Fresh Vine Wine, Inc. and Notes Live, Inc. Mutually Agree to Terminate Merger Agreement

August 01 2024 - 3:00PM

Fresh Vine Wine Inc. (NYSE American: VINE) (“Fresh Vine”) today

announced it has agreed with Notes Live, Inc. to terminate their

previously announced merger agreement, originally announced on

January 29, 2024, pursuant to which Notes Live would have combined

with, and become a wholly-owned subsidiary of, Fresh Vine. The

merger agreement provided for termination rights, subject to

certain exceptions, in favor of either party if the merger

contemplated by the merger agreement was not consummated by a July

31, 2024 end date. Conditions to the closing of the merger were not

satisfied as of the end date and Notes Live indicated its desire to

terminate the transaction. Following discussions between Fresh Vine

and Notes Live, the parties mutually agreed to terminate the merger

agreement. Fresh Vine continues to hold the shares of Notes Live’s

stock that it acquired earlier this year.

“While today’s announcement is unfortunate, I

want to thank the Notes Live management team for their partnership

over the last several months and, as a continuing shareholder of

Notes Live, we wish them success for the future,” stated Michael

Pruitt, CEO of Fresh Vine. “We intend to investigate our range of

strategic options in a continued effort to seek to maximize value

for Fresh Vine stockholders, which may include seeking to identify

another combination opportunity.”

About Fresh Vine Wine, Inc.

Fresh Vine Wine, Inc. (NYSE American: VINE) is a

producer of lower carb, lower calorie premium wines in the United

States. Fresh Vine Wine positions its core brand lineup as an

affordable luxury, retailing between $14.99 - $24.99 per bottle.

Fresh Vine Wine’s varietals currently include its Cabernet

Sauvignon, Chardonnay, Pinot Noir, Rosé, Sauvignon Blanc, Sparkling

Rosé, and a limited Reserve Napa Cabernet Sauvignon. All varietals

have been produced and bottled in Napa, California.

Note on Forward-looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements generally can

be identified using words such as “anticipate,” “expect,” “plan,”

“could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,”

“project,” and other words of similar meaning. These

forward-looking statements address various matters including

statements regarding the timing or nature of future operating or

financial performance or other events. Forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

such statements. Among these risks and uncertainties are those set

forth in Fresh Vine’s annual report on Form 10-K for the year ended

December 31, 2023, and subsequently filed documents with the SEC.

In addition to such risks and uncertainties, risks and

uncertainties related to forward-looking statements contained in

this press release include statements relating to Fresh Vine’s

business and the pursuit of Fresh Vine’s strategic options,

including seeking to identify another combination opportunity.

Actual results may differ materially from those indicated by such

forward-looking statements as a result of various factors,

including without limitation: (i) uncertainties relating to Fresh

Vine’s ability to identify a suitable combination partner within an

appropriate timeline or at all, (ii) risks related to Fresh Vine’s

continued listing on the NYSE American; (iii) the effect of the

announcement of the termination of the merger agreement on Fresh

Vine’s business relationships, operating results, business

generally and reputation; (iv) the sufficiency of Fresh Vine’s cash

and working capital to support continuing operations and efforts to

pursue another strategic transaction; (v) uncertainties regarding

other events and unanticipated spending and costs that could reduce

Fresh Vine’s cash resources; (vi) Fresh Vine’s ability to obtain

additional financing when and if needed to do so, and the dilutive

impact of any such financing; (vii) the existence and outcome of

any legal proceedings that may be instituted against Fresh Vine or

its directors or officers related to the proposed merger

transaction and the termination of the merger agreement; and (viii)

the value or benefits that may be realized by Fresh Vine’s

investment in Notes Live, Inc. A further description of the risks

and uncertainties relating to the business of Fresh Vine is

contained in Fresh Vine’s most recent Annual Report on Form 10-K

and its Quarterly Reports on Form 10-Q, as well as any amendments

thereto reflected in subsequent filings with the SEC. Fresh Vine

cautions investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read Fresh Vine’s filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this document, and Fresh Vine

undertakes no obligation to update or revise any forward-looking

statements as a result of new information, future events or changes

in its expectations.

CONTACT: info@freshvinewine.com

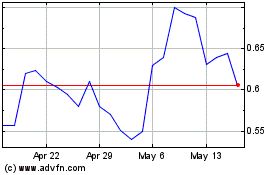

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Nov 2024 to Dec 2024

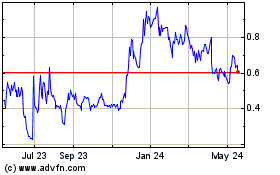

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Dec 2023 to Dec 2024