Taseko Mines Announces the Appointment of Crystal Smith to its Board of Directors

November 19 2024 - 7:00AM

Taseko Mines Limited (TSX: TKO; NYSE MKT: TGB; LSE: TKO) ("Taseko"

or the "Company") today announced a new appointment to its Board of

Directors.

Ron Thiessen, Chairman of Taseko commented, “On

behalf of the entire Board, I am pleased to welcome Chief Crystal

Smith to Taseko’s Board of Directors. Ms. Smith has many great

qualities that will strengthen our Board, through her experience as

the Haisla Nation’s elected Chief Councillor and her background in

economic development of Indigenous-led and supported industrial

projects in British Columbia.”

“Ms. Smith has been a champion for the

responsible development of liquified natural gas (LNG) on BC’s

North Coast, while establishing numerous joint ventures and limited

partnerships for the benefit of the Haisla Nation. Her leadership

in facilitating resource development in British Columbia, and

fostering mutually beneficial partnerships between industry and

Indigenous groups, will greatly benefit Taseko as we look to

advance our portfolio of projects in the province,” added Mr.

Thiessen.

Ms. Crystal Smith stated, “I am pleased to bring

my years of experience in Indigenous governance, environmental

advocacy and responsible industrial development to Taseko’s Board

of Directors as the Company seeks to grow the responsible

production of copper in Canada and the United States. I believe

responsible resource development, advanced in partnership with

Indigenous communities, can make a positive contribution to the

goals of Reconciliation, while contributing to a stronger Canadian

economy and benefitting all Canadians.”

Ms. Smith has served as elected Chief Councillor

of the Haisla Nation for the past seven years. During that time,

she was instrumental in developing Cedar LNG, the world’s first

Indigenous majority-owned LNG project located within Haisla

territory in Kitimat, BC. A partnership with Pembina Pipeline

Corporation, the project represents one of the most significant

capital investments by an Indigenous nation in Canada’s history. It

successfully completed federal and provincial environmental

assessment processes in 2023 and achieved a final investment

decision in June 2024.

Ms. Smith also leads the Haisla Nation’s

involvement with LNG Canada, and its development of the first LNG

export facility on Canada’s West Coast.

Ms. Smith is Chair of the First Nations LNG

Alliance, an advocacy group of Indigenous governments and

organizations pursuing an expanded LNG industry in Canada. She is

also a Director of the First Nations Climate Initiative, which

promotes responsible economic development in support of BC and

Canada’s net-zero targets.

Ms. Smith obtained her ICD.D Designation through

the ICD-Rotman Director Education Program in January of 2023.

For further information on Taseko, see the

Company’s website at www.tasekomines.com or contact:

Investor enquiries Brian Bergot, Vice President,

Investor Relations – 778-373-4554

Stuart McDonaldPresident and CEO

No regulatory authority has approved or

disapproved of the information contained in this news release.

Caution Regarding Forward-Looking

Information

This document contains “forward-looking

statements” that were based on Taseko’s expectations, estimates and

projections as of the dates as of which those statements were made.

Generally, these forward-looking statements can be identified by

the use of forward-looking terminology such as “outlook”,

“anticipate”, “project”, “target”, “believe”, “estimate”, “expect”,

“intend”, “should” and similar expressions.

Forward-looking statements are subject to known

and unknown risks, uncertainties and other factors that may cause

the Company’s actual results, level of activity, performance or

achievements to be materially different from those expressed or

implied by such forward-looking statements. These included but are

not limited to:

- uncertainties about the future

market price of copper and the other metals that we produce or may

seek to produce;

- changes in general economic

conditions, the financial markets, inflation and interest rates and

in the demand and market price for our input costs, such as diesel

fuel, reagents, steel, concrete, electricity and other forms of

energy, mining equipment, and fluctuations in exchange rates,

particularly with respect to the value of the U.S. dollar and

Canadian dollar, and the continued availability of capital and

financing;

- uncertainties resulting from the

war in Ukraine, and the accompanying international response

including economic sanctions levied against Russia, which has

disrupted the global economy, created increased volatility in

commodity markets (including oil and gas prices), and disrupted

international trade and financial markets, all of which have an

ongoing and uncertain effect on global economics, supply chains,

availability of materials and equipment and execution timelines for

project development;

- uncertainties about the continuing

impact of the novel coronavirus (“COVID-19”) and the response of

local, provincial, state, federal and international governments to

the ongoing threat of COVID-19, on our operations (including our

suppliers, customers, supply chains, employees and contractors) and

economic conditions generally including rising inflation levels and

in particular with respect to the demand for copper and other

metals we produce;

- inherent risks associated with

mining operations, including our current mining operations at

Gibraltar, and their potential impact on our ability to achieve our

production estimates;

- uncertainties as to our ability to

control our operating costs, including inflationary cost pressures

at Gibraltar without impacting our planned copper production;

- the risk of inadequate insurance or

inability to obtain insurance to cover material mining or

operational risks;

- uncertainties related to the

feasibility study for Florence copper project (the “Florence Copper

Project” or “Florence Copper”) that provides estimates of expected

or anticipated capital and operating costs, expenditures and

economic returns from this mining project, including the impact of

inflation on the estimated costs related to the construction of the

Florence Copper Project and our other development projects;

- the risk that the results from our

operations of the Florence Copper production test facility (“PTF”)

and ongoing engineering work including updated capital and

operating costs will negatively impact our estimates for current

projected economics for commercial operations at Florence

Copper;

- uncertainties related to the

accuracy of our estimates of Mineral Reserves (as defined below),

Mineral Resources (as defined below), production rates and timing

of production, future production and future cash and total costs of

production and milling;

- the risk that we may not be able to

expand or replace reserves as our existing mineral reserves are

mined;

- the availability of, and

uncertainties relating to the development of, additional financing

and infrastructure necessary for the advancement of our development

projects, including with respect to our ability to obtain any

remaining construction financing potentially needed to move forward

with commercial operations at Florence Copper;

- our ability to comply with the

extensive governmental regulation to which our business is

subject;

- uncertainties related to our

ability to obtain necessary title, licenses and permits for our

development projects and project delays due to third party

opposition;

- our ability to deploy strategic

capital and award key contracts to assist with protecting the

Florence Copper project execution plan, mitigating inflation risk

and the potential impact of supply chain disruptions on our

construction schedule and ensuring a smooth transition into

construction;

- uncertainties related to First

Nations claims and consultation issues;

- our reliance on rail transportation

and port terminals for shipping our copper concentrate production

from Gibraltar;

- uncertainties related to unexpected

judicial or regulatory proceedings;

- changes in, and the effects of, the

laws, regulations and government policies affecting our exploration

and development activities and mining operations and mine closure

and bonding requirements;

- our dependence solely on our 87.5%

interest in Gibraltar (as defined below) for revenues and operating

cashflows;

- our ability to collect payments

from customers, extend existing concentrate off-take agreements or

enter into new agreements;

- environmental issues and

liabilities associated with mining including processing and stock

piling ore;

- labour strikes, work stoppages, or

other interruptions to, or difficulties in, the employment of

labour in markets in which we operate our mine, industrial

accidents, equipment failure or other events or occurrences,

including third party interference that interrupt the production of

minerals in our mine;

- environmental hazards and risks

associated with climate change, including the potential for damage

to infrastructure and stoppages of operations due to forest fires,

flooding, drought, or other natural events in the vicinity of our

operations;

- litigation risks and the inherent

uncertainty of litigation, including litigation to which Florence

Copper could be subject to;

- our actual costs of reclamation and

mine closure may exceed our current estimates of these

liabilities;

- our ability to meet the financial

reclamation security requirements for the Gibraltar mine and

Florence Project;

- the capital intensive nature of our

business both to sustain current mining operations and to develop

any new projects, including Florence Copper;

- our reliance upon key management

and operating personnel;

- the competitive environment in

which we operate;

- the effects of forward selling

instruments to protect against fluctuations in copper prices,

foreign exchange, interest rates or input costs such as fuel;

- the risk of changes in accounting

policies and methods we use to report our financial condition,

including uncertainties associated with critical accounting

assumptions and estimates; and Management Discussion and Analysis

(“MD&A”), quarterly reports and material change reports filed

with and furnished to securities regulators, and those risks which

are discussed under the heading “Risk Factors”.

For further information on Taseko, investors

should review the Company’s annual Form 40-F filing with the United

States Securities and Exchange Commission www.sec.gov and home

jurisdiction filings that are available at www.sedarplus.ca,

including the “Risk Factors” included in our Annual Information

Form.

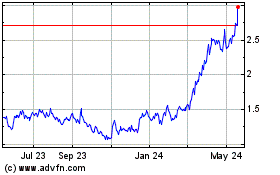

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Jan 2025 to Feb 2025

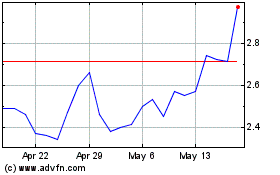

Taseko Mines (AMEX:TGB)

Historical Stock Chart

From Feb 2024 to Feb 2025