AGL Under Pressure to Keep Coal-Fired Plant Running Longer

September 11 2017 - 11:58PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Plans by one of Australia's largest

utilities to phase out coal-fired power stations is running up

against a government supportive of the fuel and eager to counter

the threat of blackouts by extending the life of the company's

oldest plant.

Under pressure from Canberra to run its Liddell plant in the

coal-rich eastern Hunter Valley for five years beyond the slated

2022 closing date or sell it to another operator, AGL Energy Ltd.

(AGL.AU) Chief Executive Andy Vesey said he had agreed to take the

government's request to his board.

He also committed to delivering to the government in 90 days

alternative action the company would take to avoid a power

shortfall when Liddell reaches the end of its scheduled life. Prime

Minister Malcolm Turnbull said that while all options would be

considered by the government, the most obvious one was to keep the

station running for longer.

"AGL's management want to look after their shareholders. For

them, scarcity of energy is good because it enables them to raise

prices. It's not good for the Australian people," Mr. Turnbull said

Tuesday.

Tension between the company and the Turnbull government

highlights the contrast between Australia's vast resources of both

coal and natural gas and looming threats of shortages and jumps in

prices for businesses and households. Earlier in the year, the

government introduced new powers to curb exports of liquefied

natural gas from big plants on the east coast if it finds there's a

threat of a gas-supply shortage in local markets, even as the

country is set within a few years to overtake Qatar as the world's

biggest LNG exporter.

The Australian Energy Market Operator, which runs much of the

country's gas and electricity markets, earlier this month warned of

a tight electricity market in the southeast following the recent

closure of Engie SA's (ENGI.FR) coal-fired Hazelwood plant. It

projected the need for 1 gigawatt in baseload capacity for populous

New South Wales and Victoria states to replace Liddell.

Coal accounts for more than 60% of the country's electricity

production, down from more than 80% at the beginning of the

century, according to government data.

The decline in coal use comes amid strong growth in wind and

solar projects. Sustainable Energy Research Analytics, a

consultancy, estimated there are about 311 megawatts of solar power

now in operation in Australia, 1 gigawatt under construction and a

further 6 gigawatts in advanced stages of design. However, without

massive storage, renewable energy doesn't meet the government's

call for more on-demand baseload electricity.

Mr. Turnbull, who has long promoted the construction of new,

cleaner-burning coal plants, recently laid out plans for an

expansion of the Snowy Mountains hydro-electricity project, which

would add 2 gigawatts of power to the market, but not until after

Liddell is set to close.

AGL has committed to closing each of its coal-fired plants when

they reach the end of the operating life, a process set to run

through 2050, replacing the capacity through gas-fired plants,

pumped hydro and batteries, in addition to wind and solar

generation.

Mr. Vesey said that in the near term, new development favored

renewables supported by gas, a trend expected to continue over the

longer term as large-scale battery systems support renewable

technology. "In this environment, we just don't see new development

of coal as economically rational, even before factoring in a carbon

cost," he said.

Liddell's four generation units were commissioned between 1971

and 1973, supplying enough electricity a year to power more than 1

million homes. But as they age unplanned outages are expected, Mr.

Vesey said.

Since buying the plant in 2015, AGL said it had invested 123

million Australian dollars (US$98.8 million) and it intends to

spend a further A$159 million before it closes, yet Liddell still

contributed to blackouts in New South Wales earlier this year when

two units went down due to boiler leaks.

Delta Electricity, which owns the Vales Point coal station in

New South Wales, said it would consider buying Liddell but that it

would need to know the condition of the plant and the cost of

maintaining operations. Any buyer would also be faced with

rehabilitation costs when the plant does close, a figure AGL has

estimated at A$898 million for the Liddell and neighboring

Bayswater coal-powered station.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 12, 2017 00:43 ET (04:43 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

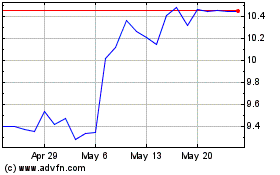

AGL Energy (ASX:AGL)

Historical Stock Chart

From Feb 2025 to Mar 2025

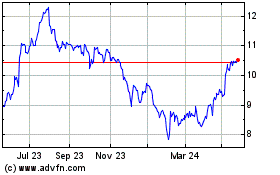

AGL Energy (ASX:AGL)

Historical Stock Chart

From Mar 2024 to Mar 2025