Will the S&P 500 Gain Pace in the Final Week of September?

September 29 2023 - 5:22AM

Finscreener.org

As September nears its end,

stocks are witnessing a downward trend. All three major indices are

staring at losses as we enter the last week of the month. The Dow

Jones Industrial Average index has fallen by 2.2%, the S&P

500 has declined by 4.2%, and the Nasdaq Composite has seen a 5.9%

reduction in September.

Let’s see what will impact the

equity markets in the upcoming week.

The U.S. government shutdown

This week, the potential

government shutdown in Washington remains a significant concern for

markets. The week commences with Congress uncertain about

finalizing a spending bill before the Saturday deadline, raising

concerns over a potential halt in government operations.

A prolonged shutdown might result

in temporary layoffs, affected benefits, or a possible slowdown in

economic growth. The House, led by Republicans, did not proceed

with a funding scheme before taking a weekend

break.

This was due to Speaker Kevin

McCarthyU+02019s inability to gain the support of conservative

members demanding significant expenditure reductions. "ItU+02019s

hard to predict whatU+02019s next," said Senate Majority Whip Dick

Durbin, D-Ill., during his appearance on CNN’s “State of the Union”

this past Sunday.

Is the Hollywood writerU+02019s strike about to

end?

After an extended strike lasting

almost 150 days, Hollywood writers and producers have inked a

preliminary labor deal. While specifics of the agreement, achieved

after two days of weekend negotiations, remain undisclosed, it

still requires ratification by the Writers Guild of America

members.

The union informed its members

that the deal covers “significant advancements and safeguards for

writers across all sectors.” As the entertainment industry evolves,

screenwriters have advocated for a larger share of streaming

profits and protections against artificial intelligenceU+02019s

impact.

The strike, coupled with an

actorsU+02019 strike that began in July, has caused disruptions in

TV and film schedules across prominent media firms.

Amazon enters the AI race

Amazon (NASDAQ:

AMZN) is going all-in on

artificial intelligence development. The e-commerce giant has

committed to a $4 billion investment in AI firm Anthropic, known

for its chatbots that compete with OpenAI’s

ChatGPT.

This collaboration will establish

Amazon Web Services (AWS) as AnthropicU+02019s chief cloud service

provider and offer enhanced features to AWS users via Anthropic.

With this move, Amazon aims to delve deeper into AI innovation,

striving to stay competitive against industry giants like Microsoft

and Alphabet.

Credit card losses in

focus

Goldman Sachs (NYSE:

GS) reports a surge in

credit card company

losses, noting levels unseen since the 2008 financial crisis. From

a low in September 2021, the current loss rate of 3.63% has

escalated by 1.5 percentage points. Goldman anticipates these

losses to increase even more, potentially nearing 5%. This forecast

emerges as the U.S. credit card debt surpasses the $1 trillion

mark.

Home price index and more

On Tuesday, the Case-Shiller

National Home Price Index and FHFA’s House Price Index for July

will be released. According to Case-ShillerU+02019s projections,

there was a 0.7% increase in July, marking six consecutive months

of positive growth after significant drops in the latter part of

2022. Annually, prices are anticipated to decrease by 1%, marking

the fifth straight month of year-over-year reductions.

Rising mortgage rates, driven by

the Fed’s interest rate increases, have peaked in more than 20

years, making homeownership unaffordable for many potential buyers.

Coupled with a scarce housing inventory, the housing market is

currently the least affordable in nearly four decades.

Approximately 80% of U.S. residents believe itU+02019s not the

right time to purchase a home.

The Bureau of Economic Analysis

(BEA) is set to release the Personal Consumption Expenditures (PCE)

Price Index for August on Friday. The index is the Federal

ReserveU+02019s favored measure of inflation. Prices in August are

expected to have gone up by 0.5%, a growth from JulyU+02019s 0.2%

increment.

Annually, a 3.5% rise is

predicted, a speed-up from July’s 3.2%. Excluding the fluctuating

food and energy costs, the core prices probably increased by 0.2%

month-to-month and 3.9% year-to-year.

The Fed prefers the PCE Price

Index over the Consumer Price Index (CPI) because it better

reflects the actual spending patterns of consumers. The Fed aims to

maintain a 2% annual PCE inflation rate, aligning with its dual

objectives of stable prices and maximum employment.

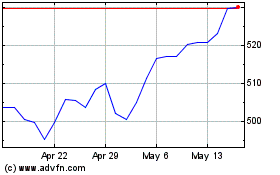

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Feb 2024 to Feb 2025