Filed by Fresh Vine Wine, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Amaze Software, Inc.

Date: December 19, 2024

To Our Shareholders,

As a brand dedicated to supporting the creators of today and tomorrow, it’s essential for us to deeply understand how they think,

what inspires them, and what challenges they face. Creators know that building a modern brand doesn’t happen overnight—it’s

a process of continuous evolution, learning, and improvement. In 2024, we proved that “becoming amazing is better than already

being amazing.”

By striving to improve just 1% every day, we strengthened our position as

a leader in creator-driven commerce while resonating with the mindset of creators and investors alike—those who recognize that growth

is a journey worth celebrating.

This concept will take center stage in 2025 with the launch of our new brand

awareness campaign:

“Becoming Amazing > Being Amazing.”

This campaign honors the journey toward success, the milestones along the

way, and the constant evolution that defines both creators and our brand. It sets the tone for our strategic roadmap rollout in 2025 and

underscores our commitment to making the journey as meaningful as the destination.

A Breakout Year for Growth and Innovation

2024 was a transformative year for Amaze—defined by significant growth, bold innovation, and extraordinary achievements by the

creators we support. From scaling our infrastructure to diversifying our product suite, we equipped creators with powerful tools to unlock

new levels of success.

Strategic investments in platform enhancements and global expansion fueled

our momentum, bringing 1.4 million new creators onto the platform and solidifying our leadership in the creator economy. Below, we spotlight

the key drivers behind this incredible year:

Global Expansion and Product Innovation

Expanding Horizons

In 2024, Amaze achieved significant milestones in global fulfillment by establishing

key centers in India and Mexico. These facilities empower creators to access high-growth markets with competitive pricing and faster shipping.

Furthermore, our localized fulfillment model has reduced our environmental footprint, reflecting our commitment to sustainable operations.

Diversifying Products

We expanded our portfolio to include over 180 physical products and introduced

20+ digital product categories in Q4, capitalizing on holiday demand. This innovation enables creators to generate revenue through digital

offerings, even after shipping deadlines, creating new opportunities for growth.

Custom Product Partnerships

Our partnership with Pietra continues to redefine creator-driven commerce,

allowing creators to design and launch bespoke products with ease. From custom toys to plushies, these personalized offerings deepen creator

loyalty and expand their reach.

Strategic Partnerships and Platform Enhancements

Streamlining the Creator Journey

Our integration with Adobe Express is revolutionizing the way creators design

and launch products. By reducing friction and boosting productivity, this collaboration is a game-changer, as highlighted by enthusiastic

feedback at Adobe MAX.

Partnerships

We’ve invested in strategic partnerships that deliver tangible value

to creators and enhance platform engagement. These collaborations provide tools that improve content creation, boost audience connection,

and streamline the shopping experience, empowering creators to grow their brands and maximize their potential.

Celebrating Creator Success

The incredible accomplishments of our creators underscore the strength of

the Amaze platform:

| |

• |

Beach Reads & Bubbly: Generated $250,000 in a two-week

presale. |

| |

• |

Don Marshall: Generated $75,000 in GMV by selling 1,871 calendars

in just 14 days. |

| |

• |

Terminal Montage: $67,000 in plushie sales in just 30 days. |

These stories are a testament to the power of the Amaze platform and our

commitment to supporting creators in every step of their journey.

Looking Ahead: 2025 and Beyond

As we close 2024, we look forward to our previously announced merger with

Fresh Vine Wine, expanding our product portfolio and unlocking new opportunities. In 2025, we will continue to scale globally, enhance

marketing support for creators, and deepen the connections between creators and their audiences.

At Amaze, we live by the philosophy that becoming amazing is better than

being amazing. We strive for continuous improvement—getting 1% better every day. Together with our creators, investors, and

partners, we’re not just building a platform; we’re shaping the future of creator-powered commerce.

Thank you for being part of this journey.

Sincerely,

Aaron Day

CEO, Amaze Software

Forward-Looking Statements

This investor letter contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements generally can be identified using words such as “anticipate,” “expect,” “plan,” “could,”

“may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,”

and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing

or nature of future operating or financial performance or other events. Forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those expressed or implied by such statements. Among these risks and uncertainties

are those set forth in Fresh Vine’s annual report on Form 10-K for the year ended December 31, 2023, and subsequently filed documents

with the SEC. In addition to such risks and uncertainties, risks and uncertainties related to forward-looking statements contained in

this press release include statements relating to Fresh Vine’s business and the pursuit of Fresh Vine’s strategic options,

including the proposed business combination with Amaze Software (the “Business Combination”). Actual results may differ materially

from those indicated by such forward-looking statements as a result of various factors, including without limitation: (i) the risk that

the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of Fresh Vine’s

securities; (ii) the failure to satisfy the conditions to the consummation of the Business Combination, including the adoption of the

Business Combination Agreement by the stockholders of Fresh Vine; (iii) the receipt of certain governmental and regulatory approvals;

(iv) the occurrence of any event, change or other circumstance that could give rise to the termination or abandonment of the Business

Combination Agreement; (v) the potential effect of the announcement or pendency of the Business Combination on Amaze’s or Fresh

Vine’s business relationships, performance and business generally, including potential difficulties in employee retention; (vi)

risks that the Business Combination disrupts current plans and operations of Fresh Vine or Amaze; (vii) the outcome of any legal proceedings

that may be instituted against Fresh Vine related to the Business Combination Agreement or the Business Combination; (viii) the risk that

Fresh Vine will be unable to maintain the listing of Fresh Vine’s securities on NYSE American; (ix) the risk that the price of Fresh

Vine’s securities, or the price of Pubco Common Stock following the closing, may be volatile due to a variety of factors, including

changes in the competitive industries in which Fresh Vine or Amaze operates, variations in performance across competitors, changes in

laws and regulations affecting Fresh Vine’s or Amaze’s business and changes in the capital structure; (x) the inability to

implement business plans, forecasts, and other expectations after the completion of the Business Combination and identify and realize

additional opportunities; (xi) the risk of changes in applicable law, rules, regulations, regulatory guidance, or social conditions in

the countries in which Amaze’s customers and suppliers operate in that could adversely impact Amaze’s operations; (xii) the

risk that Fresh Vine and/or Amaze may not achieve or sustain profitability; (xiii) the risk that Fresh Vine and/or Amaze will need to

raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; and (xiv) the risk that

Fresh Vine and/or Amaze experiences difficulties in managing its growth and expanding operations. A further description of the risks and

uncertainties relating to the business of Fresh Vine is contained in Fresh Vine’s most recent Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. Fresh Vine cautions investors

not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read Fresh

Vine’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking

statements in this press release speak only as of the date of this document, and Fresh Vine undertakes no obligation to update or revise

any forward-looking statements as a result of new information, future events or changes in its expectations.

ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

This communication is being made in respect of the proposed transaction between

Fresh Vine and Adifex Holdings LLC, a Delaware limited liability company (“Company”), pursuant to which the Company and its

future subsidiary Amaze will become subsidiaries of Fresh Vine, or its successor entity. In connection with the proposed transaction,

Fresh Vine, or its successor entity, will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement

of Fresh Vine and Company and a Prospectus of Fresh Vine, as well as other relevant documents regarding the proposed transaction. A definitive

Joint Proxy Statement/Prospectus will also be sent to Fresh Vine stockholders and Company members.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT

AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION AND FRESH VINE, THE COMPANY AND AMAZE.

A free copy of the Joint Proxy Statement/Prospectus (when it becomes available),

as well as other filings containing information about Fresh Vine, may be obtained at the SEC’s Internet site (http://www.sec.gov).

You will also be able to obtain these documents, free of charge, from Fresh Vine by accessing Fresh Vine’s website at www.ir.freshvinewine.com,

by directing a request to Fresh Vine Stockholder Relations Manager, Mike Pruitt, at Fresh Vine via PO Box 78984 Charlotte, NC 28271, by

calling 707.578.2238 or by sending an e-mail to mp@freshvinewine.com.

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

Participants in the Solicitation

Fresh Vine, Company, and Amaze and certain of their respective directors,

executive officers or other members of management may be deemed to be participants in the solicitation of proxies from Fresh Vine’s

stockholders and Company members in connection with the proposed transaction. Information regarding Fresh Vine’s directors and executive

officers is contained in Fresh Vine’s definitive proxy statement on Schedule 14A, dated November 6, 2023 and in certain of its Current

Reports on Form 8-K, which are filed with the SEC. Additional information regarding the interests of those participants and other persons

who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed

transaction when it becomes available. Investors should read the Joint Proxy Statement/Prospectus carefully when it becomes available

before making any voting or investment decisions. Free copies of these documents may be obtained as described in the preceding paragraph.

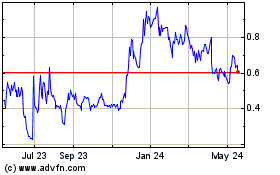

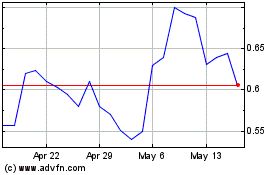

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Fresh Vine Wine (AMEX:VINE)

Historical Stock Chart

From Mar 2024 to Mar 2025