Mediobanca Profit Dented by Bailout Fund Payment

February 11 2016 - 2:10AM

Dow Jones News

MILAN—Italian bank Mediobanca Banca di Credito Finanziario SpA

said Thursday that its contribution to a bank bailout fund weighed

on second-quarter net profit, countering a revenue gain.

Net profit for the three months ended Dec. 31, fell to €76.8

million ($86.7 million) from €100.6 million a year earlier, while

revenue rose 4% to €509.2 million. Mediobanca's fiscal year ends

June 30.

As with several Mediobanca's Italian peers, net profit was hit

by contributions to the Bank Resolution Fund after the Italian

government decided to boost in November. The move followed its

approval of a rescue plan for four troubled small and midsize local

banks, applying newly enacted European rules to the resolution of

troubled lenders. Mediobanca's contribution was €57 million.

The bank launched a strategic plan in 2013 aimed at boosting its

profitability by selling its vast portfolio of stakes in

pre-eminent Italian companies, investing the proceeds in its

corporate and investment banking and retail and wealth management

units.

In the last quarter, the bank agreed the sale of a 0.22% stake

in Assicurazioni Generali SpA, which will be effective in May. It

still maintains a 13.2% stake in the Italian insurer.

The bank plans to make more acquisitions in the asset management

sector after it bought a 51% stake in London-based credit manager

Cairn Capital Group Ltd. from Royal Bank of Scotland and other

institutional investors last summer.

Its net interest income in the latest quarter rose 7% to €301.8

million, mainly driven by its consumer business.

Fees for the quarter rose 16% to €131.6 million, helped by

activity in its corporate and investment banking unit, mainly in

Italy.

"Although the weak markets mean some deals might be postponed,

the investment banking pipeline for the coming quarters continue to

look healthy," the bank said.

Trading income dropped to €19.6 million for the quarter,

compared with €27.2 million a year earlier.

Provisions for bad loans dropped by 40% to €109 million for the

last three months of last year, compared with the same period a

year earlier, as bad loans have declined over the last four

quarters.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

February 11, 2016 02:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

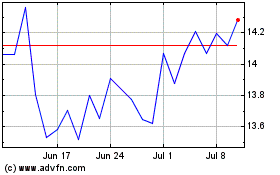

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Dec 2024 to Jan 2025

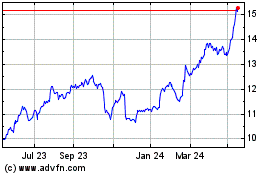

Mediobanca Banca di Cred... (BIT:MB)

Historical Stock Chart

From Jan 2024 to Jan 2025