James Hardie 1Q Net Operating Profit US$39.4 Million

August 15 2011 - 6:48PM

Dow Jones News

Building products company James Hardie Industries SE (JHX.AU)

Tuesday reported a sharp drop in net profit in its fiscal first

quarter ended June 30 to US$1.0 million from US$104.9 million in

the year-earlier period and soft conditions in its two major

residential housing markets of the U.S. and Australia.

However, excluding currency and asbestos related liabilities,

regulatory expenses and tax adjustments, operating profit in the

latest period of US$39.4 million fell 2.7% on year from US$40.5

million. This result was slightly below an estimate by UBS of

US$41.2 million.

Sales in the latest quarter were US$313.6 million, down 1.5% on

year from US$318.4 million.

Chief Executive Louis Gries described operating profit as solid

considering the difficult operating environments.

"In the U.S., new housing and repair and remodel sectors remain

weak with high unemployment, low levels of consumer confidence,

falling house values, excess housing inventory and limited credit

availability, all still inhibiting growth," he said in a statement.

"There is no evidence of a sustainable recovery in the U.S.

construction market."

In Australia, industry data indicate that new housing and repair

and remodel markets will be weaker in the current fiscal year, he

said.

-By Ray Brindal, Dow Jones Newswires; 612 62080902;

ray.brindal@dowjones.com

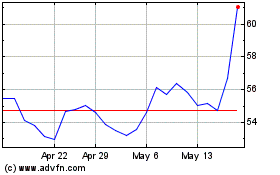

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2024 to Jan 2025

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about James Hardie Industries plc (Australian Stock Exchange): 0 recent articles

More James Hardie Industries News Articles