TIDMAAZ

RNS Number : 6957U

Anglo Asian Mining PLC

30 March 2023

30 March 2023

Anglo Asian Mining plc

Strategic plan for transformation to mid-tier copper and gold

production

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer primarily focused in

Azerbaijan, is pleased to announce details of its strategic plan

for growth.

Highlights

-- Well-defined strategy to more than double production in the

next five years with the Company transitioning to a multi-asset,

mid-tier copper and gold producer by 2028

-- The Company forecasts total production increasing by 30 to

50 per cent. to 70,000 to 75,000 gold equivalent ounces for

2024 and 2025 (copper equivalent of 15,000 to 15,500 tonnes)

-- Copper equivalent production increasing to approximately

36,000 plus tonnes per annum (gold equivalent of 175,000

ounces) from 2028

-- Production growth delivered through the sequential opening

of four new mines in Azerbaijan

-- Copper, a critical metal for the energy transition to net

zero, expected to become the principal product of the Company

from 2026

-- Positive cash-flow, current cash and an undrawn $32 million

debt facility to support near to medium term capital expenditure

requirements

-- Growth strategy underpins the continued commitment to deliver

attractive returns to shareholders

Production targets for 2023 to 2028

Anglo Asian anticipates production of between 50,000 to 54,000

gold equivalent ounces for 2023 ( see RNS announcement dated 23

February 2023). The Company's anticipated production targets for

2024 to 2028 in its strategic plan for growth are tabulated below.

Detailed production guidance will be given as mine development

progresses.

Years Production target*

Gold equivalent ounces Copper equivalent tonnes**

----------------------- ---------------------------

2023 c. 50,000 to 54,000 c. 10,300 to 11,200

----------------------- ---------------------------

2024 and 2025 c. 70,000 to 75,000 c. 15,000 to 15,500

----------------------- ---------------------------

2026 and 2027 c. 115,000 to 125,000 c. 24,000 to 26,000

----------------------- ---------------------------

2028 c. 175,000 c. 36,000

----------------------- ---------------------------

* Anglo Asian's share of the production tabulated above is based

on its Production Sharing Agreement ("PSA"), further details of

which are set out below.

**Copper equivalent calculated at $1,650 per ounce of gold and

$8,000 per tonne of copper.

Reza Vaziri, Chief Executive Officer of Anglo Asian,

commented:

"This is an exciting time for Anglo Asian. We have devised a

strategic plan for growth to drive the Company to multi-asset,

mid-tier producer status. This focuses on a very substantial

increase in copper production, augmented by our on-going

significant gold and silver production. We have an ambitious, but

realistic, plan to deliver this through sequential asset

development and the opening of four new mines in Azerbaijan over

the next five years.

"Our upcoming increased copper exposure is timely and

value-accretive. Copper is a critical metal for the energy

transition to net zero that is expected to benefit from increased

demand as the move towards electrification intensifies.

"Critically this plan will deliver long term, sustainable value

to all our stakeholders. We look forward to updating the market on

our progress as we embark on this exciting and ambitious path to

growth."

Investor presentation

The Company will provide an online investor presentation via

Investor Meets Company on 31 March 2023 at 12:00pm BST. Further

details and registration are available at:

https://www.investormeetcompany.com/anglo-asian-mining-plc/register-investor

A copy of the investor presentation will be available on the

Company's website: https://www.angloasianmining.com/

Strategic plan for growth

The Company has a strong track record of developing and

operating mines in Azerbaijan, consistently meeting production

guidance and delivering dependable shareholder returns while

maintaining a robust balance sheet.

Having assembled a portfolio of high-quality production and

development assets, the Company is well positioned to establish a

significant copper-gold mining district in the Gedabek region in

Azerbaijan, supplemented by other in-country assets and overseas

investments.

In July 2022, Anglo Asian was awarded the Garadag and Xarxar

licences. These assets underpin the Company's new strategic plan

for growth. Since September 2022, when the Company received the

historical geological data relating to Garadag and Xarxar, it has

undertaken extensive analysis of the assets and the opportunities

and options for their development.

The strategy has two phases of growth. In Phase 1

('Transition'), production at the currently operating Gedabek and

Gadir mines will be managed to maximise their output as they come

to the end of their expected mine lives. Concurrently, the Company

plans to bring into production during 2023 to 2026 three new mines

at Zafar, Gilar and Xarxar.

Phase 2 ('Transformation') builds on this growth with the

development of Garadag. The Company assesses Garadag to have the

potential to produce over 300,000 tonnes of copper ( see RNS

announcement dated 27 March 2023). The Company forecasts Garadag

commencing production in 2028.

The strategy anticipates that the contribution of copper

production to the Company's revenue will exceed that of gold dor é

from 2026. The overall value of metal output is expected to more

than double from 2023 to 2027 and could treble by 2028.

Mine development schedule to deliver strategic plan

Project Metal Contract (licence) Estimated mine

area commissioning date

-------- ----------------- ------------------- --------------------

Zafar Copper-gold+zinc Gedabek 2023/24

----------------- ------------------- --------------------

Gilar Copper-gold Gedabek 2023/24

----------------- ------------------- --------------------

Xarxar Copper Xarxar 2026

----------------- ------------------- --------------------

Garadag Copper Garadag 2027/28

----------------- ------------------- --------------------

Production Sharing Agreement ("PSA") with the Government of

Azerbaijan

The exploration period for each mining property located in a

contract area of the PSA commences upon approval by the Government

of Azerbaijan (the "Government") of an "Exploration Work Program"

and lasts up to 48 months with a 12-month extension permitted. By

the end of the exploration period, the Company must issue a "Notice

of Discovery and Its Commerciality" followed by submission to the

Government of a "Development and Production Program" for the ore

deposit. The development and production period for each mining

property is up to 15 years with two 5-year extensions permitted.

The licensing of all contract areas is in good standing.

The Company finances the operations of each mining property and

shares with the Government the commercial products of each mine.

The Government receives 51 per cent. of "Profit Production" which

is defined as the value of production less all cash operating and

capital costs incurred in its production. Profit Production is

subject to a 25 per cent. minimum of the value of production and

unrecovered capital and operating costs can be carried forward and

offset against future production.

Financing the strategic growth plan

In the near to medium term, the new mine development will be

financed with cash flow generated from the Company's existing

mines, current cash, local bank debt and equipment vendor

financing. The Company has recently secured a AZN55 million ($32

million) debt facility with the International Bank of Azerbaijan

(see RNS announcement dated 09 March 2023). The Company may seek

additional sources of finance depending on the final processing

methods chosen.

Commitment to value creation and shareholder returns

The Company and its directors believe this strategic plan for

growth will provide the necessary growth and cash flow to provide

long term value for shareholders. Under the forecasts based on the

current strategic plan for growth, Anglo Asian intends to maintain

its prevailing dividend practice as it moves to become a mid-tier

mining company.

Our mining properties are developed for the benefit of all

stakeholders. The Company has always upheld strong ESG practices

and will develop its new mines continuing to utilise

internationally recognised best standards.

Details of the development projects and exploration

potential

Further details of the development projects are set out in

Appendix One and their further exploration upside is discussed in

Appendix Two.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which was incorporated into UK law by

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

All references to "$" are to United States dollars. All

references to "AZN" are to the Azerbaijan New Manat.

For further information please contact:

Anglo Asian Mining plc

Tel: +994 12 596

Reza Vaziri, Chief Executive Officer 3350

Tel: +994 502 910

Bill Morgan, Chief Financial Officer 400

Tel: +994 502 916

Stephen Westhead, Vice President 894

SP Angel Corporate Finance LLP (Nominated Tel: +44 (0) 20

Adviser and Broker) 3470 0470

Ewan Leggat

Adam Cowl

Hudson Sandler (Financial PR) Tel: +44 0) 20 7796

Charlie Jack 4133

Harry Griffiths

Appendix One

Asset portfolio and details of development projects

The Company will continue gold production from the Gedabek and

Gadir mines during the Transition phase.

Initially the new mines at Zafar and Gilar will feed

higher-grade copper-gold ore into the existing Gedabek processing

plant to raise copper production, targeting start-up with Gilar in

2023/24 followed by Zafar. The Gedabek plant is being expanded and

adapted to increase throughput capacity in time for new feedstock

ore from the Zafar and Gilar mines. The expansion will double

capacity at a capital cost of approximately $3 million, taking the

plant throughput to around 1,300,000 tonnes per annum ("tpa") from

650,000 tpa. The two mines (Zafar and Gilar) are planned to produce

a total of approximately 120,000 tonnes of copper equivalent by

2037. Underground tunnelling work has already started at Zafar and

Gilar with 5 metre x 5 metre portals constructed, which are

designed for production. The tunnels will initially enable rapid

infill and exploration drilling from underground for better

definition of the mineral resource and low-cost development and

expansion of both mines.

The longer-term production growth will focus on the Xarxar and

Garadag copper deposits, which contain larger resources of copper

and will likely be developed using shared infrastructure due to

their proximity and to generate operational synergies. Processing

is likely to be accomplished either by conventional flotation or

bacterial heap and/or in-situ leaching.

Figure 1: Key mines and ongoing projects showing contract area

boundaries of Anglo Asian Mining (source: Google Earth).

At Gedabek, a new copper zone at the edge of the Gedabek open

pit will extend the mine life and provide further copper ore to the

Gedabek processing plant. The preliminary non-JORC resource of the

new zone is 1.4 million tonnes grading 0.48 per cent. copper.

Gedabek currently has a total non-JORC resource estimate containing

144,000 ounces of gold and over 23,600 tonnes of copper, excluding

the residual metal inventory in processed tailings impounded in the

tailings dam.

The Zafar mine will be constructed during 2023 with production

planned from 2024. Zafar will provide back up production should

there be any delay or interruption to mining of the higher-grade

ores at Gilar. Zafar's JORC resource contains 6.8 million tonnes

grading 0.5 per cent. copper and 0.4 grammes per tonnes of gold

with around 1 per cent. zinc.

Gilar is targeted to start to supply ore to the processing plant

at Gedabek in 2023/24. Recent drill results show mineral

intersections of 5.1 to 61.7 metres grading 0.90 to 4.85 grammes

per tonne of gold combined with 0.28 to 4.43 per cent. copper.

These results further validate the decision to start construction

of an underground tunnel at Gilar for exploration and production.

Gilar's non-JORC resource currently contains 5.64 million tonnes

grading 0.82 per cent. copper, 0.87 per cent. zinc and 1.37 grammes

per tonne of gold.

Xarxar and Garadag contain larger tonnages and our current plan

is to develop them using shared infrastructure and building a

processing plant to serve both mines. Processing methods are yet to

be finalised. The Company is currently considering conventional

flotation or bacterial heap leaching with conventional open pit

and/or underground mining. In-situ recovery methods are also being

investigated.

At Xarxar, a 500 metre long, 3.5 metre by 3.5 metre tunnel

constructed into the mineral deposit is providing representative

bulk samples for test processing. The Xarxar deposit appears to fit

a Corbett model for classic copper porphyry structures with

mineralised copper ore between the phyllic and potassic alternation

zones. One 600 metre vertical intersection shows argillic

mineralisation with chalcopyrite and chalcocite. Samples from the

deposit show specks of native copper visible to the naked eye.

The topography of the deposit lends itself towards open pit

mining. Trucking of ore will be downhill which will minimise costs.

The open pit should eventually finish at a depth of 205 metres.

The Company is currently optimising the Xarxar mine plan using a

base case of $8,000 per tonne for the extraction of 20.1 million

tonnes of ore grading 0.46 per cent. copper at a 1.6 strip ratio

for 93,500 tonnes of contained copper based on the current

published non-JORC resource. Production is due to start in 2026 at

circa 9,000 tonnes of copper per annum for around seven years.

Above level 1,200 Above level 1,000

metres metres

------------------------- ---------- ------------- ------------------------- ---------- -------------

cut-off Mineralisation Resultant Metal cut-off Mineralisation Resultant Metal

(Cu (tonnes) (Cu %) (Cu tonnes) (Cu (tonnes) (Cu %) (Cu tonnes)

%) %)

--------------- ---------- ------------- -------- ---------- -------------

0.15 41,394,352 0.34 140,741 0.15 64,915,146 0.32 207,728

--------------- ---------- ------------- -------- --------------- ---------- -------------

0.30 17,095,640 0.53 90,607 0.30 23,428,520 0.51 119,485

--------------- ---------- ------------- -------- --------------- ---------- -------------

0.45 8,150,558 0.72 58,684 0.45 10,212,706 0.71 72,510

--------------- ---------- ------------- -------- --------------- ---------- -------------

At Garadag, the Company is relogging around 23,000 metres of

core drilled by AzerGold CJSC to rematch the assay results.

Non-JORC internal "open pit boundary" constrained "Indicated and

Inferred Mineral" Resource estimates show 70 million tonnes grading

0.5 per cent. copper (historical resources estimated were 49

million tonnes grading 0.64 per cent. copper, C1 & C2 Russian

classification.)

Garadag and Xarxar are only four kilometres apart and connected

by a main road. The mines will therefore share infrastructure and

processing facilities, which will accelerate Garadag's development.

Garadag is planned to be commissioned in 2027/28 and is expected to

produce over 20,000 tonnes of copper per annum from 2029.

Appendix Two

Exploration and Investment upside

The Company holds eight contract areas in Azerbaijan, with a

total area of 2,544 square kilometres (Figure 2). These include

four with a total area of 1,400 square kilometres around the

Gedabek gold-copper production area (Figure 1). The exploration

upside is extensive with further copper, gold and polymetallic

targets located in all of the Company's contract areas, including

anomalies discovered by airborne electromagnetic ('ZTEM') surveying

(20 shallow, 5 deep and 6 "porphyry") and 7 identified mineral

occurrences in and adjacent to the Gedabek area. There are 6 copper

targets in the Xarxar and Garadag areas, 28 known mineralisation

occurrence targets in the Gosha area with up to 3 per cent. copper

and 3 per cent. zinc seen in surface samples, and 9 known mineral

deposits in Ordubad. Additionally, significant exploration

potential exists in the Kyzlbulag, Demirli and Vejnaly contract

areas.

The contract areas

The locations of the eight contact areas with a total land area

of over 2,500 square kilometres are shown in figure 2.

Figure 2: Location map of contract areas in Azerbaijan

The Company currently holds in excess of 1 million tonnes of

in-situ copper in the various resource categories within its total

portfolio.

A number of copper-rich porphyry systems have been identified in

and around the Gedabek mine area. These porphyritic structures

appear to be responsible for high-grade mineralisation at Zafar and

Gilar and larger lower-grade copper mineralisation at Xarxar and

Garadag. The Company plans to use remote sensing to identify areas

of phyllic and potassic alternation which indicate potential for

further porphyry-style copper mineralisation.

Exploration at Ordubad in Nakhchivan shows classic Corbett

model, argillic and phyllic alteration either side of propylitic

alteration. The team is relogging 19,725 metres of historic drill

core from 112 drill holes. Geochemical surveying shows an 8

kilometre diameter structure of malachite in soils and outcrop. The

area shows significant potential for both copper and gold

mineralisation and development opportunities. Drilling recommenced

in March 2023. The Company has also established an office in

Nakhchivan to support the ongoing exploration programme.

There is potential to restart the Demirli copper-molybdenum

porphyry mine in the northern part of the Karabakh economic region,

when the political situation allows. The mine has the capability to

add over 6,000 tonnes per annum of copper equivalent to the

Company's production from 2025. This is not included in the current

strategic plan for growth and represents upside potential to the

above targets.

This strategy plan is focused on Azerbaijan and demonstrates the

outstanding organic growth prospects of the Company's in-country

portfolio. In addition, the Company has invested in Libero Copper

& Gold Corporation, whose project portfolio includes several

copper exploration properties in North and South America, including

Mocoa in Colombia, one of the world's largest undeveloped

copper-molybdenum resources.

Mineral resource estimates

The Company has used its own in-house estimate of resources and

economically extractable copper in this announcement and these

figures are not based on a Standard, such as JORC. The Company

intends to carry out JORC reporting on completion of the ongoing

drilling and exploration programme.

Competent Person Statement

The information in the announcement that relates to exploration

results, minerals resources and ore reserves is based on

information compiled by Dr Stephen Westhead, who is a full-time

employee of Anglo Asian Mining with the position of Vice-President,

who is a Fellow of The Geological Society of London, a Chartered

Geologist, Fellow of the Society of Economic Geologists, Fellow of

the Institute of Materials, Minerals and Mining and a Member of the

Institute of Directors.

Stephen Westhead has sufficient experience that is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity being undertaken to qualify as a Competent

Person as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Stephen Westhead consents to the inclusion in the

announcement of the matters based on his information in the form

and context in which it appears.

Stephen Westhead has sufficient experience, relevant to the

style of mineralisation and type of deposit under consideration and

to the activity that he is undertaking, to qualify as a "competent

person" as defined by the AIM rules. Stephen Westhead has reviewed

the mineral resources included in this announcement. For the

avoidance of doubt, resources and economically extractable copper

figures in this notification are not based on a Standard for the

reporting of reserves and resources, such as JORC, as defined in

the AIM Rules for Companies.

About Anglo Asian Mining

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer with a high-quality portfolio of production and

exploration assets in Azerbaijan. The Company produced 57,618 gold

equivalent ounces ("GEOs") for the year ended 31 December 2022.

In December 2021, the Company undertook a private placement

which acquired 19.8 per cent. of Libero Copper & Gold

Corporation ("Libero"). Libero is listed on the TSX Venture

Exchange in Canada and owns, or has the option to acquire, several

copper exploration properties in North and South America, including

Mocoa in Colombia, one of the world's largest undeveloped

copper-molybdenum resources. Two further follow-on investments have

been made in Libero to maintain the Company's shareholding at 19.8

per cent.

On 5 July 2022, the Parliament of Azerbaijan ratified amendments

to the Company's Production Sharing Agreement, which granted it

legal title to three additional concessions with a combined area of

882 square kilometres, including the Garadag porphyry copper

deposit, with a Soviet classified resource of over 300,000 tonnes

of copper.

https://www.angloasianmining.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEDNASKDEAA

(END) Dow Jones Newswires

March 30, 2023 02:00 ET (06:00 GMT)

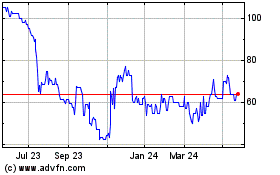

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

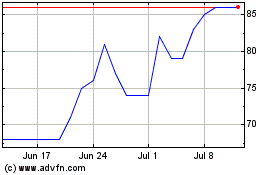

Anglo Asian (AQSE:AAZ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025