TIDMAAZ

RNS Number : 7651Q

Anglo Asian Mining PLC

23 February 2023

23 February 2023

Anglo Asian Mining PLC

2023 Production Guidance

63 to 71 per cent. forecast increase in copper production

Anglo Asian Mining PLC ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer primarily focused in

Azerbaijan, is pleased to announce its production guidance for the

full year 2023 ("FY 2023"). The Company is forecasting to produce

between 50,000 and 54,000 gold equivalent ounces comprising 4,100

to 4,300 tonnes of copper and 30,000 to 32,000 ounces of gold.

2023 is a pivotal year for Anglo Asian as it begins its

transition to achieve significant copper production with the

opening of its new Gilar and Zafar mines and the delivery of the

increased capacity of its flotation plant. Copper production is

forecast to increase by 63 to 71 per cent. and gold production to

decrease by 26 to 30 per cent. This is in accordance with the

Company's growing focus on copper, capitalising on the global

decarbonisation agenda. More information about Anglo Asian's

medium-term growth strategy and its increasing focus on copper will

be announced later this quarter.

FY 2023 production guidance is as follows:

Full year

2023

Full year

2022 Production

Metal Unit Actual production guidance

------------------- -----------------

Gold Ounces 43,114 30,000 to 32,000

-------- ------------------- -----------------

Copper Tonnes 2,516 4,100 to 4,300

-------- ------------------- -----------------

Gold equivalent

ounces GEOs 57,618 50,000 to 54,000

-------- ------------------- -----------------

Note the Company does not forecast silver production as it is

not material.

The gold equivalent ounces have been computed using the

following budget rates:

Weight of metal

equivalent to one

Price of metal ($) ounce of gold

Actual Actual

31 December 31 December Budget

Metal Unit 2022 Budget 2023 2022 2023

------- ------------- ------------- -------

Gold ounce 1,797.55 1,800.00 1.000 1.000

------- ------------- -------------- ------------- -------

Silver ounce 23.97 20.00 0.013 0.011

------- ------------- -------------- ------------- -------

Copper tonne 8,387.00 8,500.00 4.666 4.722

------- ------------- -------------- ------------- -------

Production plan for 2023

The Company's production profile will change significantly in

2023 as copper becomes a greater proportion of its production:

-- The agitation leaching plant will operate on a "campaign

basis" during the year, processing mainly gold rich ore from

Gedabek open pit and underground mines. There is a diminishing

amount of ore suitable for agitation leaching at Gedabek.

Additionally, it is more commercially advantageous to use the

plant's crushing and grinding circuit to treat ore for the expanded

flotation plant.

-- As previously announced, capacity at the flotation plant will

double in 2023 as a result of investment of approximately $3

million.

-- Copper rich ore from the Gedabek open pit will be used as

feedstock for the flotation plant during 2023. From Q4 2023, Gilar

ore will also be processed and its gold content extracted by

agitation leaching.

-- The Zafar mine will be constructed in 2023, but ore

extraction will not be required to maintain the operation of the

flotation plant at its maximum capacity during the year. Production

in 2023 will be maximised by processing Gilar ore which also

contains gold.

-- Only a very minimal amount of ore will be processed from the

Vejnaly and Gosha mines in 2023. The recent decision to fast-track

the Gilar mine into production has required redeployment of

resources away from these two projects.

Outlook for 2024

The Company will start 2024 with a flotation plant with double

its original capacity and the Gilar and Zafar mines ready to

provide the ore feedstock. This will enable to Company to produce

copper in 2024 at the same or greater rate than 2023. The Company

also anticipates increased gold production in 2024 in anticipation

of a full year of production from Gilar. Drilling and resource

estimation for Gilar will continue during 2023, expanding upon the

already known resources recently reported.

Reza Vaziri, CEO of Anglo Asian, commented:

"2023 will be a critical year for Anglo Asian as we pivot the

Company towards copper. We remain focused on production in the

short-term, creating value for our shareholders, as well as

finalising our medium-term growth strategy that culminates in our

transition to a mid-tier production profile. We look forward to

releasing this later this quarter."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which was incorporated into UK law by

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

For further information please contact:

Anglo Asian Mining plc

Tel: +994 12 596

Reza Vaziri, Chief Executive Officer 3350

Tel: +994 502 910

Bill Morgan, Chief Financial Officer 400

Tel: +994 502 916

Stephen Westhead, Vice President 894

SP Angel Corporate Finance LLP (Nominated Tel: +44 (0) 20

Adviser and Broker) 3470 0470

Ewan Leggat

Adam Cowl

Hudson Sandler (Financial PR) Tel: +44 0) 20 7796

Charlie Jack 4133

Harry Griffiths

About Anglo Asian Mining

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in south-west Asia with a broad portfolio of production

and exploration assets in Azerbaijan. The Company produced 57,618

gold equivalent ounces ("GEOs") for the year ended 31 December

2022.

In December 2021, the Company undertook a private placement

which acquired 19.8 per cent. of Libero Copper & Gold

Corporation ("Libero"). Libero is listed on the TSX Venture

Exchange in Canada and owns, or has the option to acquire, several

copper exploration properties in North and South America, including

Mocoa in Colombia, one of the world's largest undeveloped

copper-molybdenum resources. Two further follow-on investments have

been made in Libero to maintain the Company's shareholding at 19.8

per cent.

On 5 July 2022, the Parliament of Azerbaijan ratified amendments

to the Company's Production Sharing Agreement, which granted it

legal title to three additional concessions with a combined area of

882 square kilometres, including the Garadagh porphyry copper

deposit, with a Soviet classified resource of over 300,000 tonnes

of copper. https://www.angloasianmining.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLSESFAEEDSESE

(END) Dow Jones Newswires

February 23, 2023 02:00 ET (07:00 GMT)

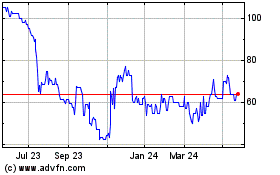

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

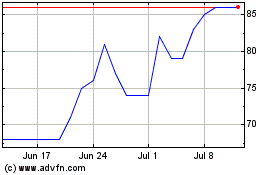

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025