UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August, 2024

Commission

File Number: 001-31965

Taseko

Mines Limited

(Translation of registrant's name into English)

12th

Floor - 1040 West Georgia St., Vancouver, BC, V6E 4H1

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ]

Form 20-F [ x ] Form 40-F

SUBMITTED

HEREWITH

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

Taseko Mines Limited |

| |

(Registrant) |

| |

|

|

| Date: August 9, 2024 |

By: |

/s/ Stuart McDonald |

| |

|

|

| |

|

Stuart McDonald |

| |

Title: |

President |

Exhibit 99.1

Taseko Reports Second Quarter

2024 Financial and Operational Performance and Florence Construction Update

| This release should be read with the Company’s Financial Statements and Management Discussion & Analysis ("MD&A"), available at www.tasekomines.com and filed on www.sedarplus.com. Except where otherwise noted, all currency amounts are stated in Canadian dollars. In March 2024 Taseko acquired the remaining 12.5% interest and now owns 100% of the Gibraltar Mine, located north of the City of Williams Lake in south-central British Columbia. Production and sales volumes stated in this release are on a 100% basis unless otherwise indicated. |

July 31, 2024, Vancouver, BC - Taseko

Mines Limited (TSX: TKO; NYSE American: TGB; LSE: TKO) ("Taseko" or the "Company") reports second quarter 2024 Adjusted

EBITDA* of $71 million and Earnings from mining operations before depletion and amortization* of $77 million. Second quarter earnings

benefited from a $26 million insurance recovery related to mill repairs that were completed in January. Revenues for the second quarter

were $138 million. A net loss of $11 million ($0.04 loss per share) was recorded for the quarter and adjusted net income was $31 million

($0.10 per share).

Gibraltar produced 20 million pounds of copper

and 185 thousand pounds of molybdenum in the second quarter, as previously disclosed. Production was impacted by planned downtime for

the in-pit crusher relocation and other maintenance, and an 18-day mine shutdown for a labour strike. Mill throughput in the quarter was

5.7 million tons, processing an average grade of 0.23% copper. Copper recoveries in the quarter averaged 78%, lower than previous quarters

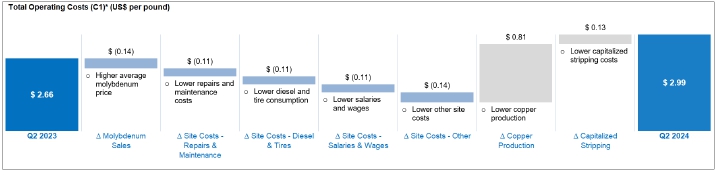

due to interruptions to operating time in both concentrators. Total operating costs (C1)* for the quarter were US$2.99 per pound of copper

produced, higher than recent quarters mainly due to lower production levels. The in-pit crusher relocation, a project in development for

nearly two years, was completed in the second quarter. Conveyor and electrical tie ins were done by mid-July and the new system is now

running at full capacity.

Stuart McDonald, President and CEO of Taseko,

commented, “This was our first full quarter with 100% ownership of Gibraltar and despite the operational disruptions, the mine’s

financial performance was quite strong as we generated $35 million of operating cashflow. With all of the major project and mill maintenance

work now completed at Gibraltar, we’re looking forward to stronger copper production and cashflow generation in the second half.”

Construction activities at the Florence Copper

project continued to ramp up in the second quarter and there are over 200 contractors now onsite. Concrete foundations have been poured

for the SX/EW plant, tank farms and other key components of the plant site. On the wellfield, 18 production wells were completed to the

end of June, in line with the schedule, and development of the pipeline corridor is well advanced. The first evaporation pond, which has

been brought ahead in the schedule to provide greater water management flexibility will be fully lined and completed in the next few weeks.

Mr. McDonald added, “We’re pleased

with the initial construction progress at Florence as all key activities are advancing on schedule. We’ve also had good success

in recruiting key management and technical roles for the commercial operation and now have nearly half of the 170 permanent positions

filled. Many of these positions have been filled by local Arizonans and there is excitement about participating in the development of

America’s next copper mine. The project remains on schedule for first copper production in the fourth quarter 2025.”

*Non-GAAP performance measure. See end of news release

Second Quarter Review

| • | Earnings from mining operations before depletion,

amortization and non-recurring items* was $76.9 million, Adjusted EBITDA* was $70.8 million, and Adjusted net income* was $30.5 million

($0.10 per share); |

| • | Second quarter cash flow from operations was

$34.7 million and net loss was $11.0 million ($0.04 loss per share) for the quarter; |

| • | Gibraltar produced 20.2 million pounds of copper

for the quarter. Average head grades were 0.23% and copper recoveries were 78% for the quarter; |

| • | Gibraltar sold 22.6 million pounds of copper

in the quarter at an average realized copper price of US$4.49 per pound; |

| • | Total operating costs (C1)* for the quarter

were US$2.99 per pound produced; |

| • | On June 1, 2024, operations at the Gibraltar

mine were suspended for 18 days due to strike action by its unionized workforce. The mine was put into temporary care and maintenance

with only essential staff operating and maintaining critical systems during the strike. Operations at Gibraltar resumed on June 19 after

the ratification of a new agreement by union members; |

| • | During the quarter, a total of 5.7 million tons

were milled. Throughput was impacted by both the labour strike and planned downtime in Concentrator #1 for the relocation of the primary

crusher and maintenance; |

| • | During the quarter, the Company finalized an insurance claim for property damage to Concentrator #2 and

business interruption for the associated production impact in 2023 and January 2024. An additional insurance recovery of $26.3 million

was recorded in the second quarter, and proceeds are expected to be received in the third quarter; |

| • | Construction of the commercial production facility

at Florence is advancing with recent activities focused on wellfield drilling, process pond construction and civil works including pouring

of concrete foundations; |

| • | On April 23, 2024, the Company completed an

offering of US$500 million aggregate principal amount of 8.25% Senior Secured Notes due May 1, 2030. The majority of the proceeds were

used to redeem the outstanding US$400 million 7% Senior Secured Notes due on February 15, 2026. The remaining proceeds, net of transaction

costs, call premium and accrued interest, were approximately $110 million and are available to fund capital projects, including construction

at Florence Copper; and |

| • | The Company had a cash balance of $199 million

at June 30, 2024 and has approximately $308 million of available liquidity including its undrawn US$80 million revolving credit facility. |

*Non-GAAP performance measure. See end of news release

Highlights

| Operating Data (Gibraltar - 100% basis) |

Three months ended June 30, |

Six months ended June 30, |

| |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

| Tons mined (millions) |

18.4 |

23.4 |

(5.0) |

41.2 |

47.5 |

(6.3) |

| Tons milled (millions) |

5.7 |

7.2 |

(1.5) |

13.4 |

14.3 |

(0.9) |

| Production (million pounds Cu) |

20.2 |

28.2 |

(8.0) |

49.9 |

53.1 |

(3.2) |

| Sales (million pounds Cu) |

22.6 |

26.1 |

(3.5) |

54.3 |

52.7 |

1.6 |

| Financial Data |

Three months ended June 30, |

Six months ended June 30, |

| (Cdn$ in thousands, except for per share amounts) |

2024 |

2023 |

Change |

2024 |

2023 |

Change |

| Revenues |

137,730 |

111,924 |

25,806 |

284,677 |

227,443 |

57,234 |

| Cash flows provided by operations |

34,711 |

33,269 |

1,442 |

94,285 |

61,268 |

33,017 |

| Net (loss) income (GAAP) |

(10,953) |

9,991 |

(20,944) |

7,943 |

43,779 |

(35,836) |

| Per share - basic (“EPS”) |

(0.04) |

0.03 |

(0.07) |

0.03 |

0.15 |

(0.12) |

| Earnings from mining operations before depletion, amortization and non-recurring items* |

76,928 |

27,664 |

49,264 |

129,725 |

68,803 |

60,922 |

| Adjusted EBITDA* |

70,777 |

22,218 |

48,559 |

120,700 |

58,277 |

62,423 |

| Adjusted net income (loss)* |

30,503 |

(4,376) |

34,879 |

38,231 |

712 |

37,519 |

| Per share - basic (“adjusted EPS”)* |

0.10 |

(0.02) |

0.12 |

0.13 |

- |

0.13 |

Effective as of March 25, 2024 the Company increased

its ownership in Gibraltar from 87.5% to 100%. As a result, the financial results reported in this MD&A include 100% of Gibraltar

income and expenses for the period March 25, 2024 to June 30, 2024 (87.5% for the period March 16, 2023 to March 24, 2024, and 75% prior

to March 15, 2023). For more information on the Company’s acquisition of Cariboo, please refer to the Financial Statements - Note

3.

The Company finalized

the accounting for the acquisition of its initial 50% interest in Cariboo from Sojitz and the related 12.5% interest in Gibraltar in the

fourth quarter of 2023. In accordance with the accounting standards

for business combinations, the comparable financial statements as of June 30, 2023 and for the three and six months then ended have been

revised to reflect the changes in finalizing the consideration paid and the allocation of the purchase price to the assets and liabilities

acquired.

*Non-GAAP performance measure. See end of news release

Review of Operations

Gibraltar mine

| Operating data (100% basis) |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

| Tons mined (millions) |

18.4 |

22.8 |

24.1 |

16.5 |

23.4 |

| Tons milled (millions) |

5.7 |

7.7 |

7.6 |

8.0 |

7.2 |

| Strip ratio |

1.6 |

1.7 |

1.5 |

0.4 |

1.5 |

| Site operating cost per ton milled (Cdn$)* |

$13.93 |

$11.73 |

$9.72 |

$12.39 |

$13.17 |

| Copper concentrate |

|

|

|

|

|

| Head grade (%) |

0.23 |

0.24 |

0.27 |

0.26 |

0.24 |

| Copper recovery (%) |

77.7 |

79.0 |

82.2 |

85.0 |

81.9 |

| Production (million pounds Cu) |

20.2 |

29.7 |

34.2 |

35.4 |

28.2 |

| Sales (million pounds Cu) |

22.6 |

31.7 |

35.9 |

32.1 |

26.1 |

| Inventory (million pounds Cu) |

2.3 |

4.9 |

6.9 |

8.8 |

5.6 |

| Molybdenum concentrate |

|

|

|

|

|

| Production (thousand pounds Mo) |

185 |

247 |

369 |

369 |

230 |

| Sales (thousand pounds Mo) |

221 |

258 |

364 |

370 |

231 |

| Per unit data (US$ per pound produced)* |

|

|

|

|

|

| Site operating costs* |

$2.88 |

$2.21 |

$1.59 |

$2.10 |

$2.43 |

| By-product credits* |

(0.26) |

(0.17) |

(0.13) |

(0.23) |

(0.13) |

| Site operating costs, net of by-product credits* |

$2.62 |

$2.04 |

$1.46 |

$1.87 |

$2.30 |

| Off-property costs |

0.37 |

0.42 |

0.45 |

0.33 |

0.36 |

| Total operating costs (C1)* |

$2.99 |

$2.46 |

$1.91 |

$2.20 |

$2.66 |

Review of Operations

Second Quarter Review

Gibraltar produced 20.2 million pounds of

copper for the quarter. Copper production and mill throughput in the quarter were impacted by a strike in June 2024 and planned downtime

in Concentrator #1 for the relocation of the in-pit crusher and other concurrent maintenance.

On June 1, 2024, operations at the mine were

suspended for 18 days due to strike action by Gibraltar’s unionized workforce strike. During this period all mining and milling

operations were shut down and only essential staff remained on site to operate and maintain critical systems. Operations resumed on June

19, after the ratification of a new agreement by union members.

Copper head grades of 0.23% were in line with

management expectations and the mine plan. Copper recoveries in the second quarter were 78%, lower than the recent quarters due to increased

milling of partially oxidized ore from the Connector pit and variable mill operating conditions during the strike and maintenance activities.

*Non-GAAP performance measure. See end of news release

Operations Analysis - Continued

A total of 18.4 million tons were mined in the second

quarter, lower than previous quarters due to the labour disruption. Stripping continued in the Connector pit and ore release will transition

from the Gibraltar pit to the Connector pit in the coming months. A total of 1.5 million tons of oxide ore from the upper benches of the

Connector pit were also added to the heap leach pads in the period.

Total site costs* at Gibraltar of $90.5 million

(which includes capitalized stripping of $10.7 million) was lower compared to the previous quarter due to the strike in June. A total

of $2.5 million care and maintenance costs were incurred during the strike which are not included in total site costs or cost of sales.

During the six months ended June 30, 2024,

the Company incurred total costs of $9.7 million in relation to the primary crusher relocation project for Concentrator #1. Direct costs

for the physical move of the crusher of $7.9 million have been included in the statement of income (loss).

Molybdenum production was 185 thousand pounds

in the second quarter and production was impacted by mill availability. At an average molybdenum price of US$21.79 per pound, molybdenum

generated a by-product credit per pound of copper produced of US$0.26 in the second quarter.

Off-property costs per pound produced* were

US$0.37 for the second quarter and also reflected higher copper sales volumes relative to production volumes compared to the prior quarter.

Total operating costs per pound produced (C1)*

was US$2.99 for the quarter, compared to US$2.66 in the prior year quarter as shown in the bridge graph below with the difference substantially

attributed to the lower copper production in the quarter:

Gibraltar Outlook

With the major project and maintenance work in both

concentrators now completed, production in the second half of 2024 is expected to be stronger than the first half of 2024. An updated

mine plan and mill throughput opportunities are being evaluated to recover some of the production that was lost during the strike. Copper

production for the year is expected to be in the range of 110 to 115 million pounds, compared to original guidance of approximately 115

million pounds.

The Gibraltar pit continued to be the main source

of mill feed in the second quarter and mining of ore is now transitioning into the Connector pit, which will be the primary source of

mill feed in the second half of the year. Additional oxide ore from Connector pit is expected to be added to the heap leach pads this

year. Refurbishment of Gibraltar’s SX/EW plant, which has been idle since 2015, will begin later this year and management is planning

to restart the facility in 2025.

*Non-GAAP performance measure. See end of news release

Gibraltar Outlook - Continued

In the quarter, the Company has tendered Gibraltar

concentrate to various customers for the remainder of 2024 and for significant tonnages in 2025 and 2026. In 2023, Treatment and Refining

Costs (“TCRCs”) accounted for approximately US$0.17 per pound of off-property costs. With these recently awarded offtake contracts,

the Company expects off-property costs to reduce to US$0.05 per pound or less over the next two and a half years due to these fixed, lower

TCRCs on the sale of its copper concentrate.

The Company has a prudent hedging program

in place to protect a minimum copper price during the Florence construction period. Currently, the Company has copper collar contracts

that secure a minimum copper price of US$3.75 per pound for 42 million pounds of copper covering the second half of 2024, and copper collar

contracts that secure a minimum copper price of US$4.00 per pound for 108 million pounds of copper for 2025. The copper collar contracts

also have ceiling prices between US$5.00 and US$5.40 per pound (refer to the section “Hedging Strategy” for details).

Florence Copper

The Company has all the key permits in place for

the commercial production facility at Florence Copper and construction has commenced. All the major SX/EW plant components are on site

and previous work on detailed engineering and procurement of long-lead items has de-risked the construction schedule. First copper production

is expected in the fourth quarter of 2025.

The Company has a technical report entitled

“NI 43-101 Technical Report Florence Copper Project, Pinal County, Arizona” dated March 30, 2023 (the “2023 Technical

Report”) on SEDAR+. The 2023 Technical Report was prepared in accordance with NI 43-101 and incorporated the results of testwork

from the Production Test Facility (“PTF”) as well as updated capital and operating costs (Q3 2022 basis) for the commercial

production facility.

Project highlights based on the 2023 Technical Report:

| • | Net present value of US$930 million (at $US 3.75 copper price, 8% after-tax discount rate) |

| • | Internal rate of return of 47% (after-tax) |

| • | Payback period of 2.6 years |

| • | Operating costs (C1) of US$1.11 per pound of copper |

| • | Annual production capacity of 85 million pounds of LME grade A cathode copper |

| • | Total life of mine production of 1.5 billion pounds of copper |

| • | Remaining initial capital cost of US$232 million (Q3 2022 basis) |

Construction activities in the second quarter of

2024 have focused on wellfield drilling, site preparations and earthworks for the commercial wellfield and plant area including the excavation

of process ponds and concrete foundation work for the plant, and the hiring of additional personnel for the construction and operations

teams.

Drilling of the commercial facility wellfield commenced

in February and two drills operated during the second quarter, with a third drill mobilized in July. As of the end of June, a total of

18 production wells had been drilled which is in line with the planned construction schedule.

The Company has a fixed-price contract with the general

contractor for construction of the SX/EW plant and associated surface infrastructure.

Florence Copper - Continued

Florence Copper Quarterly Capital Spend

| |

Three months ended |

Six months ended |

| (US$ in thousands) |

June 30, 2024 |

June 30, 2024 |

| Site and PTF operations |

4,314 |

8,559 |

| Commercial facility construction costs |

36,850 |

54,848 |

| Other capital costs |

7,053 |

22,762 |

| Total Florence project expenditures |

48,217 |

86,169 |

The estimated remaining capital costs in the

2023 Technical Report for construction of the commercial facility was US$232 million, of which US$36.9 million has been incurred in the

second quarter of 2024 and US$54.8 million has been incurred for the six months ended June 30, 2024. Other capital costs of US$22.8 million

include final payments for delivery of long-lead equipment that was ordered in 2022, and to bring forward the construction of an evaporation

pond to provide additional water management flexibility.

The Company has closed several Florence project level

financings to fund initial commercial facility construction costs. On April 26th, the Company received the second deposit of

US$10 million from the US$50 million copper stream transaction with Mitsui & Co. (U.S.A.) Inc. (“Mitsui”). The third deposit

was received in July and the remaining amounts of US$20 million should be received in October 2024 and January 2025.

The Company considers that the construction of Florence

Copper is now fully funded, and remaining project costs are expected to be funded with the Company’s available liquidity, remaining

instalments from Mitsui, and cashflow from its 100% ownership interest in Gibraltar. The Company also has in place an undrawn revolving

credit facility for US$80 million.

Long-term Growth Strategy

Taseko’s strategy has been to grow the

Company by acquiring and developing a pipeline of projects focused on copper in North America. We continue to believe this will generate

long-term returns for shareholders. Our other development projects are located in British Columbia, Canada.

Yellowhead Copper Project

Yellowhead Mining Inc. (“Yellowhead”)

has an 817 million tonnes reserve and a 25-year mine life with a pre-tax net present value of $1.3 billion at an 8% discount rate using

a US$3.10 per pound copper price based on the Company’s 2020 NI 43-101 technical report. Capital costs of the project were estimated

at $1.3 billion over a 2-year construction period. During the first 5 years of operation, the copper equivalent grade will average 0.35%

producing an average of 200 million pounds of copper per year at an average C1* cost, net of by-product credit, of US$1.67 per pound of

copper produced. The Yellowhead copper project contains valuable precious metal by-products with 440,000 ounces of gold and 19 million

ounces of silver production over the life of mine.

Long-term Growth Strategy - Continued

The Company is preparing to advance into the

environmental assessment process and has recently opened a project office to support ongoing engagement with local communities including

First Nations. The Company is also conducting a site investigation field program this year, and collecting baseline data and modeling

which will be used to support the environmental assessment and permitting of the project.

New Prosperity Gold-Copper Project

In late 2019, the Tŝilhqot’in Nation,

as represented by Tŝilhqot’in National Government, and Taseko Mines Limited entered into a confidential dialogue, with the

involvement of the Province of British Columbia, seeking a long-term resolution of the conflict regarding Taseko’s proposed copper-gold

mine previously known as New Prosperity, acknowledging Taseko’s commercial interests and the Tŝilhqot’in Nation’s

opposition to the project.

This dialogue has been supported by the parties’

agreement, beginning December 2019, to a series of standstill agreements on certain outstanding litigation and regulatory matters relating

to Taseko’s tenures and the area in the vicinity of Teẑtan Biny (Fish Lake).

The dialogue process has made meaningful progress

in recent months but is not complete. The Tŝilhqot’in Nation and Taseko acknowledge the constructive nature of discussions,

and the opportunity to conclude a long-term and mutually acceptable resolution of the conflict that also makes an important contribution

to the goals of reconciliation in Canada.

In March 2024, Tŝilhqot’in and

Taseko formally reinstated the standstill agreement for a final term, with the goal of finalizing a resolution before the end of this

year.

Aley Niobium Project

Environmental monitoring and product marketing

initiatives on the Aley niobium project continue. The converter pilot test is ongoing and is providing additional process data to support

the design of the commercial process facilities and will provide final product samples for marketing purposes. The Company has also initiated

a scoping study to investigate the potential production of niobium oxide at Aley to supply the growing market for niobium-based batteries.

Annual Sustainability

Report

In June 2024, the Company published its annual

Sustainability Report, titled H2O + ESG (the “Report”). The Report focuses on the 2023 operational and sustainability

performance of Taseko’s foundational asset, the Gibraltar copper mine in British Columbia, and highlights social and economic contributions

from the Florence Copper project in Arizona, which will soon become the Company’s second operating asset.

Taseko’s 2023 Sustainability Report features

several significant initiatives underway across the Company to conserve and reuse water, and to achieve water management objectives. This

includes a pioneering in-situ biological water treatment initiative undertaken at the Gibraltar mine last year - part of a long-term water

management program that has achieved a 77% reduction in free water stored in the mine’s tailings storage facility over the past

decade.

While profitable operations and return on investment

are critical drivers for Taseko’s success, the Company also delivers value to its employees and operating communities, business

partners, Indigenous Nations and governments. The annual Sustainability Report is an opportunity to showcase the important benefits that

the Company generates through its operations, investments and people.

The full report can be viewed and downloaded

at: tasekomines.com/sustainability/overview/

The Company will host a telephone conference

call and live webcast on Thursday, August 1, 2024, at 11:00 a.m. Eastern Time (8:00 a.m. Pacific) to discuss these results. After opening

remarks by management, there will be a question-and-answer session open to analysts and investors.

To join the conference call without operator

assistance, you may pre-register at https://emportal.ink/4fnpKl1 to receive an instant automated

call back just prior to the start of the conference call. Otherwise, the conference call may be accessed by dialing 888-390-0546 toll-free,

416-764-8688 in Canada, or online at tasekomines.com/investors/events/.

The conference call will be archived for later

playback until August 15, 2024, and can be accessed by dialing 888-390-0541 toll-free, 416-764-8677 in Canada, or online at tasekomines.com/investors/events/

and using the entry code 099395 #.

For

further information on Taseko, please see the Company's website at www.tasekomines.com or

contact:

Brian Bergot, Vice President, Investor

Relations - 778-373-4554, toll free 1-800-667-2114

Stuart McDonald

President & CEO

No regulatory authority has approved or

disapproved of the information in this news release.

Non-GAAP Performance Measures

This document includes certain non-GAAP performance

measures that do not have a standardized meaning prescribed by IFRS. These measures may differ from those used by, and may not be comparable

to such measures as reported by, other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction

with conventional IFRS measures, to enhance their understanding of the Company’s performance. These measures have been derived from

the Company’s financial statements and applied on a consistent basis. The following tables below provide a reconciliation of these

non-GAAP measures to the most directly comparable IFRS measure.

Total operating costs and site operating costs,

net of by-product credits

Total costs of sales include all costs absorbed

into inventory, as well as transportation costs and insurance recoverable. Site operating costs are calculated by removing net changes

in inventory, depletion and amortization, insurance recoverable, and transportation costs from cost of sales. Site operating costs, net

of by-product credits is calculated by subtracting by-product credits from the site operating costs. Site operating costs, net of by-product

credits per pound are calculated by dividing the aggregate of the applicable costs by copper pounds produced. Total operating costs per

pound is the sum of site operating costs, net of by-product credits and off-property costs divided by the copper pounds produced. By-product

credits are calculated based on actual sales of molybdenum (net of treatment costs) and silver during the period divided by the total

pounds of copper produced during the period. These measures are calculated on a consistent basis for the periods presented.

| (Cdn$ in thousands, unless otherwise indicated) |

2024

Q2 |

2024

Q11 |

2023

Q41 |

2023

Q31 |

2023

Q21 |

| Cost of sales |

108,637 |

122,528 |

93,914 |

94,383 |

99,854 |

| Less: |

|

|

|

|

|

| Depletion and amortization |

(13,721) |

(15,024) |

(13,326) |

(15,993) |

(15,594) |

| Net change in inventories of finished goods |

(10,462) |

(20,392) |

(1,678) |

4,267 |

3,356 |

| Net change in inventories of ore stockpiles |

1,758 |

2,719 |

(3,771) |

12,172 |

2,724 |

| Transportation costs |

(6,408) |

(10,153) |

(10,294) |

(7,681) |

(6,966) |

| Site operating costs |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

|

Oxide ore stockpile reclassification from capitalized

stripping |

- |

- |

- |

- |

(3,183) |

| Less by-product credits: |

|

|

|

|

|

| Molybdenum, net of treatment costs |

(7,071) |

(6,112) |

(5,441) |

(9,900) |

(4,018) |

| Silver, excluding amortization of deferred revenue |

(144) |

(137) |

124 |

290 |

(103) |

| Site operating costs, net of by-product credits |

72,589 |

73,429 |

59,528 |

77,538 |

76,070 |

| Total copper produced (thousand pounds) |

20,225 |

26,694 |

29,883 |

30,978 |

24,640 |

| Total costs per pound produced |

3.59 |

2.75 |

1.99 |

2.50 |

3.09 |

| Average exchange rate for the period (CAD/USD) |

1.37 |

1.35 |

1.36 |

1.34 |

1.34 |

|

Site operating costs, net of by-product credits

(US$

per pound) |

2.62 |

2.04 |

1.46 |

1.87 |

2.30 |

| Site operating costs, net of by-product credits |

72,589 |

73,429 |

59,528 |

77,538 |

76,070 |

| Add off-property costs: |

|

|

|

|

|

| Treatment and refining costs |

3,941 |

4,816 |

7,885 |

6,123 |

4,986 |

| Transportation costs |

6,408 |

10,153 |

10,294 |

7,681 |

6,966 |

| Total operating costs |

82,938 |

88,398 |

77,707 |

91,342 |

88,022 |

| Total operating costs (C1) (US$ per pound) |

2.99 |

2.46 |

1.91 |

2.20 |

2.66 |

1 Q2, Q3 and Q4 2023 includes the

impact from the March 15, 2023 acquisition of Cariboo from Sojitz, which increased the Company’s Gibraltar ownership from 75% to

87.5%. Q1 2024 includes the impact from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which increased the Company’s

Gibraltar ownership from 87.5% to 100%.

Non-GAAP Performance Measures

- Continued

Total Site Costs

Total site costs are comprised of the site operating

costs charged to cost of sales as well as mining costs capitalized to property, plant and equipment in the period. This measure is intended

to capture Taseko’s share of the total site operating costs incurred in the quarter at Gibraltar calculated on a consistent basis

for the periods presented.

|

(Cdn$ in thousands, unless otherwise indicated) -

87.5% basis (except for Q1 2024 and Q2 2024) |

2024

Q2 |

2024

Q11 |

2023

Q41 |

2023

Q31 |

2023

Q21 |

| Site operating costs |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

| Add: |

|

|

|

|

|

| Capitalized stripping costs |

10,732 |

16,152 |

31,916 |

2,083 |

8,832 |

| Total site costs - Taseko share |

90,536 |

95,830 |

96,761 |

89,231 |

92,206 |

| Total site costs - 100% basis |

90,536 |

109,520 |

110,584 |

101,978 |

105,378 |

1 Q2, Q3 and Q4 2023 includes the

impact from the March 15, 2023 acquisition of Cariboo from Sojitz, which increased the Company’s Gibraltar ownership from 75% to

87.5%. Q1 2024 includes the impact from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which increased the Company’s

Gibraltar ownership from 87.5% to 100%.

Adjusted net income

(loss) and Adjusted EPS

Adjusted

net income (loss) removes the effect of the following transactions from net income as reported under IFRS:

| • | Unrealized

foreign currency gains/losses; |

| • | Unrealized

gain/loss on derivatives; |

| • | Call

premium on settlement of debt; |

| • | Loss

on settlement of long-term debt, net of capitalized interest; |

| • | Gain

on Cariboo acquisition; |

| • | Gain

on acquisition of control of Gibraltar; |

| • | Realized

gain on sale of inventory; |

| • | Realized

gain on processing of ore stockpiles; and |

| • | Finance

and other non-recurring costs for Cariboo acquisition. |

Management

believes these transactions do not reflect the underlying operating performance of our core mining business and are not necessarily indicative

of future operating results. Furthermore, unrealized gains/losses on derivative instruments, changes in the fair value of financial instruments,

and unrealized foreign currency gains/losses are not necessarily reflective of the underlying operating results for the reporting periods

presented.

Non-GAAP Performance Measures

- Continued

| (Cdn$ in thousands, except per share amounts) |

2024

Q2 |

2024

Q1 |

2023

Q4 |

2023

Q3 |

| Net (loss) income |

(10,953) |

18,896 |

38,076 |

871 |

| Unrealized foreign exchange loss (gain) |

5,408 |

13,688 |

(14,541) |

14,582 |

| Unrealized loss on derivatives |

10,033 |

3,519 |

1,636 |

4,518 |

| Other operating costs |

10,435 |

- |

- |

- |

| Call premium on settlement of debt |

9,571 |

- |

- |

- |

| Loss on settlement of long-term debt, net of capitalized interest |

2,904 |

- |

- |

- |

| Gain on Cariboo acquisition |

- |

(47,426) |

- |

- |

| Gain on acquisition of control of Gibraltar** |

- |

(14,982) |

- |

- |

| Realized gain on sale of inventory*** |

4,633 |

13,354 |

- |

- |

| Realized gain on processing of ore stockpiles**** |

3,191 |

- |

- |

- |

|

Accretion and fair value adjustment on Florence royalty

obligation |

2,132 |

3,416 |

- |

- |

|

Accretion and fair value adjustment on consideration

payable to Cariboo |

8,399 |

1,555 |

(916) |

1,244 |

| Non-recurring other expenses for Cariboo acquisition |

394 |

138 |

- |

- |

| Estimated tax effect of adjustments |

(15,644) |

15,570 |

(195) |

(1,556) |

| Adjusted net income |

30,503 |

7,728 |

24,060 |

19,659 |

| Adjusted EPS |

0.10 |

0.03 |

0.08 |

0.07 |

Non-GAAP Performance Measures

- Continued

|

(Cdn$ in thousands, except per share amounts) |

2023

Q2 |

2023

Q1 |

2022

Q4 |

2022

Q3 |

| Net income (loss) |

9,991 |

33,788 |

(2,275) |

(23,517) |

| Unrealized foreign exchange (gain) loss |

(10,966) |

(950) |

(5,279) |

28,083 |

| Unrealized (gain) loss on derivatives |

(6,470) |

2,190 |

20,137 |

(72) |

| Gain on Cariboo acquisition |

- |

(46,212) |

- |

- |

|

Accretion and fair value adjustment on consideration

payable to Cariboo |

1,451 |

- |

- |

- |

| Non-recurring other expenses for Cariboo acquisition |

263 |

- |

- |

- |

| Estimated tax effect of adjustments |

1,355 |

16,272 |

(5,437) |

19 |

| Adjusted net (loss) income |

(4,376) |

5,088 |

7,146 |

4,513 |

| Adjusted EPS |

(0.02) |

0.02 |

0.02 |

0.02 |

**The $15.0 million gain on acquisition of control

of Gibraltar in Q1 2024 relates to the write-up of finished copper concentrate inventory for Taseko’s 87.5% share to its fair value

at March 25, 2024.

*** Cost of sales for the three months ended

June 30, 2024 included $4.6 million in write-ups to net realizable value for concentrate inventory held at March 25, 2024 that were subsequently

sold in April. The realized portion of the gains recorded in the prior quarter for GAAP purposes have been included in Adjusted net income

(loss) in the current quarter reflecting the period they were sold.

**** Cost of sales for the three months ended

June 30, 2024 included $3.2 million in write-ups to net realizable value for ore stockpiles held at March 25, 2024 that were subsequently

processed in the second quarter. The realized portion of the write-ups recorded in the prior quarter for GAAP purposes have been included

in Adjusted net income (loss) in the current quarter reflecting the period they were processed.

Non-GAAP Performance Measures

- Continued

Adjusted EBITDA

Adjusted EBITDA is presented

as a supplemental measure of the Company’s performance and ability to service debt. Adjusted EBITDA is frequently used by securities

analysts, investors and other interested parties in the evaluation of companies in the industry, many of which present Adjusted EBITDA

when reporting their results. Issuers of “high yield” securities also present Adjusted EBITDA because investors, analysts

and rating agencies consider it useful in measuring the ability of those issuers to meet debt service obligations.

Adjusted EBITDA represents net income

before interest, income taxes, and depreciation and also eliminates the impact of a number of items that are not considered indicative

of ongoing operating performance. Certain items of expense are added and certain items of income are deducted from net income that are

not likely to recur or are not indicative of the Company’s underlying operating results for the reporting periods presented or for

future operating performance and consist of:

| • | Unrealized foreign exchange gains/losses; |

| • | Unrealized gain/loss on derivatives; |

| • | Amortization of share-based compensation expense; |

| • | Call premium on settlement of debt; |

| • | Loss on settlement of long-term debt; |

| • | Gain on Cariboo acquisition; |

| • | Gain on acquisition of control of Gibraltar; |

| • | Realized gain on sale of inventory; |

| • | Realized gain on processing of ore stockpiles; and |

| • | Non-recurring other expenses for Cariboo acquisition. |

Non-GAAP Performance Measures

- Continued

| (Cdn$ in thousands) |

2024

Q2 |

2024

Q1 |

2023

Q4 |

2023

Q3 |

| Net (loss) income |

(10,953) |

18,896 |

38,076 |

871 |

| Add: |

|

|

|

|

| Depletion and amortization |

13,721 |

15,024 |

13,326 |

15,993 |

| Finance expense |

21,271 |

19,849 |

12,804 |

14,285 |

| Finance income |

(911) |

(1,086) |

(972) |

(322) |

| Income tax (recovery) expense |

(3,247) |

23,282 |

17,205 |

12,041 |

| Unrealized foreign exchange loss (gain) |

5,408 |

13,688 |

(14,541) |

14,582 |

| Unrealized loss on derivatives |

10,033 |

3,519 |

1,636 |

4,518 |

| Amortization of share-based compensation expense |

2,585 |

5,667 |

1,573 |

727 |

| Other operating costs |

10,435 |

- |

- |

- |

| Call premium on settlement of debt |

9,571 |

- |

- |

- |

| Loss on settlement of long-term debt |

4,646 |

- |

- |

- |

| Gain on Cariboo acquisition |

- |

(47,426) |

- |

- |

| Gain on acquisition of control of Gibraltar** |

- |

(14,982) |

- |

- |

| Realized gain on sale of inventory*** |

4,633 |

13,354 |

- |

- |

| Realized gain on processing of ore stockpiles**** |

3,191 |

- |

- |

- |

| Non-recurring other expenses for Cariboo acquisition |

394 |

138 |

- |

- |

| Adjusted EBITDA |

70,777 |

49,923 |

69,107 |

62,695 |

**The $15.0 million gain on acquisition of control

of Gibraltar in Q1 2024 relates to the write-up of finished copper concentrate inventory for Taseko’s 87.5% share to its fair value

at March 25, 2024.

*** Cost of sales for the three months ended

June 30, 2024 included $4.6 million in write-ups to net realizable value for concentrate inventory held at March 25, 2024 that were subsequently

sold in April. The realized portion of the gains recorded in the prior quarter for GAAP purposes have been included in Adjusted net income

(loss) in the current quarter reflecting the period they were sold.

**** Cost of sales for the three months ended

June 30, 2024 included $3.2 million in write-ups to net realizable value for ore stockpiles held at March 25, 2024 that were subsequently

processed in the second quarter. The realized portion of the write-ups recorded in the prior quarter for GAAP purposes have been included

in Adjusted net income (loss) in the current quarter reflecting the period they were processed.

Non-GAAP Performance Measures

- Continued

| (Cdn$ in thousands) |

2023

Q2 |

2023

Q1 |

2022

Q4 |

2022

Q3 |

| Net income(loss) |

9,991 |

33,788 |

(2,275) |

(23,517) |

| Add: |

|

|

|

|

| Depletion and amortization |

15,594 |

12,027 |

10,147 |

13,060 |

| Finance expense |

13,468 |

12,309 |

10,135 |

12,481 |

| Finance income |

(757) |

(921) |

(700) |

(650) |

| Income tax expense |

678 |

20,219 |

1,222 |

3,500 |

| Unrealized foreign exchange (gain) loss |

(10,966) |

(950) |

(5,279) |

28,083 |

| Unrealized (gain) loss on derivatives |

(6,470) |

2,190 |

20,137 |

(72) |

| Amortization of share-based compensation expense |

417 |

3,609 |

1,794 |

1,146 |

| Gain on Cariboo acquisition |

- |

(46,212) |

- |

- |

| Non-recurring other expenses for Cariboo acquisition |

263 |

- |

- |

- |

| Adjusted EBITDA |

22,218 |

36,059 |

35,181 |

34,031 |

Earnings from mining operations before depletion

and amortization

Earnings from mining operations before depletion and

amortization is earnings from mining operations with depletion and amortization, also any items that are

not considered indicative of ongoing operating performance are added back. The Company discloses this measure, which has been derived

from our financial statements and applied on a consistent basis, to provide assistance in understanding the results of the Company’s

operations and financial position and it is meant to provide further information about the financial results to investors.

| |

Three months ended

June 30, |

Six months ended

June 30, |

| (Cdn$ in thousands) |

2024 |

2023 |

2024 |

2023 |

| Earnings from mining operations |

44,948 |

12,070 |

69,367 |

41,182 |

| Add: |

|

|

|

|

| Depletion and amortization |

13,721 |

15,594 |

28,745 |

27,621 |

| Realized gain on sale of inventory |

4,633 |

- |

17,987 |

- |

| Realized gain on processing of ore stockpiles |

3,191 |

- |

3,191 |

- |

| Other operating costs |

10,435 |

- |

10,435 |

- |

| Earnings from mining operations before depletion, amortization and non-recurring items |

76,928 |

27,664 |

129,725 |

68,803 |

During the three and six months

ended June 30, 2024, the realized gains on sale of inventory and processing of ore stockpiles relates to inventory held at March 25, 2024

that was written-up from book value to net realizable value and subsequently sold or processed between March 26 and June 30, 2024.

Non-GAAP Performance Measures

- Continued

Site operating costs per ton milled

The Company discloses this measure,

which has been derived from our financial statements and applied on a consistent basis, to provide assistance in understanding the Company’s

site operations on a tons milled basis.

| (Cdn$ in thousands, except per ton milled amounts) |

2024

Q2 |

2024

Q11 |

2023

Q41 |

2023

Q31 |

2023

Q21 |

|

Site operating costs (included in cost of

sales) - Taseko share |

79,804 |

79,678 |

64,845 |

87,148 |

83,374 |

| Site operating costs - 100% basis |

79,804 |

90,040 |

74,109 |

99,598 |

95,285 |

| Tons milled (thousands) |

5,728 |

7,677 |

7,626 |

8,041 |

7,234 |

| Site operating costs per ton milled |

$13.93 |

$11.73 |

$9.72 |

$12.39 |

$13.17 |

1 Q2, Q3 and Q4 2023 includes the

impact from the March 15, 2023 acquisition of Cariboo from Sojitz, which increased the Company’s Gibraltar ownership from 75% to

87.5%. Q1 2024 includes the impact from the March 25, 2024 acquisition of Cariboo from Dowa and Furukawa, which increased the Company’s

Gibraltar ownership from 87.5% to 100%.

Technical Information

The technical information contained

in this MD&A related to the Florence Copper Project is based upon the report entitled: “NI 43-101 Technical Report - Florence

Copper Project, Pinal County, Arizona” issued March 30, 2023 with an effective date of March 15, 2023 which is available on SEDAR+.

The Florence Copper Project Technical Report was prepared under the supervision of Richard Tremblay, P.Eng., MBA, Richard Weymark, P.Eng.,

MBA, and Robert Rotzinger, P.Eng. Mr. Tremblay is employed by the Company as Chief Operating Officer, Mr. Weymark is Vice President Engineering,

and Robert Rotzinger is Vice President Capital Projects. All three are Qualified Persons as defined by NI 43-101.

Caution Regarding Forward-Looking Information

This document contains “forward-looking

statements” that were based on Taseko’s expectations, estimates and projections as of the dates as of which those statements

were made. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “outlook”,

“anticipate”, “project”, “target”, “believe”, “estimate”, “expect”,

“intend”, “should” and similar expressions.

Forward-looking statements are

subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of activity,

performance or achievements to be materially different from those expressed or implied by such forward-looking statements. These included

but are not limited to:

| • | uncertainties about the effect of COVID-19 and the response of local, provincial,

federal and international governments to the threat of COVID-19 on our operations (including our suppliers, customers, supply chain, employees

and contractors) and economic conditions generally and in particular with respect to the demand for copper and other metals we produce; |

| • | uncertainties and costs related to the Company’s exploration and development

activities, such as those associated with continuity of mineralization or determining whether mineral resources or reserves exist on a

property; |

| • | uncertainties related to the accuracy of our estimates of mineral reserves, mineral

resources, production rates and timing of production, future production and future cash and total costs of production and milling; |

| • | uncertainties related to feasibility studies that provide estimates of expected

or anticipated costs, expenditures and economic returns from a mining project; |

| • | uncertainties related to the ability to obtain necessary licenses permits for development

projects and project delays due to third party opposition; |

| • | uncertainties related to unexpected judicial or regulatory proceedings; |

| • | changes in, and the effects of, the laws, regulations and government policies affecting

our exploration and development activities and mining operations, particularly laws, regulations and policies; |

| • | changes in general economic conditions, the financial markets and in the demand

and market price for copper, gold and other minerals and commodities, such as diesel fuel, steel, concrete, electricity and other forms

of energy, mining equipment, and fluctuations in exchange rates, particularly with respect to the value of the U.S. dollar and Canadian

dollar, and the continued availability of capital and financing; |

| • | the effects of forward selling instruments to protect against fluctuations in copper

prices and exchange rate movements and the risks of counterparty defaults, and mark to market risk; |

| • | the risk of inadequate insurance or inability to obtain insurance to cover mining

risks; |

| • | the risk of loss of key employees; the risk of changes in accounting policies and

methods we use to report our financial condition, including uncertainties associated with critical accounting assumptions and estimates; |

| • | environmental issues and liabilities associated with mining including processing

and stock piling ore; and |

| • | labour strikes, work stoppages, or other interruptions to, or difficulties in, the

employment of labour in markets in which we operate mines, or environmental hazards, industrial accidents or other events or occurrences,

including third party interference that interrupt the production of minerals in our mines. |

For further information on Taseko, investors

should review the Company’s annual Form 40-F filing with the United States Securities and Exchange Commission www.sec.gov

and home jurisdiction filings that are available at www.sedar.com.

Cautionary Statement on Forward-Looking

Information

This discussion includes certain statements

that may be deemed "forward-looking statements". All statements in this discussion, other than statements of historical facts,

that address future production, reserve potential, exploration drilling, exploitation activities, and events or developments that the

Company expects are forward-looking statements. Although we believe the expectations expressed in such forward-looking statements are

based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking

statements include market prices, exploitation and exploration successes, continued availability of capital and financing and general

economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and

actual results or developments may differ materially from those projected in the forward-looking statements. All of the forward-looking

statements made in this MD&A are qualified by these cautionary statements. We disclaim any intention or obligation to update or revise

any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable

law. Further information concerning risks and uncertainties associated with these forward-looking statements and our business may be found

in our most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities.

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Jan 2024 to Jan 2025