AssetCo PLC FCA approve acquisition of Ocean Dial by AssetCo (2704J)

August 15 2023 - 1:00AM

UK Regulatory

TIDMASTO

RNS Number : 2704J

AssetCo PLC

15 August 2023

15 August 2023

LEI: 213800LFMHKVNTZ7GV45

For Immediate Release

AssetCo plc

("AssetCo" or the "Company")

FCA approve acquisition of Ocean Dial Asset Management Limited

by AssetCo

AssetCo (AIM: ASTO), the agile asset and wealth management

company, is pleased to announce that the Financial Conduct

Authority has approved AssetCo's change in control application.

This enables AssetCo to proceed with its acquisition of Ocean Dial

Asset Management Limited from Avendus Capital Asset Management (UK)

Limited, once Indian regulatory approvals have been obtained. The

requisite clearances from the Indian regulators are at an advanced

stage.

Further information on the acquisition and on Ocean Dial was set

out in AssetCo's announcement of the transaction on 6 March 2023.

The consideration for the acquisition is GBP4.125m (subject to

possible adjustments) to be satisfied by the issue of 2,928,258

ordinary shares of GBP0.01 each in the capital of the Company, and

GBP2.125m in cash. The acquisition is expected to be earnings

enhancing for the Group and provides that the economic interest in

the Ocean Dial business accrues to AssetCo from the date of FCA

approval.

Ocean Dial manages the assets of the India Capital Growth Fund

Limited, which, as at end July 2023, had a net asset value in

excess of GBP150m generating an annualised run rate revenue for the

manager of around GBP1.8m. The Fund has been successfully advised

for several years by Gaurav Narain and team, based in India, who

will be joining the AssetCo Group on completion. They have

delivered excellent performance with the fund out-performing its

benchmark by some 7% over the last year (to end July 2023).

Martin Gilbert, Chairman of AssetCo, commented:

"The approval of the FCA is a significant step forwards and

brings us closer to completing our acquisition of Ocean Dial, which

will broaden and strengthen our equity management capability. We

are delighted to celebrate that progress on Independence Day for

India, recognising that we await final approval from the Indian

regulators. India is making significant progress and its economy

has the potential to match or even overtake those of the US and

China in the longer term. The country is home to some market

leading companies and a remarkable pool of talent. We are excited

to be one step closer to being able to complete our acquisition of

Ocean Dial."

For further information, please contact:

AssetCo plc Numis Securities Limited

Gary Marshall, CFOO Nominated adviser and joint

Peter McKellar, Deputy Chairman broker

Tel: +44 (0) 7788 338157 Giles Rolls / Charles Farquhar

Tel: +44 (0) 20 7260 1000

Panmure Gordon (UK) Limited H/ Advisors Maitland

Joint broker Neil Bennett

Atholl Tweedie Rachel Cohen

Tel: +44 (0) 20 7886 2906 Tel: +44 (0) 20 7379 55151

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPIMATMTMBBBJ

(END) Dow Jones Newswires

August 15, 2023 02:00 ET (06:00 GMT)

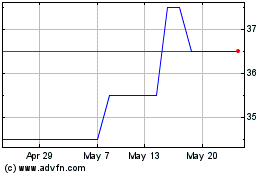

Assetco (AQSE:ASTO.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

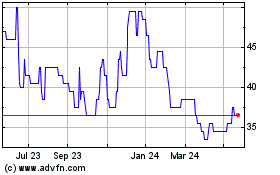

Assetco (AQSE:ASTO.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025