant to Section 2.3(e) that such holder would have received

pursuant to the Arrangement if such holder had not exercised Dissent Rights. |

| (b) | In no circumstances shall Parent, Parent Canadian Sub, Company or any other Person be required to recognize

a Person exercising Dissent Rights unless such Person is the registered holder of those Company Shares in respect of which such rights

are sought to be |

exercised as of the record date of the

Company Meeting and as of the deadline for exercising such Dissent Rights.

| (c) | In no case shall Parent, Parent Canadian Sub, Company or any other Person be required to recognize holders

of Company Shares who exercise Dissent Rights as holders of Company Shares after the time that is immediately prior to the Effective Time,

and the names of the Dissenting Shareholders shall be deleted from the central securities register as holders of the Company at the time

at which the step in Section 2.3(d) occurs. |

| (d) | For greater certainty, in addition to any other restrictions in the Interim Order and under Section 238

of the BCBCA, none of the following shall be entitled to exercise Dissent Rights: (i) a holder of any Company Incentive Awards in respect

of such holder’s Company Incentive Awards; (ii) Company Shareholders who vote or have instructed a proxyholder to vote such Company

Shares in favour of the Arrangement Resolution; and (iii) any other Person who is not a registered Company Shareholder as of the record

date for the Company Meeting. |

Article

5

GENERAL

From and after the Effective Time (a) this

Plan of Arrangement shall take precedence and priority over any and all rights related to the Company Shares and the Company Options issued

prior to the Effective Time, and (b) the rights and obligations of the holders of Company Shares, the holders of Company Options, the

Parties, the Depositary and any trustee or transfer agent therefor in relation thereto, and any other Person having any right, title or

interest in or to Company Shares and Company Options, shall be solely as provided for in this Plan of Arrangement.

| (a) | Parent and Company reserve the right to amend, modify or supplement this Plan of Arrangement at any time

and from time to time, provided that each such amendment, modification or supplement must be (i) agreed to in writing by Company and Parent,

(ii) filed with the Court and, if made following the Company Meeting, approved by the Court, and (iii) communicated to Company Shareholders

and the holders of Company Options if and as required by the Court. |

| (b) | Subject to the provisions of the Interim Order, any amendment, modification or supplement to this Plan

of Arrangement may be proposed by Parent and Company at any time prior to the Company Meeting (provided, however, that Company and Parent

shall have consented thereto in writing), with or without any other prior notice or communication, and, if so proposed and accepted by

the Persons voting at the Company Meeting (other than as may be required under the Interim Order), shall become part of this Plan of Arrangement

for all purposes. |

| (c) | Any amendment, modification or supplement to this Plan of Arrangement that is approved or directed by

the Court following the Company Meeting shall be effective only if: (i) it is |

consented to in writing by each of Parent

and Company (each acting reasonably); and (ii) if required by the Court, it is consented to by the Company Shareholders voting in the

manner directed by the Court.

| (d) | Any amendment, modification or supplement to this Plan of Arrangement may be made by Company and Parent

without the approval of or communication to the Court or the Company Shareholders, provided that it concerns a matter which, in the reasonable

opinion of Company and Parent, is of an administrative or ministerial nature required to better give effect to the implementation of this

Plan of Arrangement and is not adverse to the financial or economic interests of any of the Company Shareholders or holders of Company

Options. |

| (e) | This Plan of Arrangement may be withdrawn prior to the Effective Time in accordance with the terms of

the Arrangement Agreement. |

Notwithstanding that the transactions and events

set out in this Plan of Arrangement shall occur and be deemed to have occurred in the order set out herein, without any further act or

formality, each of the Parties shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements,

transfers, assurances, instruments or documents as may reasonably be required by any of them in order to implement this Plan of Arrangement

and to further document or evidence any of the transactions or events set out herein.

| 5.4 | Plan of Reorganization |

| (a) | The transfer of the Company Shares to Parent Canadian Sub pursuant to this Plan of Arrangement is intended

to qualify as a reorganization within the meaning of Section 368(a) of the U.S. Tax Code for U.S. federal income tax purposes. |

| (b) | The (i) election by Parent Canadian Sub on Internal Revenue Service Form 8832 (to be filed and made effective

as of one day after the Effective Date) to be classified as an association taxable as a corporation for U.S. federal income tax purposes

and (ii) conversion of Company to a British Columbia unlimited liability company pursuant to Section 2.3(h) of this Plan of Arrangement,

taken together, are intended to qualify as a reorganization within the meaning of Section 368(a)(1)(F) of the U.S. Tax Code for U.S.

federal income tax purposes. |

| (c) | The conversion of Company Canadian Sub to a British Columbia unlimited liability company pursuant to Section

2.3(i) of this Plan of Arrangement is intended to be treated as a complete liquidation of Company Canadian Sub pursuant to Section 332

of the U.S. Tax Code for U.S. federal income tax purposes. |

| (d) | The Arrangement Agreement and this Plan of Arrangement are intended to be a “plan of reorganization”

with respect to each such reorganization within the meaning of the U.S. Treasury Regulations promulgated under Section 368 of the U.S.

Code. |

| (e) | The Amalgamation pursuant to Section 2.3(k) of this Plan of Arrangement is intended to be a transaction

that is disregarded for U.S. federal income tax purposes. |

Article

6

U.S. Securities Law Exemption

| 6.1 | U.S. Securities Law Exemption |

Notwithstanding any provision herein to the

contrary, Company and Parent each agree that this Plan of Arrangement will be carried out with the intention that (i) all Consideration

Shares issued under the Arrangement by Parent, and (ii) all Parent Replacement Options granted under the Arrangement by Parent, in each

case, pursuant to this Plan of Arrangement, whether in the United States, Canada or any other country, be issued or granted, as the case

may be, in reliance on the exemption from the registration requirements of the U.S. Securities Act, as provided by Section 3(a)(10) thereof

and applicable state securities Laws, and pursuant to the terms, conditions and procedures set forth in the Arrangement Agreement. To

the extent necessary, Parent shall, on or as promptly as practicable following the Effective Date, file one or more registration statements

on Form S-8 with the U.S. SEC to register the issuance of Parent Shares upon exercise of Parent Replacement Options.

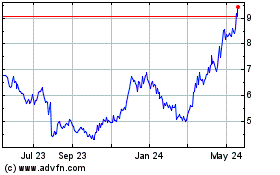

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Jan 2025 to Feb 2025

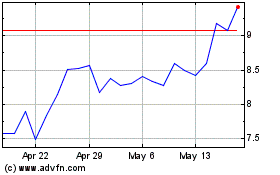

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Feb 2024 to Feb 2025