Rio Tinto Coal Sale Gets Regulatory Approval in Australia

April 12 2017 - 7:01PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Rio Tinto PLC's (RIO.LN) deal to sell a

large chunk of its coal business for US$2.45 billion to a Chinese

company has secured approval from Australia's Foreign Investment

Review Board.

Yancoal Australia Ltd. (YAL.AU) on Thursday said FIRB, which

advises the federal government, had advised that it had no

objection to the acquisition of Rio Tinto's Coal & Allied

Industries Ltd. subsidiary.

The deal, which was unveiled by the companies in late January,

remains subject to approval by the shareholders of both Rio Tinto

and Yanzhou Coal Mining Co.

Yancoal said approval from FIRB was subject to its continued

compliance with existing governance conditions, which apply to its

current assets.

In 2009, Canberra approved Yanzhou Coal Mining's 3.5 billion

Australian dollar (US$2.6 billion) takeover of Felix Resources Ltd.

only after it shackled the deal with conditions like listing a unit

on the Australian Securities Exchange. At the time, the deal was

the biggest Chinese takeover of an Australian company.

Coal & Allied includes Rio's giant coal operation in

Australia's Hunter Valley, which the company has been attempting to

unload for years, and its Mount Thorley Warkworth mines.

Yancoal said it expected to close the deal in the third

quarter.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 12, 2017 19:46 ET (23:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

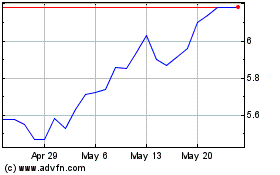

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

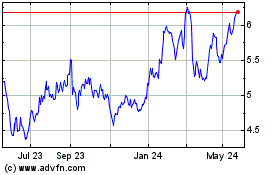

Yancoal Australia (ASX:YAL)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Yancoal Australia Ltd (Australian Stock Exchange): 0 recent articles

More Yancoal Fpo News Articles