Vanguard Chops More ETF Fees -- WSJ

February 27 2019 - 2:02AM

Dow Jones News

Money manager takes aim at funds that invest in international

assets

By Asjylyn Loder

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 27, 2019).

Vanguard Group is cutting management fees on 10 exchange-traded

funds, the latest money manager to trim fees on a host of

investment products.

The ETFs, with combined assets of $176 billion, include funds

that invest in international stocks and bonds. The biggest is the

$63 billion Vanguard FTSE Emerging Markets ETF, which will cost $12

a year for every $10,000 invested. That is down from $14, making it

cheaper than a competing ETF from BlackRock Inc.'s iShares Core

lineup. In addition, 43 Vanguard mutual funds are also reducing

fees.

The price cuts were disclosed in new regulatory filings

Tuesday.

"A broader and broader base of investors are using ETFs, and

that's pushing more assets into these funds," said Rich Powers,

head of ETF product management at Vanguard. As the funds grow,

economies of scale allow Vanguard to pass savings along to

investors, he said.

Vanguard's move is the latest in an escalating fee war in ETFs,

where the cheapest funds typically raise the most money. Filings

due within the next week for eight other Vanguard ETFs, with a

total of almost $440 billion in assets, could show additional fee

cuts.

The price war is going well beyond ETF-management costs and into

a host of other investment products. Vanguard has been at the

forefront of the trend for decades, continually cutting the costs

of investing. The focus on lower fees has made the money-management

giant in the Philadelphia suburb of Malvern the second-largest

asset manager in the world.

Vanguard's success has forced its competitors to match its

ultralow prices, a trend often called "the Vanguard effect."

Last year, Fidelity Investments grabbed headlines by introducing

a zero-fee lineup of mutual funds, kindling speculation that a free

ETF wouldn't be far behind.

Online lender Social Finance Inc. said Monday it planned to

start the first zero-fee ETFs. But there's catch: The fees are only

being waived for the first year. After that, they could rise to $19

a year for every $10,000 invested, the filing shows.

The cheapest U.S. stock ETFs now cost $3 to $4 a year for every

$10,000 invested.

The price paid for index funds that invest in big U.S. companies

barely budged in 2018, but there remains steady competition in

segments like bonds and emerging markets, according to a report

earlier this month from Morningstar.

The price wars also have expanded into new areas of asset

management, like advice and brokerage. Earlier this month, Charles

Schwab Corp. and Fidelity Investments doubled the number of ETFs

that are exempt from trading commissions on their brokerage

platforms.

To be sure, management fees aren't the only factor investors use

when choosing a fund. They also have to factor in tax implications,

trading costs and fund strategy. Vanguard's emerging markets ETF

doesn't include South Korean stocks -- unlike the competing iShares

funds -- because the funds follow different index

methodologies.

Investors also have shown a willingness to pay a little more for

index strategies that try to smooth out market turbulence or pick

the best-run companies.

Write to Asjylyn Loder at asjylyn.loder@wsj.com

(END) Dow Jones Newswires

February 27, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

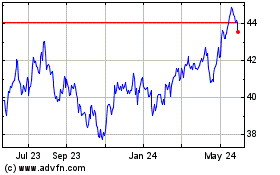

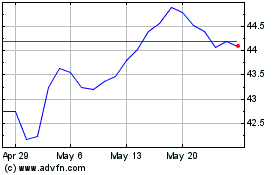

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Feb 2024 to Feb 2025