TIDMRLE

RNS Number : 4370N

Real Estate Investors PLC

25 September 2023

Real Estate Investors Plc

("REI" the "Company" or the "Group")

Half Year Results

For the six months ended 30 June 2023

ROBUST OPERATIONAL PERFORMANCE, CONTINUED SALES & DEBT

REDUCTION

Real Estate Investors Plc (AIM: RLE), the UK's only

Midlands-focused Real Estate Investment Trust (REIT) with a

portfolio of commercial property across all sectors, is pleased to

report its unaudited half year results for the six-month period

ended 30 June 2023 ("H1 2023").

FINANCIAL

-- Disposals of GBP3.6 million, plus post-period disposals of

GBP6.8 million - total disposals year to date of GBP10.4 million at

an aggregate uplift of 8.7%, (pre-costs) to 31 December 2022 year

end (FY 2022) book value (comprising of 18 retail units and a

drive-thru pod development)

-- Disposal proceeds used to pay down GBP8.4 million of debt year to date 2023

-- Further pipeline of sales are in solicitors' hands to

generate receipts in order to reduce portfolio debt and execute

stated strategy

-- Underlying profit before tax* of GBP2.2 million (H1 2022: GBP2.9 million) due to sales

-- Loss before tax of GBP779,000 (H1 2022: GBP8.3 million

profit) includes GBP4.1 million loss on property revaluations

(non-cash item) representing a 2.4% portfolio valuation decline (H1

2022: GBP3.1 million gain), GBP737,000 profit on sale of investment

property (H1 2022: GBP1 million profit) and GBP388,000 surplus on

hedge valuation (H1 2022: GBP1.2 million surplus)

-- EPRA** Net Tangible Assets ("NTA") per share of 60.3p (FY 2022: 62.2p)

-- Revenue of GBP6.1 million (H1 2022: GBP7.2 million) reduction

due to H2 2022 and H1 2023 sales

-- EPRA** EPS of 1.26p (H1 2022: 1.64p)

-- The Company will make a fully covered quarterly dividend

payment of 0.625p per share in respect of Q2 2023 (Q2 2022: 0.8125p

per share)

-- GBP48.5 million total declared/paid to shareholders since dividend policy commenced in 2012

OPERATIONAL

-- Strong rent collection for H1 2023 of 99.93% (H1 2022: 99.36%)

-- GBP169.2 million gross portfolio valuation (after asset

disposals) (FY 2022: GBP175.4 million)

-- On a like for like basis the portfolio valuation has reduced

by 2.4% on 31 December 2022 valuation to GBP166.8 million

-- Completed 46 lease events, with new lettings generating GBP385,438 p.a. of new income

-- WAULT*** of 4.81 years to break/5.99 years to expiry (FY 2022: 4.98 years /6.29 years)

-- Contracted rental income of GBP12.5 million p.a. as at 30

June 2023 (H1 2022: GBP14 million p.a. / FY 2022: GBP12.6 million

p.a.) due to portfolio disposals

-- Occupancy levels marginally higher at 85.04% (FY 2022: 84.54%)

BANKING & DEBT RELATED

-- Disposal proceeds used to pay down GBP8.4 million of debt in 2023 year to date

-- Total drawn debt of GBP67.9 million (H1 2022: GBP75.5

million), post period reduced to GBP63 million

-- Company's debt is 100% fixed, with a blended debt profile term of 18 months

-- Refinancing negotiations with our bankers commenced in early H2 2023

-- Loan to Value (net of cash) of 35.9% (FY 2022: 36.8%)

(management revised target LTV net of cash to 35% or below,

previously 40% or below)

-- GBP8 million cash at bank - the Company is maximising returns

on cash reserves, with monies on deposit now earning 4.5% on

instant access

-- Average cost of debt maintained at 3.7% (FY 2022: 3.7%)

-- Hedge facility has improved by GBP388,000 for half year to 30 June 2023

PAUL BASSI, CHIEF EXECUTIVE, COMMENTED:

"Throughout 2023 investment and sales activity has been at its

lowest level since the 2008 financial crisis, with corporate and

institutional investors remaining dormant. With a lack of available

assets for purchase and against the backdrop of an inactive

investment marketplace, the diverse nature of our portfolio has

allowed us to break-up and sell individual units, taking advantage

of the ongoing demand for smaller lot sizes from private investors

and owner occupiers. We will continue with this approach until we

see a normalised market. Since the start of 2021, we have operated

a successful sales programme, with sales totalling GBP48.9 million

and GBP38.3 million of debt repaid, with further pipeline sales in

legals.

We are confident that normalised market conditions will return

once the trajectory of interest rates settles, allowing us to sell

further assets where asset management initiatives have been

completed. It is our intention to accelerate our sales programme

and we will consider the sale of assets either on an individual or

collective basis, on terms that represent value for

shareholders.

Subject to market conditions and our sales rate, the Company

intends to repay bank debt and, in due course, consider a share

buyback or other form of capital return. Management remains open to

evaluating any corporate transaction that is in the best interests

of shareholders and in the meantime, we will continue to pay a

fully covered dividend."

FINANCIAL & OPERATIONAL RESULTS

30 June 2023 30 June 2022

Revenue GBP6.1 million GBP7.2 million

---------------- ---------------

Underlying profit before GBP2.2 million GBP2.9 million

tax*

---------------- ---------------

Contracted rental income GBP12.5 million GBP14.0 million

---------------- ---------------

EPRA EPS** 1.26p 1.64p

---------------- ---------------

Pre-tax (loss)/profit (GBP0.8 million) GBP8.3 million

---------------- ---------------

Dividend per share 1.25p 1.625p

---------------- ---------------

Average cost of debt 3.7% 3.5%

---------------- ---------------

Like for like rental income GBP12.5 million GBP12.4 million

---------------- ---------------

30 June 2023 31 December 2022

Gross property assets GBP169.2 million GBP175.4 million

---------------- ----------------

EPRA NTA per share** 60.3p 62.2p

---------------- ----------------

Like for like capital GBP122.44 psf GBP125.42 psf

value psf

---------------- ----------------

Like for like valuation GBP166.8 million GBP170.9 million

---------------- ----------------

Tenants 209 201

---------------- ----------------

WAULT to break*** 4.81 years 4.98 years

---------------- ----------------

Total ownership (sq ft) 1.36 million 1.37 million sq

sq ft ft

---------------- ----------------

Net assets GBP106.4 million GBP109 million

---------------- ----------------

Loan to value 40.7% 42.2%

---------------- ----------------

Loan to value (net of

cash) 35.9% 36.8%

---------------- ----------------

Definitions

* Underlying profit before tax excludes profit/loss on

revaluation and sale of properties and interest rate swaps

** EPRA = European Public Real Estate Association

*** WAULT = Weighted Average Unexpired Lease Term

Enquiries:

Real Estate Investors Plc

Paul Bassi/Marcus Daly +44 (0)121 212 3446

Cavendish Securities (Nominated Adviser)

Katy Birkin/Ben Jeynes +44 (0)20 7220 0500

Liberum (Broker)

Jamie Richards/William King +44 (0)20 3100 2000

About Real Estate Investors Plc

Real Estate Investors Plc is a publicly quoted, internally

managed property investment company and REIT with a portfolio of

mixed-use commercial property, managed by a highly-experienced

property team with over 100 years of combined experience of

operating in the Midlands property market across all sectors. The

Company's strategy is to invest in well located, real estate assets

in the established and proven markets across the Midlands, with

income and capital growth potential, realisable through active

portfolio management, refurbishment, change of use and lettings.

The portfolio has no material reliance on a single asset or

occupier. On 1st January 2015, the Company converted to a REIT.

Real Estate Investment Trusts are listed property investment

companies or groups not liable to corporation tax on their rental

income or capital gains from their qualifying activities. The

Company aims to deliver capital growth and income enhancement from

its assets, supporting its dividend policy. Further information on

the Company can be found at www.reiplc.com .

CHAIRMAN'S & CHIEF EXECUTIVE'S STATEMENT

Despite the backdrop of market uncertainty and the lowest level

of activity since the financial crisis of 2008, the diversity and

flexibility of our portfolio has allowed us to attract interest

from private investors and owner occupiers, enabling us to progress

our sales programme and reduce debt in line with our stated

strategy. At the half year, we had disposed of GBP3.6 million of

assets and repaid GBP3.6 million of debt. Since the period end, we

have disposed of a further GBP6.8 million of assets and repaid a

further GBP4.8 million of debt, resulting in total sales year to

date of GBP10.4 million and total debt repayment of GBP8.4 million.

These sales are at an aggregate uplift of 8.7%, (pre-costs) to

December 2022 year end book value (comprising of 18 retail units

and a drive-thru pod development).

Operationally, the REI portfolio remains stable with robust rent

collection levels of 99.93% for H1 2023. Revenue as at 30 June 2023

was GBP6.1 million (H1 2022: GBP7.2 million) with the reduction due

to H2 2022 and H1 2023 disposals. Underlying profit at the half

year was GBP2.2 million (H1 2022: GBP2.9 million) with a loss

before tax of GBP779,000, driven predominantly by a GBP4.1 million

non-cash loss on property revaluations which is reflective of

market sentiment towards the office sector and a lack of

transactional evidence. Of the GBP4.1 million valuation reduction,

51.2% was across offices.

There remains a risk of downward pressure on future valuations

due to rising interest rates and an inactive investment market,

however, our active asset management approach and diversified

portfolio offer some protection against this. Contracted rents at

the half year were GBP12.5 million p.a. (H1 2022: GBP14 million

p.a.) reflecting loss of rent from sales in H2 2022 and H1 2023. At

the period end, WAULT was 4.81 years to break and 5.99 years to

expiry, with occupancy sitting at 85.04%. Post period lettings that

are expected to complete in H2 2023, will also add to our revenues

and occupancy going forward, along with the potential to add

further capital appreciation and further sales stock.

The business remains well insulated from rising rates with low

gearing of 35.9% (net of cash) and 100% fixed debt at an average

cost of 3.7%, with a blended debt maturity of 18 months at the half

year. Management have engaged in refinancing discussions with

lenders to ensure that sensible gearing levels are maintained in

line with management's revised objective to operate gearing at sub

35%, as we are actively repaying debt from sales proceeds (previous

gearing target 40%).

SALES STRATEGY

Presently, there is little or no demand from our normal buyer

pool of property companies, REITs, UK funds, pension funds,

overseas or private equity buyers and the only known investor

demand is from private investors for smaller lot sizes, owner

occupiers, government and public bodies, plus special

purchasers.

Our diverse portfolio has no material reliance on any one

sector, asset or occupier, and has enabled us to withstand

significant headwinds of the financial crisis, a global pandemic

and inflation, whilst enabling us to continue paying a covered

dividend. It has also allowed us to identify properties that can be

sold to a private investor market whilst most other investors

remain inactive. However, attracting a buyer for the whole or large

parts of the portfolio is more difficult as most buyers have a

specialised strategic approach and therefore are not seeking assets

of a diverse, regional nature which require focused asset

management and local expertise. Management have therefore focused

efforts on capitalising on private investor demand and reducing the

portfolio size by disposing of assets individually, with sales year

to date of GBP10.4 million.

We have identified a further 20% of our portfolio that can

satisfy this known demand, some of which is already under offer and

in legals. This will provide us with a reduced portfolio, which

assuming a more normalised marketplace, may attract a corporate or

portfolio buyer. Ongoing sales will allow us to reduce our debt

further and, subject to market conditions, consider a share buyback

or other form of capital return, all whilst continuing to pay a

covered dividend.

BANKING & FINANCING

In March 2023, the Group extended the GBP20 million facility

with Lloyds Banking Group Plc for 6 months to 31 May 2024 and the

GBP31 million facility with National Westminster Bank Plc for 3

months to June 2024, with a view to formalising new facilities when

long-term rates have stabilised.

As at 30 June 2023, 100% of the Company's debt was fixed, with a

blended debt profile term of 18 months and an average cost of debt

of 3.7% (FY 2022: 3.7%).

Management are mindful of the ongoing inflationary pressures on

interest rates and proactively entered refinancing negotiations

with our bankers in early H2 2023 in relation to banking facilities

that are due for renewal in 2024. These discussions are ongoing and

management are confident of securing competitive banking facilities

for the business but, notwithstanding the continuing repayment of

debt from sales, interest costs will increase next year.

The business remains multi-banked with debt spread across 4

lenders and all banking covenants (a combination of interest cover

against rental income and LTV against asset value measurements)

continue to be met with headroom available and cure facilities if

necessary:

As at 30 June 2023

Lender Debt Facility Debt Maturity Hedging

--------------- --------------- --------

Lloyds Bank GBP20.0m May 2024 100%

--------------- --------------- --------

National Westminster

Bank GBP32.5m June 2024 100%

--------------- --------------- --------

Barclays GBP7.6m December 2024 100%

--------------- --------------- --------

Aviva GBP8.2m 2027 & 2030 100%

--------------- --------------- --------

Following a successful period of sales in H1 2023 and with

management firmly focused on reducing gearing levels via debt

repayment, GBP3.6 million of debt was repaid using disposal

proceeds during the first half of the year. Since the period end, a

further sum of GBP4.8 million has been repaid, reducing total drawn

debt to GBP63.4 million (H1 2022: GBP75.5 million).

2021 2022 2023 to date Total

Sales GBP17.6m GBP20.9m GBP10.4m GBP48.9m

--------- --------- ------------- --------

Debt Repaid GBP11.9m GBP18m GBP8.4m GBP38.3m

--------- --------- ------------- --------

Total Drawn GBP89.4m GBP71.4m GBP63m GBP63m

Debt

--------- --------- ------------- --------

Loan to value (net of cash) at the half year was 35.9% (FY 2022:

36.8%). Our hedge facility improved by GBP388,000 for the half year

to 30 June 2023. Whilst management focuses on debt repayment, it is

prudent to keep cash reserves at a healthy level, should the

business be required to provide bank security in the form of cash.

The Company continues to maximise its returns on cash reserves,

with GBP8 million cash at bank at the half year with the majority

on deposit earning 4.5% on an instant access basis.

COST SAVINGS & EMPLOYEE LTIPS

Identified savings of GBP300,000 per annum and cost cutting

remain on track for the year end 2023 and further savings of up to

GBP500,000 have been identified for 2024. The sales of some vacant

and part-vacant assets will also reduce void holding costs going

forward, such was the case with the sale of part-vacant York House

in July 2023 which was sold to a college and provided us with

significant savings in void costs.

Management and employee LTIPs are the subject of a comprehensive

review and, upon a conclusion of the review, a further announcement

will be made. Any changes will be directly aligned to the stated

strategy and it is anticipated that a new LTIP scheme will be

adopted for the new financial year.

DIVID

Subject to the acceleration of our ongoing sales programme,

along with the businesses' operational performance, the Board

remains committed to paying a covered dividend. The Board is

pleased to announce a Q2 2023 fully covered dividend of 0.625p

reflecting a yield of 9.1% based on a mid-market opening price of

27.50p on 22 September 2023. A total of GBP48.5 million has been

declared/paid to shareholders since the Company's dividend policy

commenced in 2012. The proposed timetable for the dividend, which

will be paid as an ordinary dividend, is as follows:

Ex-dividend date: 5 October 2023

Record date: 6 October 2023

----------------

Dividend payment date: 27 October 2023

----------------

ASSET MANAGEMENT & OCCUPANCY

The portfolio remains operationally robust with strong rent

collection levels during H1 2023 of 99.93%. Q1 2023 saw a strong

start to the year with occupier interest and demand for space

continuing from the previous year. The occupational market in the

retail sector (neighbourhood and convenience) has remained

resilient. We have disposed of all our Central Business District

assets, with the exception of our own Head Office in Birmingham.

Our non-city centre occupier demand is stable and we are achieving

our ERV levels. However, there is a notable slowing down of

decision making and completions in H2 2023.

In H1 2023, we effected 46 lease events, to include 6 lease

renewals, 5 breaks removals and 19 new lettings with new lettings

generating GBP385,438 p.a. of new income to the portfolio, more

than offsetting the GBP184,500 p.a. of lost income associated with

sales. Contracted rental income was GBP12.5 million per annum as at

30 June 2023, due to disposals (FY 2022: GBP12.6m).

The portfolio occupancy at the period end was 85.04% (FY 2022:

84.54%) and the WAULT was 4.81 years to break and 5.99 years to

expiry. There are a significant number of lettings in the pipeline

that, once completed, will continue to improve the WAULT and

occupancy across the portfolio (subject to sales and other

unforeseen lease events). The lettings will also reduce the

associated void costs across the portfolio and support the

Company's underlying profit and covered dividend payments.

Example key lease events year to date include:

-- AFH Financial Group Limited took out a new lease for 11.5

years at the passing rent of GBP396,077 per annum (at ERV) with no

break, now occupying all 25,000 sq ft at Avon House, Bromsgrove

-- Walsall - Luxury Leisure took 9,500 sq ft on a 10-year lease

at GBP60,000 per annum at ERV, removing a void unit and associated

costs

-- Walsall - Superdrug renewed on a 5-year lease at GBP110,900

per annum, therefore retaining a national retailer in the unit at

ERV and ensuring no void costs whilst maintaining rental income to

a strong covenant

-- Wolverhampton - SGS UK Limited took 5,500 sq ft at GBP90,500

per annum on a 10-year lease at Venture Court at ERV, maximising

occupancy at the property

-- Bromsgrove - detailed planning consent secured for letting to

Costa Coffee on a new straight 15-year lease at GBP85,000 per

annum, without the usual Costa terms of a break at 10 years

-- Nuneaton - Poundland, new 5-year lease in their existing unit

at a rent of GBP90,000 per annum

-- Acocks Green - Poundstretcher, new 10-year lease at GBP60,000 per annum

Following the recent publicity relating to Wilkos closures, we

can confirm that we only have one unit in Crewe which is already

the subject of discussions with other operators, representing 2% of

our rental income.

PORTFOLIO MIX TABLE

GBP per

Sector annum % by income

Office Office 5,398,868 43.17%

-------------------------------------------- ----------- ------------

TR Traditional Retail 2,027,790 16.22%

-------------------------------------------- ----------- ------------

Discount Retail - Poundland/B&M

DR /Poundstretcher etc 1,472,350 11.77%

-------------------------------------------- ----------- ------------

Medical and Pharmaceutical -

M&P Boots/Holland & Barrett etc 759,049 6.07%

-------------------------------------------- ----------- ------------

Restaurant/Bar/Coffee - Costa

RBC Coffee 531,251 4.25%

-------------------------------------------- ----------- ------------

Financial/Licences/Agency -

FIN Bank of Scotland 346,125 2.77%

-------------------------------------------- ----------- ------------

Food Stores - Lidl, Co-op, Iceland

FS etc 406,545 3.25%

-------------------------------------------- ----------- ------------

Other - Hotels (Travelodge),

Leisure (The Gym Group), Car

Other parking, AST , (Education) School/College 1,563,606 12.50%

-------------------------------------------- ----------- ------------

Total 12,505,584 100%

----------------------------------------------------- ----------- ------------

PORTFOLIO SUMMARY TABLE

Value Area Contracted ERV NIY EQY RY Occupancy

(GBP) (sq ft) Rent (GBP) (GBP) (%) (%) (%) (%)

Portfolio 166,800,000 1,373,631 12,505,584 15,066,920 7.02% 8.38% 8.46% 85.04%

------------ ---------- ------------ ----------- ------ ------ ------ ----------

Land* 2 ,393,390 - - - - - -

------------ ---------- ------------ ----------- ------ ------ ------ ----------

Total 169,193,390 1,373,631 12,505,584 15,066,920 7.02% 8.38% 8.46% 85.04%

------------ ---------- ------------ ----------- ------ ------ ------ ----------

*Our land holdings are excluded from the yield calculations

ENVIRONMENTAL & SOCIAL GOVERNANCE ("ESG")

REI continues to work with leading professionals to collect,

track and report carbon emissions data across landlord-controlled

areas. The reduction of the portfolio's carbon footprint is an

ongoing priority for the business.

In accordance with government guidelines, REI also continues to

ensure our assets meet the UK statutory regulations and timeframes

for Energy Performance Certificates ("EPCs"). An overview of the

asset EPC ratings across the portfolio is noted below, showing the

progress since 31 December 2022 to date:

% of portfolio (by sq ft)

EPC Rating

A B C D E F G Total

----- ------ ------ ------ ----- ---- ---- --------

31 Dec

2022 1.36 22.99 31.18 37.49 6.98 0 0 100.00

----- ------ ------ ------ ----- ---- ---- --------

22 Sep

2023 2.08 37.19 22.96 34.52 3.25 0 0 100.00

----- ------ ------ ------ ----- ---- ---- --------

ONGOING STRATEGY & OUTLOOK

In the absence of any consolidation opportunities within the

real estate sector that align with the best interests of

shareholders and the backdrop of poor market conditions, management

have focused efforts on an opportunistic and targeted sales

programme with a view to significantly reducing debt and leverage

and returning capital to shareholders.

Maximum flexibility will be maintained when considering all

future options, including share buybacks or another form of capital

return, with the view to maximising shareholder returns.

The Company will consider sales of assets either on an

individual or collective basis, subject to market conditions that

represent value for shareholders. Management remain open to

evaluating any corporate transaction that is in the best interests

of shareholders.

OUR STAKEHOLDERS

Our continued thanks to our shareholders, advisors, occupiers

and staff for their ongoing support and assistance.

CHANGE OF NAME OF NOMINATED ADVISER

The Company also announces that its nominated adviser has

changed its name to Cavendish Securities plc (formerly Cenkos

Securities plc) following completion of its own corporate

merger.

William Wyatt Paul Bassi CBE D.UNIV

Chairman Chief Executive

22 September 2023 22 September 2023

CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

For the 6 months ended 30

June 2023

Six months Six months

to to Year ended

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Revenue 6,056 7,165 13,293

Cost of sales (1,285) (1,170) (2,489)

------------ ------------ -------------------------------

Gross profit 4,771 5,995 10,804

Administrative expenses (1,359) (1,483) (3,252)

Gain on sale of investment

properties 737 1,001 948

(Loss)/gain in fair value

of investment properties (4,073) 3,149 3,152

------------ ------------ -------------------------------

Profit from operations 76 8,662 11,652

Finance income 51 26 49

Finance costs (1,294) (1,600) (2,981)

Gain on financial liabilities

held at fair value 388 1,238 2,214

------------ ------------ -------------------------------

(Loss)/profit on ordinary

activities before taxation (779) 8,326 10,934

Income tax charge - - -

------------ ------------ -------------------------------

Net (loss)/profit after taxation

and total comprehensive income (779) 8,326 10,934

------------ ------------ -------------------------------

Basic earnings per share 6 Nil 4.64p 6.33p

------------ ------------ -------------------------------

Diluted earnings per share 6 Nil 4.56p 6.25p

------------ ------------ -------------------------------

EPRA earnings per share 6 1.26p 1.64p 2.68p

------------ ------------ -------------------------------

CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

for the 6 months ended 30 June 2023

Share Share Capital Other Retained Total

Capital Premium Redemption Reserves Earnings

Account Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December 2021 17,938 51,721 749 759 33,855 105,022

Share based payment - - - 75 - 75

Dividends - final

2021 - - - - (1,457) (1,457)

Dividends - interim

2022 - - - - (1,458) (1,458)

-------- ------------------ ----------- --------- --------- --------

Transactions with

owners - - - 75 (2,915) (2,840)

-------- ------------------ ----------- --------- --------- --------

Profit for the period

and total comprehensive

income - - - - 8,326 8,326

At 30 June 2022 17,938 51,721 749 834 39,266 110,508

Share based payment - - - 75 - 75

Share buyback (714) - - - (1,296) (2,010)

Transfer re capital - - 714 - (714) -

Share issue 42 108 - (150) - -

Dividends - interim

2022 - - - - (2,216) (2,216)

-------- ------------------ ----------- --------- --------- --------

Transactions with

owners (672) 108 714 (75) (4,226) (4,151)

-------- ------------------ ----------- --------- --------- --------

Profit for the period

and total comprehensive

income - - - - 2,608 2,608

At 31 December 2022 17,266 51,829 1,463 759 37,648 108,965

Share based payment - - - 75 - 75

Dividends - final

2022 - - - - (755) (755)

Dividends - interim

2023 - - - - (1,079) (1,079)

-------- ------------------ ----------- --------- --------- --------

Transactions with

owners - - - 75 (1,834) (1,759)

-------- ------------------ ----------- --------- --------- --------

Loss for the period

and total comprehensive

income - - - - (779) (779)

At 30 June 2023 17,266 51,829 1,463 834 35,035 106,427

======== ================== =========== ========= ========= ========

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

as at 30 June

2023

31 December

30 June 2023 30 June 2022 2022

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investment properties 5 166,800 187,875 173,030

Property, plant and

equipment 2 4 3

166,802 187,879 173,033

----------------- -------------------------------------- -----------------

Current assets

Inventories 2,393 2,387 2,389

Trade and other receivables 2,882 3,757 3,110

Derivative financial

asset 456 - 68

Cash and cash equivalents 8,010 8,268 7,818

13,741 14,412 13,385

----------------- -------------------------------------- -----------------

Total assets 180,543 202,291 186,418

================= ====================================== =================

Liabilities

Current liabilities

Bank loans (52,915) (379) (20,325)

Trade and other payables (6,205) (7,078) (5,982)

(59,120) (7,457) (26,307)

----------------- -------------------------------------- -----------------

Non-current liabilities

Bank loans (14,996) (83,418) (51,146)

Derivative financial

liabilities - (908) -

(14,996) (84,326) (51,146)

----------------- -------------------------------------- -----------------

Total liabilities (74,116) (91,783) (77,453)

================= ====================================== =================

Net assets 106,427 110,508 108,965

================= ====================================== =================

Equity

Ordinary share capital 17,266 17,938 17,266

Share premium account 51,829 51,721 51,829

Capital redemption

reserve 1,463 749 1,463

Other reserves 834 834 759

Retained earnings 35,035 39,266 37,648

----------------- -------------------------------------- -----------------

Total equity 106,427 110,508 108,965

----------------- -------------------------------------- -----------------

CONSOLIDATED STATEMENT OF CASHFLOWS

for the 6 months ended 30 June 2023

Six months Six months

to to Year ended

30 June 31 December

2023 30 June 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cashflows from operating activities

(Loss)/profit after taxation (779) 8,326 10,934

Adjustments for:

Depreciation - 1 2

Gain on sale of investment property (737) (1,001) (948)

Net valuation loss/(gain) 4,073 (3,149) (3,152)

Share based payment 75 75 150

Finance income (51) (27) (49)

Finance costs 1,294 1,600 2,981

Gain on financial liabilities

held at fair value (388) (1,238) (2,214)

Increase in inventories (4) (3) (5)

(Increase)/decrease in trade

and other receivables 231 (169) 478

Decrease in trade and other

payables (164) (618) (1,051)

3,550 3,797 7,126

==================== =================== ========================

Cash flows from investing activities

Expenditure on investment properties (425) (723) (609)

Purchase of property, plant

and equipment (-) (1) (1)

Proceeds from sale of property,

plant and equipment 3,318 5,483 20,164

Interest received 51 27 49

2,944 4,786 19,603

==================== =================== ========================

Cash flow from financing activities

Interest paid (1,294) (1,600) (2,981)

Share buyback - - (2,010)

Equity dividends paid (1,448) (2,904) (5,783)

Repayment of bank loans (3,560) (5,647) (17,973)

(6,302) (10,151) (28,747)

==================== =================== ========================

Net increase/(decrease) in cash

and cash equivalents 192 (1,568) (2,018)

Cash and cash equivalents at

beginning of period 7,818 9,836 9,836

Cash and cash equivalents at

end of period 8,010 8,268 7,818

==================== =================== ========================

NOTES TO THE INTERIM FINANCIAL INFORMATION

for the 6 months ended 30 June 2023

1. BASIS OF PREPARATION

Real Estate Investors Plc, a Public Limited Company, is

incorporated and domiciled in the United Kingdom.

The interim financial report for the period ended 30 June 2023

(including the comparatives for the year ended 31 December 2022 and

the period ended 30 June 2022) was approved by the board of

directors on 22 September 2023.

It should be noted that accounting estimates and assumptions are

used in preparation of the interim financial information. Although

these estimates are based on management's best knowledge and

judgement of current events and action, actual results may

ultimately differ from these estimates. The areas involving a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the interim financial

information are set out in note 3 to the interim financial

information.

The interim financial information contained within this

announcement does not constitute statutory accounts within the

meaning of the Companies Act 2006. The full accounts for the year

ended 31 December 2022 received an unqualified report from the

auditor and did not contain a statement under Section 498 of the

Companies Act 2006.

2. ACCOUNTING POLICIES

The interim financial information has been prepared under the

historical cost convention.

The principal accounting policies and methods of computation

adopted to prepare the interim financial information are consistent

with those detailed in the 2022 financial statements approved by

the Board on 27 March 2023.

Some accounting pronouncements which have become effective from

1 January 2023 and have therefore been adopted do not have a

significant impact on the Group's financial results or

position.

3. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal actual results. The estimates and assumptions that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next accounting year

are as follows:

Investment property revaluation

The Group uses the valuations performed by its independent

valuers or the directors as the fair value of its investment

properties. The valuation is based upon assumptions including

future rental income, anticipated maintenance costs, anticipated

purchaser costs and the appropriate discount rate. The valuer and

the directors also make reference to market evidence of transaction

prices for similar properties.

Interest rate swap valuation

The Group carries the interest rate swap as a liability at fair

value through the profit or loss at a valuation. This valuation has

been provided by the Group's bankers.

Critical judgements in applying the Group's accounting

policies

The Group makes critical judgements in applying accounting

policies. The critical judgement that has been made is as

follows:

REIT Status

The Group elected for REIT status with effect from 1 January

2015. As a result, providing certain conditions are met, the

Group's profit from property investment and gains are exempt from

UK corporation tax. In the Directors' opinion the Group have met

these conditions.

4. SEGMENTAL REPORTING

Primary reporting - business segment

The only material business that the Group has is that of

investment in commercial properties. Revenue relates entirely to

rental income from investment properties.

5. INVESTMENT PROPERTIES

The carrying amount of investment properties for the periods

presented in the interim financial information is reconciled as

follows:

GBP'000

Carrying amount at 31 December 2021 188,485

Additions 723

Disposals (4,482)

Revaluation 3,149

-----------------

Carrying amount at 30 June 2022 187,875

Additions (114)

Disposals (14,734)

Revaluation 3

-----------------

Carrying amount at 31 December 2022 173,030

Additions 425

Disposals (2,582)

Revaluation (4,073)

Carrying amount at 30 June 2023 166,800

=================

6. EARNINGS AND NAV PER SHARE

The calculation of the basic earnings per share is based on the

profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period. The

calculation of the diluted earnings per share is based on the basic

earnings per share adjusted to allow for all dilutive potential

ordinary shares.

The calculation of the basic NAV per share is based on the

balance sheet net asset value divided by the weighted average

number of shares in issue during the period. The calculation of the

diluted NAV per share is based on the basic NAV per share adjusted

to allow for all dilutive potential ordinary shares.

The European Public Real Estate Association ("EPRA") earnings

and NAV figures have been included to allow more effective

comparisons to be drawn between the Group and other businesses in

the real estate sector.

EPRA EPS per share

30 June 2023 30 June 2022

Earnings Shares Earnings per share Earnings Shares Earnings per share

GBP'000 No P GBP'000 No P

Basic (loss)/earnings per

share (779) 172,651,577 Nil 8,326 179,377,898 4.64

Fair value of investment

properties 4,073 (3,149)

Gain on disposal of

investment properties (737) (1,001)

Change in fair value of

derivatives (388) (1,238)

EPRA Earnings 2,169 172,651,577 1.26 2,938 179,377,898 1.64

========= ============ =================== ========= ============ ===================

NET ASSET VALUE PER SHARE

The Group has adopted the new EPRA NAV measures which came into

effect for accounting periods starting 1 January 2020. EPRA issued

new best practice recommendations (BPR) for financial guidelines on

its definitions of NAV measures. The new NAV measures as outlined

in the BPR are EPRA net tangible assets (NTA), EPRA net

reinvestment value (NRV) and EPRA net disposal value (NDV).

The Group considered EPRA Net Tangible Assets (NTA) to be the

most relevant NAV measure for the Group and we are now reporting

this as our primary NAV measure, replacing our previously reported

EPRA NAV and EPRA NNNAV per share metrics. EPRA NTA excludes the

intangible assets and the cumulative fair value adjustments for

debt-related derivatives which are unlikely to be realised.

30 June 2023

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 106,426 106,426 106,426

Fair value of derivatives (456) (456) -

Real estate transfer tax - 1 0,842 -

EPRA NAV 105,970 1 16,812 106,426

------------ ------------ ------------

Number of ordinary shares issued for diluted and EPRA net assets per share 175,749,795 175,749,795 175,749,795

EPRA NAV per share 60.3p 66.5p 60.6p

============ ============ ============

The adjustments made to get to the EPRA NAV measures above are

as follows:

-- Real estate transfer tax: Gross value of property portfolio

as provided in the Valuation Certificate (i.e. the value prior to

any deduction of purchasers' costs).

-- Fair value of derivatives: Exclude fair value financial

instruments that are used for hedging purposes where the company

has the intention of keeping the hedge position until the end of

the contractual duration.

31 December 2022

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 108,965 108,965 108,965

Fair value of derivatives (68) (68) -

Real estate transfer tax - 11,245 -

-----------------------------------------------------------------------

EPRA NAV 108,897 120,142 108,965

----------------------------------------------------------------------- -------------- --------------- ------------

Number of ordinary shares issued for diluted and EPRA net assets per

share 174,964,252 174,964,252 174,964,252

EPRA NAV per share 62.2p 68.7p 62.3p

======================================================================= ============== =============== ============

30 JUNE 2023 31 DECEMBER 2022

No of Shares No of Shares

Number of ordinary shares issued at end of period 172,651,577 172,651,577

Dilutive impact of options 3,098,218 2,312,675

Number of ordinary shares issued for diluted and EPRA net assets per share 175,749,795 174,964,252

----------------------------------------------------------------------------- ------------------ -------------------

Net assets per ordinary share

Basic 60.3p 62.2p

Diluted 66.5p 68.7p

EPRA NTA 60.6p 62.3p

============================================================================= ================== ===================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGZLGFKGFZM

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

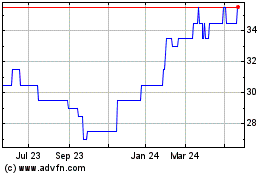

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

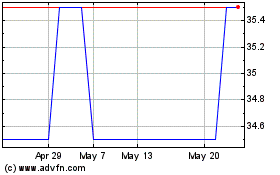

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024