TIDMBZT

RNS Number : 5635R

Bezant Resources PLC

01 March 2023

1 March 2023

Bezant Resources Plc

("Bezant" or the "Company")

Mankayan Project Update

Bezant (AIM: BZT), the copper-gold exploration and development

company, further to its announcement dated 26 October 2022

regarding the conditional share purchase agreement (the "SPA") to

exchange its 27.5% shareholding in IDM Mankayan Pty Ltd ("IDM

Mankayan") for a 27.5% shareholding in IDM International Limited

(ACN 108029198) ("IDM International") confirms that IDM

International has issued a notice of meeting for an extraordinary

general meeting on 24 March 2023 for its shareholders ("IDM

Shareholders Meeting") to approve the SPA and the acquisition by

IDM International of the shares of the other shareholder of IDM

Mankayan (the "Other IDM Mankayan Shareholder") (the "Proposed

Transaction") ("IDM International NoM") so IDM International will

own 100% of IDM Mankayan. Upon the IDM International shareholders

approving the Proposed Transaction at the IDM Shareholders Meeting

all conditions in relation to the SPA will have been met.

Highlights:

-- A copy of the IDM International NoM which incorporates as

Annexure 1 an Independent Expert's Report by BDO Corporate Finance

(WA) Pty Ltd dated 3 February 2023 as to whether the Proposed

Transaction is fair and reasonable for existing IDM International

shareholders (Independent Expert's Report) is available at:

https://www.advancedshare.com.au/assets/documents/IDM_NOM_2023_EGM.pdf

.

-- The Independent Expert's Report includes as an appendix an

Independent Technical Assessment and Valuation Report for Mankayan

Copper-Gold project, Philippines by E2M Limited (Sahara) dated 27

December 2022 (effective date) and prepared applying the guidelines

and principles of the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves_the 2012

JORC Code, the Australasian Code for Public Reporting of Technical

Assessments and Valuations of Mineral Assets - the 2015 VALMIN Code

and the rules and guidelines issued by such bodies as ASIC and ASX

pertaining to Independent Expert Reports (Technical Report).

-- Subsequent to the signing of the SPA holders of 3,050,000 IDM

International options expiring at differing dates in 2024 and 2026

with an exercise price of A$0.20 per share issued to investors who

previously subscribed for IDM International shares at A$0.10 per

share have been exercised early for A$610,000 (approx. GBP348,000)

so that IDM International currently has 47,097,850 shares in issue

and after the Proposed Transaction will have 73,526,560 shares in

issue ("IDM Proposed Shares in Issue"). As a result of the exercise

of these IDM International options, upon completion of the Proposed

Transaction Bezant's holding of 19,381,054 IDM International shares

(the "Consideration Shares") will be diluted from 27.5% to 26.36%

of IDM International.

-- IDM International's sole asset following the Proposed

Transaction will be its interest in the Mankayan Project. The

Independent Expert's Report included a valuation of an IDM

International share on a diluted minority basis following the

Proposed Transaction and the table below shows these valuations and

the corresponding valuation of the Consideration Shares to be

issued to Bezant following the Proposed Transaction using an FX

rate of A$1= GBP0.56 as at 28 February 2023.

Valuation in Independent Expert's Report

--------------------------------------------------

Low Preferred High

--------------- --------------- ----------------

Expert Report Valuation

per IDM International

share AUD 0.232 AUD 0.470 AUD 0.726

--------------- --------------- ----------------

No. of Consideration

Shares to be issued

to Bezant 19,381,054 IDM International shares

--------------------------------------------------

Value in A$ AUD 4,496,405 AUD 9,109,095 AUD 14,070,645

--------------- --------------- ----------------

Value in GBP GBP 2,517,987 GBP 5,101,093 GBP 7,879,561

--------------- --------------- ----------------

-- Further to its 26 October 2022 announcement Bezant confirms

it subscribed A$137,500 (approx. GBP77K) in a 4 year IDM

International convertible loan note (the "Convertible Loan Note")

on the same terms as IDM International convertible loan notes with

entities associated with two of its directors to raise A$362,500

(approx. GBP203K) (together the "Convertible Notes"). The

Convertible Notes convert at A$0.20 per IDM International share and

have attached to them one option for each 2 shares in IDM

International issued to the Company under the Convertible Notes (an

" IDM Option ") with an exercise price A$0.40 within the 4 years

from the date of issue of the IDM Option.

Colin Bird, Executive Chairman of Bezant, commented: " We

continue to be very pleased with the progress made in advancing the

Mankayan Project since IDM International's involvement, not least

the renewal of the MPSA for 25 years which we believe is a catalyst

for the development of this Tier 1 world class copper gold porphyry

project. We are very confident that management in the Philippines

supported by IDM International have the experience and expertise to

take the project forward through the next stages of evaluation and

development which will significantly enhance the value of the

project. "

As previously reported IDM International, through Crescent

Mining Development Corporation's ("Crescent"), continue to make

very good progress on initial Pre-Feasibility Studies on the

Mankayan copper-gold project in the Philippines since IDM Mankayan

acquired its interest in the Mankayan project in October 2021. This

has included:

-- Renewal by the Mines and Geosciences Bureau of the Department

of Environment and Natural Resources of the Philippines government

("MGB") of Crescent's Mineral Production Sharing Agreement No.

057-96-CAR (the "MPSA") for a second 25-year term with effect from

12 November 2021 (the "MPSA Renewal");

-- Meetings with the MGB who have expressed their support and

encouragement for local projects such as the Mankayan Project and

working closely with various Government departments for approvals

required for the development of the Mankayan Project;

-- Working closely with the local communities including direct investment into those areas;

-- The completion of 2 Pre-feasibility holes to depths of 1,000m

each focusing on metallurgy, geotechnical and hydrogeological

studies and the collection and management of all data produced from

the 2 holes for analysis by Crescent's in country team and its

advisors;

-- Commencement of the process of appointing key consultants who

will be undertaking Pre-Feasibility Studies work, including mine

designs and engineering studies, infrastructure and tailings

facilities, environmental studies and indigenous peoples' consent;

and

-- Discussions with private equity and mining finance houses for

the funding of the Pre-Feasibility Studies work program.

Going forward, IDM International and Crescent, along with their

various consultants and advisors, intend to complete a full

Pre-Feasibility Studies during 2023 and 2024 that will present the

Mankayan Project as a globally significant copper-gold project at a

time when the supply-demand gap for copper is expected to be large

as the world transitions to electrification.

For further information, please contact:

Bezant Resources Plc

Colin Bird, Executive Chairman +44 (0) 20 3416 3695

Beaumont Cornish (Nominated Adviser)

Roland Cornish/Asia Szusciak +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law pursuant to the Market Abuse (Amendment) (EU Exit)

regulations (SI 2019/310).

Qualified Person:

Technical information in this announcement has been reviewed by

Edward (Ed) Slowey, BSc, PGeo, technical director of Bezant

Resources Plc. Mr Slowey is a graduate geologist with more than 40

years' relevant experience in mineral exploration and mining, a

founder member of the Institute of Geologists of Ireland and is a

Qualified Person under the AIM rules. Mr Slowey has reviewed and

approved this announcement.

Technical Glossary

"Pre-Feasibility A Preliminary Feasibility Study (Pre-Feasibility

Study" Study) is a comprehensive study of a range of

options for the technical and economic viability

of a mineral project that has advanced to a

stage where a preferred mining method, in the

case of underground mining, or the pit configuration,

in the case of an open pit, is established and

an effective method of mineral processing is

determined. It includes a financial analysis

based on reasonable assumptions on the Modifying

Factors and the evaluation of any other relevant

factors which are sufficient for a Competent

Person, acting reasonably, to determine if all

or part of the Mineral Resources may be converted

to an Ore Reserve at the time of reporting.

A Pre-Feasibility Study is at a lower confidence

level than a Feasibility Study.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSSMFLFEDSELD

(END) Dow Jones Newswires

March 01, 2023 09:49 ET (14:49 GMT)

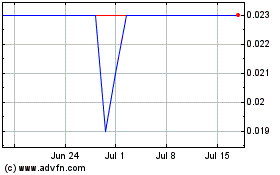

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From May 2024 to Jun 2024

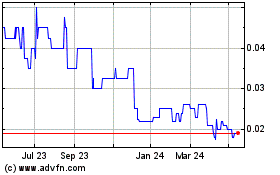

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jun 2023 to Jun 2024