Analyst Reveals Bitcoin Key Support Levels For Reaccumulation – Details

November 10 2024 - 6:30AM

NEWSBTC

The price of Bitcoin showed a highly positive reaction to Donald

Trump’s emergence as the next US President, gaining by 9.62% in the

past week according to data from CoinMarketCap. Amidst this

price rally, Bitcoin established a new all-time high at $77,252 on

November 8 but has since retraced by over 0.5%. Commenting on the

asset’s potential next movements, analyst Ali Martinez postulates

BTC may be set for significant corrections which may present

opportunities for reaccumulation. Related Reading: Bitcoin Stock To

Flow Model Shows Price Is Ready For Next Phase Transition Above

$100,000 Bitcoin Likely To Fall To $69,000 – Here’s How In an X

post on November 9, Martinez predicted that Bitcoin may finally

record some significant price pullback, after days of bullish

uptrend triggered by US election results and the Federal Reserve’s

latest decision to initiate a 25 bps rate cut. Following the

premier cryptocurrency’s descent from above $77,000, Martinez

explains the price movement indicates a fall from a rising wedge

which is a chart pattern that signals a potential reversal in an

uptrend due to converging highs and lows. If this signal holds, the

popular crypto analyst predicts Bitcoin could fall to around

$73,900. Albeit, intense selling pressure could cause a further

decline to $71,500, with $69,000 emerging as a strong support level

in a worst-case scenario. Interestingly, Ali Martinez shares he has

set buy orders at all these support regions as any potential price

recorrection by Bitcoin presents a good opportunity for massive

purchases at lower prices. This trading strategy emerges from the

general belief that the Bitcoin bull season is still in its early

phase despite significant price rallies in the past few weeks.

Analysts continue to postulate a six-figure price target by the end

of 2024, indicating potential for magnanimous price gains in the

upcoming year. Related Reading: Analyst Reveals What The Gold Chart

Says About The Possibility Of Bitcoin Price Reaching $100,000 BTC

Leverage Ratio Hits 2-Year High In other news, data from analytics

firm IntoTheBlock shows that the ratio of Bitcoin’s Open Interest

to its market cap is 5.93%, which is the highest value of this

metric since the FTX collapse in November 2022. This

development indicates that traders are holding a high level of

leveraged positions, which can result in drastic volatility levels

upon any minute price changes, thus adding to the growing sentiment

around an incoming price correction. At the time of writing,

Bitcoin exchanges hands at $76,740 following a 0.70% decline in the

past 24 hours. Meanwhile, the assets trading volume is down by

44.63% and valued at $31.87 billion. However, the maiden

cryptocurrency continues to retain global headlines following its

27.76% price gain in the last month, resulting in a market cap

value of $1.51 trillion. Featured image from Nairametrics, chart

from Tradingview

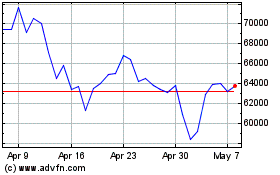

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024