Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (NYSE: PAC; BMV:

GAP) (“the Company” or “GAP”) reported its consolidated results for

the first quarter ended March 31, 2022 (1Q22) (tables are presented

at the end of this report comparing passenger traffic and

consolidated results for 2022 and 2019, in order to illustrate the

recovery of these metrics and their trend).

Figures are

unaudited and have been prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”).

COVID-19 Impact

During the first quarter ended March 31, 2022,

passenger traffic increased 69.9% as compared to the same period of

2021 and increased 5.8% as compared to 2019, demonstrating a

positive trend. This increase, which is due to the recovery of the

tourism and business segments, which caused first quarter results

for 2022 to exceed 2019 and 2021. This increase resulted in net

cash flows that exceeded the previous quarters.

Company measures during

1Q22:

- The Company continued supporting

commercial clients during the quarter by granting discounts on

guaranteed minimum rents in accordance with the percentage decrease

in passenger traffic at each airport as compared to 1Q19; however,

for the most part, the discount was not applied because revenue

sharing percentages surpassed rents. With regards to support for

the airlines, the Company continued its incentive program in

accordance with the reactivation of routes and frequencies that

existed prior to the pandemic.

- Cost of services have been

increasing, due to the positive trend in passenger traffic during

1Q22 we have gradually increased certain costs such as maintenance,

security, personnel, cleaning services and others, as relates to

the quality and experience of our passengers, however, these

increases have lagged significantly behind traffic growth due to

cost controls that we have continued to the extent possible.

Company’s Financial

Position:

During 1Q22, results were significantly better

as compared to 1Q21. The Company generated positive EBITDA of Ps.

3,708.4 million, an increase of 111.0% as compared to 1Q21 as a

result of a 65.3% increase in total revenues and an increase in

cost of services of only 15.4%.

In 1Q22, operating activities continued

generating positive cash flow of Ps. 2,168.7 million. The Company

reported a financial position of cash and cash equivalents as of

March 31, 2022, of Ps. 16,899.9 million (14.7% higher than the

balance as of March 31, 2021). During 1Q22, the Company issued Ps.

5,000.0 million in long-term debt securities to finance the

committed investments for our Mexican airports and to make the Ps.

1,500.0 million maturity payment on our “GAP-17” debt securities.

Additionally, Ps. 499.5 million in share repurchases were made

during 1Q22.

In 1Q22, the Company performed an assessment of

the portfolio risk of our airlines and commercial clients in terms

of liquidity. Because of this assessment and due to the growth and

recovery of our main airlines and commercial clients, it was

determined that no reserve provision for expected credit losses was

necessary for this quarter.

During 1Q22, the Company continued evaluating

the possible adverse impacts of the pandemic on its financial

condition and operating results. The Company also reviewed key

indicators and impairment tests of significant long-term assets,

expected credit losses and recovery of assets due to deferred

taxes. In this evaluation, the Company reviewed financial results

for the short, medium, and long term, concluding that a significant

deterioration of the Company’s assets is not expected. As such, the

Company does not foresee a business interruption or closing

operations at any of its airports. However, the Company cannot

ensure that the negative effect of the pandemic will continue

decreasing in the coming quarter, nor can it ensure that local and

global economic conditions will improve. The Company can not

predict the availability of financing, or what general credit

conditions will be.

The Company will continue to monitor the

pandemic effects on the results of operations and will continue

informing the market in a timely manner regarding future material

updates on airport operations and the measures adopted for

preserving liquidity and ensuring business continuity.

Summary of Results 1Q22 vs.

1Q21 (and 1Q19 for purposes of illustrating the

recovery trend):

- The sum of aeronautical and

non-aeronautical services revenues increased by Ps. 2,313.4

million, or 85.4% (Ps. 1,489.5 million, or 42.2%, as

compared to 1Q19). Total revenues increased by Ps. 2,374.6 million,

or 65.3% (Ps. 2,333.5 million, or 63.4%, as compared to 1Q19).

- Cost of services increased

by Ps. 100.8 million, or 15.4% (as compared to 1Q19, cost

of services increased Ps. 157.9 million, or 26.5%).

- Income from operations

increased by Ps. 1,889.4 million, or 150.6% (Ps. 1,065.4

million, or 51.3%, as compared to 1Q19).

- EBITDA increased by Ps.

1,951.2 million, or 111.0% (Ps. 1,208.3 million, or 48.3%,

as compared to 1Q19), going from Ps. 1,757.2 million in 1Q21 to Ps.

3,708.4 million in 1Q22. EBITDA margin (excluding the effects of

IFRIC 12) increased from 64.9% in 1Q21 to 73.8% in 1Q22 (EBITDA

margin (excluding the effects of IFRIC 12) was 70.8% in 1Q19).

- Net comprehensive income

increased Ps. 923.8 million, or 70.1% (as compared to

1Q19, it

increased

Ps. 937.5 million, or 71.9%), from income of Ps. 1,317.2 million in

1Q21 to income of Ps. 2,241.0 million in 1Q22.

Passenger Traffic

During 1Q22, total passengers at the Company’s

14 airports increased by 5,175.3 thousand passengers, an increase

of 69.9%, compared to 1Q21 (as compared to 1Q19, total passengers

increased by 694.2 thousand passengers, or 5.8%).

During 1Q22, the following new routes were

opened:

Domestic:

|

Airline |

Departure |

Arrival |

Opening date |

Frequencies |

|

VivaAerobus |

Guadalajara |

Santa Lucia (Mexico City) |

March 21, 2022 |

7 weekly frequencies |

|

Volaris |

Tijuana |

Santa Lucia (Mexico City) |

March 21, 2022 |

7 weekly frequencies |

| Note: Frequencies can vary without prior

notice. |

|

|

| |

|

|

|

|

|

International |

|

|

|

|

|

Airline |

Departure |

Arrival |

Opening date |

Frequencies |

|

Swoop |

Los Cabos |

Abbotsford |

January 31, 2022 |

1 weekly frequency |

|

Jet blue |

Puerto Vallarta |

Nueva York JFK |

February 19, 2022 |

4 weekly frequencies |

|

Southwest |

Los Cabos |

Baltimore |

March 5, 2022 |

1 weekly frequencies |

| Note: Frequencies can vary without prior

notice. |

|

|

|

Domestic Terminal Passengers – 14 airports (in

thousands): |

|

|

|

|

|

Airport |

1Q21 |

1Q22 |

Change |

|

|

Guadalajara |

1,573.6 |

2,360.4 |

50.0% |

|

| Tijuana

* |

1,410.7 |

1,820.9 |

29.1% |

|

| Los

Cabos |

366.9 |

512.8 |

39.8% |

|

| Puerto

Vallarta |

300.4 |

498.8 |

66.0% |

|

| Montego

Bay |

0.0 |

0.0 |

0.0% |

|

|

Guanajuato |

286.0 |

382.3 |

33.7% |

|

|

Hermosillo |

257.6 |

383.2 |

48.8% |

|

|

Mexicali |

190.2 |

290.2 |

52.5% |

|

|

Kingston |

0.1 |

0.2 |

100.0% |

|

| Morelia |

109.1 |

147.6 |

35.3% |

|

| La Paz |

169.1 |

238.2 |

40.8% |

|

|

Aguascalientes |

97.7 |

158.0 |

61.6% |

|

| Los

Mochis |

70.9 |

96.1 |

35.5% |

|

|

Manzanillo |

17.1 |

24.0 |

40.1% |

|

|

Total |

4,849.5 |

6,912.7 |

42.5% |

|

| *Cross Border Xpress (CBX) users are classified as

international passengers. |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

International Terminal Passengers – 14

airports (in

thousands): |

|

|

|

Airport |

1Q21 |

1Q22 |

Change |

|

|

Guadalajara |

595.0 |

969.9 |

63.0% |

|

| Tijuana

* |

424.8 |

923.2 |

117.3% |

|

| Los

Cabos |

534.4 |

1,124.8 |

110.5% |

|

| Puerto

Vallarta |

352.5 |

1,061.0 |

201.0% |

|

| Montego

Bay |

304.7 |

928.1 |

204.5% |

|

|

Guanajuato |

85.4 |

175.5 |

105.5% |

|

|

Hermosillo |

19.9 |

18.6 |

(6.3%) |

|

|

Mexicali |

0.7 |

1.2 |

70.7% |

|

|

Kingston |

115.4 |

268.2 |

132.4% |

|

| Morelia |

75.1 |

116.3 |

55.0% |

|

| La Paz |

4.0 |

7.5 |

88.0% |

|

|

Aguascalientes |

33.9 |

47.1 |

39.0% |

|

| Los

Mochis |

1.6 |

1.7 |

12.0% |

|

|

Manzanillo |

9.4 |

25.6 |

173.2% |

|

|

Total |

2,556.6 |

5,668.7 |

121.7% |

|

| *CBX users are classified as international

passengers. |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Total Terminal Passengers – 14

airports (in

thousands): |

|

|

|

|

Airport |

1Q21 |

1Q22 |

Change |

|

|

Guadalajara |

2,168.5 |

3,330.3 |

53.6% |

|

| Tijuana

* |

1,835.5 |

2,744.1 |

49.5% |

|

| Los

Cabos |

901.3 |

1,637.6 |

81.7% |

|

| Puerto

Vallarta |

652.9 |

1,559.8 |

138.9% |

|

| Montego

Bay |

304.7 |

928.1 |

204.5% |

|

|

Guanajuato |

371.4 |

557.9 |

50.2% |

|

|

Hermosillo |

277.4 |

401.8 |

44.8% |

|

|

Mexicali |

190.9 |

291.4 |

52.6% |

|

|

Kingston |

115.5 |

268.3 |

132.4% |

|

| Morelia |

184.1 |

263.9 |

43.3% |

|

| La Paz |

173.1 |

245.6 |

41.9% |

|

|

Aguascalientes |

131.7 |

205.1 |

55.8% |

|

| Los

Mochis |

72.5 |

97.8 |

34.9% |

|

|

Manzanillo |

26.5 |

49.6 |

87.2% |

|

|

Total |

7,406.1 |

12,581.4 |

69.9% |

|

| *CBX users are classified as international

passengers. |

|

|

| |

|

|

|

|

| CBX

Users (in

thousands): |

|

|

|

|

|

Airport |

1Q21 |

1Q22 |

Change |

|

| Tijuana |

421.0 |

917.4 |

117.9% |

|

| |

|

|

|

|

Consolidated Results for the First

Quarter of 2022 (in thousands of

pesos):

|

|

1Q21 |

1Q22 |

Change |

|

|

Revenues |

|

|

|

|

|

Aeronautical services |

2,072,767 |

3,854,232 |

85.9% |

|

|

Non-aeronautical services |

635,987 |

1,167,912 |

83.6% |

|

|

Improvements to concession assets (IFRIC-12) |

929,243 |

990,454 |

6.6% |

|

|

Total revenues |

3,637,996 |

6,012,598 |

65.3% |

|

|

|

|

|

|

|

|

Operating costs |

|

|

|

|

|

Costs of services: |

652,698 |

753,524 |

15.4% |

|

|

Employee costs |

243,634 |

288,518 |

18.4% |

|

|

Maintenance |

94,439 |

125,030 |

32.4% |

|

|

Safety, security & insurance |

123,826 |

126,174 |

1.9% |

|

|

Utilities |

77,173 |

96,081 |

24.5% |

|

|

Other operating expenses |

113,626 |

117,721 |

3.6% |

|

|

|

|

|

|

|

|

Technical assistance fees |

88,356 |

174,146 |

97.1% |

|

|

Concession taxes |

213,840 |

399,766 |

86.9% |

|

|

Depreciation and amortization |

502,745 |

564,533 |

12.3% |

|

|

Cost of improvements to concession assets (IFRIC-12) |

929,243 |

990,454 |

6.6% |

|

|

Other (income) |

(3,350) |

(13,711) |

309.3% |

|

|

Total operating costs |

2,383,532 |

2,868,712 |

20.4% |

|

|

Income from operations |

1,254,464 |

3,143,885 |

150.6% |

|

|

Financial Result |

(79,303) |

(272,945) |

244.2% |

|

|

Income before income taxes |

1,175,161 |

2,870,940 |

144.3% |

|

|

Income taxes |

(137,581) |

(543,489) |

295.0% |

|

| Net

income |

1,037,580 |

2,327,450 |

124.3% |

|

|

Currency translation effect |

61,729 |

(178,331) |

(388.9%) |

|

|

Cash flow hedges, net of income tax |

216,794 |

91,752 |

(57.7%) |

|

|

Remeasurements of employee benefit – net income tax |

1,102 |

102 |

(90.7%) |

|

|

Comprehensive income |

1,317,205 |

2,240,973 |

70.1% |

|

|

Non-controlling interest |

(12,895) |

(19,026) |

47.5% |

|

|

Comprehensive income attributable to controlling

interest |

1,304,310 |

2,221,946 |

70.4% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

1Q21 |

1Q22 |

Change |

|

| EBITDA |

1,757,209 |

3,708,418 |

111.0% |

|

|

Comprehensive income |

1,317,205 |

2,240,973 |

70.1% |

|

|

Comprehensive income per share (pesos) |

2.5136 |

4.3896 |

74.6% |

|

|

Comprehensive income per ADS (US dollars) |

1.2624 |

2.2046 |

74.6% |

|

| |

|

|

|

|

| Operating

income margin |

34.5% |

52.3% |

51.6% |

|

| Operating

income margin (excluding IFRIC-12) |

46.3% |

62.6% |

35.2% |

|

| EBITDA

margin |

48.3% |

61.7% |

27.7% |

|

| EBITDA

margin (excluding IFRIC-12) |

65.0% |

73.8% |

13.7% |

|

| Costs of

services and improvements / total revenues |

43.5% |

29.0% |

(33.3%) |

|

| Cost of

services / total revenues (excluding IFRIC-12) |

24.1% |

15.0% |

(37.7%) |

|

|

|

|

|

|

|

| |

|

|

|

|

- Net income and comprehensive income per share

for 1Q22 were calculated based on 510,520,111 shares outstanding as

of March 31, 2022 and for 1Q21 were calculated based on 524,038,200

shares outstanding as of March 31, 2021. U.S. dollar figures

presented were converted from pesos to U.S. dollars at a rate of

Ps. 19.9110 per U.S. dollar (the noon buying rate on March 31,

2022, as published by the U.S. Federal Reserve Board). - For

purposes of the consolidation of the Jamaican airports, the average

three-month exchange rate of Ps. 20.5229 per U.S. dollar for the

three months ended March 31, 2022 was used.

Revenues (1Q22 vs. 1Q21)

- Aeronautical services

revenues increased by Ps. 1,781.5 million, or 85.9%.

- Non-aeronautical services

revenues increased by Ps. 531.9 million, or 83.6%.

- Revenues from improvements

to concession assets increased by Ps. 61.2 million, or

6.6%.

- Total revenues increased by

Ps. 2,374.6 million, or 65.3%.

- The change in aeronautical

services revenues was composed primarily of the following

factors:

- Revenues at our Mexican

airports increased by Ps. 1,435.2 million or 77.4%

compared to 1Q21, mainly due to the 63.0% increase in passenger

traffic and the adjustment in maximum rates as a result of

inflation.

- Revenues from the Montego

Bay airport increased by Ps. 251.4 million, or 185.6%,

compared to 1Q21. This was mainly due to the 204.5% increase in

passenger traffic. During 1Q22, there was a 1.0% depreciation of

the peso versus the U.S. dollar, which went from an average

exchange rate of Ps. 20.3190 in 1Q21 to Ps. 20.5229 in 1Q22.

- Revenues from the Kingston

airport increased by Ps. 94.8 million, or 115.4% compared

to 1Q21, mainly due to a 132.4% increase in passenger traffic.

- The change in

non-aeronautical services revenues was composed

primarily of the following factors:

- Revenues at our Mexican

airports increased by Ps. 436.6 million, or 82.1%,

compared to 1Q21. Revenues from businesses operated by third

parties increased by Ps. 291.8 million or 79.9%. This was mainly

due to the recovery of passenger traffic that resulted in revenue

sharing percentages that surpassed minimum guaranteed rents. The

business lines that increased the most were food and beverage,

retail tenants, duty-free stores, car rentals, time shares and

ground transportation, which jointly increased by Ps. 262.7

million, or 91.2%. Revenues from businesses operated directly by

the Company increased by Ps. 135.8 million, or 101.3%, while the

recovery of costs increased by Ps. 9.0 million, or 28.2%.

- Revenues from the Montego

Bay airport increased by Ps. 76.7 million, or 99.3%,

compared to 1Q21. Revenues in U.S. dollars increased US$ 3.7

million, or 97.3%.

- Revenues from the Kingston

airport increased by Ps. 18.6 million, or 68.2%, compared

to 1Q21. Revenues in U.S. dollars increased US$ 0.9 million, or

66.6%.

| |

|

|

|

|

|

|

1Q21 |

1Q22 |

Change |

|

| Businesses

operated by third parties: |

|

|

|

|

|

Duty-free |

81,342 |

161,984 |

99.1% |

|

| Food and

beverage |

81,489 |

169,159 |

107.6% |

|

| Retail |

65,476 |

134,444 |

105.3% |

|

| Car

rentals |

80,707 |

129,819 |

60.9% |

|

| Leasing of

space |

49,030 |

65,209 |

33.0% |

|

| Time

shares |

30,364 |

61,182 |

101.5% |

|

| Ground

transportation |

26,641 |

42,460 |

59.4% |

|

|

Communications and financial services |

16,351 |

25,478 |

55.8% |

|

| Other

commercial revenues |

26,894 |

48,521 |

80.4% |

|

|

Total |

458,295 |

838,255 |

82.9% |

|

| |

|

|

|

|

| Businesses

operated directly by us: |

|

|

|

|

| Car

parking |

69,344 |

115,520 |

66.6% |

|

| VIP

lounges |

31,771 |

80,435 |

153.2% |

|

|

Advertising |

10,443 |

15,314 |

46.6% |

|

| Convenience

stores |

25,193 |

65,017 |

158.1% |

|

|

Total |

136,751 |

276,286 |

102.0% |

|

| Recovery of

costs |

40,940 |

53,369 |

30.4% |

|

|

Total Non-aeronautical Revenues |

635,987 |

1,167,912 |

83.6% |

|

|

Figures expressed in thousands of Mexican pesos. |

|

|

|

| |

|

|

|

|

Revenues from improvements to concession

assets1Revenues from improvements to concession assets

(IFRIC12) increased by Ps. 61.2 million, or 6.6%, compared to 1Q21.

The change was composed primarily of:

- The Company’s Mexican airports,

which increased by Ps. 46.1 million, or 5.1%, as a result of the

adjustment in committed investments in the Master Development

Program for the 2020-2024 period.

- Improvements to concession assets

at the Montego Bay airport increased Ps. 15.1 million, or 76.7%.

During 1Q22, no improvements to concession assets were made at the

Kingston airport.

Total operating costs increased

by Ps. 485.2 million, or 20.4%, compared to 1Q21, mainly due to a

Ps. 271.7 million, or 89.9%, increase in concession taxes and

technical assistance fees, a Ps.100.8 million, or 15.4%, increase

in cost of services, and a Ps. 61.2 million, or 6.6%, increase in

the cost of improvements to the concession assets (IFRIC12),

(excluding the cost of improvements to concession assets,

operating costs increased Ps. 424.0 million, or

29.2%).

This increase in total operating costs was

composed primarily of the following factors:

Mexican Airports:

- Operating costs increased

by Ps. 341.4 million, or 17.1%, compared to 1Q21,

primarily due to a combined Ps. 171.4 million, or 82.8%, increase

in technical assistance fees and concession taxes, a Ps. 65.1

million, or 12.9%, increase in cost of services, a Ps. 59.7

million, or 20.7%, increase in depreciation and amortization, and a

Ps. 46.1 million, or 5.1%, increase in the cost of improvements to

the concession assets (IFRIC-12), (excluding the cost of

improvements to the concession assets (IFRIC-12), operating costs

increased by Ps. 295.3 million or

29.2%).

The change in the cost of services during 1Q22

was mainly due to:

- Employee costs

increased Ps. 39.4 million, or 20.0%, compared to 1Q21, mainly due

to the hiring of additional personnel as required for airport

operations due to the recovery of passenger traffic, as well as the

changes in the Labor Law in Mexico.

- Maintenance costs

increased by Ps. 19.2 million, or 25.0%, compared to 1Q21.

- Safety, security and

insurance costs increased Ps. 5.5 million, or 6.3%,

compared to 1Q21, mainly due to an increase in the number of

security staff as compared to 1Q21 when the partial closure of some

operating areas reduced the need for personnel.

Montego Bay Airport:

- Operating costs increased

by Ps. 58.9 million, or 22.4%, compared to 1Q21, mainly

due to a Ps. 30.7 million, or 106.4%, increase in concession taxes,

a Ps. 20.7 million, or 22.3%, increase in the cost of services,

a

Ps. 15.1 million, or 76.7%, increase in the cost of improvements to

concession assets (IFRIC-12), and a Ps. 1.9 million, or 1.6%,

increase in depreciation and amortization, which was offset by the

increase in other income by Ps. 9.4 million.

Kingston Airport:

- Operating costs increased

by Ps. 84.8 million, or 68.2%, compared to 1Q21, mainly

due to a Ps. 69.6 million, or 105.1%, increase in concession taxes,

and a Ps. 15.0 million, or 27.2%, increase in the cost of

services.

Operating margin went from

34.5% in 1Q21 to 52.3% in 1Q22. Excluding the effects of IFRIC-12,

operating margin went from 46.3% in 1Q21 to 62.6% in 1Q22.

Operating income increased Ps. 1,889.4 million, or 150.6%, compared

to 1Q21.

EBITDA margin went from 48.3%

in 1Q21 to 61.7% in 1Q22. Excluding the effects of IFRIC-12, EBITDA

margin went from 64.9% in 1Q21 to 73.8% in 1Q22. The

nominal value of EBITDA increased Ps. 1,951.2 million, or

111.0%, compared to 1Q21.

Financial cost increased by

Ps. 193.6 million, or 244.2%, from a net expense

of Ps. 79.3 million in 1Q21 to a net expense of Ps. 272.9 million

in 1Q22. This change was mainly the result of:

- Foreign exchange rate

fluctuations, which went from income of Ps. 219.6 million

in 1Q21 to income of Ps. 52.7 million in 1Q22. This

generated a decrease in the foreign exchange gain of Ps.

166.9 million. Currency translation effect income

decreased Ps. 240.0 million, compared to 1Q21.

- Interest expenses increased

by Ps. 87.8 million, or 22.7%, compared to 1Q21, mainly

due to higher debt as a result of the issuance of long-term debt

securities and increase in interest rates.

- Interest income increased

by Ps. 61.0 million, or 70.1%, compared to 1Q21, mainly

due to an increase in the reference interest rates.

In 1Q22, comprehensive income increased

Ps. 923.8 million, or 70.1%, compared to 1Q21. This

increase was mainly due to a Ps. 1,695.8 million increase in profit

before taxes derived from the significant increase in passenger

traffic. This increase was partially offset by an increase in

income taxes of Ps. 405.9 million and a Ps. 240.0 million decrease

in currency translation effect.

During 1Q22, net income increased by Ps.

1,289.9 million, or 124.3%, compared to 1Q21. Income taxes

increased by Ps. 450.1 million and were partially offset by a Ps.

44.2 million increase in the benefit for deferred taxes, mainly due

an increase in the inflation rate, from 2.3% in 1Q21 to 2.5% in

1Q22.

Statement of Financial

Position

Total assets as of March 31, 2022 increased by

Ps. 6,981.4 million as compared to March 31, 2021, primarily due to

the following items: (i) a Ps. 2,685.7 million increase in

improvements to concession assets; (ii) a Ps. 2,171.5 million

increase in cash and cash equivalents; (iii) a Ps. 1,519.8 million

increase in machinery, equipment and leasehold improvements and

advances to suppliers; and (iv) a Ps. 518.4 million increase in

accounts receivable from customers, among others.

Total liabilities

as of March 31, 2022 increased by Ps. 8,643.1 million compared to

March 31, 2021. This increase was primarily due to the following

items: (i) issuance of Ps. 9,000.0 million in long-term debt

securities; (ii) Ps. 1,049.9 million in accounts payable, iii)

income taxes of Ps. 621.7 million and (iv) concession taxes of Ps.

111.5 million. This was partially offset by decreases of: (i) Ps.

2,323.8 million in bank loans and (ii) Ps. 410.8 million in

derivative financial instruments, among others.

Recent Events

- On March 31, 2022, we made the Ps.

1,500.0 million maturity payment on our “GAP-17” debt securities

(equal to 15 million long-term debt securities. The payment was

made with proceeds obtained from the issuance of long-term debt

securities on March 17, 2022.

Company Description

Grupo Aeroportuario del Pacífico, S.A.B. de C.V.

(GAP) operates 12 airports throughout Mexico’s Pacific region,

including the major cities of Guadalajara and Tijuana, the four

tourist destinations of Puerto Vallarta, Los Cabos, La Paz and

Manzanillo, and six other mid-sized cities: Hermosillo, Guanajuato,

Morelia, Aguascalientes, Mexicali and Los Mochis. In February 2006,

GAP’s shares were listed on the New York Stock Exchange under the

ticker symbol “PAC” and on the Mexican Stock Exchange under the

ticker symbol “GAP”. In April 2015, GAP acquired 100% of Desarrollo

de Concesiones Aeroportuarias, S.L., which owns a majority stake in

MBJ Airports Limited, a company operating Sangster International

Airport in Montego Bay, Jamaica. In October 2018, GAP entered into

a concession agreement for the operation of the Norman Manley

International Airport in Kingston, Jamaica and took control of the

operation in October 2019.

This press release contains references to

EBITDA, a financial performance measure not recognized under IFRS

and which does not purport to be an alternative to IFRS measures of

operating performance or liquidity. We caution investors not to

place undue reliance on non-GAAP financial measures such as EBITDA,

as these have limitations as analytical tools and should be

considered as a supplement to, not a substitute for, the

corresponding measures calculated in accordance with IFRS.

This press release may contain forward-looking

statements. These statements are statements that are not historical

facts, and are based on management’s current view and estimates of

future economic circumstances, industry conditions, company

performance and financial results. The words “anticipates”,

“believes”, “estimates”, “expects”, “plans” and similar

expressions, as they relate to the company, are intended to

identify forward-looking statements. Statements regarding the

declaration or payment of dividends, the implementation of

principal operating and financing strategies and capital

expenditure plans, the direction of future operations and the

factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are

subject to a number of risks and uncertainties. There is no

guarantee that the expected events, trends or results will actually

occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry

conditions, and operating factors. Any changes in such assumptions

or factors could cause actual results to differ materially from

current expectations.

In accordance with Section 806 of the

Sarbanes-Oxley Act of 2002 and article 42 of the “Ley del Mercado

de Valores”, GAP has implemented a “whistleblower”

program, which allows complainants to anonymously and

confidentially report suspected activities that may involve

criminal conduct or violations. The telephone number in Mexico,

facilitated by a third party that is in charge of collecting these

complaints, is 01 800 563 00 47. The web site is

www.lineadedenuncia.com/gap. GAP’s Audit Committee will be notified

of all complaints for immediate investigation.

Exhibit A: Operating results by

airport (in thousands of pesos):

|

Airport |

1Q21 |

1Q22 |

Change |

|

Guadalajara |

|

|

|

|

Aeronautical services |

626,719 |

979,945 |

56.4% |

|

Non-aeronautical services |

161,949 |

205,437 |

26.9% |

|

Improvements to concession assets (IFRIC 12) |

281,771 |

499,974 |

77.4% |

|

Total Revenues |

1,070,439 |

1,685,356 |

57.4% |

|

Operating income |

481,125 |

820,131 |

70.5% |

|

EBITDA |

584,062 |

936,874 |

60.4% |

| |

|

|

|

|

Tijuana |

|

|

|

|

Aeronautical services |

332,362 |

546,561 |

64.4% |

|

Non-aeronautical services |

86,762 |

117,755 |

35.7% |

|

Improvements to concession assets (IFRIC 12) |

405,221 |

85,505 |

(78.9%) |

|

Total Revenues |

824,345 |

749,821 |

(9.0%) |

|

Operating income |

230,867 |

453,557 |

96.5% |

|

EBITDA |

299,333 |

527,490 |

76.2% |

| |

|

|

|

| Los

Cabos |

|

|

|

|

Aeronautical services |

324,257 |

629,476 |

94.1% |

|

Non-aeronautical services |

129,069 |

256,852 |

99.0% |

|

Improvements to concession assets (IFRIC 12) |

98,748 |

63,265 |

(35.9%) |

|

Total Revenues |

552,073 |

949,594 |

72.0% |

|

Operating income |

270,708 |

639,948 |

136.4% |

|

EBITDA |

334,819 |

712,588 |

112.8% |

| |

|

|

|

|

Puerto Vallarta |

|

|

|

|

Aeronautical services |

225,766 |

596,139 |

164.1% |

|

Non-aeronautical services |

69,041 |

127,934 |

85.3% |

|

Improvements to concession assets (IFRIC 12) |

77,359 |

199,303 |

157.6% |

|

Total Revenues |

372,166 |

923,376 |

148.1% |

|

Operating income |

163,360 |

557,296 |

241.1% |

|

EBITDA |

210,087 |

603,020 |

187.0% |

| |

|

|

|

|

Montego Bay |

|

|

|

|

Aeronautical services |

135,424 |

386,822 |

185.6% |

|

Non-aeronautical services |

77,238 |

153,952 |

99.3% |

|

Improvements to concession assets (IFRIC 12) |

19,696 |

34,808 |

76.7% |

|

Total Revenues |

232,357 |

575,581 |

147.7% |

|

Operating (loss) income |

(30,306) |

244,395 |

906.4% |

|

EBITDA |

91,315 |

367,917 |

302.9% |

|

|

|

|

|

|

Guanajuato |

|

|

|

|

Aeronautical services |

99,876 |

160,220 |

60.4% |

|

Non-aeronautical services |

26,520 |

37,041 |

39.7% |

|

Improvements to concession assets (IFRIC 12) |

3,094 |

10,647 |

244.2% |

|

Total Revenues |

129,489 |

207,908 |

60.6% |

|

Operating (loss) income |

69,180 |

128,468 |

85.7% |

|

EBITDA |

87,722 |

148,455 |

69.2% |

|

|

|

|

|

|

Hermosillo |

|

|

|

|

Aeronautical services |

60,789 |

92,890 |

52.8% |

|

Non-aeronautical services |

15,851 |

15,645 |

(1.3%) |

|

Improvements to concession assets (IFRIC 12) |

4,341 |

16,897 |

289.2% |

|

Total Revenues |

80,981 |

125,432 |

54.9% |

|

Operating (loss) income |

22,385 |

54,588 |

(143.9%) |

|

EBITDA |

42,673 |

75,709 |

77.4% |

| |

|

|

|

|

Others (1) |

|

|

|

|

Aeronautical services |

267,575 |

462,180 |

72.7% |

|

Non-aeronautical services |

68,675 |

93,804 |

36.6% |

|

Improvements to concession assets (IFRIC 12) |

39,014 |

80,056 |

105.2% |

|

Total Revenues |

375,263 |

636,041 |

69.5% |

|

Operating (loss) income |

15,540 |

156,444 |

(906.7%) |

|

EBITDA |

81,749 |

226,372 |

176.9% |

| |

|

|

|

|

Total |

|

|

|

|

Aeronautical services |

2,072,767 |

3,854,233 |

85.9% |

|

Non-aeronautical services |

635,104 |

1,008,420 |

58.8% |

|

Improvements to concession assets (IFRIC 12) |

929,243 |

990,454 |

6.6% |

|

Total Revenues |

3,637,114 |

5,853,108 |

60.9% |

|

Operating income |

1,222,859 |

3,054,826 |

149.8% |

|

EBITDA |

1,731,761 |

3,598,426 |

107.8% |

|

|

|

|

|

| (1) Others include

the operating results of the Aguascalientes, La Paz, Los Mochis,

Manzanillo, Mexicali, Morelia and Kingston airports. |

Exhibit B: Consolidated statement of

financial position as of March 31 (in thousands of

pesos):

|

|

1Q21 |

1Q22 |

Change |

% |

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

14,728,391 |

16,899,886 |

2,171,495 |

14.7% |

|

|

Trade accounts receivable - Net |

1,318,636 |

1,837,038 |

518,402 |

39.3% |

|

|

Other current assets |

1,162,282 |

1,190,410 |

28,128 |

2.4% |

|

|

Total current assets |

17,209,309 |

19,927,334 |

2,718,025 |

15.8% |

|

|

|

|

|

|

|

|

|

Advanced payments to suppliers |

466,306 |

1,001,256 |

534,950 |

114.7% |

|

|

Machinery, equipment and improvements to leased buildings -

Net |

2,307,962 |

3,292,806 |

984,844 |

42.7% |

|

|

Improvements to concession assets - Net |

13,846,300 |

16,531,959 |

2,685,659 |

19.4% |

|

|

Airport concessions - Net |

10,659,934 |

10,111,568 |

(548,366) |

(5.1%) |

|

|

Rights to use airport facilities - Net |

1,263,452 |

1,190,057 |

(73,395) |

(5.8%) |

|

|

Deferred income taxes - Net |

6,063,843 |

6,394,719 |

330,876 |

5.5% |

|

|

Other non-current assets |

111,566 |

460,405 |

348,839 |

312.7% |

|

|

Total assets |

51,928,672 |

58,910,101 |

6,981,429 |

13.4% |

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities |

4,992,770 |

6,161,952 |

1,169,183 |

23.4% |

|

|

Long-term liabilities |

23,104,100 |

30,578,050 |

7,473,950 |

32.3% |

|

|

Total liabilities |

28,096,870 |

36,740,001 |

8,643,131 |

30.8% |

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

Common stock |

6,185,082 |

170,381 |

(6,014,701) |

(97.2%) |

|

|

Legal reserve |

1,592,551 |

1,592,551 |

0 |

0.0% |

|

|

Net income |

1,050,154 |

2,291,596 |

1,241,442 |

118.2% |

|

|

Retained earnings |

11,908,890 |

13,925,092 |

2,016,202 |

16.9% |

|

|

Reserve for share repurchase |

3,283,374 |

5,531,292 |

2,247,918 |

68.5% |

|

|

Repurchased shares |

(2,071,558) |

(3,499,510) |

(1,427,952) |

68.9% |

|

|

Foreign currency translation reserve |

1,073,704 |

872,719 |

(200,985) |

(18.7%) |

|

|

Remeasurements of employee benefit – Net |

(8,950) |

5,313 |

14,263 |

159.4% |

|

|

Cash flow hedges- Net |

(254,312) |

121,421 |

375,733 |

147.7% |

|

|

Total controlling interest |

22,758,935 |

21,010,854 |

(1,748,080) |

(7.7%) |

|

|

Non-controlling interest |

1,072,867 |

1,159,246 |

86,378 |

8.1% |

|

|

Total stockholder's equity |

23,831,802 |

22,170,100 |

(1,661,702) |

(7.0%) |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

51,928,672 |

58,910,101 |

6,981,429 |

13.4% |

|

|

|

|

|

|

|

|

| The non-controlling interest corresponds to the

25.5% stake held in the Montego Bay airport by Vantage Airport

Group Limited (“Vantage”). |

Exhibit C: Consolidated statement of cash

flows (in thousands of pesos):

|

|

|

|

|

|

|

|

1Q21 |

1Q22 |

Change |

|

| Cash

flows from operating activities: |

|

|

|

|

| Consolidated

net income |

1,037,580 |

2,327,450 |

124.3% |

|

|

|

|

|

|

|

|

Postemployment benefit costs |

8,900 |

8,605 |

(3.3%) |

|

|

Allowance expected credit loss |

23,525 |

(1,684) |

(107.2%) |

|

|

Depreciation and amortization |

502,745 |

564,533 |

12.3% |

|

|

(Gain) loss on sale of machinery, equipment and improvements to

leased assets |

596 |

290 |

(51.3%) |

|

|

Interest expense |

381,139 |

475,407 |

24.7% |

|

|

Provisions |

(12,313) |

7,487 |

(160.8%) |

|

|

Income tax expense |

137,581 |

543,489 |

295.0% |

|

|

Unrealized exchange loss |

163,039 |

(124,319) |

176.3% |

|

|

Net (gain) on derivative financial instruments |

- |

(6,765) |

100.0% |

|

|

|

2,242,797 |

3,794,494 |

69.2% |

|

|

Changes in working capital: |

|

|

|

|

| (Increase)

decrease in |

|

|

|

|

|

Trade accounts receivable |

(73,688) |

(121,464) |

64.8% |

|

|

Recoverable tax on assets and other assets |

(56,433) |

125,736 |

(322.8%) |

|

| (Decrease)

increase |

|

|

|

|

|

Concession taxes payable |

(43,092) |

(37,490) |

(13.0%) |

|

|

Accounts payable |

41,644 |

(192,770) |

562.9% |

|

|

Cash generated by operating activities |

2,111,228 |

3,568,506 |

69.0% |

|

|

Income taxes paid |

(302,349) |

(1,399,856) |

363.0% |

|

|

Net cash flows provided by operating

activities |

1,808,879 |

2,168,650 |

19.9% |

|

|

|

|

|

|

|

| Cash

flows from investing activities: |

|

|

|

|

|

Machinery, equipment and improvements to concession assets |

(829,935) |

(1,117,599) |

34.7% |

|

|

Cash flows from sales of machinery and equipment |

651 |

107 |

(83.6%) |

|

|

Other investment activities |

3,205 |

(22,674) |

(807.5%) |

|

|

Net cash used by investment activities |

(826,079) |

(1,140,166) |

38.0% |

|

|

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

Debt securities |

- |

5,000,000.00 |

100.0% |

|

|

Payment from Debt securities |

- |

(1,500,000) |

100.0% |

|

|

Bank loans payments |

(1,889,706) |

(3,878,004) |

(105.2%) |

|

|

Bank loans |

1,889,706 |

3,872,783 |

104.9% |

|

|

Repurchase of shares |

(338,184) |

(499,473) |

(47.7%) |

|

|

Interest paid |

(339,197) |

(360,255) |

6.2% |

|

|

Interest paid on lease |

(502) |

(1,194) |

137.8% |

|

|

Payments of obligations for leasing |

(3,059) |

(3,486) |

14.0% |

|

|

Net cash flows used in financing activities |

(680,942) |

2,630,371 |

(486.3%) |

|

|

|

|

|

|

|

|

Effects of exchange rate changes on cash held |

(18,009) |

(91,845) |

410.0% |

|

|

Net increase in cash and cash equivalents |

283,842 |

3,567,010 |

1156.7% |

|

|

Cash and cash equivalents at beginning of the

period |

14,444,549 |

13,332,877 |

(7.7%) |

|

|

Cash and cash equivalents at the end of the

period |

14,728,391 |

16,899,886 |

14.7% |

|

|

|

|

|

|

|

| |

|

|

|

|

Exhibit D: Consolidated statements of

profit or loss and other comprehensive income (in

thousands of pesos):

|

|

|

|

|

|

|

|

1Q21 |

1Q22 |

Change |

|

|

Revenues |

|

|

|

|

|

Aeronautical services |

2,072,767 |

3,854,232 |

85.9% |

|

|

Non-aeronautical services |

635,987 |

1,167,912 |

83.6% |

|

|

Improvements to concession assets (IFRIC-12) |

929,243 |

990,454 |

6.6% |

|

|

Total revenues |

3,637,996 |

6,012,598 |

65.3% |

|

|

|

|

|

|

|

|

Operating costs |

|

|

|

|

|

Costs of services: |

652,698 |

753,524 |

15.4% |

|

|

Employee costs |

243,634 |

288,518 |

18.4% |

|

|

Maintenance |

94,439 |

125,030 |

32.4% |

|

|

Safety, security & insurance |

123,826 |

126,174 |

1.9% |

|

|

Utilities |

77,173 |

96,081 |

24.5% |

|

|

Other operating expenses |

113,626 |

117,721 |

3.6% |

|

|

|

|

|

|

|

|

Technical assistance fees |

88,356 |

174,146 |

97.1% |

|

|

Concession taxes |

213,840 |

399,766 |

86.9% |

|

|

Depreciation and amortization |

502,745 |

564,533 |

12.3% |

|

|

Cost of improvements to concession assets (IFRIC-12) |

929,243 |

990,454 |

6.6% |

|

|

Other (income) |

(3,350) |

(13,711) |

309.3% |

|

|

Total operating costs |

2,383,532 |

2,868,712 |

20.4% |

|

|

Income from operations |

1,254,464 |

3,143,885 |

150.6% |

|

|

Financial Result |

(79,303) |

(272,945) |

244.2% |

|

|

Income before income taxes |

1,175,161 |

2,870,940 |

144.3% |

|

|

Income taxes |

(137,581) |

(543,489) |

295.0% |

|

| Net

income |

1,037,580 |

2,327,450 |

124.3% |

|

|

Currency translation effect |

61,729 |

(178,331) |

(388.9%) |

|

|

Cash flow hedges, net of income tax |

216,794 |

91,752 |

(57.7%) |

|

|

Remeasurements of employee benefit – net income tax |

1,102 |

102 |

(90.7%) |

|

|

Comprehensive income |

1,317,205 |

2,240,973 |

70.1% |

|

|

Non-controlling interest |

(12,895) |

(19,026) |

47.5% |

|

|

Comprehensive income attributable to controlling

interest |

1,304,310 |

2,221,946 |

70.4% |

|

|

|

|

|

|

|

|

The non-controlling interest corresponds to the 25.5% stake held in

the Montego Bay airport by Vantage Airport Group Limited

(“Vantage”). |

Exhibit E: Consolidated stockholders’

equity (in thousands of

pesos):

|

|

Common Stock |

Legal Reserve |

Reserve forShare Repurchase |

Repurchased Shares |

Retained Earnings |

Othercomprehensiveincome |

Totalcontrollinginterest |

Non-controllinginterest |

TotalStockholders' Equity |

|

Balance as of January 1, 2021 |

6,185,082 |

1,592,551 |

3,283,374 |

(1,733,374) |

11,908,890 |

556,287 |

21,792,811 |

1,059,972 |

22,852,783 |

|

Repurchased share |

- |

- |

- |

(338,184) |

- |

- |

(338,184) |

- |

(338,184) |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

Net income |

- |

- |

- |

- |

1,050,154 |

- |

1,050,154 |

(12,575) |

1,037,579 |

|

Foreign currency translation reserve |

- |

- |

- |

- |

- |

36,259 |

36,259 |

25,470 |

61,729 |

|

Remeasurements of employee benefit – Net |

- |

- |

- |

- |

- |

1,102 |

1,102 |

- |

1,102 |

|

Reserve for cash flow hedges – Net of income tax |

- |

- |

- |

- |

- |

216,794 |

216,794 |

- |

216,794 |

|

Balance as of March 31, 2021 |

6,185,082 |

1,592,551 |

3,283,374 |

(2,071,558) |

12,959,044 |

810,442 |

22,758,936 |

1,072,867 |

23,831,803 |

| |

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2022 |

170,381 |

1,592,551 |

5,531,292 |

(3,000,037) |

13,925,091 |

1,069,102 |

19,288,380 |

1,140,220 |

20,428,600 |

|

Repurchased share |

- |

- |

- |

(499,475) |

- |

- |

(499,475) |

- |

(499,475) |

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

Net income |

- |

- |

- |

- |

2,291,595 |

- |

2,291,595 |

35,854 |

2,327,450 |

|

Foreign currency translation reserve |

- |

- |

- |

- |

- |

(161,503) |

(161,503) |

(16,828) |

(178,331) |

|

Remeasurements of employee benefit – Net |

- |

- |

- |

- |

- |

102 |

102 |

- |

102 |

|

Reserve for cash flow hedges – Net of income tax |

- |

- |

- |

- |

- |

91,752 |

91,752 |

- |

91,752 |

|

Balance as of March 31, 2022 |

170,381 |

1,592,551 |

5,531,292 |

(3,499,511) |

16,216,687 |

999,453 |

21,010,854 |

1,159,246 |

22,170,100 |

|

|

|

|

|

|

|

|

|

|

|

| For presentation purposes, the 25.5% stake in

Desarrollo de Concesiones Aeroportuarias, S.L. (“DCA”) held by

Vantage appears in the Stockholders’ Equity of the Company as a

non-controlling interest. |

As a part of the adoption of IFRS, the effects

of inflation on common stock recognized pursuant to Mexican

Financial Reporting Standards (MFRS) through December 31, 2007 were

reclassified as retained earnings because accumulated inflation

recognized under MFRS is not considered hyperinflationary according

to IFRS. For Mexican legal and tax purposes, Grupo Aeroportuario

del Pacífico, S.A.B. de C.V., as an individual entity, will

continue preparing separate financial information under MFRS.

Therefore, for any transaction between the Company and its

shareholders related to stockholders’ equity, the Company must take

into consideration the accounting balances prepared under MFRS as

an individual entity and determine the tax impact under tax laws

applicable in Mexico, which requires the use of MFRS. For purposes

of reporting to stock exchanges, the consolidated financial

statements will continue being prepared in accordance with IFRS, as

issued by the IASB.

Exhibit F: Other operating data (in

thousands):

|

|

|

|

|

|

|

1Q21 |

1Q22 |

Change |

| Total

passengers |

7,406.9 |

12,581.4 |

69.9% |

| Total cargo

volume (in WLUs) |

668.2 |

626.8 |

(6.2%) |

| Total

WLUs |

8,075.1 |

13,208.2 |

63.6% |

| |

|

|

|

| Aeronautical

& non aeronautical services per passenger (pesos) |

365.7 |

399.2 |

9.2% |

| Aeronautical

services per WLU (pesos) |

256.7 |

291.8 |

13.7% |

| Non

aeronautical services per passenger (pesos) |

85.9 |

92.8 |

8.1% |

| Cost of

services per WLU (pesos) |

80.8 |

57.0 |

(29.4%) |

|

|

|

|

|

| WLU = Workload units represent passenger traffic

plus cargo units (1 cargo unit = 100 kilograms of cargo). |

Passenger Traffic and Consolidated

Results compared to the same periods of 2019:

Domestic Terminal Passengers – 14

airports (in

thousands):

|

|

|

|

Airport |

1Q19 |

1Q22 |

Change |

|

|

Guadalajara |

2,420.4 |

2,360.4 |

(2.5%) |

|

| Tijuana

* |

1,361.2 |

1,820.9 |

33.8% |

|

| Los

Cabos |

394.7 |

512.8 |

29.9% |

|

| Puerto

Vallarta |

351.8 |

498.8 |

41.8% |

|

| Montego

Bay |

1.8 |

0.0 |

(100.0%) |

|

|

Guanajuato |

462.0 |

382.3 |

(17.2%) |

|

|

Hermosillo |

385.0 |

383.2 |

(0.5%) |

|

|

Mexicali |

266.0 |

290.2 |

9.1% |

|

|

Kingston |

0.0 |

0.2 |

100.0% |

|

| Morelia |

110.2 |

147.6 |

33.9% |

|

| La Paz |

210.1 |

238.2 |

13.4% |

|

|

Aguascalientes |

142.9 |

158.0 |

10.5% |

|

| Los

Mochis |

83.8 |

96.1 |

14.7% |

|

|

Manzanillo |

23.9 |

24.0 |

0.5% |

|

|

Total |

6,213.6 |

6,912.7 |

11.3% |

|

| *CBX users are

classified as international passengers. |

|

| |

|

|

|

|

|

International Terminal Passengers – 14

airports (in

thousands): |

|

|

|

Airport |

1Q19 |

1Q22 |

Change |

|

|

Guadalajara |

988.1 |

969.9 |

(1.8%) |

|

| Tijuana

* |

658.1 |

923.2 |

40.3% |

|

| Los

Cabos |

1,056.2 |

1,124.8 |

6.5% |

|

| Puerto

Vallarta |

1,257.0 |

1,061.0 |

(15.6%) |

|

| Montego

Bay |

1,336.1 |

928.1 |

(30.5%) |

|

|

Guanajuato |

171.3 |

175.5 |

2.5% |

|

|

Hermosillo |

17.1 |

18.6 |

8.8% |

|

|

Mexicali |

1.4 |

1.2 |

(18.0%) |

|

|

Kingston |

0.0 |

268.2 |

N/A |

|

| Morelia |

101.3 |

116.3 |

14.9% |

|

| La Paz |

3.6 |

7.5 |

108.5% |

|

|

Aguascalientes |

44.5 |

47.1 |

5.9% |

|

| Los

Mochis |

1.6 |

1.7 |

6.6% |

|

|

Manzanillo |

37.2 |

25.6 |

(31.0%) |

|

|

Total |

5,673.5 |

5,668.7 |

(0.1%) |

|

| *CBX users are

classified as international passengers. |

|

| |

|

|

|

|

|

Total Terminal Passengers – 14 airports

(in thousands): |

|

|

|

|

Airport |

1Q19 |

1Q22 |

Change |

|

|

Guadalajara |

3,408.5 |

3,330.3 |

(2.3%) |

|

| Tijuana

* |

2,019.3 |

2,744.1 |

35.9% |

|

| Los

Cabos |

1,450.9 |

1,637.6 |

12.9% |

|

| Puerto

Vallarta |

1,608.7 |

1,559.8 |

(3.0%) |

|

| Montego

Bay |

1,337.9 |

928.1 |

(30.6%) |

|

|

Guanajuato |

633.4 |

557.9 |

(11.9%) |

|

|

Hermosillo |

402.1 |

401.8 |

(0.1%) |

|

|

Mexicali |

267.4 |

291.4 |

8.9% |

|

|

Kingston |

0.0 |

268.3 |

N/A |

|

| Morelia |

211.5 |

263.9 |

24.8% |

|

| La Paz |

213.6 |

245.6 |

15.0% |

|

|

Aguascalientes |

187.5 |

205.2 |

9.5% |

|

| Los

Mochis |

85.4 |

97.8 |

14.5% |

|

|

Manzanillo |

61.0 |

49.6 |

(18.6%) |

|

|

Total |

11,887.2 |

12,581.4 |

5.8% |

|

| *CBX users are

classified as international passengers. |

|

|

| |

|

|

|

|

|

CBX Users (in

thousands): |

|

|

|

|

|

Airport |

1Q19 |

1Q22 |

Change |

|

| Tijuana |

647.3 |

917.4 |

41.7% |

|

| |

|

|

|

|

Consolidated Results and Other Data

compared with 2019 (in thousands of

pesos):

|

|

|

|

|

|

|

|

1Q19 |

1Q22 |

Change |

|

|

Revenues |

|

|

|

|

|

Aeronautical services |

2,631,325 |

3,854,232 |

46.5% |

|

|

Non-aeronautical services |

901,324 |

1,167,912 |

29.6% |

|

|

Improvements to concession assets (IFRIC 12) |

146,487 |

990,454 |

576.1% |

|

|

Total revenues |

3,679,136 |

6,012,598 |

63.4% |

|

|

|

|

|

|

|

|

Operating costs |

|

|

|

|

|

Costs of services: |

595,639 |

753,524 |

26.5% |

|

|

Employee costs |

194,323 |

288,518 |

48.5% |

|

|

Maintenance |

112,440 |

125,030 |

11.2% |

|

|

Safety, security & insurance |

102,131 |

126,174 |

23.5% |

|

|

Utilities |

72,769 |

96,081 |

32.0% |

|

|

Other operating expenses |

113,976 |

117,721 |

3.3% |

|

|

|

|

|

|

|

|

Technical assistance fees |

115,574 |

174,146 |

50.7% |

|

|

Concession taxes |

325,267 |

399,766 |

22.9% |

|

|

Depreciation and amortization |

421,601 |

564,533 |

33.9% |

|

|

Cost of improvements to concession assets (IFRIC 12) |

146,487 |

990,454 |

576.1% |

|

|

Other (income) |

(3,908) |

(13,711) |

250.8% |

|

|

Total operating costs |

1,600,660 |

2,868,712 |

79.2% |

|

|

Income from operations |

2,078,476 |

3,143,885 |

51.3% |

|

|

|

|

|

|

|

|

Financial Result |

(82,609) |

(272,945) |

230.4% |

|

|

Income before taxes |

1,995,867 |

2,870,940 |

43.8% |

|

|

Income taxes |

(598,319) |

(543,489) |

(9.2%) |

|

| Net

income |

1,397,549 |

2,327,450 |

66.5% |

|

|

Currency translation effect |

(93,951) |

(178,331) |

89.8% |

|

|

Cash flow hedges, net of income tax |

0 |

91,752 |

100.0% |

|

|

Remeasurements of employee benefit – net income tax |

(147) |

102.0 |

(169.4%) |

|

|

Comprehensive income |

1,303,451 |

2,240,973 |

71.9% |

|

|

Non-controlling interest |

(25,166) |

(19,026) |

24.4% |

|

|

Comprehensive income attributable to controlling

interest |

1,278,285 |

2,221,946 |

73.8% |

|

| |

|

|

|

|

| |

|

|

|

|

|

|

1Q19 |

1Q22 |

Change |

|

| EBITDA |

2,500,077 |

3,708,418 |

48.3% |

|

|

Comprehensive income |

1,303,451 |

2,240,973 |

71.9% |

|

|

Comprehensive income per share (pesos) |

2.3234 |

4.3896 |

88.9% |

|

|

Comprehensive income per ADS (US dollars) |

1.1978 |

2.2046 |

84.1% |

|

| |

|

|

|

|

| Operating

income margin |

56.5% |

52.3% |

(7.4%) |

|

| Operating

income margin (excluding IFRIC 12) |

58.8% |

62.6% |

6.4% |

|

| EBITDA

margin |

68.0% |

61.7% |

(9.2%) |

|

| EBITDA

margin (excluding IFRIC 12) |

70.8% |

73.8% |

4.3% |

|

| Costs of

services and improvements / total revenues |

20.2% |

29.0% |

43.8% |

|

| Cost of

services / total revenues (excluding IFRIC 12) |

16.9% |

15.0% |

(11.0%) |

|

|

|

|

|

|

|

| IR

Contacts: |

|

| Saúl Villarreal, Chief Financial Officer |

svillarreal@aeropuertosgap.com.mx |

| Alejandra Soto, IRO and Corporate Finance Director |

asoto@aeropuertosgap.com.mx |

| Gisela Murillo, Investor Relations |

gmurillo@aeropuertosgap.com.mx / +52-33-3880-1100

ext.20294 |

| |

|

[1] Revenues from improvements to concession

assets are recognized in accordance with International Financial

Reporting Interpretation Committee 12 “Service Concession

Arrangements” (IFRIC 12), but this recognition does not have a cash

impact or an impact on the Company’s operating results. Amounts

included as a result of the recognition of IFRIC 12 are related to

construction of infrastructure in each quarter to which the Company

has committed in accordance with the Company’s Master Development

Programs in Mexico and Capital Development Program in Jamaica. All

margins and ratios calculated using “Total Revenues” include

revenues from improvements to concession assets (IFRIC 12), and,

consequently, such margins and ratios may not be comparable to

other ratios and margins, such as EBITDA margin, operating margin

or other similar ratios that are calculated based on those results

of the Company that do have a cash impact.

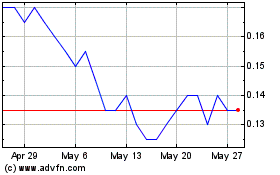

Gale Pacific (ASX:GAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gale Pacific (ASX:GAP)

Historical Stock Chart

From Dec 2023 to Dec 2024