James Hardie Announces Adjusted Net Operating Profit of US$54.6 Million for Q4 Fiscal Year 2017 & US$248.6 Million for the Fu...

May 17 2017 - 6:46PM

Business Wire

James Hardie today announced results for the fourth quarter of

fiscal year 2017 and the full year ended 31 March 2017:

- Group Adjusted net operating profit of

US$54.6 million for the quarter and US$248.6 million for the full

year, a decrease of 6% for the quarter and an increase of 2% for

the full year, compared to the prior corresponding periods

(“pcp”);

- Group Adjusted EBIT of US$77.1 million

for the quarter and US$354.3 million for the full year, a decrease

of 8% for the quarter and an increase of 1% for the full year,

compared to pcp;

- Group net sales of US$494.3 million for

the quarter and US$1,921.6 million for the full year, an increase

of 13% and 11%, respectively, compared to pcp;

- North America Fiber Cement Segment

volume for the quarter and full year increased 12% and 13%,

respectively, compared to pcp;

- North America Fiber Cement Segment net

sales of US$387.7 million for the quarter and US$1,493.4 million

for the full year, an increase of 12% for the quarter and full

year, compared to pcp;

- North America Fiber Cement Segment EBIT

margin of 19.6% for the quarter and 23.0% for the full year;

and

- International Fiber Cement Segment EBIT

margin of 23.0% for the quarter and 23.1% for the full year.

CEO Commentary

James Hardie CEO Louis Gries said, “Our North America Fiber

Cement Segment delivered strong top-line performance as fourth

quarter and full year net sales were both up 12% versus prior

corresponding periods. The volume and net sales growth was driven

by underlying market growth and continued improvement in our

commercial execution resulting in improved market penetration.

“During the year we significantly increased our manufacturing

capacity with the addition of four new brownfield lines that will

drive a high, longer term, return on capital for the company.

However, this capacity growth created challenges for our North

America manufacturing network as we accelerated commissioning of

new capacity and overall performance of the network lagged fiscal

year 2016 performance. These increased manufacturing costs along

with increased investment in marketing development programs, in

both the quarter and full year, resulted in EBIT decreasing 2% and

11% for the full year and fourth quarter, respectively. Improving

the performance of our North America manufacturing network remains

a key focus for the business going forward.”

He added, “Within our International Fiber Cement business, net

sales increased 18% for the fourth quarter and 9% for the full

year. Furthermore, EBIT increased 21% for the quarter and 22% for

the full year. This strong performance was driven by our Australian

and New Zealand businesses net sales growth and the non-recurrence

of Carole Park start-up costs reported in the prior corresponding

periods.”

Mr. Gries concluded, “Our group results for the full year

reflected strong top line growth and cash generation, and $276.6

million returned to shareholders through dividends and share

buybacks, while EBIT margin and Adjusted NOPAT were below internal

expectations as North America incurred higher production costs as

we continued to increase our capacity.”

Outlook

We expect the modest market growth and more prolonged recovery

of the US housing market to continue into fiscal year 2018. The

single family new construction market and repair and remodel market

are expected to grow similar to the year-on-year growth experienced

in fiscal year 2017. The Company expects new construction starts

between approximately 1.2 and 1.3 million.

We expect our North America Fiber Cement segment EBIT margin to

be in our stated target range of 20% to 25% for fiscal year 2018.

This expectation is based upon the Company continuing to drive

improved operating performance in its plants, stable exchange rates

and input cost trends.

Net sales from the Australian business are expected to trend in

line with the average growth of the domestic repair and remodel and

single family detached housing markets in the eastern states of

Australia. Similarly, growth in the New Zealand business is

expected into fiscal year 2018.

Further Information

Readers are referred to the Company’s Consolidated Financial

Statements and Management’s Analysis of Results for the fourth

quarter and full year ended 31 March 2017 for additional

information regarding the Company’s results, including information

regarding income taxes, the asbestos liability and contingent

liabilities.

As of 30 June 2016, the Company changed its reportable operating

segments. Previously, the Company reported on three operating

segments: (i) North America and Europe Fiber Cement, (ii) Asia

Pacific Fiber Cement, and (iii) Research and Development. As of 30

June 2016, the Company began reporting on four operating segments:

(i) North America Fiber Cement; (ii) International Fiber Cement;

(iii) Other Businesses; and (iv) Research and Development. The

significant changes to how certain businesses are reported in the

new segment structure are as follows: (i) our European business is

now reported in the International Fiber Cement segment, along with

the other businesses that were historically reported in the Asia

Pacific Fiber Cement segment; and (ii) business development,

including some non-fiber cement operations, such as our Windows

business in North America, are now reported in the Other Businesses

segment as opposed to previously being reported in the North

America and Europe Fiber Cement segment. The Company has revised

its historical segment information at 31 March 2016 and for the

fourth quarter and full year ended 31 March 2016 to be consistent

with the new reportable segment structure. The change in reportable

segments had no effect on the Company’s financial position, results

of operations or cash flows for the periods presented. Readers are

referred to Note 14 of our condensed consolidated financial

statements for further information on our segments.

Use of Non-GAAP Financial Information; Australian Equivalent

Terminology

This Media Release includes financial measures that are not

considered a measure of financial performance under generally

accepted accounting principles in the United States (GAAP), such as

Adjusted net operating profit and Adjusted EBIT. These non-GAAP

financial measures should not be considered to be more meaningful

than the equivalent GAAP measure. Management has included such

measures to provide investors with an alternative method for

assessing its operating results in a manner that is focused on the

performance of its ongoing operations and excludes the impact of

certain legacy items, such as asbestos adjustments. Additionally,

management uses such non-GAAP financial measures for the same

purposes. However, these non-GAAP financial measures are not

prepared in accordance with US GAAP, may not be reported by all of

the Company’s competitors and may not be directly comparable to

similarly titled measures of the Company’s competitors due to

potential differences in the exact method of calculation. For

additional information regarding the non-GAAP financial measures

presented in this Media Release, including a reconciliation of each

non-GAAP financial measure to the equivalent US GAAP measure, see

the sections titled “Definition and Other Terms” and “Non-US GAAP

Financial Measures” included in the Company’s Management’s Analysis

of Results for the fourth quarter and full year ended 31 March

2017.

In addition, this Media Release includes financial measures and

descriptions that are considered to not be in accordance with US

GAAP, but which are consistent with financial measures reported by

Australian companies, such as operating profit, EBIT and EBIT

margin. Since the Company prepares its Consolidated Financial

Statements in accordance with US GAAP, the Company provides

investors with a table and definitions presenting cross-references

between each US GAAP financial measure used in the Company’s

Consolidated Financial Statements to the equivalent non-US GAAP

financial measure used in this press release. See the sections

titled “Definition and Other Terms” included in the Company’s

Management’s Analysis of Results for fourth quarter and full year

ended 31 March 2017.

Forward-Looking Statements

This Media Release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of James Hardie to be materially

different from those expressed or implied in this release,

including, among others, the risks and uncertainties set forth in

Section 3 “Risk Factors” in James Hardie’s Annual Report on Form

20-F for the year ended 31 March 2017; changes in general economic,

political, governmental and business conditions globally and in the

countries in which James Hardie does business; changes in interest

rates, changes in inflation rates; changes in exchange rates; the

level of construction generally; changes in cement demand and

prices; changes in raw material and energy prices; changes in

business strategy and various other factors. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described herein. James Hardie assumes no obligation to

update or correct the information contained in this Media Release

except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170517006445/en/

James HardieJason Miele, +61 2 8845 3352Vice President, Investor

and Media Relationsmedia@jameshardie.com.auNYSE: JHXASX: JHX

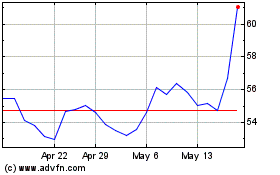

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2024 to Jan 2025

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Jan 2024 to Jan 2025